Updated on January 23rd, 2023 by Quinn Mohammed

Consumer staples stocks are some of the most reliable dividend payers in the stock market. People need staples products for their daily lives, which provides a certain level of demand from year to year.

Demand for everyday products remains steady, even during recessions, which makes it an appealing industry for investors looking for consistent dividends.

This is why there are several consumer staples stocks on the Dividend Aristocrats list, which includes 65 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download an Excel spreadsheet of all 65 Dividend Aristocrats (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Each year, we review all Dividend Aristocrats individually. The next stock in the series is The Clorox Company (CLX). Clorox has raised its dividend for 45 years in a row.

This article will provide an in-depth review of Clorox’s business model, and future outlook.

Business Overview

Clorox started out over 100 years ago, with the debut of its namesake liquid bleach in 1913. Today, it is a global manufacturer of consumer and professional products than collectively span a wide variety of uses and customers. The company produces annual revenue in excess of $7 billion and it sells its products in more than 100 markets.

The company has a highly diverse set of businesses with myriad brands and products within each, providing Clorox with huge global scale.

Source: Investor Presentation

The company’s largest segment is health and wellness, which is part of the core Cleaning segment. However, Clorox is much more than a cleaner company as it produces food, pet products, charcoal, and a wide variety of other brands.

The Household segment includes the Glad, Kingsford, Fresh Step, and Renew Life brands. Cleaning products include Clorox, Pine-Sol, and the Clorox Commercial Solutions businesses. Lifestyle brands include Hidden Valley, Burt’s Bees, and Brita. Lastly, the International segment sells Clorox’s brands around the world.

Many of Clorox’s brands hold the #1 or #2 market share in their respective product categories. In fact, more than 80% of its total revenue comes from products that fit this description.

This results in pricing power, and high profit margins. The company states that nine of ten of its portfolio of brands have stable or growing household penetration, so organic growth should be easier to come by in the coming years.

Clorox reported first quarter fiscal 2023 results on November 1st, 2022. For the quarter, Clorox reported sales of $1.74 billion, which was down 4% year-over-year. Clorox faced a difficult comparison, and the company pointed out sales on a three-year basis were up 5%. The year-over-year decline was due to a reduction in volume, partially offset by a gain from favorable price mix. Organic sales were down 2%.

Gross margin contracted by 110 basis points to 36% of revenue. This was driven primarily by higher manufacturing, logistics, commodity costs, and lower volume. Adjusted earnings-per-share fell 23% to 93 cents. The decline was a result of lower gross margin, lower volume, and higher SG&A, partially offset by the benefits of pricing actions.

We expect Clorox to generate roughly $4.10 in earnings-per-share for 2023, which is roughly unchanged from 2022 results.

Growth Prospects

Looking ahead, Clorox has some levers it can pull to continue its growth. The company is continuously innovating with product extensions on its current lineup, such as flavors and cross-branding. It has done those things for a long time and will continue to do so in order to stay competitive.

It is also focusing its mergers and acquisitions on companies that are growing, focused in the US, and are margin-accretive. Clearly, the company wants to boost domestic growth and margins through acquisitions.

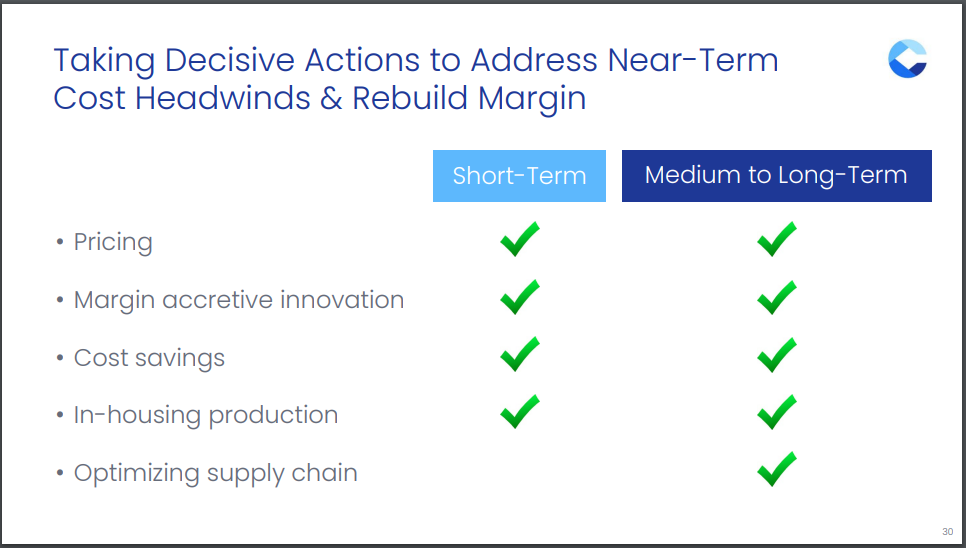

Margin expansion is another longer-term goal for the company, though Clorox must first rebuild its margins which have been negatively impacted throughout 2022. Clorox sees potential in rebuilding its margins through pricing actions, cost savings, and by optimizing its supply chain over the long-term.

Source: Investor Presentation

Clorox is also taking a prudent approach by buying companies with a better margin profile than its existing portfolio, which boosts revenue and margins simultaneously. This is congruent with the company’s constant focus on driving every basis point of margin from each product, which has served it well during the recent top line weakness.

We forecast 12% earnings-per-share gains in the next five years. While this appears to be a tremendous growth rate for such a large company, this growth rate is only forecasted due to the low comparison base formed for fiscal year 2023 results.

Competitive Advantages & Recession Performance

Clorox has multiple competitive advantages. First, it holds a tremendously strong brand portfolio. As previously mentioned, Clorox products enjoy very high market share across the portfolio.

Source: Investor Presentation

Clorox retains its high industry position in part through advertising and it spends very heavily to maintain that position. Product marketing is a necessity for consumer products manufacturers and Clorox spends ~10% of its revenue on this each year.

Another advantage of Clorox’s business model is that its products are used by millions of people each day, in good economies and bad. According to the company, Clorox-branded products are in about nine of ten U.S. households.

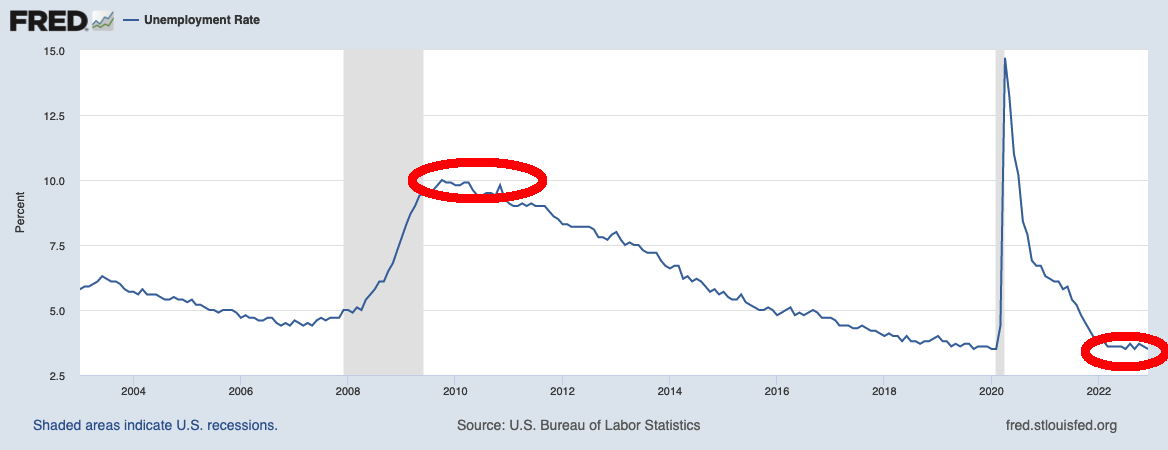

There will always be a certain level of demand for household cleaning products and food, even if the economy enters a downturn. This allows the company to remain profitable during recessions. Indeed, Clorox is a strong example of a defensive stock. Its earnings-per-share through the Great Recession are shown below:

- 2007 earnings-per-share of $3.23

- 2008 earnings-per-share of $3.24 (0.3% increase)

- 2009 earnings-per-share of $3.81 (18% increase)

- 2010 earnings-per-share of $4.24 (11% increase)

As you can see, Clorox increased earnings-per-share each year throughout the recession, including double-digit earnings growth in 2009 and 2010.

Clorox also performed very well during the coronavirus pandemic, as its products saw much higher demand as consumers spent much more time at home. This demonstrates the company has a very recession-resistant business model and a high level of safety.

Valuation & Expected Returns

We expect Clorox to generate earnings-per-share of $4.10 for fiscal 2023. Based on this, shares trade for a price-to-earnings ratio of 34.8. This is significantly above our estimate of fair value, which is 23 times earnings.

As the stock is trading above fair value, we see it as significantly overvalued. If the P/E multiple falls from 34.8 to 23 over the next five years, it would reduce annual returns by 8.0%.

Shareholder returns will be further boosted by future earnings-per-share growth, which we estimate at 12% per year. Finally, Clorox’s 3.3% dividend yield will add to shareholder returns. This leads to total expected returns of 6.2% per year over the next five years.

This is a decent expected rate of return but is not high enough to warrant a buy rating at this time.

Final Thoughts

Clorox is a reliable dividend stock. The company has a leadership position across its product markets, with potential for some growth. The company should be able to continue its four-decade long streak of annual dividend raises regardless of the overall economic climate. This makes it a consistent dividend stock for risk-averse income investors.

However, the stock remains a hold in our view, and investors interested in total return potential should wait for a further pullback in the share price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].