Updated on January 27th, 2023 by Nathan Parsh

Investors looking for high-quality dividend growth stocks should look first and foremost at the Dividend Aristocrats. The Dividend Aristocrats are an exclusive list of 68 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

The Dividend Aristocrats are an elite group of dividend growth stocks. For this reason, we created a full list of all 68Dividend Aristocrats.

You can download your free copy of the Dividend Aristocrats list, along with important metrics like dividend yields and price-to-earnings ratios, by clicking on the link below:

T. Rowe Price Group (TROW) is on the Dividend Aristocrats list and is one of just 7 Dividend Aristocrats from the financial sector. It has increased its dividend for 35 years in a row, including an impressive 20% hike on February 9th, 2021. T. Rowe Price has a strong brand, a highly profitable business, and future growth potential.

The stock has a 4.2% dividend yield, which is above the ~1.6% average dividend yield of the broader S&P 500 Index. Add it all up, and T. Rowe Price stock possesses many of the qualities dividend growth investors typically look for.

Business Overview

T. Rowe Price was founded in 1937 by Thomas Rowe Price, Jr. In the eight decades since, T. Rowe Price has grown into one of the largest financial services providers in the United States. Today, the company has a market cap of ~$26 billion and manages nearly $1.3 trillion in assets as of this writing.

Source: Investor Presentation

The company provides mutual funds, advisory services, and separately managed accounts for individuals, institutional investors, retirement plans, and financial intermediaries.

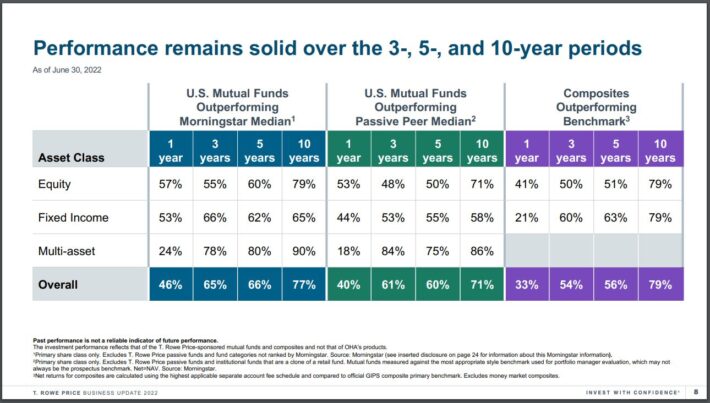

T. Rowe Price has a diverse client base in terms of assets and client type. The company has recorded an impressive track record of investment performance in the past 5 and 10 years.

Source: Investor Presentation

This is a challenging climate for asset managers. Certain investors have grown weary of higher trading costs and annual fees. The onset of low-cost exchange-traded funds, or ETFs, has successfully lured client assets away from traditional mutual funds that have higher fees. This has caused brokers to lower commissions and fees to retain client assets.

However, shares of T. Rowe Price continue to perform well, and the company has strong growth potential in the years ahead.

Growth Prospects

T. Rowe Price has a number of catalysts for future growth. The first catalyst is a trenimons amount of assets under management even after recent declines in the market.

For the fourth quarter, ending assets under management (AUM) came in at $1.27 trillion, down 12.6% compared to the fourth quarter of 2021, led by net client outflows of $17.1 billion, net distributions not reinvested of $2.5 billion, client transfers of $2.1 billion, and market deprecation.

Net revenue fell 22.4% to $1.52 billion during the most recent quarter. Adjusted earnings-per-share of $1.74 compared to $3.17 in the prior year but did beat analysts’ estimates by $0.03.

For the year, revenue fell 15.4% to $6.5 billion while adjusted earnings-per-share of $8.02 compared to $12.75 in 2021.

Share repurchases are also a part of the company’s earnings-per-share growth plan. T. Rowe Price reduced its weighted-average diluted share count by 1.7% in 2022, a sign that management believes the stock is undervalued. In addition, fewer outstanding shares make each share more valuable by increasing earnings-per-share.

Competitive Advantages & Recession Performance

T. Rowe Price’s competitive advantage comes from its brand recognition and expertise. The company enjoys a good reputation in the financial services industry. This helps generate fees, a significant driver of revenue. It has built this reputation through strong mutual fund performance.

T. Rowe Price considers its employees to be its most valuable assets. There is a good reason for this since it is critical for an asset management company to have qualified experts and retain top talent. This focus on building a strong brand gives the company competitive advantages, primarily the ability to keep existing clients and bring in new ones.

T. Rowe Price did not perform well during the Great Recession:

- 2007 earnings-per-share of $2.40

- 2008 earnings-per-share of $1.82 (24% decline)

- 2009 earnings-per-share of $1.65 (9% decline)

- 2010 earnings-per-share of $2.53 (53% increase)

As could be expected, T. Rowe Price experienced a sharp decline in earnings-per-share in 2008 and 2009. When stock markets decline, equity investors typically withdraw funds to raise cash.

Fortunately, the company remained profitable throughout the recession, allowing it to raise its dividend each year. And T. Rowe Price quickly recovered in the aftermath of the Great Recession. Earnings increased significantly in 2010 and by 2011 had reached a new high.

Also notable is the company’s strong balance sheet. As of the most recent quarter, T. Rowe held $1.8 billion in cash and total assets of $11.6 (35% of which were investments) against $1.1 billion in total liabilities and zero long-term debt.

Valuation & Expected Returns

We expect T. Rowe Price to produce adjusted earnings-per-share of $7.25 for 2023. Using the recent share price of ~$114, the stock has a price-to-earnings ratio of 15.7. We have a 2028 target price-to-earnings ratio of 14. If the stock valuation returns to the fair value estimate, total returns would be reduced by 2.3% annually over the next five years.

The company does have a strong brand, with fairly consistent profitability and earnings growth, but T. Rowe Price stocks is overvalued. We see earnings-per-share increasing at a rate of 3% annually through 2028 due to a combination of the sheer number of AUM and share repurchases.

Therefore, total returns would consist of the following:

- 3% earnings growth

- 4.2% dividend yield

- -2.3% multiple contraction

T. Rowe Price is expected to return 4.9% annually through 2028. T. Rowe Price is a particularly attractive stock for dividend growth. The company has raised its dividend for over 36 years in a row, including an 11.1% increase for 2022. And the dividend is reasonably secure, with an expected payout ratio below 66% for this year.

Final Thoughts

Investors scanning the financial sector for dividend stocks may naturally land on the big banks. But there is only one bank stock on the list of Dividend Aristocrats, People’s United Financial (PBCT).

In fact, most Dividend Aristocrats hailing from the financial sector come from the insurance and investment management industry. This speaks volumes about the stability of their business models.

T. Rowe Price is an industry leader and should continue increasing its dividend yearly. The focus on lower fees will continue to be a headwind for the industry. Shares of T. Rowe Price earn a hold rating due to projected returns.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].