Updated on February 29th, 2024

Each year, we publish an in-depth look at each of the Dividend Aristocrats, an exclusive list of stocks in the S&P 500 Index with 25+ years of consecutive dividend increases. There are just 68 Dividend Aristocrats in the entire S&P 500 Index, indicating difficulty in reaching 25 consecutive annual dividend increases.

To join the Dividend Aristocrats list, a company must have competitive advantages and the ability to increase its dividend each year, even during recessions. As a result, Dividend Aristocrats are an excellent source of dividend growth stocks.

With this in mind, we created a list of all 68 Dividend Aristocrats, with important metrics such as dividend yields and price-to-earnings ratios. You can see the full list of all 68 Dividend Aristocrats by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Up next in our annual Dividend Aristocrats In Focus series is S&P Global Inc. (SPGI).

S&P Global has a very impressive dividend track record. It has paid a dividend every year since 1937 and has raised its dividend for 51 years in a row.

This article will look closely at S&P Global and what makes it such a high-quality dividend growth stock.

Business Overview

S&P Global traces its roots back to 1917 when McGraw Publishing Company and the Hill Publishing Company came together. The company was first named McGraw Hill Financial. In 1957, McGraw Hill introduced the S&P 500, the most widely-recognized index of all large-cap U.S. stocks.

S&P Global offers financial services to the global capital and commodity markets, including credit ratings, benchmarks, analytics, and data. It derives revenue from four operating segments: Ratings, Market Intelligence, Platt’s, and S&P Dow Jones Indices. S&P Global has a highly profitable business model. It is the industry leader in credit ratings and stock market indexes, providing high-profit margins and growth opportunities.

S&P Global has a very strong business model. Today, the S&P 500 is arguably the world’s most widely-known stock market index.

S&P Global benefits from a strong secular trend, namely the steadily growing amount of global debt. This trend has markedly accelerated in the last three years, as nearly all the countries have issued unprecedented amounts of debt in response to the pandemic.

In addition, numerous companies have come under pressure, and thus they have issued appreciable amounts of debt. This is a strong tailwind for the business of S&P Global, which has enjoyed a steep increase in its number of debt ratings.

The strength of the business model of S&P Global has been on full display in recent years.

Growth Prospects

S&P Global has exhibited an impressive performance record. It had grown its earnings per share every year for more than a decade, except for 2022, when the company took a breather due to blowout earnings in previous years.

The exceptional growth rate combined with the consistent performance are testaments to the strength of the business model of S&P Global and its reliable growth trajectory.

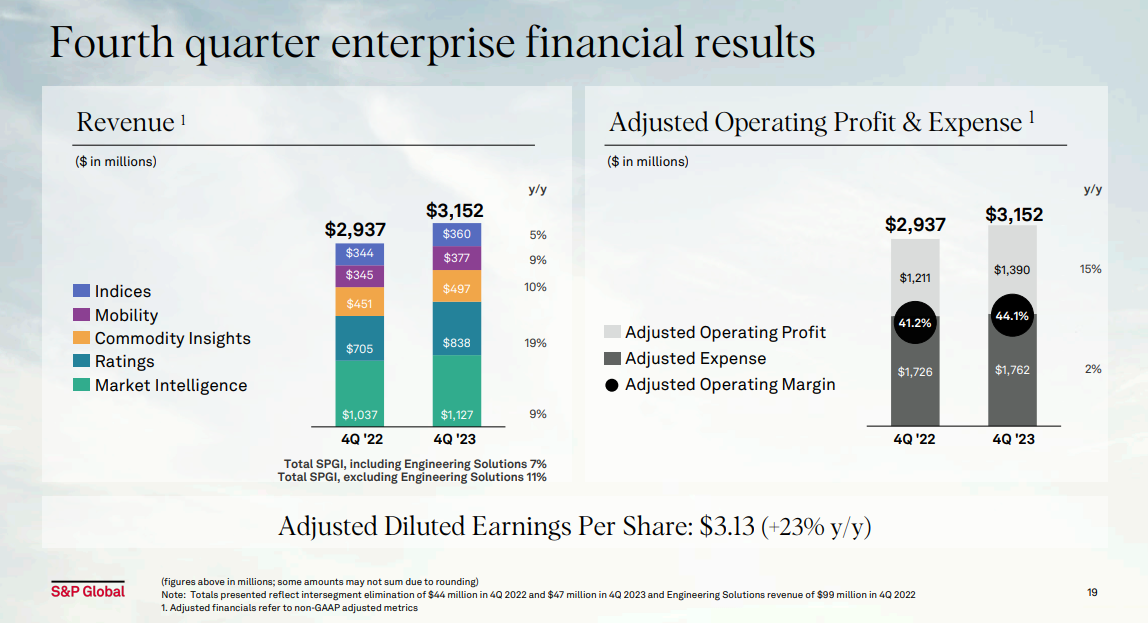

S&P posted fourth quarter and full-year earnings on February 8th, 2024. Adjusted earnings-per-share for the fourth quarter came to $3.13, which missed by a penny. Earnings rose from $2.54 per share in the year-ago period.

Source: Investor Presentation

Revenue was up 7% year-over-year to $3.15 billion, beating estimates by $20 million. Market Intelligence revenue was $1.13 billion, up from $1.04 billion a year ago. Ratings revenue rose from $705 million to $838 million. Commodity Insights revenue was $497 million, up from $451 million.

Mobility revenue rose from $345 million to $377 million. Indices revenue was $360 million, up from $344 million a year ago. Adjusted operating profit was $1.39 billion, down from $1.47 billion in Q3, but up sharply year-over-year from $1.21 billion.

Guidance was slightly weaker than analysts had expected, sending the stock lower after the report. Still, we start 2024 with an estimate of $14.00 in earnings-per-share, which would be a record if achieved.

Competitive Advantages & Recession Performance

S&P Global enjoys multiple competitive advantages. First, it operates in a highly concentrated industry. It is one of only three major credit rating agencies in the U.S., along with Moody’s (MCO) and Fitch Ratings.

Put together, these three companies control over 90% of the global financial debt rating industry, with S&P Global on top. Moreover, there are high barriers to entry in this industry. Specifically, becoming an accepted rating agency would require a great deal of trust from the financial industry and government that is hard to build quickly, if at all.

Clients pay S&P Global hefty sums for investment research, as S&P Global has built a strong reputation over its many decades of business. These competitive advantages helped the company remain consistently profitable throughout the Great Recession:

- 2007 earnings-per-share of $2.94

- 2008 earnings-per-share of $2.51 (15% decline)

- 2009 earnings-per-share of $2.33 (7% decline)

- 2010 earnings-per-share of $2.65 (14% increase)

S&P Global’s earnings declined in 2008 and 2009, as investors should expect during recessions. A global recession will naturally result in lower demand for financial services as investors exit the markets. With that said, S&P Global quickly bounced back after the recession ended. By 2011, earnings-per-share had hit a new post-recession high.

Valuation & Expected Returns

Based on the expected earnings per share of $14 for 2024, the stock has a price-to-earnings ratio of 30.8. S&P Global’s 5-year average price-to-earnings ratio is 29.1, so we are assuming a fair price-to-earnings ratio of 29 times given the sustained, outstanding performance the company has produced.

If shares were to retreat to a price-to-earnings ratio of 29 over the next five years, investors would see a reduction in annual returns of 1.2%. The stock also has a current dividend yield of 0.8%. The dividend is highly secure, with a payout ratio of only 26%.

A potential bull-case breakdown of future returns is as follows:

- 11% earnings-per-share growth

- 0.8% dividend yield

- -1.2% valuation headwind

In this scenario, S&P Global will generate a total return of 10.6% per year through 2029. This qualifies the stock as a buy in our view.

Thanks to its exceptional performance record and its consistent performance, S&P Global has almost always traded with a premium valuation.

Final Thoughts

S&P Global is a strong business with a long growth runway ahead. There will always be a need for financial rating services while future growth potential is strong in new areas as well, such as data and financial technology. S&P Global will accelerate its growth in these segments via acquisitions.

The dividend yield of 0.8% might not be attractive to income investors, as it trails the S&P 500 current yield of 1.6%, but dividend growth investors should view the stock more favorably.

S&P Global receives a buy recommendation at the current price.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].