Mark Wilson

Berkshire Hathaway’s “Secret Sauce”

Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) last bought shares of Coca-Cola (KO) in 1994. Its position in the iconic soda company had reached 400 million shares, the same number of shares BRK owns today, at a total cost of $1.3 billion — about $3.25 per share.

As Buffett recounts in the 2022 Berkshire Hathaway annual letter:

The cash dividend we received from Coke in 1994 was $75 million. By 2022, the dividend had increased to $704 million. Growth occurred every year, just as certain as birthdays. All Charlie and I were required to do was cash Coke’s quarterly dividend checks. We expect that those checks are highly likely to grow.

In 1994, right after Buffett had finished building BRK’s position in KO, the stock holding yielded ~5.8% on cost (the dividend divided by the cost basis).

By 2022, KO’s stock price had risen above $60 per share, and BRK’s yield-on-cost had soared to… wait for it… 54%.

And after another 4.5% dividend hike for 2023, BRK’s new yield-on-cost has risen to nearly 57%.

Just to be clear, this means that over half of BRK’s originally invested dollars are now being returned to Buffett’s investment company every year in the form of cash dividends.

Much the same story could be told about Buffett’s nearly 30-year holding in American Express (AXP). Writes Buffett:

American Express is much the same story. Berkshire’s purchases of Amex were essentially completed in 1995 and, coincidentally, also cost $1.3 billion. Annual dividends received from this investment have grown from $41 million to $302 million. Those checks, too, seem highly likely to increase.

In 1995, BRK finished up its buying of AXP at a starting dividend yield just shy of 3.2%. In 2022, BRK’s yield-on-cost for its AXP holding had grown to 23%. And after AmEx’s last few big dividend increases, BRK’s up-to-date YoC now sits at 28%.

Without even trying to be, Warren Buffett has proven himself to be an excellent dividend growth investor (“DGI”) over the years and decades.

This leads us to what Buffett calls “the secret sauce”:

The lesson for investors: The weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And, yes, it helps to start early and live into your 90s as well.

So, to drop the punch line right away, we might summarize Buffett’s lesson for DGIers as:

- Identify quality companies capable of consistently compounding profits and dividends,

- buy them at reasonable prices and attractive dividends,

- watch and wait patiently as the wonders of compounding gradually take effect, and

- live long enough to see the dividend snowball become an avalanche.

It’s deceptively simple. Not easy, mind you, but simple.

Although BRK famously does not pay a dividend as Buffett and his longtime partner, Charlie Munger, prefer to retain as much cash as possible in the business, Buffett and co. display quite a penchant for owning dividend-paying and dividend-growing stocks.

Across all holdings, including the stock holdings of its wholly owned subsidiary New England Asset Management, BRK collects over $6 billion in dividends annually, including over $4.9 billion from publicly traded companies. Most of Buffett’s holdings pay a dividend, although he by no means seeks out the highest yields.

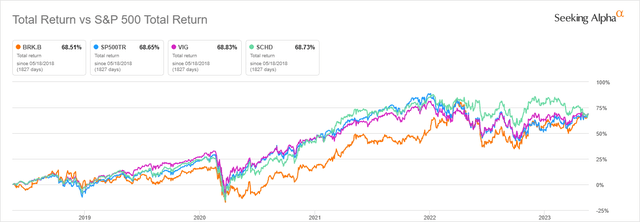

Dividend investors will be glad to know that, at this point, we aren’t that much by foregoing ownership of BRK, as Buffett’s company has delivered almost exactly the same total returns over the last five years as the S&P 500 (SPY), Vanguard Dividend Appreciation ETF (VIG), and Schwab US Dividend Equity ETF (SCHD):

Seeking Alpha

Although BRK doesn’t fit with a DGI strategy, there are lots and lots (and lots) of lessons DGIers can (and should) learn from Buffett. The man is a fount of investing wisdom who, by sticking with his simple investment principles over a long lifetime as an investment manager, has produced phenomenal returns for himself, his shareholders, and the charitable organizations to which he has pledged his wealth someday.

In what follows, let’s briefly cover Buffett’s dividend stock holdings, and then we’ll discuss how three critical Buffett investment principles apply to dividend growth investors.

In the process, we DGIers will hopefully pick up some valuable tips on how to do what Buffett has done: turn our invested dollars into an ever-growing passive income stream.

Berkshire’s Dividend Portfolio

By my count, 30 of BRK’s 48 publicly traded holdings (or 46 if you exclude the S&P 500 ETFs) pay dividends.

About 80% ($4.91 billion) of BRK’s total dividend income comes from these publicly traded companies.

Below, we find all 30 of BRK’s dividend-paying stocks, along with their portfolio weighting (excluding cash), the total dividend income each holding generates for BRK, and the percentage of total dividends from public companies each holding contributes.

| Company | Weighting | Total Dividend Income | % of Public Dividends |

| Apple (AAPL) | 46% | $879m | 17.9% |

| Bank of America (BAC) | 9.1% | $909m | 18.5% |

| American Express (AXP) | 7.7% | $364m | 7.4% |

| Coca-Cola (KO) | 7.6% | $736m | 15.0% |

| Chevron (CVX) | 6.6% | $800m | 16.3% |

| Occidental Pet. (OXY) | 4.1% | $152m | 3.1% |

| Kraft Heinz (KHC) | 3.9% | $521m | 10.6% |

| Moody’s (MCO) | 2.3% | $76m | 1.5% |

| HP Inc. (HPQ) | 1.1% | $127m | 2.6% |

| Citigroup (C) | 0.8% | $113m | 2.3% |

| Kroger (KR) | 0.8% | $52m | 1.1% |

| Paramount Global (PARA) | 0.6% | $19m | <1% |

| Visa (V) | 0.6% | $15m | <1% |

| General Motors (GM) | 0.5% | $14m | <1% |

| Mastercard (MA) | 0.4% | $9m | <1% |

| Aon Plc (AON) | 0.4% | $11m | <1% |

| Celanese (CE) | 0.3% | $25m | <1% |

| Capital One (COF) | 0.3% | $24m | <1% |

| McKesson (MCK) | 0.3% | $5m | <1% |

| Ally Financial (ALLY) | 0.2% | $35m | <1% |

| Globe Life (GL) | 0.2% | $6m | <1% |

| Louisiana Pac (LPX) | 0.1% | $7m | <1% |

| Marsh & McLennan (MMC) | 0.1% | $1m | <1% |

| Johnson & Johnson (JNJ) | <0.1% | $1.5m | <1% |

| Procter & Gamble (PG) | <0.1% | $1m | <1% |

| Diageo (DEO) | <0.1% | $1m | <1% |

| Mondelez (MDLZ) | <0.1% | $1m | <1% |

| Jeffries (JEF) | <0.1% | $0.5m | <1% |

| United Parcel Service (UPS) | <0.1% | $0.5m | <1% |

| Vitesse Energy (VTS) | <0.1% | $0.1m | <1% |

(Information taken from BRK’s Q1 2023 13F filing found at 13f.info.)

Interestingly, BRK’s top ten publicly traded holdings by portfolio weighting also generate slightly over 95% of its dividend income. The top 5 generate 75% of dividend income from public stocks.

Now, with the snapshot of BRK’s current public stock portfolio in mind, let’s consider how three of Buffett’s investment principles apply to a dividend growth strategy.

1. Own Top-Quality Businesses

The flipside of this principle is: “…and ignore the rest.”

Remember that in Buffett’s view, the best businesses boast enduring, moat-worthy, timelessly valuable assets and know how to use those assets to generate consistently growing profits indefinitely.

(We’ll come back to that word “indefinitely” below.)

The Coca-Cola brand is irreplaceable. It’s known all over the world. It is perhaps the best-known brand on the planet.

The same could be said of Apple. When consumers buy an Apple product, they rarely ever go back to equivalent non-Apple products. It’s a lifestyle brand that people trust. The products exude quality and user-friendliness. And despite technically having plenty of competition in the electronics world, the Apple brand has so thoroughly won over its customers as to create a high-margin moat out of nothing. It’s luxury for the everyman. People will pay more for an Apple product… just because it’s an Apple product.

High-quality businesses like these don’t present themselves every day. That’s why Buffett (inspired by Munger) said:

Our goal is to find outstanding businesses at sensible prices, not a mediocre business at a bargain price.

At the 2013 annual meeting, in response to a question, Buffett remarked:

Looking back, when we’ve bought wonderful businesses that turned out to continue to be wonderful, we could’ve paid significantly more money, and they still would have been great business decisions.

… Generally speaking, if you get a chance to buy a wonderful business – and by that, I would mean one that has economic characteristics that lead you to believe, with a high degree of certainty, that they will be earning unusual returns on capital over time – unusually high – and, better yet, if they get the chance to employ more capital at – again, at high rates of return – that’s the best of all businesses. And you probably should stretch a little.

Of course, it is a good idea to pay less, rather than more, if you can help it. But the most important thing, according to Buffett, is to pick quality businesses. If you pay a little bit more than you have to in the short term, the decision to own quality will more than make up for this in the long term.

Or, as Charlie Munger put it (quoted in the 2022 Berkshire Hathaway annual letter):

Don’t bail away in a sinking boat if you can swim to one that is seaworthy.

How to know what’s a temporarily mispriced but fundamentally seaworthy vessel and what’s sinking hopelessly is a judgement call every investor will have to make at some point or another.

This principle applies to dividend growth investors as equally as it does to any other investor. If you want a reliable dividend and robust dividend growth, focus on quality. Be willing to pay up, if you have to, for quality dividend compounders.

As an example, my top holding is a net lease real estate investment trust (“REIT”) called Agree Realty (ADC). It is consistently one of the most “expensive” net lease REITs by price-to-adjusted funds from operations (the non-GAAP earnings metric for REITs).

- Agree Realty: 16.6x AFFO

- Realty Income (O): 14.6x AFFO

- Essential Properties Realty Trust (EPRT): 14.6x AFFO

- NNN REIT (NNN): 13.4x AFFO

But as I explained recently in an article rating ADC as a “strong buy,” ADC boasts the most recession-resistant portfolio, the strongest balance sheet, and among the lowest cost of capital of its peers. Its ability to churn out solid results year after year after year through its simple yet elegant formula is what makes it worthy of the higher multiple.

2. Buy And Hold For The Long Run

This principle flows out from the first. If you own high-quality businesses that have the ability to consistently generate high returns on capital and steady dividend growth, why would you sell it? As long as the business continues to exhibit the same strong qualities, it would be short-sighted to take profits.

Selling a high-quality company when you don’t have to is like going to an apple orchard and chopping the trees down for firewood.

That’s why Warren Buffett said his favorite holding period is “forever.”

In the words of Buffett’s business partner, Charlie Munger, from the 2022 Berkshire annual letter:

Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.

3. Embrace Portfolio Concentration

Although BRK has 48 holdings, which sounds quite diversified, the portfolio is also heavily concentrated in its top holdings.

It is well-known that Apple is BRK’s top holding, and not by a little bit. It’s by far BRK’s largest holding at 46% of the total public stock portfolio.

The top 5 stocks make up 77% of the portfolio, and the top 10 holdings account for 90%!

Buffett has described diversification as “protection against ignorance” and that “risk comes from not knowing what you are doing.”

Rather than seeing diversification as “the only free lunch in investing,” to borrow the phrase of Harry Markowitz, Buffett sees it as needless for any investor with a deep understanding of what exactly they are investing in. For the non-specialists, Buffett has often recommended simply buying the S&P 500 index.

But for those who treat investing like being a business owner, putting in the time and effort to understand its ins and outs, it makes sense to be concentrated.

In most cases, self-made wealth is generated by owning and operating a business, which by nature involves heavy concentration of one’s capital, time, efforts, and resources.

Generally speaking, riches are gained from concentration and kept by diversification.

Might I add that riches can also be kept by investing them in such a way that they generate sufficient passive income to live on without the need to sell the principal. Even better would be an investment strategy in which the passive income grows over time.

Is there a type of investing that accomplishes this? I can think of one. And it rewards concentration in high-quality companies just as much as any other investment strategy.

Recall the examples of Buffett’s investments in Coca-Cola and American Express.

Bottom Line

To be clear, Warren Buffett isn’t exclusively a dividend growth investor. But he has made some phenomenal dividend growth investments in his lifetime. And his formula of success, his “secret sauce,” is as repeatable as it is simple:

- Buy quality companies, even if you have to pay a little more than you’d like

- Hold them for as long as they remain quality companies

- Let the magic of compounding do its work

That’s it.

This formula works just as well for dividend-paying companies as it does for others. In fact, the joy of compounding is even greater when it involves a snowballing stream of passive dividend income.