Updated on February 3rd, 2023 by Samuel Smith

High-quality dividend growth stocks have the potential to deliver outsized returns to investors over the long term. And, for retirees, dividend growth stocks can help replace employment earnings.

A good place to look for the best dividend growth stocks is the list of Dividend Aristocrats. This is a select group of 66 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 68 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

We review all 68 Dividend Aristocrats each year. Next up is pharmacy giant Walgreens Boots Alliance (WBA). Walgreens has increased its dividend for 47 years in a row. However, the past few years have been difficult for the company.

Still, Walgreens has a strong brand, and it remains an industry leader. It still has room for growth moving forward and has a long history of annual dividend increases.

Plus, Walgreens stock yields 5.1% today, and the company continues to increase its dividend each year. Walgreen’s stock’s high yield makes it one of the Dogs of the Dow; one of the 10 highest yielding stocks in the Dow 30.

Business Overview

Walgreens was founded all the way back in 1901. In its current form, the company was created when Walgreens merged with Alliance Boots in 2014. The merger created the largest retail pharmacy in the U.S. and Europe.

Today, together with its equity method investments, Walgreens has a presence in more than 25 countries, employs more than 450,000 people, and has more than 21,000 stores.

Investor sentiment has been subdued in recent years, due to fears of rising competition from online retail giants like Amazon (AMZN).

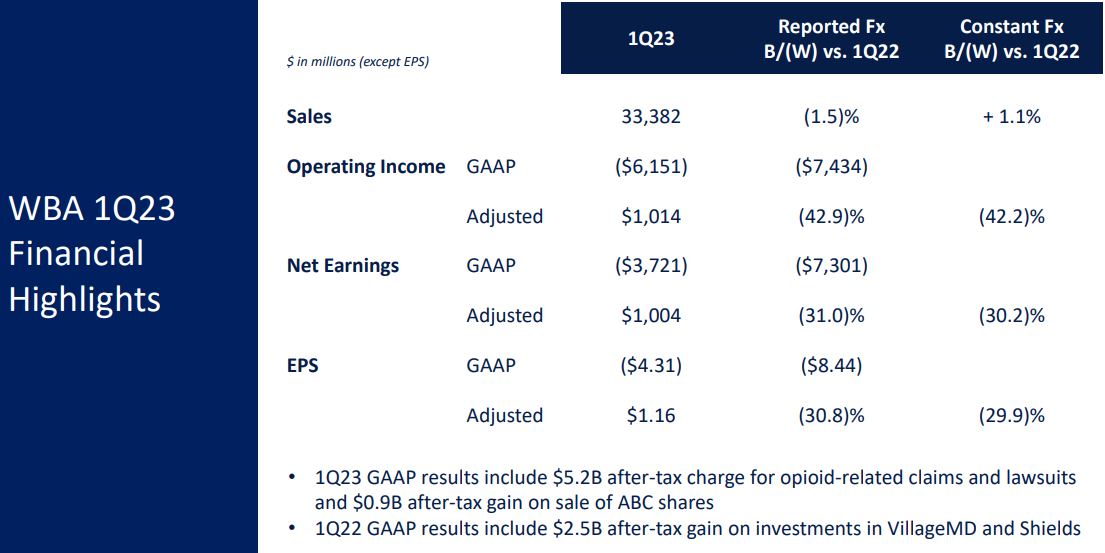

On January 5th, 2023, Walgreens reported results for the first quarter of fiscal 2023. Sales dipped -1.5% and adjusted earnings-per-share slumped -31% over the prior year’s quarter, from $1.68 to $1.16, mostly due to high COVID-19 vaccinations in the prior year’s period.

Source: Investor Presentation

Earnings-per-share exceeded analysts’ consensus by $0.02. The company has beaten analysts’ estimates for 10 consecutive quarters. However, as the pandemic has subsided, Walgreens is facing tough comparisons. It thus reaffirmed its guidance for earnings-per-share of $4.45-$4.65 in fiscal 2023, implying a -10% decrease at the mid-point. The stock has plunged -30% over the last 12 months due to the fading tailwind from the pandemic (8.4 million vaccinations in Q1-2023 vs. 11.8 million in Q2-2022) and somewhat more intense competition.

Source: Investor Presentation

Growth Prospects

Walgreens’ most important catalyst in the U.S. is to grow through new stores and customers. It has accomplished this through acquisitions. For example, Walgreens acquired over 1,900 Rite Aid (RAD) stores, three distribution centers, and related inventory, for $4.375 billion.

As discussed above, the Rite Aid transaction has already helped Walgreens grow earnings. Walgreens assumed the real estate obligation but did not assume any debt from Rite Aid. Furthermore, there are significant cost synergies to accelerate earnings growth from the acquisition.

From 2010 through 2019, Walgreens grew earnings–per–share by 12.0% per year. This was driven by a combination of factors including top–line growth ($67 billion to $137 billion), net profit margin expansion (3.2% to 4.0%), and a reduction in the number of shares outstanding.

In 2020 results fell off dramatically, with the company posting a –21% EPS decline, mostly attributable to the COVID–19 pandemic. The three factors of success in the past –revenue growth, margin expansion, and a lower share count –were simultaneously challenged in the short term.

Since then, the business has rebounded with more normalized results in 2021 and 2022. Looking out further, Walgreens should continue to grow earnings for the long-term, due to favorable macro trends.

Specifically, the U.S. is an aging population. As they age, consumers will have a higher demand for healthcare products and prescriptions. Walgreens still has a strong market position and balance sheet.

Competitive Advantages & Recession Performance

The first competitive advantage for Walgreens is its scale. Walgreens has one of the world’s largest global wholesale and distribution networks, with roughly 400 distribution centers that supply more than 230,000 pharmacies, doctors, health centers, and hospitals.

With such a massive global footprint, it is very challenging for a competitor to compete on the same scale as Walgreens. Despite the difficulties facing retail, there is still an operational advantage of physical stores. Most of the U.S. lives within a short distance of a Walgreens store. As a result, it is very difficult for competitors to take market share.

Separately, Walgreens benefits from a strong brand and operates in a stable industry. Consumers cannot go without prescriptions and health care products. This helps earnings stay afloat, even during recessions. For example, Walgreens suffered only a slight decline in earnings-per-share during the Great Recession:

- 2007 earnings-per-share of $2.03

- 2008 earnings-per-share of $2.17 (6.9% increase)

- 2009 earnings-per-share of $2.02 (7.2% decline)

- 2010 earnings-per-share of $2.16 (6.9% increase)

Walgreens grew earnings-per-share from 2007 to 2010. It followed up this performance with over 20% earnings growth in 2011. Earnings-per-share has nearly tripled from the fiscal year 2009 to the fiscal year 2019, which equates to a CAGR of more than 24% during this time period. Erring on the side of caution and taking into account recent challenges, we anticipate an annual earnings growth rate of 4% through 2028.

It is clear that Walgreens has a recession-resistant business model, which helps it raise its dividend each year.

Valuation & Expected Returns

Walgreens has a current share price of ~$37 and a midpoint for adjusted earnings-per-share of $4.55 for fiscal 2023. As a result, the stock trades for a price-to-earnings ratio of 8.1. This is a low valuation for a highly-profitable company, especially one with a strong brand and leadership position in its industry.

But due to Walgreens’ slower growth and current headwinds, we have a fair value price-to-earnings ratio target of 10 for the stock.

The P/E multiple is currently 8.1, so investors could see annual returns increase by 4.3% per year over the next five years as the valuation multiple reaches our estimate of fair value. Plus, Walgreens will generate returns from earnings growth and dividends. Expected returns could be as follows:

- 4% earnings-per-share growth

- 5.1% dividend yield

- 4.3% multiple expansion

In this forecast, total annualized returns could reach 13.4% over the next five years. This is a good expected rate of return for Walgreens stock. Therefore, we rate the stock a buy due to its solid dividend yield and regular dividend increases as well as its current valuation.

Final Thoughts

When it comes to retail stocks, there is a great deal of fear in the market. This is apparent, even with strong retailers like Walgreens. Not only are investors worried about a sluggish environment for brick-and-mortar retailers, but the threat of Amazon entering the healthcare industry is a constant overhang.

Walgreens remains a strong company, with a great brand and positive growth prospects moving forward. The addition of Rite Aid has allowed the company to grow its prescription drug market share.

In addition, Walgreens offers an above-market dividend yield. Given the business fundamentals, the company should have no trouble raising the dividend every year.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].