Updated on September 29th, 2023 by Bob Ciura

We believe long-term investors should focus on the highest-quality dividend growth stocks. These are companies with long histories of raising their dividends, and durable competitive advantages to fuel continued dividend growth.

Therefore, we tend to steer investors toward the Dividend Kings, a group of just 50 stocks with at least 50 years of dividend increases.

You can also download an Excel spreadsheet with the full list of all 50 Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

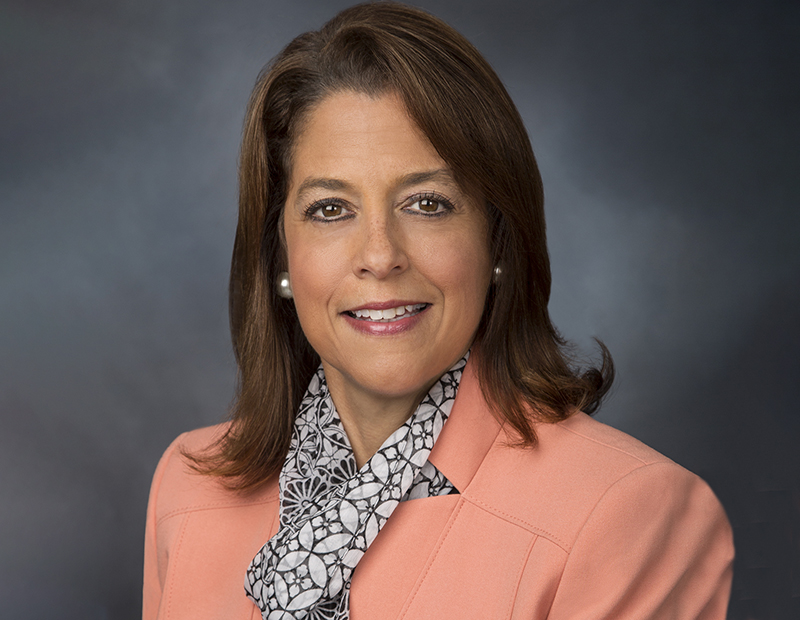

We review each of the Dividend Kings every year. The next stock to be reviewed in this year’s edition is AbbVie (ABBV).

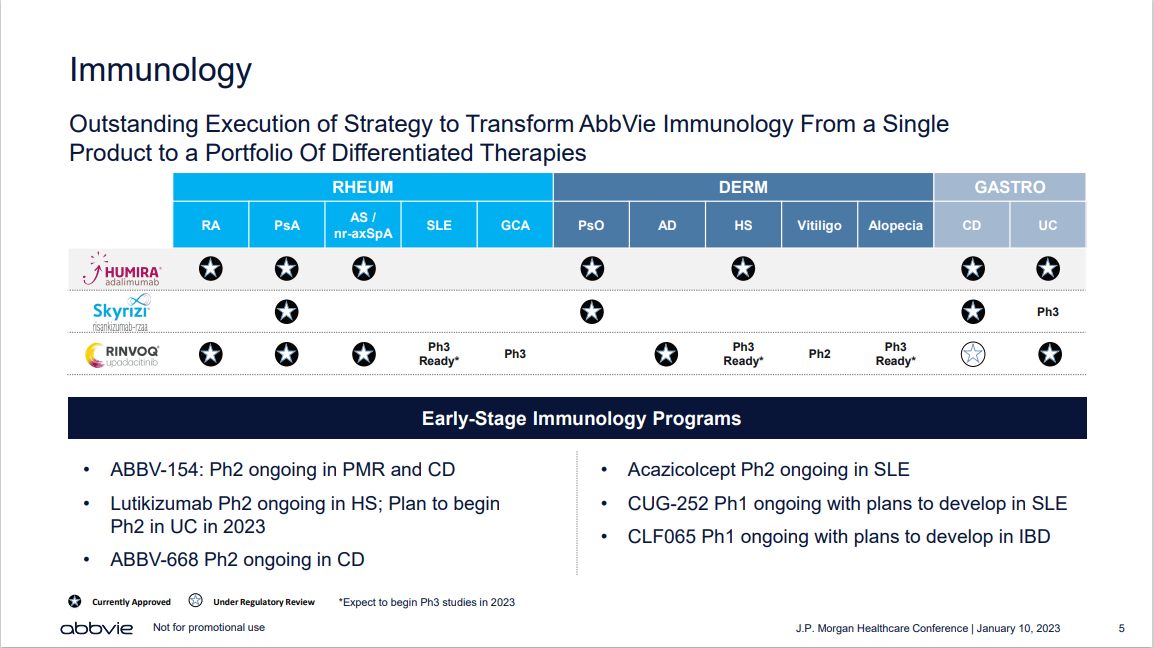

There are questions regarding AbbVie’s future growth, due to its flagship drug Humira facing patent expiration. However, the company has a plan to continue growing in the years ahead.

Business Overview

AbbVie is a global pharmaceutical giant. It began trading as an independent company in 2013, after it was spun off from Abbott Laboratories (ABT). AbbVie generated strong growth since the spin-off. According to AbbVie, it grew revenue and adjusted EPS growth by 14.7% and 19% respectively, each year from 2013-2021.

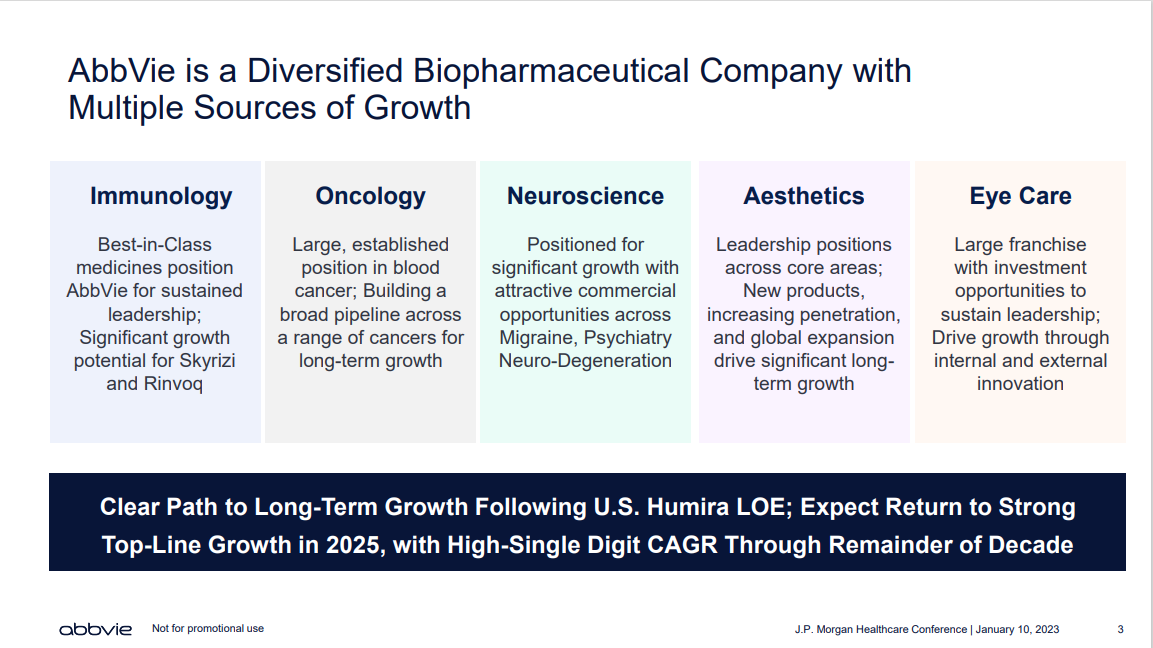

Today, AbbVie focuses on one main business segment—pharmaceuticals. It focuses on a few key treatment areas, including immunology, hematologic oncology, neuroscience, and more.

Source: Investor Presentation

Since the spin-off from Abbott, AbbVie has produced excellent growth, due in large part to Humira, a multi-purpose drug. The challenge for AbbVie is that Humira is now facing biosimilar competition after it has lost patent exclusivity.

Even so, AbbVie remains a giant in the healthcare sector, with a large and diversified product portfolio.

In the 2023 second quarter, revenues of $13.9 billion declined 5% from the same quarter last year. Revenues were positively impacted by growth from some of its newer drugs, including Skyrizi and Rinvoq. Still, declining revenue for Humira took its toll last quarter.

Earnings-per-share of $2.91 declined 14% from the same quarter last year, but EPS did beat analyst estimates by $0.10.

Growth Prospects

The major risk for global pharmaceutical manufacturers is patent loss. When a particular drug loses patent, the market is typically flooded with competition, especially for the world’s top-selling products.

For AbbVie, its biggest risk is the competition about to hit its flagship drug Humira, a multi-purpose drug that is used to treat a variety of conditions. Some of these include rheumatoid arthritis, plaque psoriasis, Crohn’s disease, ulcerative colitis, and more.

Humira at one point generated over half of AbbVie’s annual sales. Loss of patent exclusivity is a significant overhang–AbbVie expects its total sales will decline in 2023 as a result. At the same time, AbbVie also expects to return to sales growth in 2025, with high single-digit annual growth through the end of the decade.

Fortunately, the company prepared for the loss of patent exclusivity on Humira by investing heavily in new products, as well as acquisitions to boost its growth. For example, Rinvoq and Skyrizi are two key products that represent long-term growth catalysts.

Source: Investor Presentation

AbbVie also completed the $63 billion acquisition of Allergan. Allergan’s flagship product is Botox, which diversifies AbbVie’s portfolio with exposure to global aesthetics.

The company sees its aesthetics revenue growing at a high rate over the next several years, exceeding $9 billion in 2029.

Source: Investor Presentation

In all, we expect 3% EPS growth for AbbVie over the next five years, reflecting the steep patent cliff facing Humira. We believe the growth outlook will improve when the Humira overhang is gone, but there is uncertainty surrounding AbbVie’s ability to overcome that with new products.

Competitive Advantages & Recession Performance

The most important competitive advantage for AbbVie, and any pharmaceutical company, is its patent portfolio. Pharmaceutical giants need to spend heavily to develop new drugs and therapies, when one of their blockbusters loses patent protection.

AbbVie has over 80 clinical programs. It has multiple growth opportunities to replace Humira, particularly in the therapeutic areas of immunology, hematology, and neuroscience. The result of its significant investment in R&D is a well-stocked pipeline.

AbbVie was not a standalone company during the last financial crisis, so there is no recession track record. However, the fact remains that since sick people require treatment whether the economy is strong or not, it is highly likely that AbbVie would continue to perform well during a recession.

AbbVie’s earnings are likely to decline somewhat in a recession, but the dividend should remain secure. AbbVie has a projected dividend payout ratio of ~54% for 2023.

Valuation & Expected Returns

AbbVie is expected to generate adjusted EPS of $11.00 for 2023, at the midpoint of guidance. At this EPS level, the stock is currently trading for a price-to-earnings ratio of 13.7.

Our fair value estimate for AbbVie is a price-to-earnings ratio of 11, meaning the stock is slightly over-valued today. A declining P/E multiple could reduce shareholder returns by approximately 4.3% per year over the next 5 years.

In addition, we expect annual earnings growth of 3% through 2028.

Lastly, the stock has a current dividend yield of 3.9%. Given these inputs, we expect annual returns of 2.6% per year over the next five years, making AbbVie stock a hold.

Final Thoughts

AbbVie is a very high-quality business, with a strong pharmaceutical pipeline and growth potential. It is also a shareholder-friendly company that returns excess cash flow to investors through stock buybacks and dividends.

AbbVie faces a significant challenge in replacing lost Humira sales as it faces competition in the U.S. and Europe. This is why we have fairly low assumptions for the company’s future EPS growth and fair value P/E multiple.

Still, the company has built a large portfolio of new products that should keep its growth intact. And, AbbVie will be able to generate additional growth from the acquisition of Allergan.

However, the low expected returns make the stock a hold.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Dividend Kings: considered to be the ultimate dividend growth stocks, the Dividend Kings list is comprised of stocks with 50+ years of consecutive dividend increases

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].