Mongkol Onnuan

Good morning, everyone! Today, I’d like to recap the last 10 years of dividend income I have received, look at the growth and predict what the next 10 years could look like!

We all know that “Father time” can either work against us or for us. In the world of dividend investing, building passive income on the road to financial freedom, “Father time” can be your best friend.

Grab your coffee and let’s dive in!

Last 10 Years Of Passive Income | Dividend Income

Here is 10 years of consistently investing into dividend stocks. What has helped me along the way are a few items, such as a high savings rate and definitely not trying to time the market.

I aim to save at least 60% of my earned income and use the majority of that to invest into dividend stocks. 2022 was definitely a big year of investing, simply due to the S&P 500 and the entire stock market plummeting 20% due to inflation as well as recession concerns.

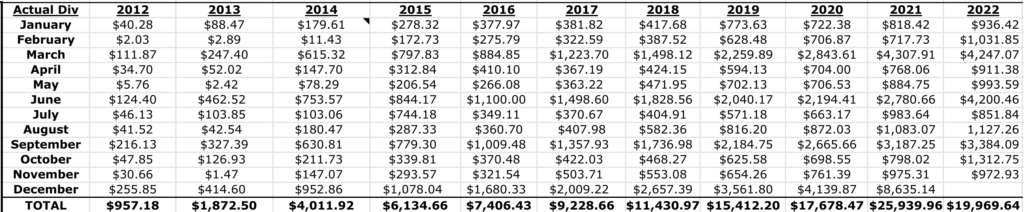

In the chart above, you see 2012 through 2022, 10+ full years of dividend investing results. Technically, we have almost 11 full years due to counting the year 2012!

The average growth rate is 55% over the years. Obviously, that is significantly skewed due to the 2012-2014 era of years that include 100% growth rates. When removing those years, the growth rate is reduced down to 31%.

Over the last 5 years, I have decided to simply just go for it and invest even more than I thought I could, really pushing to the brink. This includes investing $400-650 per week into the Vanguard High Dividend Yield ETF (VYM), which started July 2020.

That is why you also see immense growth from 2020 to 2021, one of the largest growth rates I have had, at 47%. In addition, owning the Vanguard Institutional Index Fund Institutional Shares (VINIX), a mutual fund in my old 401(k), sends capital gain distributions at the end of the year. This is along with the quarterly dividend, which increases those December month-ends, especially in 2021.

I also maximize my 401(k) contributions (which is currently $20,500 for 2022 and goes up to $22,500 for 2023). The current investment is Fidelity’s S&P 500 – FXAIX.

In addition, in the spring of 2022, I also decided to buy Vanguard’s S&P 500 (VOO) daily, currently at $60 per day. Doing this allows me to buy the entire stock market without timing and having emotions in my investment decision. No matter what, then, dividend income grows from this strategy, typically at a yield of 1.50-1.75%. I use SoFi’s investing app for this, which I highly recommend due to a few reasons:

1) Automatically buy any amount, any frequency.

2) 3.50% APY on savings and 2.50% APY on checking.

Therefore, a combination of extremely high savings rate, consistently investing thousands of dollars per month (which I am fortunate to do so) and not paying attention to the noise has allowed me to have a true growth rate of around 30%.

Next 10 Years… Financial Freedom?

Here is the true point of the article. What do the next 10 years look like? Given growth rates of over 30% recently, will this allow me to reach financial freedom sooner?

My continual plan is to keep investing, of course. I want to keep adding passive income in the form of dividend income (arguably the best form of passive income!) over the next 12 months.

2022 may not reach the dividend income levels as 2021, let alone have growth. This is unfortunate, but that’s what happens when 2021 brings large capital gain distributions from the mutual fund investments (i.e., see above – VINIX). However, the dividend income should be close to the 2021 level at least, as I am anticipating over $5,000 in passive income.

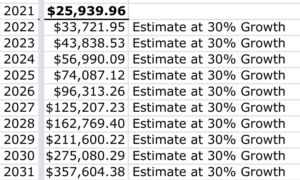

At a 30% growth rate, technically this would push, starting in 2022, the dividend income totals to reach $357,000 per year in the year 2031. I truly do not think that will be the case. It would take a lot of investing to keep that up, and though doing it for 1 or 2 years could be doable, I just don’t think that is in the cards. See the small chart:

You would be quite wealthy earning $350,000 in dividend income, to say the least. You could do anything you want in Northeast, Ohio – that’s for sure!

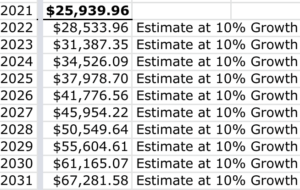

However, I am going to shock the growth rate and reduce the growth rate to 10% (which one could argue that is my dividend yield + dividend growth rate). 10% is more realistic and conservative on the financial freedom journey. One could argue that this could be if I wasn’t able to invest or use the dividend income for living for 10 more years. Here are the results:

That is definitely more realistic. In 10 years, one could argue that I could conservatively be earning a passive income stream of $67,000 per year. That represents over $5,500 in dividend income per month! Heck, married filing jointly, you aren’t even paying taxes on that. This would easily get me to financial freedom, without a shadow of a doubt! Receiving a passive income stream at these levels would be a comfortable life, no doubt.

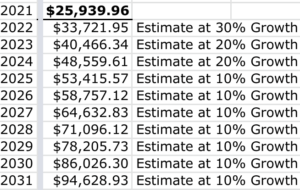

Let’s mix it up again, though. Let’s say I am able to grow the dividend income stream by 30% for 1 year, 20% for 2 years, then the remainder is 10% for 7 years.

Think about this for a moment. Can you go hard and go hammer by investing as much as you can for the next 1-3 years? The results would create possibly an additional $27,000 in additional passive income per year!

This is why I strongly encourage and urge all investors to do as much as they can per day, week, month, year – you name it. Time can be your very best friend but also can be your worst enemy.

Financial Freedom and Passive Income Goal Conclusion

Though inflation is at all-time highs, one can expect that to continue to decline. Therefore, keeping that in mind, one could believe I could be financially free in the next 10 years.

The main point though is to do as much as you can, as early as you can. As you saw in my third scenario, one can dramatically increase the ongoing passive income stream by almost 50% if you do more for a few years and then cool it down. Like they always say, your first best day was yesterday and your next best day is today. That is absolutely true, especially in the financial freedom journey / creating passive income.

Have you run an income shock like this? Does your dividend income and/or other passive income stream grow at these rates? Are you already financially free, and do the numbers hold? Please leave your feedback in the comments below!

As always, thank you for stopping by, good luck and happy investing, everyone!

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.