Updated on September 17th, 2022 by Felix Martinez

Regarding dividend growth stocks, the Dividend Aristocrats are the “cream of the crop.” These are stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. We recommend that long-term investors looking for the best stocks first consider the Dividend Aristocrats.

We have compiled a list of all 66 Dividend Aristocrats, along with relevant financial metrics like dividend yield and P/E ratios. You can download the full list of Dividend Aristocrats by clicking on the link below:

At the same time, Real Estate Investment Trusts (REITs) seem like natural fits for the Dividend Aristocrats. REITs are required to distribute at least 90% of their earnings to shareholders, which leads to steady dividend growth for the asset class, provided earnings grow over time.

And yet, there are only three REITs on the list of Dividend Aristocrats: Federal Realty Investment Trust (FRT), Essex Property Trust (ESS), and Realty Income (O). The reason for the relative lack of REITs in the Dividend Aristocrats Index is primarily due to the high payout requirement of REITs. It’s challenging to grow dividends year-in-and-year-out when the bulk of income is distributed, as this leaves little margin for error.

Realty Income has a very impressive dividend history, particularly for a REIT. Realty Income is a Dividend Aristocrat. It is also a monthly dividend stock, meaning it pays shareholders 12 dividends each year instead of the more typical quarterly payment schedule.

This article will discuss this Dividend Aristocrat in more detail.

Business Overview

Realty Income was founded in 1969. It is a retail-focused REIT that has become famous for its successful dividend growth history and monthly dividend payments, even labeling itself “The Monthly Dividend Company.” The trust employs a highly scalable business model that has enabled it to grow into a massive landlord of more than 11,100 properties. Realty Income is a large cap stock with a market cap of $39.2 billion.

While many retail landlords are struggling in the age of Amazon (AMZN) and e-commerce, Realty Income continues to thrive because it owns retail properties that are not part of a wider retail development (such as a mall) but instead are standalone properties. This means the properties are viable for many tenants, including government services, healthcare services, and entertainment.

In fact, Realty Income owns a highly diversified portfolio by industry, tenant, and geography. The vast majority of its rent comes from e-commerce and recession-resistant tenants, making it a good bond substitute. The company also has exposure to industrial, office, and agricultural tenants, though retail still makes up the bulk of its rental income. The company derives rental income from all over the United States and the United Kingdom, insulating itself against regional challenges.

Source: Investor Presentation

The REIT’s business model is quite simple and has delivered spectacular long-term results. Realty Income acquires well-located commercial properties, remains disciplined in acquisition underwriting, executes long-term net lease agreements, and actively manages the portfolio to maximize value. It also maintains a conservative balance sheet with a laser-like focus on growing funds from operations (FFO) per share and monthly dividend payments to investors.

The results of this model speak for themselves: 15.1% compound average annual total return since the 1994 listing on the New York Stock Exchange, a lower beta value (a measure of stock volatility) than the S&P 500 in the same time period, and positive earnings-per-share growth in 25 out of the past 26 years.

Source: Investor Presentation

Growth Prospects

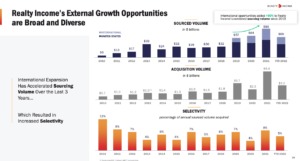

The trust’s growth history is remarkable. Annual growth – fueled by slow but steady annual rent hikes and a consistently strong acquisition pipeline – has been consistent across economic cycles, making it a spectacular dividend growth stock.

Realty Income’s future growth will be fueled by its proven, highly scalable business model, access to significant low-cost capital, and extensive network of relationships with a diverse array of tenants. Acquisitions have been a major component of Realty Income’s growth for many years.

Source: Investor Presentation

Annual rent increases are low, making organic growth very slow. As a result, it must find a way to continue acquiring enough properties to keep moving the needle in a meaningful way.

The good news is that its low cost of capital (via share issuances above net asset value and low-interest rates thanks to its A-rating) enables it to actively deploy capital despite compressing cap rates. However, if management fails to continue this effort, investors may be in for significant multiple contractions to adjust for declining growth expectations.

In the most recent quarter, Realty Income beat analyst estimates on both revenue and FFO-per-share. Revenue increased 74.9% from the same quarter last year due to property acquisitions and rent increases. Adjusted FFO-per-share beats estimates by $0.03 and increased by 15.9% compare to the secound quarter of 2021.

Future growth remains likely, as the company’s acquisition pipeline is robust. For example, Realty Income’s acquisition of VEREIT, which closed in early November, is responsible for the majority of the forecasted growth in this year’s results, despite the dilution that was caused by the shares that were issued for the takeover.

Competitive Advantages & Recession Performance

One way REITs establish a competitive advantage is through investing in the highest-quality portfolios. Realty Income has done this by building a broadly diversified portfolio of well-located real estate with many high-quality tenants.

Realty Income also benefits from a favorable economic backdrop, with high occupancy rates and the ability to raise rents over time.

Another – and perhaps the most prominent – competitive advantage for Realty Income is its extremely strong balance sheet. With a credit rating of A- from Standard & Poor’s – which is solidly investment-grade and a high rating for a REIT – it is able to unlock value in significant acquisitions simply through refinancing the existing debt on the properties it acquires at considerably lower interest rates.

As a result, it is able to profitably invest in high-quality assets that many of its competitors could not. This gives it the ability to build a more robust portfolio while also having more growth levers available to it, generating superior risk-adjusted returns for shareholders.

History shows that these competitive strengths allow Realty Income to outperform well during the worst of economic recessions. For example, its FFO per share during the Great Recession (from 2007-2009) grew at an annualized rate of 2.1%, and its occupancy remained highly resilient throughout the entire period.

This was a remarkable achievement and speaks to the strength of the business model. We expect Realty Income to hold up similarly well during the next downturn, and in fact, it will likely present the trust with an opportunity to refuel its growth pipeline as it will likely use its strong balance sheet to snatch up discounted properties.

Valuation & Expected Returns

Based on our expected 2022 adjusted FFO-per-share of $4.00, Realty Income’s stock trades for a price-to-FFO ratio of 16.1. Investors can think of this as similar to a price-to-earnings ratio. Our fair value estimate is a P/FFO ratio of 18, making the stock undervalued right now.

An increasing P/FFO ratio could increase annual returns by 2.5% per year over the next five years. Also, future returns will be comprised of a mix of FFO growth (estimated at 4% annually) and dividends (current yield is 4.7%), leading to expected annual returns of 11.2% per year.

The current dividend yield of 4.7% is well above the S&P 500 average, and the company has done an excellent job growing the dividend payout over time. Realty Income has paid over 625 consecutive monthly dividends without interruption and has raised the dividend over 116 times.

Final Thoughts

Investors flock to REITs for dividends, and with high yields across the asset class, it is easy to see why they are so popular for income investors.

We have compiled a list of 150+ REITs, that are worthy of further consideration based on their dividend yields and dividend growth potential. You can see our entire REIT list here.

Realty Income is undervalued at present and offers investors good total return potential. That said, we believe the stock remains highly appealing for income investors looking for a secure payout with steady dividend growth.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].