Teka77

Introduction

It’s time to dive into macroeconomics and one of my favorite (cyclical) dividend growth stocks on the market: Caterpillar Inc. (NYSE:CAT).

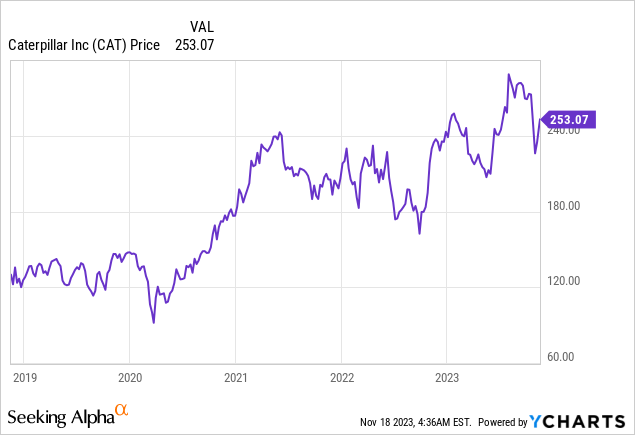

As it turns out, Caterpillar is currently the smallest holding of my 20-stock dividend growth portfolio. That’s not necessarily because of its performance (I’m up roughly 100% since my initial investment) but because I haven’t bought a lot more Caterpillar in recent quarters.

The reason is my defensive stance toward cyclical investments. Although I have upped my stakes in cyclical investments like railroads and energy, I have not yet made the decision to throw some of my excess cash at machinery companies.

On September 1, I wrote an article titled Caterpillar Goes Boom! Now What?. In that article, I discussed the company’s strong 2Q23 results and my belief that it may be a bit early to invest in this yellow machinery giant.

While the company’s long-term growth prospects look promising, the current valuation leaves little room for immediate upside.

For dividend investors, Caterpillar’s commitment to growing free cash flow, a strong balance sheet, and an A+ credit rating offer a promising proposition.

As a shareholder, I’m keeping a watchful eye, anticipating a potential buying opportunity of around $220 if economic headwinds create a more favorable entry point.

Despite its recent stock price surge, the stock is still trading 11% lower since that article came out.

Even though I’m long, I’m happy about that, as the recent stock market surge has ruined a lot of good buying opportunities – especially in light of ongoing economic weakness.

In this article, I’ll re-assess the risk/reward using new macroeconomic developments, the company’s 3Q23 earnings, and the value this dividend aristocrat brings to the table.

So, let’s get to it!

Dividend Brilliance

Generating shareholder value is hard – very hard. While we may take dividends for granted, we should continue to remind ourselves that the ability to consistently grow dividends is something that takes serious skill.

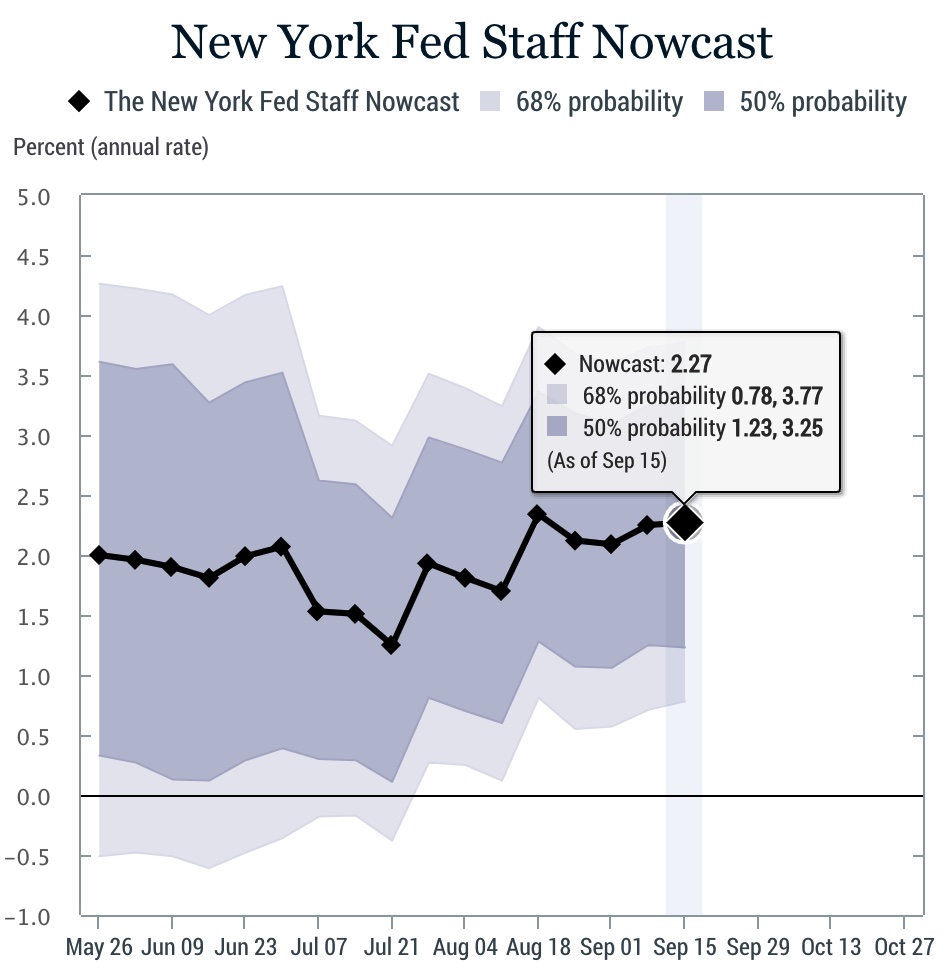

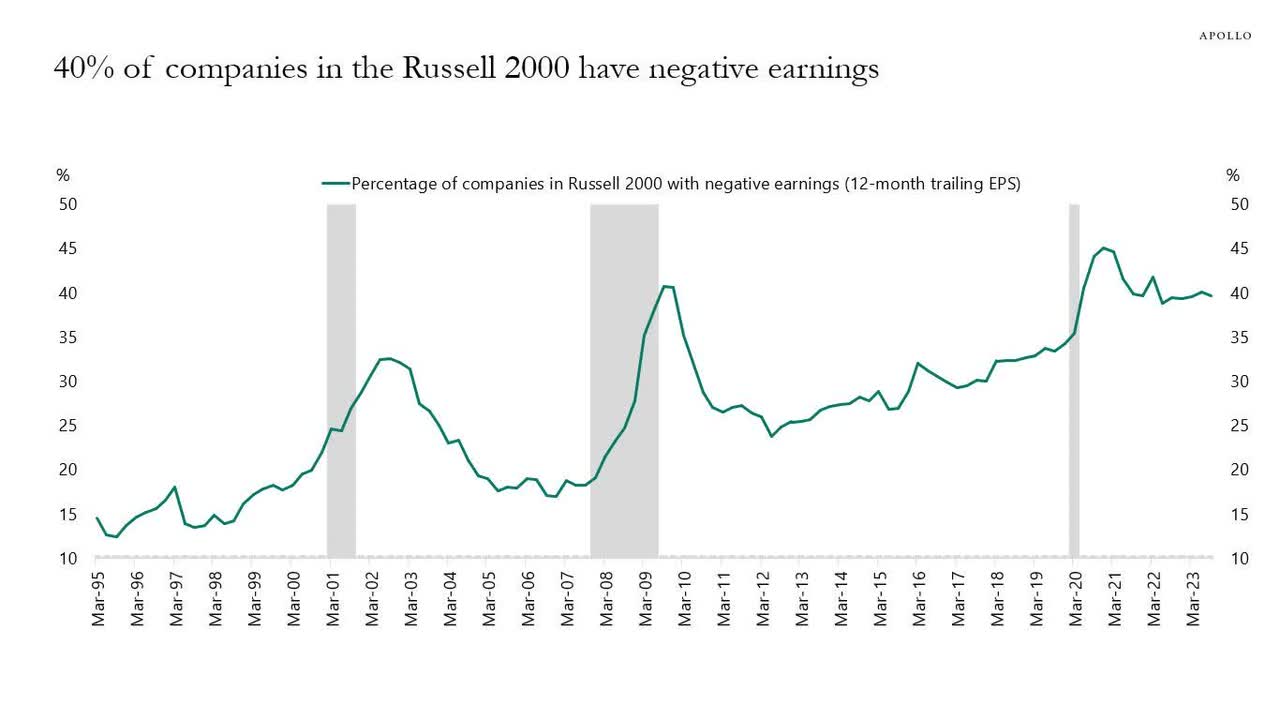

To give you an example, looking at the chart below, we see that 40% of Russell 2000 companies have negative earnings. That’s as high as it was during the peak of the Great Financial Crisis and even scarier if we consider that this is outside of an official recession!

Apollo Global Management

Consistently growing dividends is even harder in cyclical industries.

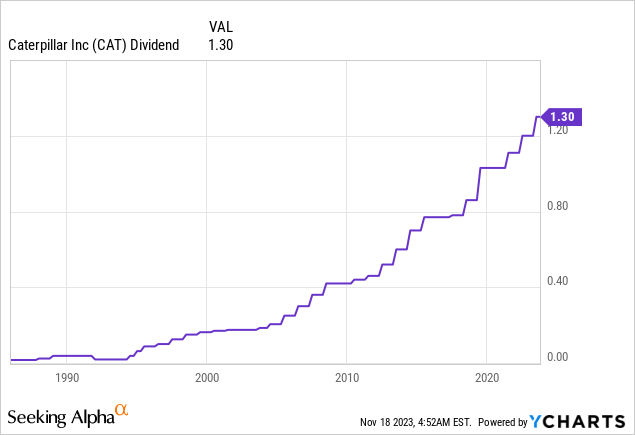

Caterpillar has done it for 30 consecutive years, making it a dividend aristocrat.

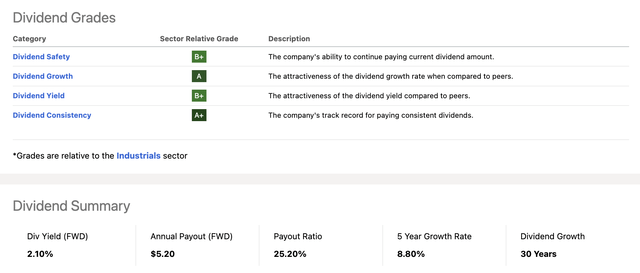

Even better, the company is a dividend aristocrat with a great dividend scorecard.

Looking at the overview below, it scores high on dividend consistency (that one is obvious), dividend growth, safety, and yield.

Seeking Alpha

The bad news is that the company pays a $1.30 per quarter per share dividend. This translates to a 2.1% yield, as one share currently sells for $253.

A 2.1% yield is nothing to write home about in this market. If I wanted to buy income, I could easily buy high-quality companies yielding up to 6% without having to go dumpster diving.

However, there’s more to it than its yield.

CAT’s dividend is protected by a 25% payout ratio. It has hiked its dividend for 30 consecutive years and grown its dividend by 8.8% per year (on average) over the past five years.

Markets love consistency and companies that prove their ability to thrive through many economic cycles – even if it’s a cyclical company like CAT that will almost certainly have the occasional implosion in its earnings when the economy enters a recession.

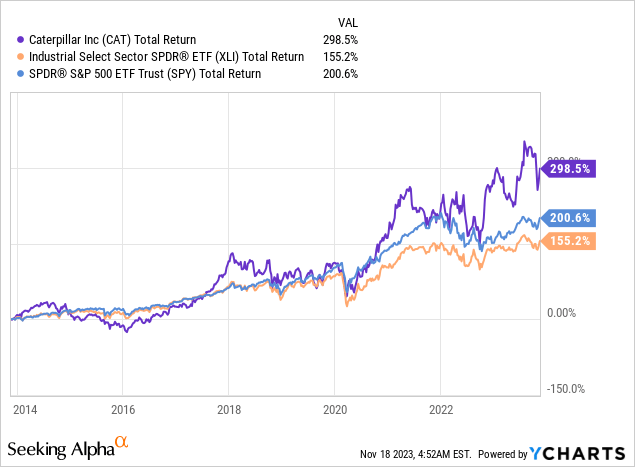

Hence, despite a very steep manufacturing recession in 2015, a pandemic, and the post-2021 sell-off, CAT has returned close to 300% over the past ten years, beating both the S&P 500 and the industrial ETF (XLI) by a wide margin.

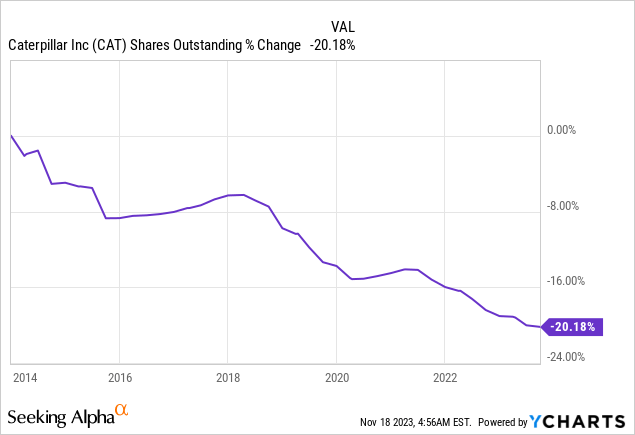

It also bought back a fifth of its shares over the past ten years, which has added tremendously to its ability to outperform the market. After all, buybacks improve the per-share value of a company.

I obviously cannot guarantee that the stock will continue to outperform over the next ten years. However, I’m making that assumption, as the company is strong and benefitting from a number of tailwinds – despite mounting cyclical headwinds.

Oh, it also has an A-rated balance sheet, which is one of the highest ratings in general, especially in the machinery industry.

What Is Caterpillar Up to?

Normally, this is the part where I give you my view on the economy.

However, as Caterpillar’s earnings and comments reveal so much about the economy, I’m going to combine my view with the company’s comments.

At the end of October, the company reported its 3Q23 earnings, which were good.

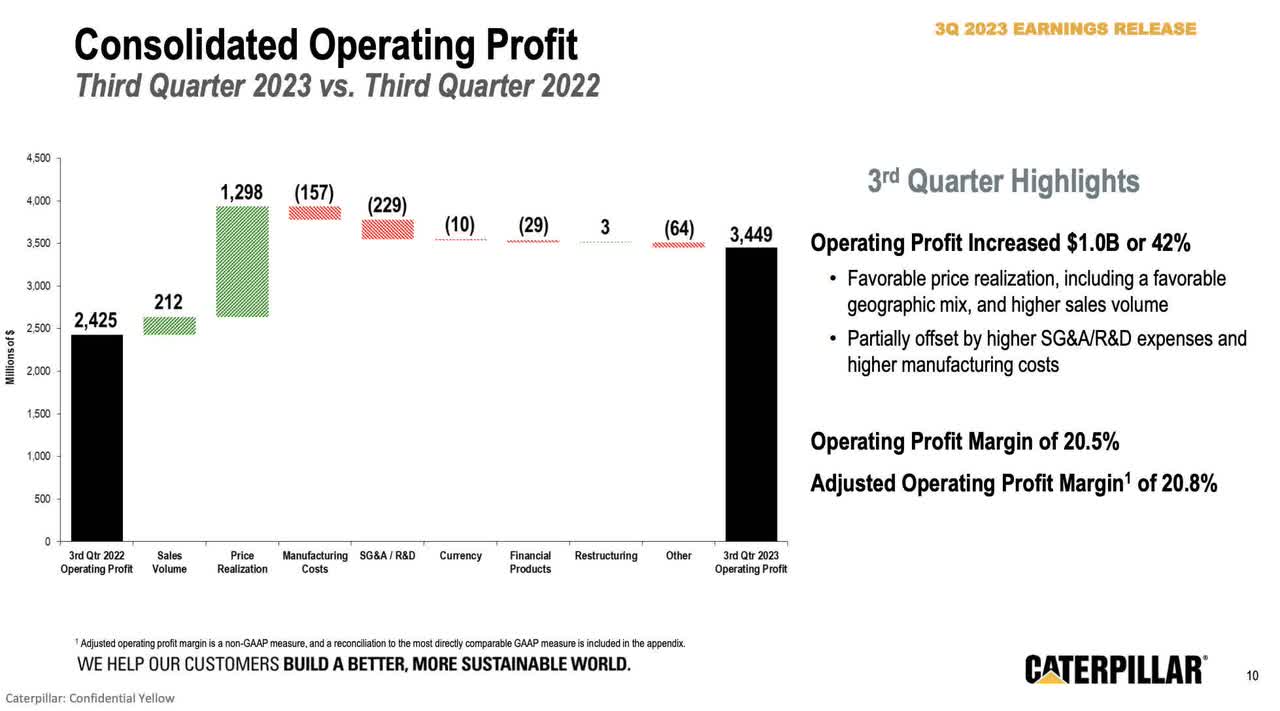

- Operating profit increased by 42% to $3.4 billion, with an adjusted operating profit margin of 20.8%, a 430 basis points increase from the prior year.

- Profit per share was $5.45, including restructuring costs.

- Adjusted profit per share increased by 40% to $5.52. Other income of $195 million was lower due to less favorable currency impacts and increased pension expenses.

As we can see in the overview below, the company benefited from higher sales, better pricing, and subdued cost inflation. That’s almost a best-case scenario.

Caterpillar Inc.

We also see that strength was provided by all segments.

- Construction Industries’ profit increased by 53% to $1.8 billion.

- Resource Industries’ profit increased by 44% to $730 million.

- Energy & Transportation’s profit increased by 26% to $1.2 billion.

Do you know what is even better than this?

A good outlook.

Going forward, the company’s Construction Industries in North America expect to see positive momentum, with continued growth in non-residential construction.

Asia Pacific (excluding China) expects growth due to public infrastructure spending.

Resource Industries sees a high level of quoting activity, and customer acceptance of autonomous solutions is growing.

As I have discussed in prior articles, the mining industry has to expand, fueled by general demand and secular factors like the energy transition, which requires a lot of metals.

Also, as major mining companies want to lower supply chain emissions, demand for next-gen machinery is rising, benefitting Caterpillar tremendously.

Furthermore, I’m bullish on oil and gas, which is also benefitting Caterpillar.

According to Caterpillar, oil and gas customers continue to show strong demand for reciprocating engines and gas compression.

Meanwhile, power generation demand remains positive. Transportation anticipates strength in high-speed marine.

Reasons To Be Cautious

Despite strong earnings in Resource Industries, order rates are slightly lower than expected, reflecting continued capital discipline by customers.

Furthermore, although construction levels are expected to remain healthy, construction growth has moderated, with additional risks in China.

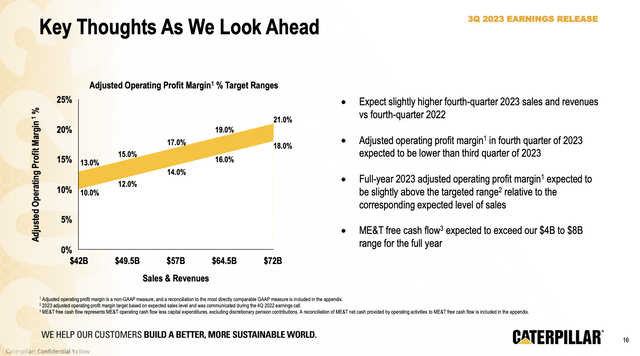

Despite some minor headwinds, the company expects fourth-quarter sales to be higher on a year-on-year basis. The same goes for margins.

Caterpillar Inc.

Again, none of this is bad.

At best, we’re dealing with minor cracks in an otherwise good outlook.

To give you another example, the company’s backlog is down. The year-on-year backlog is down $1.9 billion. The quarter-on-quarter backlog was down $2.6 billion.

Meanwhile, dealer inventories increased.

What we are seeing here is a mixed picture of supply chain normalization, allowing the company to turn orders faster into finished products and healthier dealer inventories.

Going forward, I expect this trend to continue as manufacturing conditions (impacting the demand side) are deteriorating.

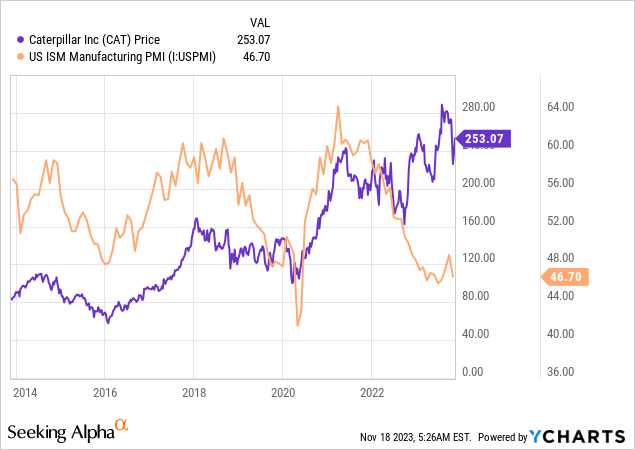

The ISM Manufacturing Index just took another hit, keeping the index well below the neutral 50 level.

Historically speaking, this index has functioned as a magnet, pressuring CAT shares during downtrends and providing upside momentum during recoveries.

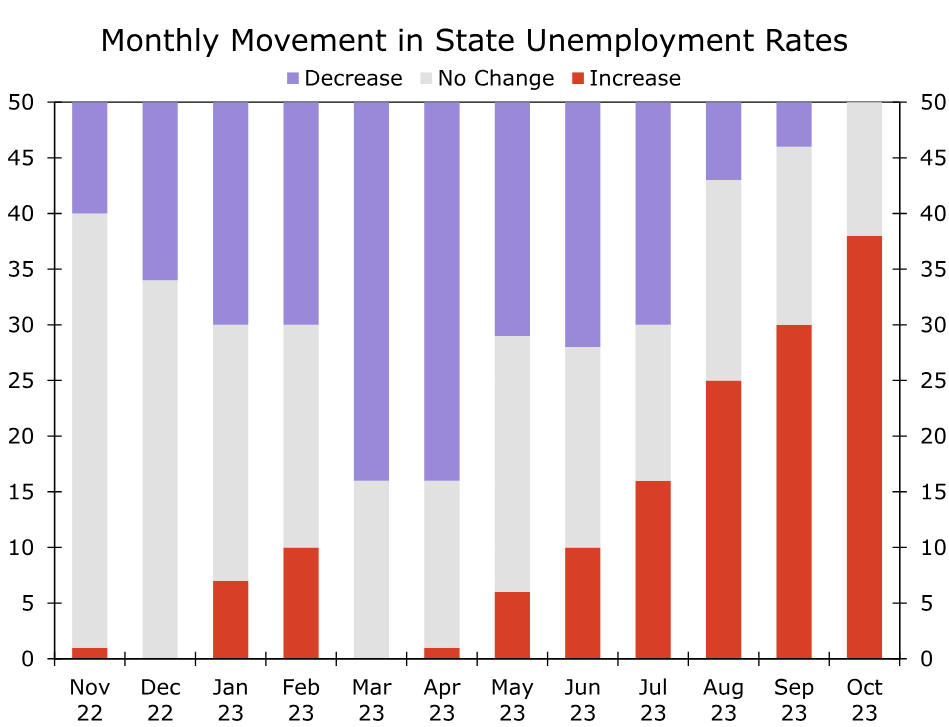

We also see a deterioration in employment fundamentals, as more than 35 states see higher unemployment. The uptrend since April has been steep and in line with other economic indicators.

Wells Fargo

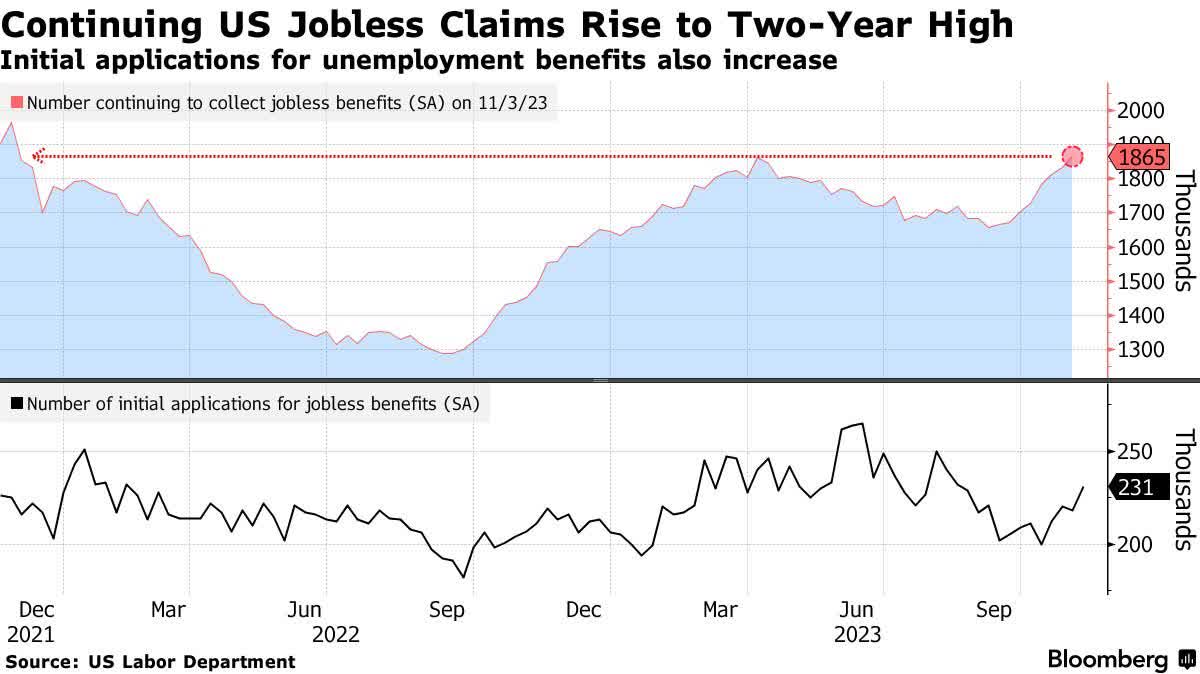

This is what continuing jobless claims look like:

Bloomberg

Even homebuilding sentiment has erased the entire recovery it started earlier this year. This does not bode well for cyclical demand (i.e., machinery).

NAHB/Wells Fargo

Don’t get me wrong, I’m not saying this to scare people. I just believe that this shows that despite good financial results, we could see poorer results from Caterpillar and its peers in the quarters ahead.

This also explains why the Caterpillar stock price has lost momentum since 2021.

I believe it requires a bottom in the ISM index to bring back buyers and start a new meaningful uptrend – as we saw in 2016 and 2020, to name two major economic bottoms.

Valuation

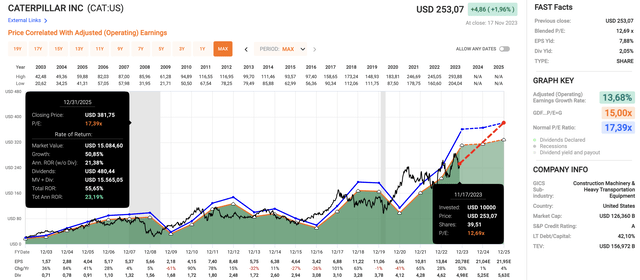

Looking at key numbers (all visible in the chart below), we can conclude that CAT shares are cheap.

- CAT is trading at a blended P/E of 12.7x.

- Going back two decades, the normalized P/E ratio is 17.4x, which has been a good guide for the stock through multiple cycles.

- Analysts believe that CAT is expected to avoid earnings contraction. This year, EPS is expected to grow by 50%, followed by 1% growth in 2024 and 4% growth in 2025.

FAST Graphs

If these expectations were to turn into reality, it would be a very unusual development.

As we can see at the bottom of the chart above, CAT’s EPS growth tends to be either high or in deep negative territory, which reflects the impact of economic cycles on CAT.

Based on the numbers above, CAT is very undervalued. If the economy were to bottom in the next 2-3 months, the stock could make its way to its 17.4x multiple, returning more than 20% per year through 2025.

This is absolutely possible, as it benefits from tailwinds that weren’t a thing two years ago.

However, I would not rule out lower expectations, as we’re now finding out that the economy is not in great shape (and declining further).

Hence, my plan is to add more to my CAT position if I get another correction opportunity between $200 and $220. If it were to fall further, I would continue to average my position.

Needless to say, waiting for more downside may be a mistake. I could be totally wrong on the economy, causing CAT shares to continue their uptrend.

My main message is that the risk/reward has become a bit clouded.

Nonetheless, I don’t mind, as I am eager to boost my CAT stake, benefiting from its ability to grow dividends and what I believe will be a continuation of outperformance for many years to come.

Takeaway

In the complex world of cyclical investments, Caterpillar stands out as a resilient dividend aristocrat, boasting 30 years of consecutive dividend growth.

Despite recent headwinds in the manufacturing sector, the company’s 3Q23 earnings report showed a robust performance across its segments.

While caution is warranted due to mixed economic signals and supply chain nuances, Caterpillar’s undervalued position and potential for future tailwinds make it an enticing prospect.

As a shareholder, I’m eyeing a buying opportunity in the $200-$220 range, as I want to make CAT a much larger holding in my portfolio.