Updated on October 4th, 2022 by Josh Arnold

Nordson Corporation (NDSN) has a dividend track record that few companies can rival. The company has increased its cash dividend for 58 consecutive years, ranking it 16th among companies with the longest streaks of annual dividend increases.

That puts Nordson among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 45 Dividend Kings here.

Additionally, we created a list of all 45 Dividend Kings along with important financial metrics such as P/E ratios and current dividend yields. You can access your copy of the Dividend Kings sheet by clicking on the link below:

Dividend Kings have the longest track records when it comes to rewarding shareholders with cash, and Nordson is no different. Nordson does not have a household name, and may not be well-known among investors. But the company certainly has a long and successful history of raising its dividend.

Nordson has been a high-growth company for many years. It experienced a slowdown in 2020 and into 2021, but this was only a temporary setback due to the coronavirus pandemic. Nordson is back to generating strong growth, and its dividend growth has accelerated in turn. In this article we’ll examine the business, as well as its prospects for investment.

Business Overview

Nordson was founded in 1954 in Amherst, Ohio, but the company can trace its roots much further back to 1909 as the U.S. Automatic Company. That enterprise specialized in making screw machine parts for the fledgling automotive industry but in the 1930’s, the company shifted to making more high-precision parts you’d probably associate with the Nordson of today.

Then in 1954, Nordson was started as a division of the US Automatic Company via the acquisition of patents covering the “hot airless” method of spraying paint and other coating materials. The rest, as they say, is history as Nordson has grown to about $2.5 billion in annual revenue, and trades with a market cap of just over $12 billion.

Nordson engineers, manufactures and markets unique products used to dispense, apply and control adhesives, sealants, polymers, coatings and other fluids to test for quality as well as to treat and cure surfaces. The company’s products are found all over the world – sold primarily by a direct, global sales force – and offer custom solutions to their customers’ engineering problems. Nordson has built a reputation over the past five decades of quality and value with its wide range of solutions.

The company has a highly diverse customer base:

Source: Investor Presentation

Nordson is split into two business segments: Industrial Precision Solutions and Advanced Technology Solutions. The first segment is made up of Adhesives, Polymer Processing Solutions, and Industrial Coatings Solutions. The Advanced Technology Solutions segment is comprised of Medical, Electronic Processing Systems, Test and Inspection, and Fluid Management.

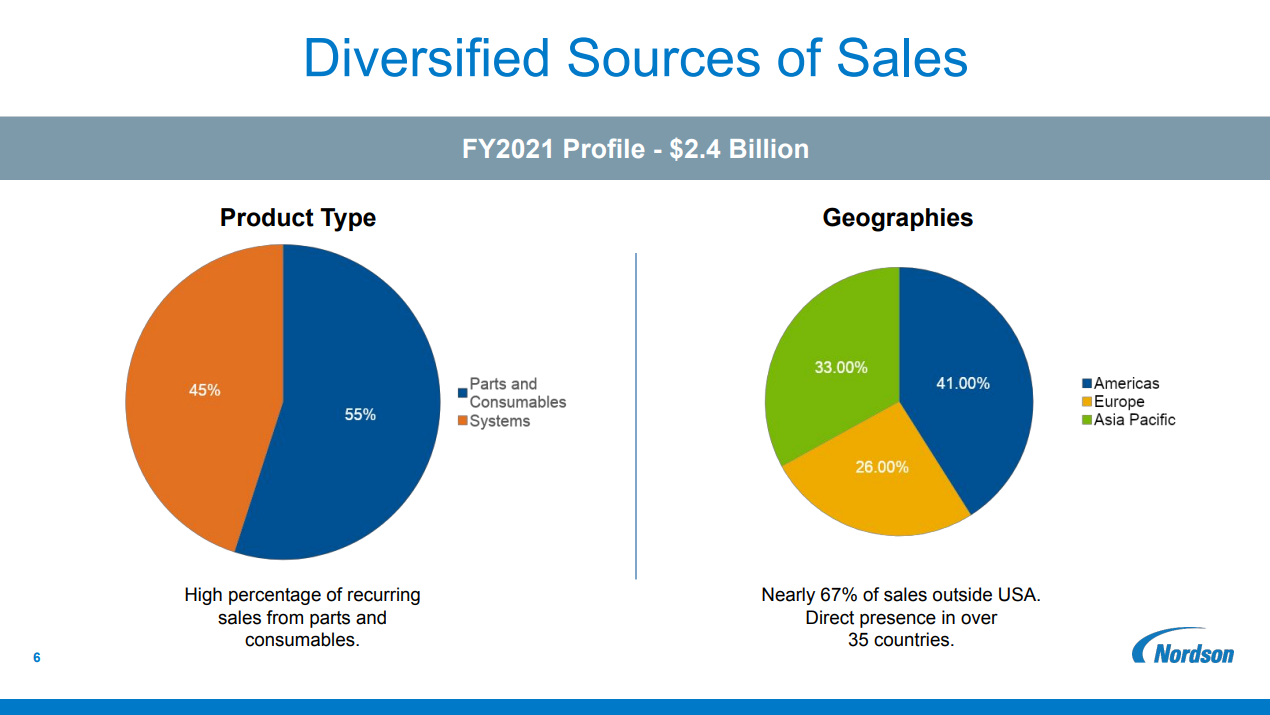

Nordson’s revenue mix is highly diversified as only ~33% of it comes from the U.S. The remainder is from a wide variety of global customers, offering Nordson not only a diverse customer base, but also diversity when it comes to currencies. We note that this opens the company’s results up to currency volatility, such as what markets have experienced in 2022.

The U.S. is Nordson’s largest in terms of geographic presence, but Asia-Pacific and Europe aren’t far behind. Nordson is a truly global company.

Source: Investor Presentation

In terms of product type, Nordson generates approximately 55% of its sales from parts and consumables, which is a relatively attractive area of focus because much of this revenue is recurring in nature. Separately, Nordson generates the balance of its sales from systems.

Growth Prospects

From 2010-2019, Nordson more than doubled its revenue and grew its earnings per share at an 11.3% average annual rate. The company stumbled in 2020, with a 6.6% decline in earnings-per-share. Management attributed the lackluster performance to the challenging global economic environment amid the coronavirus pandemic.

However, the company remained highly profitable even during the worst of the pandemic, and only experienced a mild decline in EPS for 2020. Nordson was back to growth in 2021, with an extremely impressive 41% increase in earnings-per-share for 2021.

The company reported third quarter earnings on August 22nd, 2022, and results were modestly better than expected on both the top and bottom lines. The company reported sales of $662 million, which was a 2% gain year-over-year. Organic volume was up 4%. In terms of segments, Advanced Technology Solutions revenue was up 7%, while Industrial Precision Solutions saw a 1% decline.

Earnings-per-share came to $2.49 on an adjusted basis, up about 3% year-over-year. The company reaffirmed guidance of earnings-per-share of about $9.25, so that’s where our current estimate lies.

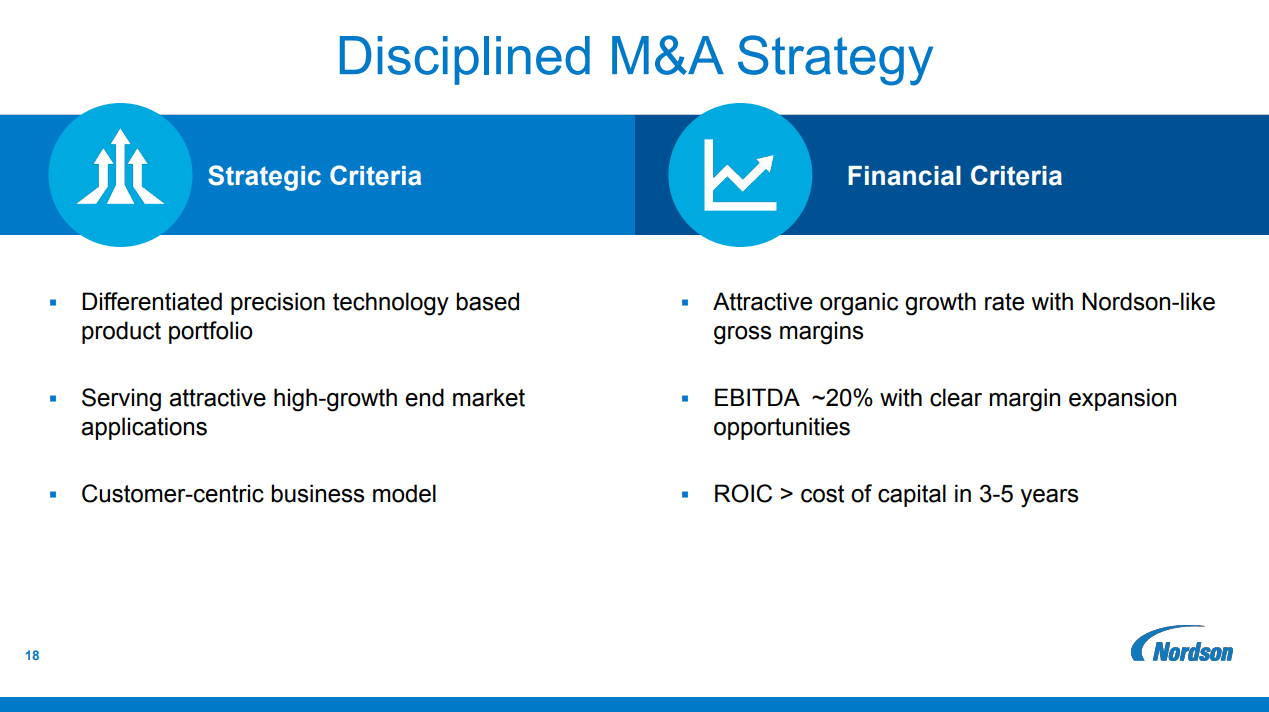

We believe that the long-term growth prospects of Nordson should remain intact. There are many levers for Nordson’s long-term growth. Nordson is a serial acquirer and has been basically from the beginning when it was started with the acquisition of patents covering the hot airless method of spraying.

Nordson’s track record when it comes to acquisitions is a good one as the company looks for takeover targets that give it some sort of competitive advantage it does not already possess, with high percentages of recurring revenue and expense synergies.

Growth-by-acquisition is a difficult endeavor for long-term success but Nordson has proven its ability to do so over the long term. This is a key differentiator for Nordson and should not be overlooked by investors. Nordson has generated strong growth for many years, consisting of both internal initiatives as well as acquisitions.

Source: Investor Presentation

The combination of acquisitions, organic growth and focus on continuous improvement drives, not only top line expansion, but margin gains as well. Organic revenue growth is driven by continually introducing new products and technology. This steady stream of new ideas turns into new products and drives organic revenue growth.

In addition, Nordson’s focus on emerging markets has been a significant growth driver and will continue to contribute to growth in the future. The company’s emerging markets have produced low double-digit revenue growth on average in the past decade, outpacing Nordson’s core markets of the U.S. and Europe.

The growing middle classes of these emerging markets should allow Nordson to continue to see impressive rates of organic revenue growth as well as opening up the opportunity for continued, targeted acquisitions in those markets.

Nordson has also been in the process of improving its efficiency through what it calls the Nordson Business System. This is essentially a set of tools and best practices Nordson has collected over the years that is rooted in Lean Six Sigma principles and is applied throughout the company in all business units. Nordson closely monitors and measures results against benchmarks and this focus on efficiency is a growth driver via margins.

The company is also buying back stock in big quantities, which will help increase earnings-per-share via a reduced float. In early September, the company said it would buy back half a billion dollars of stock, or about 4% of the current float.

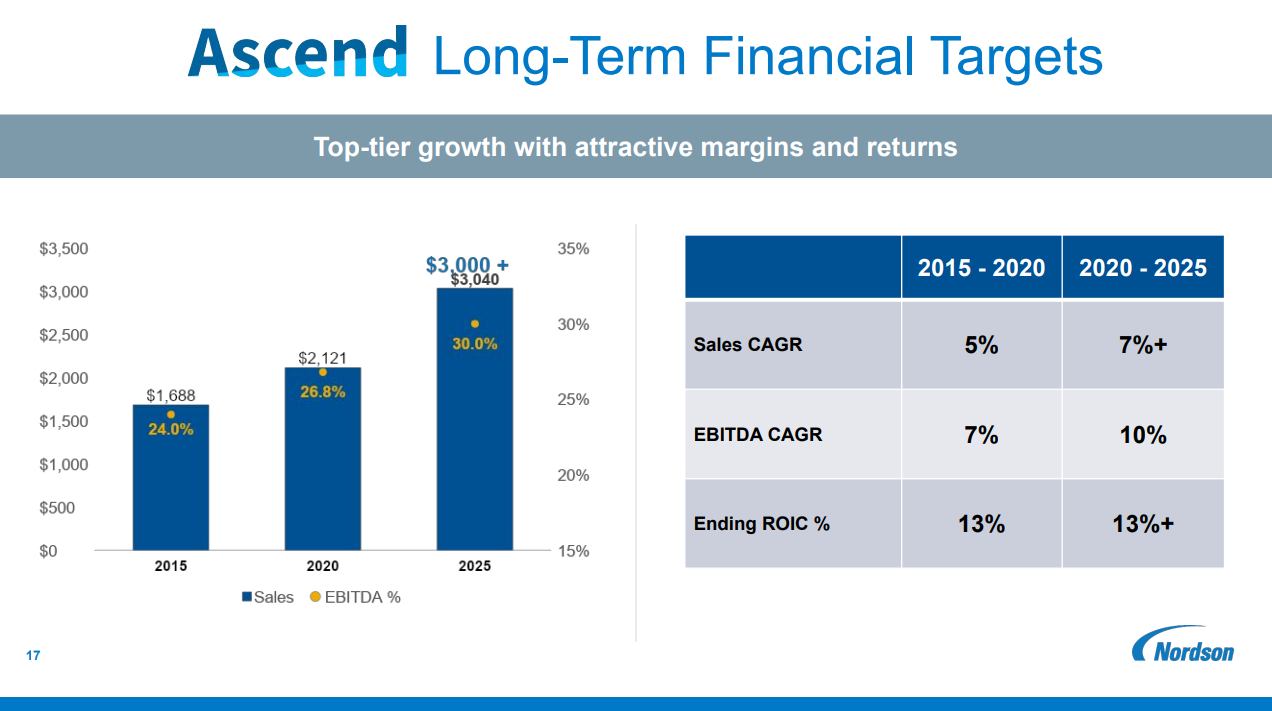

Nordson has managed to grow its EBITDA margin alongside its revenue over the last five years, and the company expects continued growth and margin expansion through 2025.

Source: Investor Presentation

Thanks to all the above growth drivers, we expect Nordson to grow its earnings per share at a 4.5% average annual rate over the next five years. We note that our estimate takes into account the risk of a prolonged global recession, but that means it has upside if there is no prolonged recession.

Competitive Advantages & Recession Performance

Nordson’s competitive advantages are varied and when combined, they paint a pretty rosy picture of the company’s position. First, Nordson has an impressive global infrastructure that puts it in a place of not only having a diverse customer base, but diverse groups of talent as well.

In addition, its facilities are where its customers are in the world (direct presence in 35 countries), and hence Nordson can react more quickly to product needs. This also affords Nordson an advantage when service is needed, as it has people near its customers wherever they are. This is the sort of thing that drives long term relationships, which are Nordson’s bread and butter.

That brings us to our next point, which is Nordson’s R&D and patents. Nordson only spends about 3% of its revenue on R&D but it makes the most of it, filing for dozens of patents each year. In addition, it buys patents and businesses with critical products it can use to supplement its existing lines.

Moreover, Nordson’s large installed customer base means that not only does it have a large amount of recurring revenue, but it is also much more challenging for competitors to take customers away. Switching costs are high for the kinds of things Nordson sells and thus, the incumbent in any given space has a huge advantage. Nordson’s installed base has many advantages and is a primary reason why the company has remained so successful.

Nordson’s many competitive advantages allow it to hold up fairly well in recessionary environments; the company’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $1.33

- 2008 earnings-per-share of $1.77 (increase of 33%)

- 2009 earnings-per-share of $1.20 (decrease of 32%)

- 2010 earnings-per-share of $2.24 (increase of 87%)

Earnings were volatile during the recession, but on the whole, Nordson performed very well. There aren’t many companies with EPS figures that look like this during and after the Great Recession and in particular, ones that manufacture for a living. Keep in mind that many products of Nordson require capital expenses from its customers, whose budgets tend to be slashed during recessions.

However, Nordson also sells things that are absolutely vital to many businesses and thus, when the dust settles, those orders tend to materialize. Indeed, Nordson’s recession-resistance is surprisingly good. We saw the company’s resilience to weak economic conditions during the pandemic-impacted period of 2020 and 2021 once again. Among industrial companies in particular, Nordson is quite resilient to weak economic conditions.

Valuation & Expected Returns

We expect Nordson to generate earnings-per-share of $9.25 this year. As a result, the stock is trading at a forward price-to-earnings ratio of 23.1. This is much lower than the stock has traded for in recent quarters, spending much of its time with valuations in excess of 30 times earnings.

We consider a price-to-earnings ratio of 22 to be fair for Nordson. With shares just over that today, we see a ~1% headwind annually from the valuation.

We also expect 4.5% annual EPS growth over the next five years while the stock is also offering a 1.2% dividend yield. Both of these items will add positively to shareholder returns. However, with the yield and valuation headwind largely offsetting each other, we see just 4.8% total annual returns in the years ahead.

Nordson’s strong free cash flow and disciplined approach to acquisitions mean that the dividend is very well covered. It also happens to grow quickly. Nordson has raised its dividend every year for more than 50 years. The last two dividend raises were 31% and 27%, respectively, so from a pure dividend growth perspective, Nordson is outstanding.

A low payout ratio helps the company grow its dividend at a high rate. With a projected payout ratio of 28% this year, the dividend is well-covered with room for continued increases.

Nordson’s approach to spending its cash is a bit different from other companies in that, depending upon the year, it may buy back lots of stock, make acquisitions, pay down debt or any number of other things. Since 2012, Nordson has spent its cash in different ways from one year to the next, including more than half of it over this time frame on acquisitions. There have been years of high levels of buybacks, and years with none.

Overall, Nordson’s results can be lumpy but the company is tremendously successful in generating growth over the long term.

Final Thoughts

Nordson is a high-quality business that is much closer to fair value than it has been in past years. The stock’s yield is still quite low, but closer to that of the S&P 500 than it has been in recent years, owed to massive dividend increases and a lower share price.

Nordson isn’t a strong stock for high income. This is somewhat surprising, given that it is a very rare Dividend King, but the low payout ratio shows that a generous dividend is not a priority for management. The priority is growing the business and this company has done that exceedingly well, producing sector-leading total returns for shareholders. The dividend will rise for many more years because Nordson has made it clear over the past 58 years that it intends to continue doing so for the foreseeable future.

We see Nordson as a hold at the moment given expected total returns of less than 5% annually.

Additional Reading

The following databases of stocks contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].