Updated on September 12th, 2023 by Bob Ciura

Investors looking for stocks with long histories of dividend growth should take a closer look at the Dividend Kings. This elite group of stocks have the longest streaks of annual dividend increases. The Dividend Kings have each raised their dividends for at least 50 consecutive years.

To be a Dividend King, a company must have a strong business model with competitive advantages, along with the ability to navigate recessions. It should be no surprise that we consider the Dividend Kings to be among the highest-quality dividend stocks in the entire stock market.

We created a full list of all 50 Dividend Kings, along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios. You can download the full list by clicking on the link below:

Altria recently increased its dividend by 4%, representing its 58th dividend increase in the past 54 years. Altria enjoys numerous competitive advantages, which have allowed the company to raise its dividend for so long.

With a high dividend yield of 8.8%, we view Altria stock as an attractive option for income investors.

Business Overview

Altria sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 10% equity stake in Anheuser-Busch InBev (BUD), a 35% stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

Related: 2023 Tobacco Stocks List | The 6 Best Now, Ranked In Order

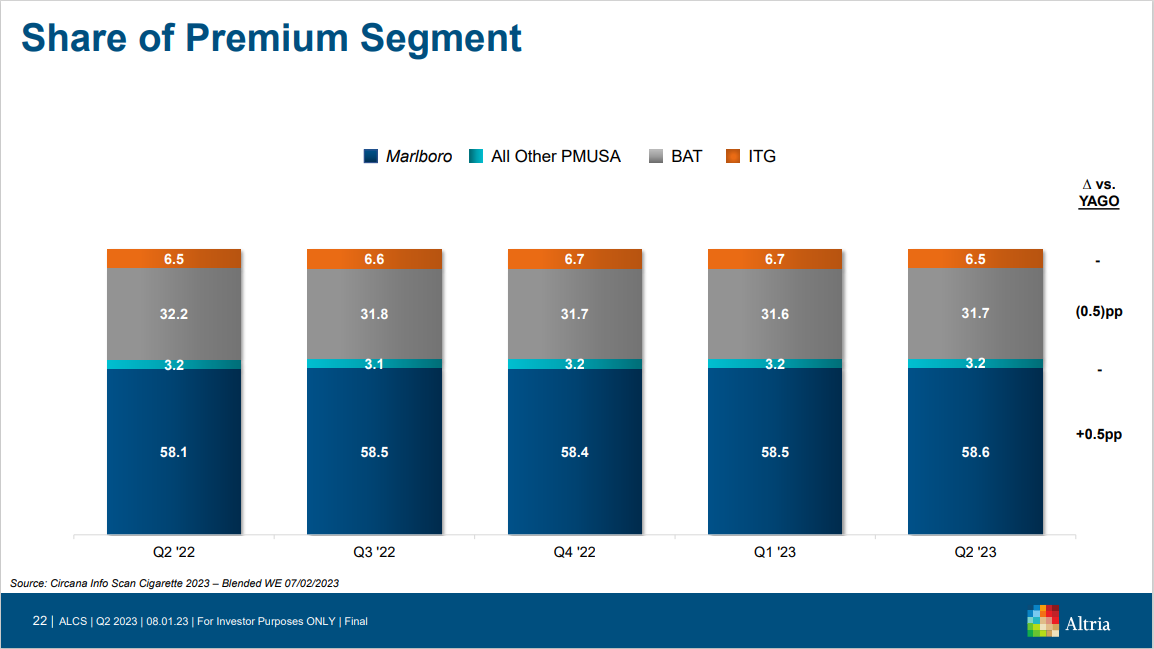

Smokeable tobacco products still comprise the vast majority of Altria’s revenue and profit. The Marlboro brand still commands a leading market share in the U.S. market.

Source: Investor Presentation

Over the past several decades, this has served the company (and its shareholders) extremely well. Altria has increased its dividend for 54 years in a row. While high dividend yields are routine among tobacco stocks, no company has as long of a dividend increase streak as Altria.

On August 1st, 2023, Altria reported second-quarter results. Its adjusted diluted earnings per share came in at $1.31, up 4% year-over-year, while its net revenues declined by 0.5% year-over-year.

Management reaffirmed its 2023 full year guidance range of adjusted diluted earnings per share of between $4.89 and $5.03, reflecting a potential growth range of 1-4% year-over-year.

Growth Prospects

Altria’s future growth faces a cloudy future due to changing consumer habits.

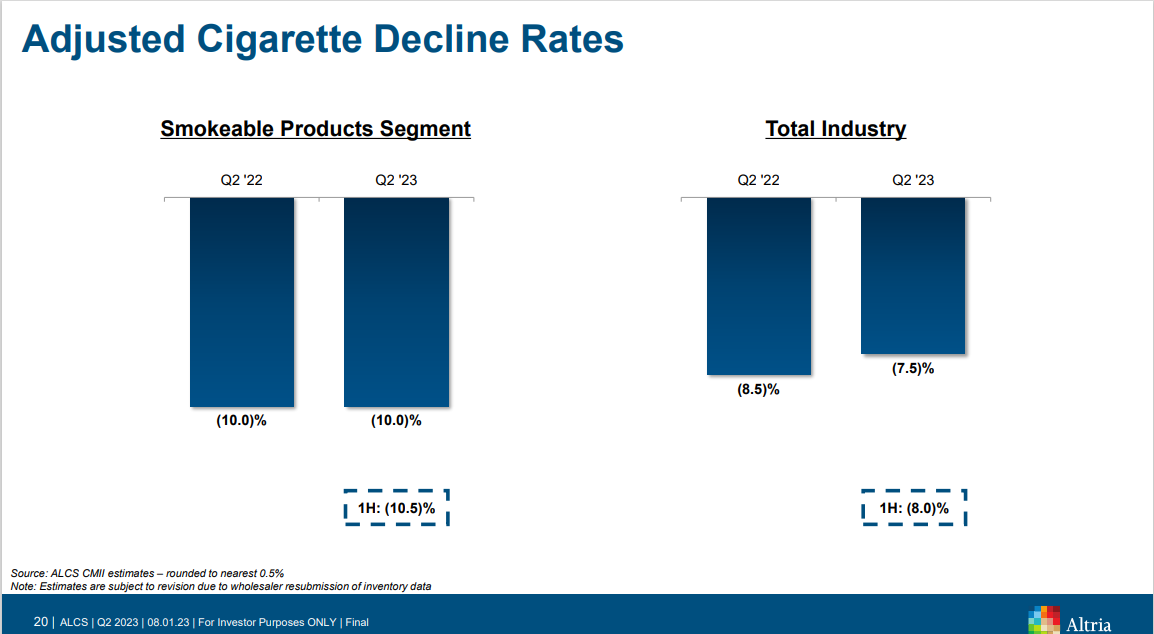

As a major tobacco company, Altria has to deal with the reality of declining smoking rates in the United States. Each year, there are fewer cigarette smokers in the U.S and, therefore, fewer customers for tobacco giants like Altria.

In its most recent quarterly results, the company reported that its smokeable products segment recorded a domestic cigarette shipment volume decline of 10% compared to last year when adjusted for trade inventory movement.

Source: Investor Presentation

Historically, tobacco manufacturers compensated for falling smoking volumes with pricing increases. This has been a successful tactic to offset lost revenue, and Altria will continue to raise prices in the years to come.

But ultimately, tobacco companies must adapt to the new environment, and Altria is preparing for a post-cigarette world by investing heavily in the development of non-combustible products.

Altria has invested heavily in non-combustible products, such as its $13 billion investment in e-cigarette leader JUUL and its $1.8 billion investment in Cronos. E-vapor and cannabis could be two major long-term growth catalysts going forward.

Altria also acquired Swiss company Burger Söhne Group, to commercialize its on! oral nicotine pouches. Oral tobacco is a growth area for Altria, as consumers who have quit smoking increasingly shift to oral tobacco products.

Source: Investor Presentation

Finally, Altria is aggressively expanding its own e-cigarette brand IQOS. Growth from these new products will help Altria to continue increasing revenue in the years ahead, even as smoking rates keep falling.

The company will also be able to generate earnings-per-share growth through cost reductions and share repurchases. In all, we expect ~1.7% compound annual growth in Altria’s earnings-per-share over the next five years.

Competitive Advantages & Recession Performance

Altria benefits from a number of competitive advantages, which allowed the company to generate steady growth over so many years. First and foremost, Altria has tremendous brand loyalty. The retail market share for the flagship Marlboro cigarette brand has remained high for many years. This affords the company the ability to raise prices every year and not lose customers.

Second, tobacco manufacturers operate an advantageous business model which does not require intensive capital outlays. Tobacco is not a capital-intensive business, thanks to economies of scale in production and distribution. This is why Altria generates strong free cash flow each year, even as revenue has stagnated from falling smoking rates.

Such strong free cash flow leaves plenty of cash available for shareholder returns, debt repayment, and investment in future growth initiatives.

Another benefit of Altria’s business model is that it is highly resistant to recessions. Cigarettes and alcohol sales hold up very well during recessions, which keeps Altria’s profitability and dividend growth intact. The company performed strongly during the previous major economic downturn, the Great Recession of 2008-2009:

- 2008 earnings-per-share: $1.66

- 2009 earnings-per-share: $1.76

- 2010 earnings-per-share: $1.87

Altria grew its adjusted earnings-per-share in each year of the Great Recession. This demonstrates the company’s ability to produce steady earnings growth, even when the broader economic environment becomes more challenging.

Given Altria’s exposure to recession-resistant products, it should hold up very well during the next downturn.

Valuation & Expected Returns

Based on the expected 2023 earnings-per-share of $4.96, Altria stock trades for a price-to-earnings ratio of 9.0, compared with our fair value estimate of 11.0.

As a result, Altria stock appears to be undervalued, which could result in positive returns from an expanding valuation multiple. If Altria’s P/E ratio rises from 9 to 11 over the next five years, shareholder returns would be boosted by 4.1% per year.

In addition, we expect 1.7% annual earnings-per-share growth through 2028, which will further boost shareholder returns.

Lastly, Altria has a high dividend yield of 8.8%, making the stock very attractive for investors who focus primarily on income. The dividend appears to be safe, as the company maintains a payout ratio of 79% of its annual adjusted earnings-per-share.

Taken together, Altria stock has total expected returns above 14% per year over the next five years. With a high expected rate of return above 10% per year, we rate Altria stock a buy.

Final Thoughts

When it comes to dividend stocks, Altria is about as steady as they come. It has increased its dividend each year for over five decades, a highly impressive performance.

The company faces uncertainty due to the continued decline in smoking rates, but Altria has planned for the changing consumer landscape by investing in new products such as heated tobacco, e-vapor, and cannabis. These adjacent categories will fuel continued growth for years to come.

Altria stock also appears to be undervalued, meaning right now is an opportune time to buy shares. The high dividend yield of 8.8% is relatively secure. Overall, the stock seems very attractive for value and income investors.

Related: How to Live Off Dividends In Retirement

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].