Updated on March 26th, 2024 by Bob Ciura

Each year, we individually review each of the Dividend Aristocrats, a group of 68 stocks in the S&P 500 Index that have raised their dividends for at least 25 consecutive years.

To make it on the list of Dividend Aristocrats, a company must possess a profitable business model with a valuable brand, global competitive advantages, and the ability to withstand recessions. This is why the Dividend Aristocrats can continue to raise their dividends in difficult years.

With this in mind, we have created a list of all 68 Dividend Aristocrats.

You can download your free copy of the Dividend Aristocrats list, along with important financial metrics such as price-to-earnings ratios and dividend yields, by clicking on the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

One of the three newest member to join this list is Nordson Corporation (NDSN). Nordson has an incredible dividend growth track record, with a remarkable 60 years of consecutive increases.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Nordson was founded in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, but the company can trace its roots back to 1909 with the U.S. Automatic Company.

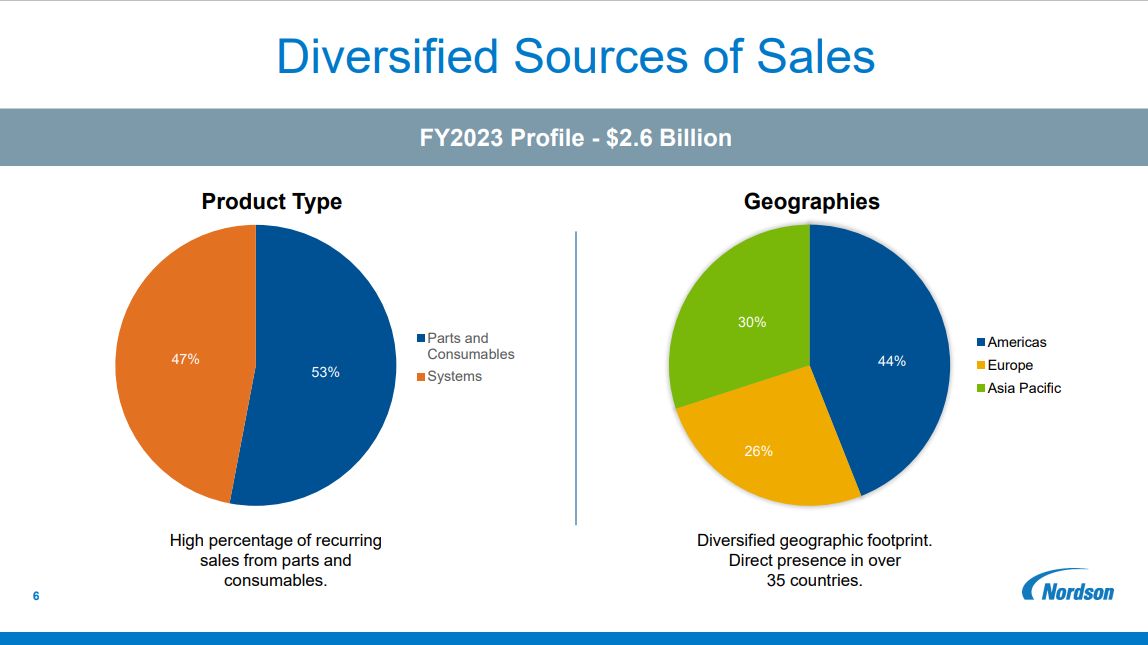

Today the company has operations in over 35 countries and engineers, manufactures, and markets products used for dispensing adhesives, coatings, sealants, biomaterials, plastics, and other materials, with applications ranging from diapers and straws to cell phones and aerospace.

Source: Investor Presentation

On February 21st, 2024, Nordson reported first quarter results for the period ending January 31st, 2024. (Nordson’s fiscal year ends October 31st.) For the quarter, the company reported sales of $633 million, a 4% increase compared to Q1 2023, driven by a positive acquisition impact, offset by organic decrease of 2%.

The Industrial Precision and Medical and Fluid Solutions saw sales increase by 14% and 3%, respectively, while the Advanced Technology Solutions segment had sales declines of (18%). The company generated adjusted earnings per share of $2.21, a 3% increase compared to the same prior year period.

The company’s backlog equaled $750 million at the end of the first quarter. Management reduced the top end of its sales growth guidance to 4% to 7% (from 4% to 9% previously) for fiscal 2024 compared to fiscal 2023. Additionally, Nordson expects adjusted EPS for FY 2024 to be $10.00 to $10.50.

Growth Prospects

From 2014 through 2023, Nordson grew earnings-per-share by a solid 10% annually. In its investment thesis, Nordson lists factors such as best-in-class technology that boosts client production while cutting costs, a worldwide service model, a balanced income stream, and a successful track record.

A growing demand for disposable goods, productivity investments, mobile computing, an increase in the use of medical devices, and the production of lightweight/lean vehicles are all areas of growth for the company’s adhesive and coating sectors, and would add to the company’s top line.

Nordson will keep making acquisitions where it can gain access to unique precision technologies and strengthen its competitive advantage.

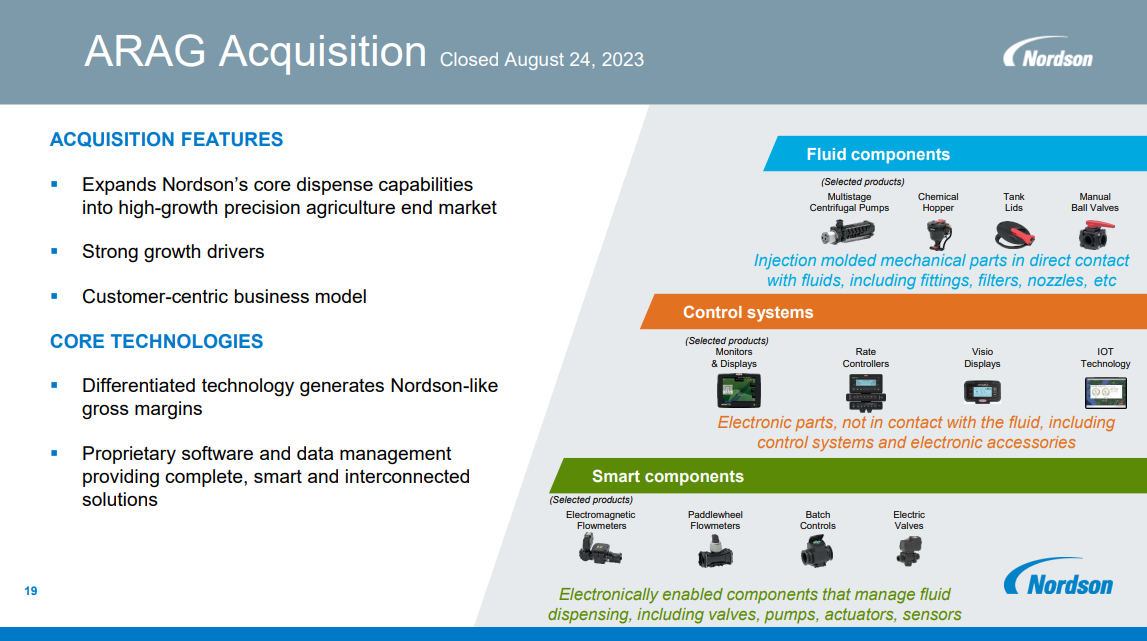

For example, in 2023 Nordson completed its acquisition of the ARAG Group. ARAG is a global market and innovation leader in the development, production and supply of precision control systems and smart fluid components for agricultural spraying.

Source: Investor Presentation

Our projection for 2024 earnings, based on management’s guidance midpoint, is for $10.25 per share.

We also project 9.0% EPS growth over the next five years, driven by an increase in top line revenue, modest margin expansion, and the favorable effects of acquisitions.

Competitive Advantages & Recession Performance

The competitive advantage for Nordson lies in its proprietary precision technologies. The business offers specialized and essential components used in various manufacturing processes.

This has enabled Nordson to muster an enormous installed base of customers spread all over the world. Due to its extensive global presence, Nordson has been able to diversify its revenue both geographically and by industry and segment.

However, this does not imply that Nordson is immune to economic downturns. Earnings decreased by -32% for the year during the Great Financial Crisis before rapidly increasing. Given the company’s reliance on global expansion, another recession could reduce its projections for near-term growth.

Valuation & Expected Returns

Nordson’s current price-to-earnings ratio is 26.1 based on our 2024 forecasted earnings-per-share of $10.25. This valuation is slightly elevated compared to the company’s trailing decade average P/E ratio of about 23.0. We believe that 24 times earnings is a reasonable fair value estimate for Nordson given its solid prospects.

Given shares trade above our fair value estimate today, Nordson stock could experience losses of roughly 1.7% per year over the next five years from a declining multiple.

Nordson also sports a 1% dividend yield. The dividend has increased every year for 60 years. Furthermore, we forecast a payout ratio of only 27% for 2024, leaving ample room for continued increases in the years ahead.

Combining the company’s 1% dividend yield with the 9.0% forecasted EPS growth rate, and the potential valuation headwind, we see Nordson stock generating total returns of 8.3% per year in the intermediate term. As a result, Nordson receives a hold rating at this time.

Final Thoughts

The company’s growth prospects seem promising, and Nordson has an impressive track record in terms of earnings and dividends in the past. However, the company is currently trading at a high level, which reduces the attractiveness of the stock.

The company may continue its incredible earnings-per-share growth this year, or it may take a breather and remain flat. However, we believe Nordson will continue growing over the long-term. This long-term earnings growth, coupled with the very conservative dividend payout ratio, should see the company increasing its dividend for many more years ahead.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].