Updated on September 27th, 2023 by Aristofanis Papadatos

California Water Service (CWT) has an amazing track record when it comes to increasing dividends to shareholders. CWT is part of the Dividend Kings, a group of stocks that have raised their payouts for at least 50 consecutive years.

You can see all 50 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Impressively, CWT has paid 314 consecutive quarterly dividends.

The Dividend Kings are the “best of the best” when it comes to rewarding shareholders with cash and this article will discuss the dividend of California Water Service, as well as its valuation and outlook.

Business Overview

California Water Service is a water stock and is the third-largest publicly-owned water utility in the United States.

It was founded in 1926 and has six subsidiaries that provide water to approximately 2 million people in 100 communities, primarily in California but also in Washington, New Mexico and Hawaii.

Just like the vast majority of utility companies, California Water Service is a slow-growth company. Utilities spend excessive amounts on the expansion and maintenance of their infrastructure and thus they accumulate high debt loads.

As a result, they rely on the regulatory authorities to approve of rate hikes every year. These rate hikes aim to help utilities service their debt but they usually result in modest growth of revenue and earnings. Regulatory authorities have incentive to offer attractive rate hikes to utilities in order to encourage them to invest in infrastructure.

On the other hand, authorities offer limited rate hikes in order to keep customers satisfied. The reliable rate hikes that utilities enjoy result in a resilient business model, which is characterized by fairly predictable cash flows and earnings growth.

This is clearly reflected in the exceptional dividend growth record of California Water Service. The company has raised its dividend for 55 consecutive years and has a projected payout ratio of just over 55% for 2023.

California Water Service reported its second-quarter earnings results on July 27th, 2023. Revenue decreased 6% over the prior year’s quarter primarily due to lower water consumption and earnings per share plunged 53%, from $0.36 to $0.17, thus missing the analysts’ consensus by $0.32.

Nevertheless, water consumption is expected to have recovered strongly in the third quarter. As a result, we expect the company to grow its earnings per share 7% in the full year, from $1.77 in 2022 to $1.90 this year.

Growth Prospects

As mentioned above, utilities rely on modest rate hikes by regulatory authorities year after year, and thus they are mostly slow-growth stocks. California Water Service is not an exception to this, as it has grown its earnings per share at a 6.3% average annual rate over the last decade.

We expect the company to grow its earnings per share by 5% per year on average over the next five years. One major driver of earnings growth will be continued rate hikes.

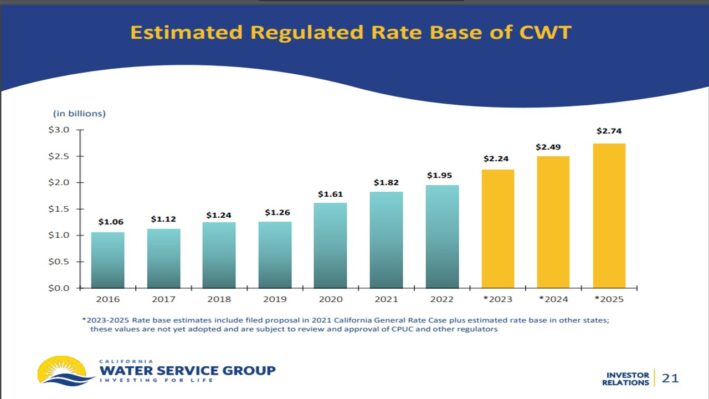

The chart below show that the regulated rate base of California Water Service is expected to grow by 12.0% per year from 2022 to 2025.

Source: Investor Presentation

Earnings growth in the long run should be achievable thanks to the rate hikes that are regularly approved by relevant authorities/regulators.

Regulators need to continuously encourage the company to keep investing in the expansion and maintenance of its network.

Customers are dependent on high–quality infrastructure that will remain reliable in the future, which is why future rate increases are more or less a given.

Another growth catalyst for California Water Service is acquisitions. This is a common practice for companies in many industries, including utilities, to generate inorganic growth by simply acquiring new customers.

Source: Investor Presentation

As shown in the above slide, the company is currently progressing through multiple acquisitions, which will instantly add thousands of new customers.

Overall, we expect California Water Service to grow its earnings per share at a 5% average annual rate over the next five years, which is roughly in line with its historical long-term growth rate.

Competitive Advantages & Recession Performance

Utilities invest enormous amounts on the maintenance and expansion of their network. These amounts result in high amounts of debt, but they also form extremely high barriers to entry to potential competitors.

It is essentially impossible for new competitors to enter the markets in which California Water Service operates. Overall, utilities have the widest business moat investors can hope for.

In addition, while the vast majority of companies suffer during recessions, water utilities are among the most resilient companies during such periods, as economic downturns do not affect the amount of water consumed by customers.

The resilience of California Water Service was evident in the Great Recession. Its earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $0.75

- 2008 earnings-per-share of $0.95 (27% increase)

- 2009 earnings-per-share of $0.97 (2% increase)

- 2010 earnings-per-share of $0.90 (7% decrease)

Therefore, not only did California Water Service not incur a decrease in its earnings during the Great Recession, but it grew its earnings per share by 20% throughout the 3-year period of 2007-2010. That performance was in sharp contrast to the performance of the vast majority of companies, which saw their earnings collapse during the Great Recession.

The exceptional resilience of California Water Service was also evident in the 2020 economic downturn caused by the coronavirus pandemic. While most companies incurred a material decrease in their earnings during this period, California Water Service grew its earnings per share by a staggering 50% in 2020.

Put simply, California Water Service is one of the most resilient companies during recessions and bear markets.

Valuation & Expected Returns

California Water Service is expected to generate earnings per share of $1.90 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 24.7. This is a high valuation multiple for a utility stock, which is a slow-growth stock. We consider 20.0 to be a fair earnings multiple for this stock.

The reliable and predictable growth trajectory is a reason behind the elevated valuation of the stock but we find it prudent not to pay an excessive premium for slow-growth stock, such as utilities. If investors overpay for a utility, the stock may generate weak returns for years.

In this case, the downside risk of California Water Service is significant whenever the company faces an unforeseen headwind, such as an adverse scenario of persistently high interest rates for years.

If California Water Service reverts to our assumed fair price-to-earnings ratio of 20.0 over the next five years, it will incur a -4.2% annualized drag in its returns. This could partly offset the positive returns of earnings-per-share growth and dividends.

Another negative aspect of a rich valuation is a low dividend yield. Due to its lofty price, the stock is offering just a 2.2% dividend yield. This is lower than the current rate of inflation of 3.6%.

Through the combination of expected earnings-per-share growth, valuation changes, and dividends, we believe California Water Service is likely to offer an average annual total return of 3.1% over the next five years.

Final Thoughts

California Water Service has exhibited an exceptional dividend growth record thanks to its reliable earnings growth, which is secured by rate hikes that are approved by regulatory authorities.

In addition, thanks to its healthy payout ratio and its solid business model, the company should easily continue raising its dividend at a mid-single-digit rate for many more years.

While California Water Service is a “boring” stock, it is exceptionally resilient during recessions. When most companies see their earnings collapse, California Water Service provides a safe haven to investors.

However, we believe that the market has fully priced in future growth. The stock is likely to offer lackluster returns over the next five years. As a result, we currently rate this utility as a sell.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].