Published on June 28th, 2023 by Bob Ciura

The Dividend Kings are a selective group of stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

Archer Daniels Midland (ADM) is a recent addition to the Dividend Kings list.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Archer Daniels Midland was founded in 1902 when George A. Archer and John W. Daniels began a linseed-crushing business. In 1923, Archer-Daniels Linseed Company acquired Midland Linseed Products Company, which created Archer Daniels Midland.

Today, it is an agricultural industry giant. Archer-Daniels-Midland operates in 160 countries and generates annual revenue above $85.2 billion.

The company produces a wide range of products and services designed to meet the growing demand for food due to rising populations.

Source: Investor Presentation

It operates four business segments: Origination, Oilseeds, Carbohydrate Solutions, and Nutrition. The Oilseeds segment is Archer Daniels Midland’s largest.

Archer-Daniels-Midland reported its first-quarter results for Fiscal Year (FY)2023 on April 25th, 2023. The company had another excellent quarter and full year. The company reported adjusted earnings per share of $2.09 the quarter vs. $1.90 in 1Q23, an increase of 9.9% Year over Year (YoY). Revenues were up by 1.8%.

Net income increased from $1,054 million to $1,170 million, or 11% growth for the quarter compared to 1Q22. Ag Services results were much higher than the first quarter of 2022. Also, Nutrition results were significantly lower year-over-year versus the record prior-year quarter.

Growth Prospects

Acquisitions are a significant driver of ADM’s historical growth. The company has acquired multiple various businesses over the past few decades to boost its growth.

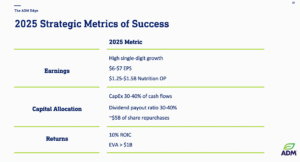

Source: Investor Presentation

We expect better growth with the new acquisition of Ziegler Group and the nutrition flavor research and customer center opening. We believe that a growth rate of around 3.0% is feasible for moving forward. The business is resistant to recessions, as people have to eat even during an economic downturn.

On the other hand, Archer-Daniels-Midland does not profit from economic expansion, as the amount of food sold does not rise quickly during good times. Thus, a strong economy is not a significant tailwind for Archer-Daniels-Midland, unlike many other companies, which profit substantially from higher consumer spending.

Competitive Advantages & Recession Performance

Archer Daniels Midland has built significant competitive advantages over the years. It is the largest processor of corn in the world. This gives way to economies of scale and efficiencies in production and distribution.

The company is an industry giant with ~453 crop procurement locations, 320 food and feed processing facilities, and 61 innovation centers.

At its innovation centers, the company conducts research and development on responding more effectively to changes in customer demand and improving processing efficiency. Archer Daniels Midland’s unparalleled global transportation network serves as a huge competitive advantage.

The company’s global distribution system provides the company with high margins and barriers to entry. In turn, this allows Archer Daniels Midland to remain highly profitable, even during industry downturns.

Profits held up, even during the Great Recession. Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $2.38

- 2008 earnings-per-share of $2.84 (19% increase)

- 2009 earnings-per-share of $3.06 (7.7% increase)

- 2010 earnings-per-share of $3.06

Archer Daniels Midland’s earnings-per-share increased in 2008 and 2009, during the Great Recession. Very few companies can boast such a performance in one of the worst economic downturns in U.S. history.

The reason for Archer Daniels Midland’s remarkable durability in recessions could be that grains still need to be processed and transported, regardless of the economic climate. There will always be a certain level of demand for Archer Daniels Midland’s products. From a dividend perspective, the payout looks quite safe.

Valuation & Expected Total Returns

Based on the expected 2023 EPS of $6.85, ADM shares trade for a price-to-earnings ratio of 10.8. Archer–Daniels–Midland has been valued at a price-to-earnings multiple of 15.5 over the last decade. Our fair value P/E is 14, meaning the stock is undervalued.

An increasing valuation multiple could generate 5.4% annual returns for shareholders over the next five years. Future returns will also be derived from earnings growth and dividends. We expect Archer Daniels Midland to grow its future earnings by ~3% per year through 2028, and the stock has a current dividend yield of 2.4%.

In this case, total expected returns are 10.8% per year over the next five years, a solid risk-adjusted rate of return for Archer Daniels Midland stock.

Final Thoughts

Archer Daniels Midland has a long history of navigating through challenging periods. It has continued to generate profits and reward shareholders with rising dividends along the way.

The stock trades at a low valuation and pays a 2.4% dividend yield, plus annual dividend increases. With expected returns above 10% per year, Archer Daniels Midland stock is a buy.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].