Updated on February 11th, 2023 by Samuel Smith

The Dividend Aristocrats are a group of 68 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases. Broadly speaking, they are among the highest-quality dividend growth investments in the entire stock market.

You can see a full downloadable spreadsheet of all 68 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

This update will cover food distributor Sysco (SYY). Sysco has a long history of steady dividends and regular dividend increases. It has paid a dividend every quarter since it went public in 1970.

Sysco has many attractive qualities as a dividend growth stock. It is the largest company in its industry, which provides it with higher profit margins and durable competitive advantages over its smaller rivals. It also has growth potential, and the ability to increase its dividend each year.

Business Overview

Sysco was founded in 1969 and went public the following year. The company has grown steadily over the nearly five decades since.

Today, Sysco is the largest food distributor in the U.S. It distributes products including fresh and frozen foods, as well as dairy and beverage products. It also provides non-food products including tableware, cookware, restaurant and kitchen supplies, and cleaning supplies.

The company has a wide range of customers, which include restaurants, healthcare facilities, education, government offices, travel, leisure, and retail businesses. It also has a large segment of other customer types such as bakeries, churches, civic and fraternal organizations, vending distributors, and international exports.

In all, Sysco has approximately 600,000 customers. Its position atop the food distribution industry provides Sysco with high-profit margins and future growth potential.

Source: Investor Presentation

Growth Prospects

The operating climate for Sysco was challenged in 2020-2021 as the coronavirus pandemic forced closures of restaurants and other dining venues that make up Sysco’s customer base and also sparked supply chain issues across the country. Fortunately, Sysco remained profitable in 2021 and saw a significant recovery in 2022.

On November 1st, 2022, Sysco reported first-quarter results for Fiscal Year (FY) 2023. The company ends its fiscal year at the end of June. Sales for the quarter were $19.1 billion, an increase of 16.2% versus the same period in the fiscal year 2022. Gross profit increased 17.4% to $3.5 billion, as compared to the same quarter last year. Gross margin increased 18 basis points to 18.2% and adjusted gross margin is now 18.2% compared to 1Q2022. Net income also saw a significant increase of 23.2% year-over-year. Earnings per share (EPS) increased to $0.97 for the first quarter of FY2022 compared to $0.83 in the prior year, a 16.9% increase.

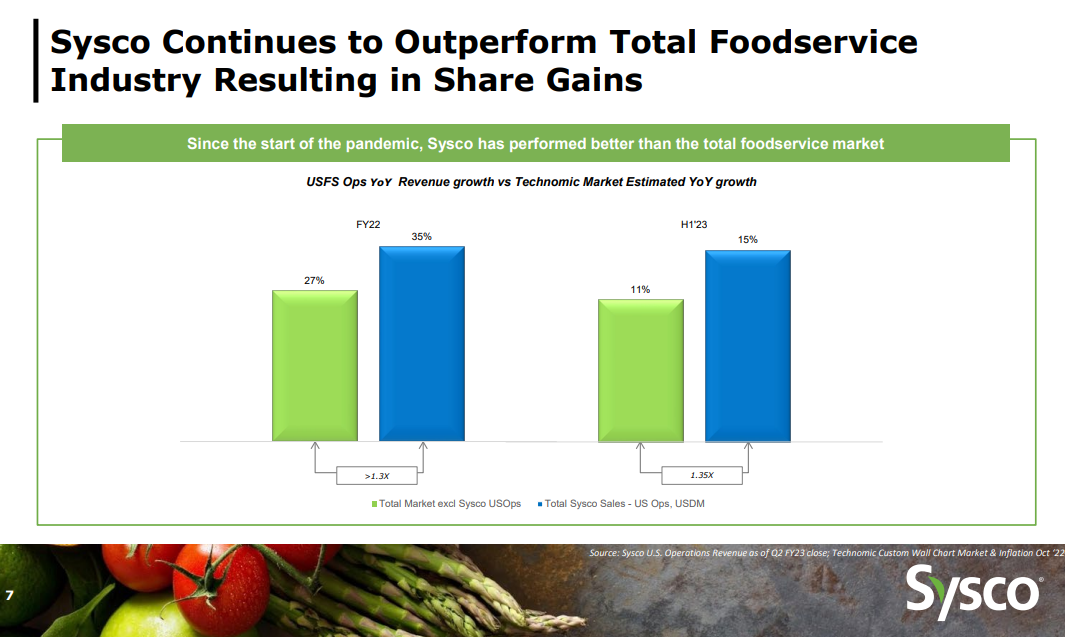

The company was able to grow both top and bottom line because they have effectively managed inflation, increased case volume and grew market share. Overall, the company delivered strong financial results, growing volumes and sales, and improving profitability. At the same time, the company was able to strengthen its balance sheet and return $517 million to its shareholders.

Source: Investor Presentation

The combination of organic sales growth, acquisition-added revenue growth, and share repurchases is expected to result in ~7% annual earnings-per-share growth, in our view. We believe this is an attainable goal, due to the company’s strong business model and impressive competitive advantages.

Competitive Advantages & Recession Performance

The U.S. foodservice industry is fiercely competitive. There are thousands of competitors to Sysco, which include other food distributors, as well as wholesale or retail outlets, grocery stores, and online retailers. Sysco also faces the risk of its customers negotiating directly with its suppliers.

However, what has kept competitors at bay for so many years, is that Sysco is the largest operator in the industry. It controls about 16% of the U.S. foodservice industry. Sysco operates over 300 distribution facilities worldwide and serves over 600,000 customer locations. Such a huge presence allows Sysco to keep costs low, ant it can pass on the benefit to its customers.

Another benefit of Sysco’s business model is that it is resistant to recessions. Everyone has to eat, which gives Sysco a certain level of demand, regardless of the condition of the U.S. economy.

This is why Sysco’s profits held up well during the Great Recession:

- 2007 earnings-per-share of $1.60

- 2008 earnings-per-share of $1.81 (13% increase)

- 2009 earnings-per-share of $1.77 (2% decline)

- 2010 earnings-per-share of $1.99 (12% increase)

Sysco grew earnings-per-share at a double-digit pace in 2008 and 2010, with only a mild dip in 2009. The company grew earnings from 2007 to 2010, which was a rare achievement.

Sysco’s stable industry and top competitive position allowed it to raise its dividend each year, even during recessions.

Valuation & Expected Returns

While the coronavirus pandemic has had a huge impact on Sysco, we believe the company will earn $4.15 per share for FY2023. Based on this, the stock has a price-to-earnings ratio of 18.7. Our fair value estimate is a price-to-earnings ratio of 20, which implies that the stock is currently trading below fair estimate.

Because Sysco is an undervalued stock, annual returns could be increased by 1.3% per year if the P/E multiple increases to 20 over the next five years.

Fortunately, Sysco does not need to rely on multiple expansion for generating strong total returns, as the company has an attractive growth profile and dividend. We expect Sysco to deliver up to 7% annual earnings growth going forward, consisting of organic growth, acquisitions, and share repurchases.

In addition, Sysco has a current dividend yield of 2.5%, which is a higher yield than the average yield of the broader S&P 500 Index. This leads to total expected annualized returns of 10.8% per year over the next five years. This is a strong expected rate of return, making the stock a Buy.

Sysco should have little trouble increasing its dividend going forward. The company has a projected dividend payout ratio of 47% for fiscal 2023. This indicates the dividend is more than sufficiently covered.

Final Thoughts

Sysco operates at the top of a stable industry. It has an entrenched industry position and should see steady demand, even during recessions. These qualities make Sysco a reliable stock for income.

Sysco is on the exclusive list of Dividend Kings, a group of stocks with 50+ consecutive years of dividend increases.

The stock appears undervalued, meaning that right now is likely a good time to buy the stock. We believe future returns will be quite satisfactory for investors buying the stock at the current valuation level.

While returns will likely be boosted by an expanding valuation multiple, they will primarily be driven through earnings growth and dividends. As a result, Sysco remains a quality holding within a dividend growth portfolio, and we rate it a buy at the current price.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].