Updated on September 29th, 2023 by Bob Ciura

Leggett & Platt (LEG) recently increased its dividend for the 52nd consecutive year. As a result, it is a member of the exclusive list of Dividend Kings.

The Dividend Kings have raised their dividend payouts for at least 50 years, making them the best-of-the-best when it comes to dividend longevity. You can see all 50 Dividend Kings here.

You can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Leggett & Platt has a long history of steady growth, with regular dividend increases. The company struggles during recessions, but its competitive advantages allow it to recover quickly.

With a reasonable valuation, over 7% dividend yield, and long-term growth potential, we currently rank Leggett & Platt stock as a buy.

Business Overview

Leggett & Platt is a diversified manufacturing company. It was founded all the way back in 1883 when an inventor named J.P. Leggett created a bedspring that was superior to the existing products at that time.

Today, Leggett & Platt designs and manufactures a wide range of products, including bedding components, bedding industry machinery, steel wire, adjustable beds, carpet cushioning, and vehicle seat support systems.

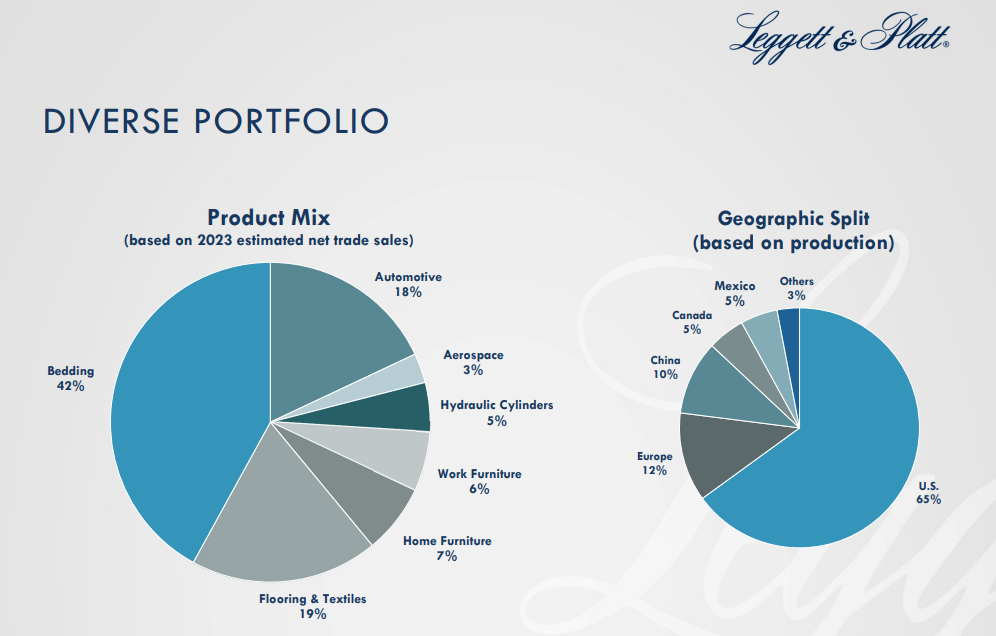

It designs and manufactures products found in many homes and automobiles. The company has a diversified business, both in terms of product mix and geographic split.

Source: Investor Presentation

Leggett & Platt reported second quarter earnings on July 31st. Revenues of $1.22 billion for the quarter declined 8% year-over-year. Revenues were slightly lower than the consensus estimate.

Leggett & Platt generated earnings-per-share of $0.38 during the second quarter, down 2.5% year-over-year. The company is forecasting revenues of $4.75 billion to $4.95 billion, implying a revenue decline for the current year. The earnings-per-share guidance range has been set at $1.45 to $1.65 for 2023.

Growth Prospects

We expect Leggett & Platt to grow its earnings-per-share by 4% annually over the next five years. Earnings growth can be produced from multiple sources, including organic revenue growth, acquisitions, and share repurchases.

Leggett & Platt has a long-held policy of acquiring smaller companies to expand its market dominance in existing categories, or to branch out into new areas. The acquisition of Elite Comfort Solutions was a very large purchase for Leggett & Platt, but it does smaller tuck-in acquisitions as well.

Source: Investor Presentation

Cost controls will be an important aspect of the company’s earnings growth strategy. Leggett & Platt continuously evaluates its portfolio to ensure it is investing in the highest-growth opportunities, and it is not afraid to divest low-margin businesses with poor expected growth.

For low-growth or low-margin businesses, it either improves performance, or exits the category. The company also drives cost reductions across the business, including in selling, general, and administrative expenses, and distribution costs.

Leggett & Platt has been able to reach its long-term growth targets thanks in large part to its significant competitive advantages in the core industries in which it operates.

Competitive Advantages & Recession Performance

Leggett & Platt has established a wide economic “moat,” meaning it has several operational advantages, which keep competitors at bay. First, the company enjoys a leadership position in the industry, which allows for scale.

Leggett & Platt also benefits from operating in a fragmented industry, which makes it easier to establish a dominant position. In most of its product markets, there are few, or no, large competitors. And when a smaller competitor does achieve significant market share, Leggett & Platt can simply acquire them, as it did with Elite Comfort Solutions.

Leggett & Platt also has an extensive patent portfolio, which is critical in keeping competition at bay. Together, these competitive advantages help it maintain healthy margins and consistent profitability.

Source: Investor Presentation

That said, the company did not perform well during the Great Recession.

Earnings-per-share during the Great Recession are shown below:

- 2006 earnings-per-share of $1.57

- 2007 earnings-per-share of $0.28 (-82% decline)

- 2008 earnings-per-share of $0.73 (161% increase)

- 2009 earnings-per-share of $0.74 (1% increase)

- 2010 earnings-per-share of $1.15 (55% increase)

This earnings volatility should not come as a surprise. As primarily a mattress and furniture products manufacturer, it is reliant on a healthy housing market for growth. The housing market collapsed during the Great Recession, which caused a significant decline in earnings-per-share in 2007.

It also took several years for Leggett & Platt to recover from the effects of the Great Recession. Earnings continued to rise after 2007, but earnings-per-share did not exceed 2006 levels until 2012. The company saw another difficult year in 2020, due to the coronavirus pandemic. This demonstrates that Leggett & Platt is not a recession-resistant business.

That said, Leggett & Platt has come through previous recessions intact, and recovered strongly in 2021. In addition, it has continued to raise its dividend for more than half a century.

Valuation & Expected Returns

Leggett & Platt has an impressive dividend history given it has increased its dividend for 52 years. Shares currently yield 7.2%, a high dividend yield given the S&P 500 Index yields just ~1.5% on average.

Leggett & Platt is expected to generate earnings-per-share of $1.55 for 2023. Based on a current stock price of $25, shares are presently trading at a price-to-earnings ratio of 16.4.

The company has generated steady growth over many years, with a strong position in its industry. Still, we believe a valuation multiple of 15 times earnings is fair value for Leggett & Platt stock. A declining P/E multiple would reduce annual returns by 1.8% per year over the next five years.

We also expect 4% annual EPS growth from Leggett & Platt. Lastly, the stock has a 7.2% dividend yield, leading to total expected returns of 9.4% per year over the next five years.

Final Thoughts

With a long history of dividend growth that recently eclipsed the 50-year mark, Leggett & Platt is one of the top blue-chip stocks.

The company is highly profitable, with durable competitive advantages to fuel its long-term growth. We expect annual returns just above 9% per year, making the stock a hold, but not quite a buy.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].