Updated on October 7th, 2022 by Nikolaos Sismanis

American States Water (AWR) has an amazing track record when it comes to paying dividends to shareholders.

AWR is part of the Dividend Kings, a group of stocks that have raised their payouts for at least 50 consecutive years. You can see all 45 Dividend Kings here.

And, you can download the full list of Dividend Kings, plus important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Dividend Kings are the “best of the best” when it comes to rewarding shareholders with cash, and this article will discuss AWR’s dividend, as well as its valuation and outlook.

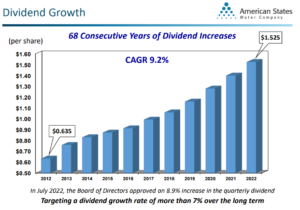

AWR has raised its dividend for 68 consecutive years, earning it the longest dividend growth streak in the stock market. No other company features a longer dividend growth streak than AWR. For context, the second-longest dividend growth streak is Dover Corporation, featuring 67 years of consecutive annual dividend increases.

This article will discuss the reasons why American States Water has maintained such a long history of steady dividend increases.

Business Overview

AWR is primarily a regulated water utility business that serves ~263,000 customers in California. It also has a regulated electric utility business in California and a non-regulated business in which it provides services for water distribution and wastewater collection on 11 military bases in the U.S.

Related: The 7 Best Water Stocks To Buy Now

The regulated water utility business is by far the most important division, as it generates ~70% of the total revenues of the company.

Source: Investor Presentation

While the regulated water business generates most of the revenues of AWR, the non-regulated business that provides services to water and wastewater systems on military bases is significant as well. AWR has signed 50-year contracts with the military bases, and thus, it has secured a reliable and recurring stream of revenues.

Utility stocks are slow-growth companies. They spend enormous amounts on the expansion and maintenance of their infrastructure, and thus, they accumulate high debt loads.

As a result, they rely on the regulatory authorities to approve rate hikes every year. These rate hikes aim to help utilities service their debt, but they usually result in modest growth of revenue and earnings.

Authorities have incentives to offer attractive rate hikes to utilities in order to encourage them to continue to invest heavily in infrastructure. On the other hand, authorities try to keep consumers satisfied, and hence they usually offer limited rate hikes.

AWR is a bright exception to the rule of slow growth in the utility sector. The company has grown its earnings per share at an 8.6% average annual rate in the past decade.

AWR achieved a superior growth pace primarily thanks to the material rate hikes it has received from regulatory authorities and its growth in its non-regulated business. Overall, it has a less “boring” business model than a typical utility company.

Growth Prospects

American States Water reported its second-quarter earnings results on August 1st, 2022. Fully diluted earnings–per–share decreased from $0.72 in Q2 2021 to $0.54 in Q2 2022, while Q2 revenue grew by 4.5% to $122.6 million year–over–year.

Adjusted diluted earnings per share rose by 2.9% per share to $0.71 compared to last year’s same period, nonetheless.

As already mentioned, utilities are slow-growth stocks in general due to the lackluster rate hikes they receive from regulatory authorities in exchange for their hefty capital expenses. AWR is superior to most utilities in this aspect, as it has enjoyed an exceptional 11.3% average annual rate hike in its regulated water business in recent years.

Source: Investor Presentation

This has helped the company grow its earnings per share at an 8.6% average annual rate over the last decade, which is one of the highest growth rates in the utility sector.

Moreover, thanks to its positive performance, its resilience to the coronavirus crisis, and its bright outlook, AWR raised its dividend by 8.9% this year. This is above the typical dividend growth rate of utility stocks.

AWR has now grown its dividend for 68 consecutive years, The company’s 10-year dividend-per-share CAGR stands at a satisfactory 9.2%.

Source: Investor Presentation

It is also remarkable that management has set a goal of raising the dividend by more than 7% per year on average over the long term.

Such a high dividend growth rate is rare in the slow-growth utility sector and renders the 1.9% dividend yield of the stock somewhat more attractive.

Moreover, AWR has a markedly strong balance sheet, with an A+ credit rating, one of the highest in the utility industry.

Thanks to its healthy payout ratio of ~64%, its strong balance sheet, and its sustained growth, AWR has a good chance of delivering its ambitious goal of more than 7% annual dividend growth to its shareholders.

Going forward, AWR is likely to continue growing at a meaningful pace thanks to rate hikes in its water utility business. In addition, thanks to the highly fragmented status of the water utility business, AWR can also grow by acquiring small companies.

Competitive Advantages & Recession Performance

Utilities invest excessive amounts in the maintenance and expansion of their network. These amounts result in high amounts of debt, but they also form impenetrable barriers to entry to potential competitors.

It is essentially impossible for new competitors to enter the utility markets in which AWR operates.

Even in its non-regulated business, AWR enjoys weak competition thanks to the 50-year duration of its contracts.

In addition, while most companies suffer during recessions, utilities are among the most resilient companies during such periods, as economic downturns do not affect the consumption of water and electricity.

The resilience of AWR was prominent in the Great Recession. Its earnings-per-share during the Great Recession are as follows:

- 2007 earnings-per-share of $1.56

- 2008 earnings-per-share of $1.49 (4% decrease)

- 2009 earnings-per-share of $1.61 (8% increase)

- 2010 earnings-per-share of $1.66 (3% increase)

Therefore, AWR remained resilient during the Great Recession, managing to grow its earnings per share by 6% between 2007 and 2010.

The resilience of AWR was also evident in 2020, as the company still managed to grow earnings-per-share, despite the deep economic downturn caused by the coronavirus pandemic.

Overall, AWR is one of the most resilient companies during recessions and bear markets. This resilience is very important as it supports the long-term returns of the stock and makes it easier for the shareholders to retain the stock during broad market sell-offs.

Valuation & Expected Returns

We expect AWR to generate earnings-per-share of $2.48 this year. As a result, the stock is currently trading at a price-to-earnings ratio of 33.8. We consider 25.0 to be a fair earnings multiple for this stock.

The extremely high price-to-earnings ratio, which has been sustained over the years, can be attributed, at least in part, to the depressed interest rates over the past decade.

When interest rates are low, income-oriented investors have a problem identifying attractive yields in the market, and thus, they view the dividend yields of utilities as more attractive. As a result, utility stock prices benefit from suppressed interest rates.

Surprisingly, even with interest rates now on the rise, AWR has retained a steep valuation premium. We believe this is due to investors flocking to the company’s recession-proof cash flows, predictable growth avenues, and excellent track record of shareholder value creation even during the harshest market environments.

Still, nobody can guarantee this will remain the case indefinitely. The stock could easily be priced lower if investors wake up to the realization it trades at an excessive valuation multiple. Therefore, we see the potential for contraction of the P/E multiple moving forward.

If AWR reaches our assumed fair price-to-earnings ratio of 25.0 over the next five years, it will incur a -5.9% reduction in annual returns due to the contraction of its earnings multiple.

Moreover, AWR is currently offering a 1.9% dividend yield. We also expect the company to grow its earnings per share at a 7.2% average annual rate over the next five years.

Putting it all together, AWR is likely to achieve annual returns of 3.0% through 2027.

It appears that the market has almost fully priced in the reliable earnings growth and the defensive characteristics of the stock, leaving almost no return margin for current investors.

Final Thoughts

AWR is much more interesting than the average utility stock as it has some exceptional characteristics.

It has grown its earnings per share at a high single-digit annual rate over the last decade. This is much better than the low growth rates of most utilities.

In addition, the business of AWR includes a non-regulated segment, which provides recurring revenue for 50 years and offers significant growth potential.

However, investors should realize that the market has almost fully appreciated all the virtues of AWR.

With a humble five-year expected total return potential, AWR stock receives a “sell” rating.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].