Updated on September 20th, 2023 by Bob Ciura

The Dividend Kings are the best stocks in the market for returning cash to shareholders over time. To make the list, a company has to increase its per-share dividend for at least 50 consecutive years.

Given this extremely high bar, only the businesses that can show stability through all kinds of economic conditions make the cut.

Indeed, just 50 companies qualify as Dividend Kings. You can see all 50 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus metrics that matter, such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Hormel Foods Corporation (HRL) is a processed food manufacturer that competes in several grocery categories. The company was founded 131 years ago and has managed to increase its dividend for the past 57 years.

Hormel is a famously recession-resistant company performed relatively well during the coronavirus pandemic.

In this article, we’ll take a look at Hormel’s fundamentals to evaluate the attractiveness of the stock.

Business Overview

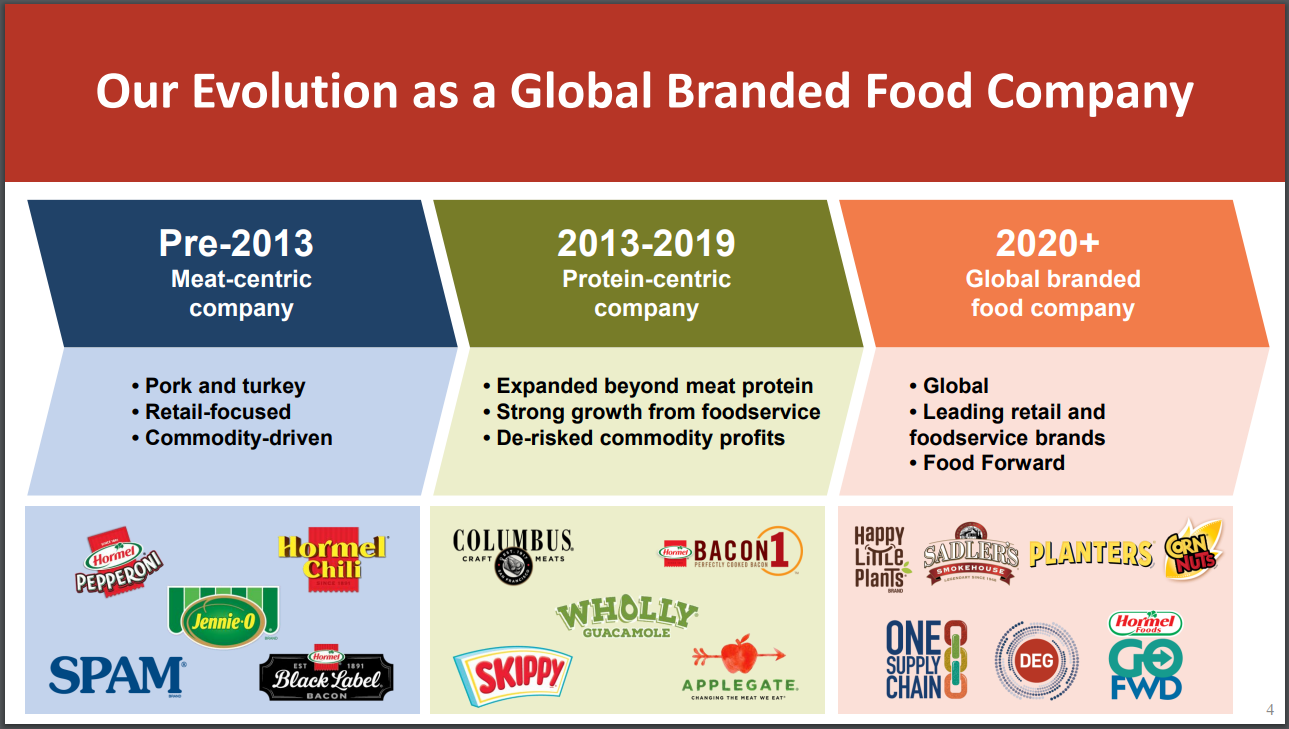

Hormel was founded in 1891. In the years since, it has grown through organic expansion and an extensive history of acquisitions and divestitures.

Today, the company produces over $12 billion in annual revenue, with its core products remaining true to its history as a meat processor.

Hormel’s reach is expansive, with distribution in more than 80 countries across the globe.

Source: Investor Presentation

Hormel has a staggering 40 product categories where its brands are first or second in terms of market share.

The company has focused on building scale and brand recognition in all of its categories, which has paid off over time. This kind of dominance is difficult to find in any industry, but Hormel has managed to do it.

Hormel’s products are arranged in four categories: Refrigerated Foods, Center Store Foods, Jennie-O Turkey, and International.

The Jennie-O brand sells turkey products, with equal parts of revenue going to grocery and food service.

Growth Prospects

We currently expect Hormel to produce 6% annual earnings-per-share growth for the foreseeable future as it continues to remake its portfolio to accelerate growth.

Hormel is executing six strategic priorities to push growth. And each strategic priority is also aimed at specific brands within the company. Sales growth should be the primary driver of earnings-per-share expansion. Margins are also a key focus in 2023 and beyond, given the current cost of inflation.

In addition, Hormel has been busy remaking its portfolio through acquisitions and divestitures in recent years.

For example, in 2021, Hormel announced the acquisition of the Planters snack nuts business from Kraft-Heinz (KHC) for $3.35 billion. The acquisition has boosted Hormel’s growth.

Source: Investor Presentation

Hormel posted third quarter earnings on August 31st, 2023. Adjusted earnings-per-share of $0.40 missed estimates by one cent. Revenue fell 2.3% year-over-year to $2.96 billion, which missed consensus by $90 million. Retail segment volume was up 1%, while net sales fell 2%, and segment profit was down 7%.

Foodservice volume was up 2%, while net sales fell 3%, but segment profit rose 14%. The international segment saw volume decline 10%, while net sales fell 6%, and segment profit was cut in half. The company said volume growth was driven by stronger results from turkey, broad demand for food service products, and strength in SPAM, Black Label, Planters, and pepperoni.

Competitive Advantages & Recession Performance

Hormel’s competitive advantage is its roughly 40 products that are #1 or #2 in terms of market share in their respective categories. It competes very well in categories with stable demand and repeats purchases, as it only sells consumables.

Its distribution network that gets products to more than 80 countries means Hormel’s revenue stream is very well diversified.

Hormel’s recession record is fairly robust, having grown its earnings during and after the Great Recession:

- 2007 earnings-per-share of $0.54

- 2008 earnings-per-share of $0.52 (3.7% decrease)

- 2009 earnings-per-share of $0.63 (21.1% increase)

- 2010 earnings-per-share of $0.76 (20.6% increase)

Hormel saw a small decline during the initial downturn during the Great Recession but posted huge earnings growth in 2009 and 2010.

The coronavirus pandemic was similar, as Hormel reaped the benefit of pantry-stocking worldwide.

Therefore, Hormel remains a good choice for investors seeking defensive stocks for their dividend portfolio.

Valuation & Expected Returns

We expect Hormel will generate adjusted earnings-per-share of $1.65 for the current year. Therefore, the stock trades for a price-to-earnings ratio of 23.5, which is above our fair value P/E of 22.0.

That works out to be a modest headwind to total returns over the next five years as the stock remains expensive. Given Hormel’s struggles with volume and margins, we believe investors are much more likely to reduce the earnings multiple than expand it further.

If the P/E declines from 23.5 to 22.0 over the next five years, annual shareholder returns would be reduced by 1.3% per year.

On a positive note, expected earnings-per-share growth of 4.0% and the 2.8% dividend yield will add to shareholder returns.

Overall, we see the potential for annual returns of 5.5% per year for Hormel stock. This is a good enough return to maintain a hold rating on Hormel, especially due to the company’s consistent dividend growth.

Indeed, the dividend is very safe, as Hormel has a projected dividend payout ratio of 57% for 2023. Therefore, the company should not have much trouble increasing the dividend each year going forward.

Final Thoughts

Hormel’s track record of earnings stability and dividend growth are difficult to match. The company has proven it can survive and thrive in a variety of conditions, including perhaps the most challenging conditions the economy has ever faced with the coronavirus crisis.

However, the stock appears to be overvalued right now, which limits its total return potential. We currently rate the stock as a hold for dividend growth investors, but it is not a buy right now due to valuation.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].