Updated on October 5th, 2023 by Aristofanis Papadatos

The Dividend Kings are a group of just 50 stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings.

You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Each year, we individually review all the Dividend Kings. The next in the series is Canadian Utilities (CDUAF).

Canadian Utilities has increased its dividend for 50 consecutive years, which makes it the only Canadian company on the list of Dividend Kings. This article will analyze the company in greater detail.

Business Overview

Canadian Utilities is a utility stock with approximately 5,000 employees. ATCO owns 53% of Canadian Utilities. Based in Alberta, Canadian Utilities is a diversified global energy infrastructure corporation that delivers solutions in electricity, pipelines & liquid, and retail energy.

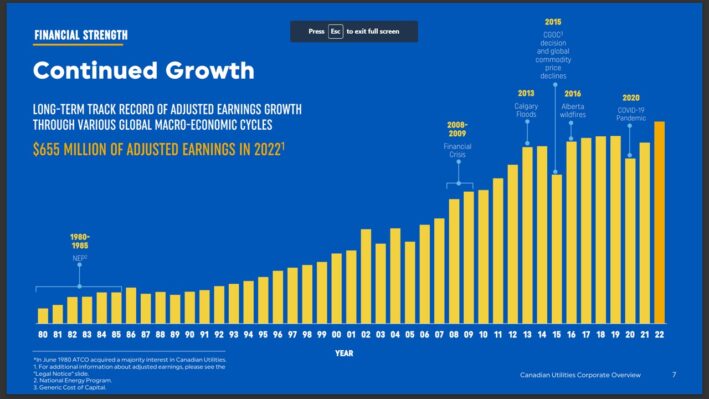

The company has a long history of generating steady growth and consistent profits through the economic cycle.

Source: Investor Presentation

On July 27th, 2023, Canadian Utilities reported its Q2-2023 results for the period ending June 30th, 2023. Revenue for the quarter amounted to $663 million, which was 6% lower year-over-year, while adjusted earnings per share decreased 27.5%, from $0.51 to $0.37.

The decrease in revenues resulted primarily from cost efficiencies generated by Electricity Distribution and Natural Gas Distribution over the second-generation Performance Base Regulation (PBR) term now being passed onto customers under the 2023 Cost of Service rebasing framework, as well as the decision of AUC (Alberta Utilities Commission) to maximize the collection of 2021 deferred revenues in 2022 as a result of rate relief provided to customers in 2021 (due to COVID-19 at the time).

The substantial decline in earnings was caused primarily by reduced revenues, which squeezed the company’s margins, coupled with the impact of inflation on the overall costs of the company.

During the quarter, Canadian Utilities invested C$332 million in capital projects. Approximately 86% of this amount was allocated on its regulated utilities business, with the remaining 14% invested in its energy infrastructure business.

Growth Prospects

By benefiting from a stable business model, Canadian Utilities can slowly but progressively grow its earnings. The company consistently invests appreciable amounts in new projects and benefits from base rate increases, which tend to hover between 3% and 4% per year.

As growth in the regulated utilities space remains rather limited, Canadian Utilities is now seeking to expand its business through the strategic acquisition of renewable generation assets. The $730 million investment should provide the company with immediate scale and future growth through the development pipeline and enjoy the qualities of long-term purchase power agreements that are common in wind projects. Further, management expects that this investment will be accretive to cash flow and earnings in 2023.

Combining the company’s growth projects, the potential for modest margin improvements, and – as voluntarily pursued – the postponed rate base increases, we maintain our expected average annual growth rate over the next five years at 4%. Our expected annual dividend growth rate remains at 2.5%.

The company will likely improve its payout ratio before its new projects start producing enough cash flows to re-accelerate dividend growth. The stock’s historical 10-year average annual dividend growth rate of 4.0% is sufficient to compensate for the currency fluctuations, progressively growing investors’ income.

Competitive Advantages & Recession Performance

The company’s competitive advantage lies in the moat surrounding regulated utilities. With no easy entry into the sector, regulated utilities enjoy an oligopolistic market with little competition threat. The company’s resilience has been proven decade after decade.

Another competitive advantage is the company’s strong financial position. Canadian Utilities has investment-grade credit ratings of BBB+ from Standard & Poor’s and A- from Fitch. This allows the company to raise capital at attractive interest rates.

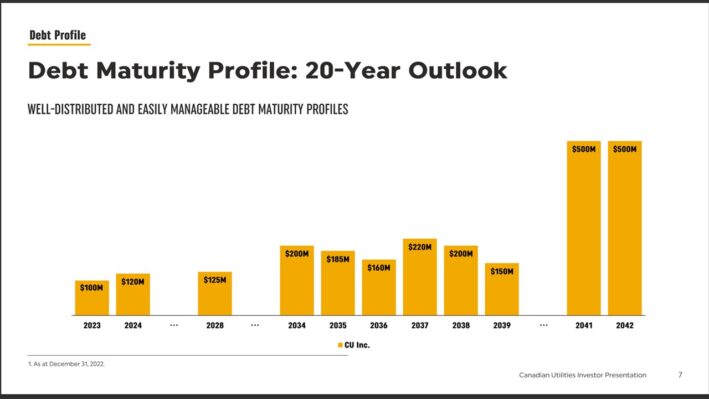

The company also has a strong balance sheet with a well-laddered debt maturity profile, which will help keep the dividend sustainable, even if interest rates continue to rise.

Source: Investor Presentation

Despite multiple recessions and uncertain environments over the past 50 years, the company has withstood every one of them while raising its dividend. While Canadian Utilities’ payout ratio came under pressure during 2020 (though dividends were in reality covered from its operating cash flows if we are to exclude depreciation and amortization,) by 2028, we expect it to have returned to much more comfortable levels of around 76% of its net income.

The company held up extremely well during previous recessions and economic downturns, such as the coronavirus pandemic. We would expect Canadian Utilities to perform relatively well in future recessions, given that the company operates in a virtually recession-proof industry.

Valuation & Expected Returns

Using the current share price of ~$21 and expected earnings-per-share of US$1.66 for the running fiscal year, Canadian Utilities is trading at a price-to-earnings ratio of 12.7. Our fair earnings multiple for Canadian Utilities is 16.0.

Therefore, the stock seems to be undervalued at its current price level. If the stock trades at our assumed fair valuation level in 2028, it will enjoy a 4.8% annualized valuation tailwind over the next five years.

Aside from changes in the price-to-earnings multiple, future returns will be driven by earnings growth and dividends.

We expect 4% annual earnings growth over the next five years, as utilities are generally slow-growth businesses. In addition, Canadian Utilities currently pays a quarterly dividend of CAD $0.4486 per share. This works out to roughly CAD $1.79 per share on an annualized basis. At current exchange rates, this translates to an annualized dividend of $1.35 per share in U.S. dollars for a 6.4% dividend yield.

Total returns could consist of the following:

- 0% earnings growth

- 4.8% multiple expansion

- 6.4% dividend yield

Given all the above, Canadian Utilities is expected to offer an average annual total return of 13.5% over the next five tears. As a result, we have a buy recommendation on the stock and remain confident in the company’s ability to raise dividends through a recessionary environment.

Final Thoughts

Canadian Utilities has a long growth record and a positive future outlook. We currently find the stock undervalued. As a result, shares may offer a 13.5% average annual total return over the next five years.

The stock should continue to raise its dividend for many more years, as the business is likely to hold up well during recessions. Canadian Utilities also has a high yield of above 6%, which is attractive to risk-averse income investors, such as retirees. Therefore, shares earn a buy rating.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].