Updated on February 28th, 2024

In order to become a Dividend Aristocrat, a company must have a strong brand and a dominant industry position. The Dividend Aristocrats are a group of 68 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

With this in mind, we have created a list of all 68 Dividend Aristocrats.

You can download your free copy of the Dividend Aristocrats list, along with important financial metrics such as price-to-earnings ratios and dividend yields, by clicking on the link below:

A perfect example of a Dividend Aristocrat with an industry-leading brand is consumer products company McCormick & Company (MKC). McCormick has paid dividends each year since 1925 and has increased its dividend for 38 years in a row.

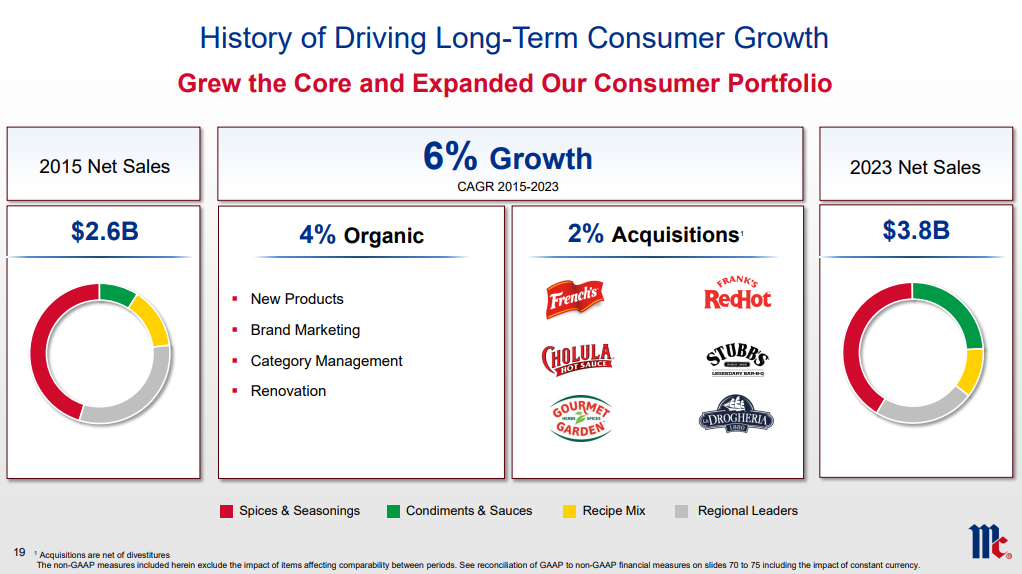

Its dividend growth streak is due to its high-quality business. McCormick is the global leader in food spices, seasonings, and flavors. It has grown its leadership position organically and also through acquisitions. This has fueled McCormick’s dividend growth for many years.

Business Overview

McCormick was formed in 1889, when founder Willoughby M. McCormick started making flavors and extracts in his cellar, which he then sold door-to-door. At first, the business grew at a gradual pace. In 1896, McCormick entered spices by issuing its first McCormick’s Cookbook.

Over time, the company has steadily built itself into the leading spices and seasonings company in the world.

McCormick & Company produces, markets, and distributes seasoning mixes, spices, condiments, and other products to customers in the food industry. Major brands include McCormick, Lawrys, Stubb’s, Club House, Ducros, Schwartz, Kamis, Kohinoor, Zatarains, Thai Kitchen, and Simply Asia.

Source: Investor Presentation

On January 25th, 2024, McCormick reported results for the fourth quarter and full year for the period ending November 30th, 2023. For the quarter, revenue improved 3.6% to $1.75 billion, which was $50 million below estimates.

Adjusted earnings-per-share of $0.85 compared favorably to $0.73 in the prior year and was $0.06 better than expected. For the year, revenue grew 5% to $3.81 billion while adjusted earnings-per-share of $2.52 was unchanged.

For the quarter, pricing was a favorable 5.2% while currency was a 1.5% tailwind to results. This was partially offset by a 3.1% decline in volume and mix and a 0.2% decrease related to divestitures. The Consumer segment’s return to growth continued, with net sales improving once again by 1.0%.

McCormick provided guidance for 2024 as well. The company expects revenue to be in a range of down 2% to flat compared to 2023. Adjusted earnings-per-share is projected to be in a range of $2.76 to $2.81.

Growth Prospects

Going forward, there is plenty of room for continued growth for McCormick, due to growth in the emerging markets, and also acquisitions. First, international growth is a strong catalyst for McCormick. The slow reopening of China following strict pandemic-related restrictions is already benefiting the company.

Higher demand for herbs and spices, as well as increased prices also contributed to sales growth in the region. Separately, acquisitions are a major part of McCormick’s growth strategy.

Source: Investor Presentation

In 2018, McCormick acquired Frank’s RedHot and French’s as part of a $4.2 billion purchase of RB Foods, the food division of consumer products giant Reckitt Benckiser (RGBLY). This was the largest deal in McCormick’s history, and is already a driver of growth for the company.

McCormick has utilized its leadership position in industry to quickly expand these top brands globally. Frank’s RedHot is the leading hot sauce brand in the U.S., while French’s leads the mustard category. The common theme within McCormick’s M&A strategy is that it seeks out top brands that lead their respective categories, that can be easily scaled up.

This theme is clear once again with the recent acquisitions of Cholula Hot Sauce and FONA International. First, in November 2020 McCormick acquired Cholula, the premium Mexican hot sauce brand, for $800 million. This acquisition fits perfectly into McCormick’s strategy of acquiring top-quality brands and quickly scaling them.

McCormick followed this up with the December 2020 acquisition of FONA International, a leading manufacturer of clean and natural flavors with customers across the food, beverage, and nutritional markets. McCormick acquired FONA International for $710 million in cash.

We expect that the company’s various acquisitions, combined with its own strong brands, will result in strong earnings-per-share growth going forward. We estimate that McCormick can grow earnings at a rate of 7% per year through fiscal 2028.

Competitive Advantages & Recession Performance

The two most important competitive advantages for McCormick are its brand strength and global scale. McCormick is the top brand in the global spices and seasonings industry, which is expected to grow for the next five years.

As a result, this gives McCormick leverage with retailers and pricing power. These qualities help the company generate consistent profits each year, even when the economy enters recession.

McCormick managed to grow earnings-per-share each year during the last recession. Earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $1.92

- 2008 earnings-per-share of $2.14 (11% increase)

- 2009 earnings-per-share of $2.34 (9.3% increase)

- 2010 earnings-per-share of $2.65 (13% increase)

As you can see, McCormick & Company grew earnings-per-share every year through the Great Recession. Not only that, the company averaged double-digit annual growth each year, which was highly impressive and a very rare accomplishment, even for a Dividend Aristocrat.

Valuation & Expected Returns

At the midpoint of full-year guidance, McCormick expects adjusted earnings-per-share of roughly $2.79 this year. As a result, the stock trades at a price-to-earnings ratio of 24.4. This is slightly below our fair value price-to-earnings ratio of ~25.

McCormick’s valuation multiple has expanded considerably in recent years, as the company has turned in strong earnings growth. Still, the stock appears to be slightly undervalued. If the P/E multiple expands to our target P/E by 2029, then valuation would be a 0.5% boost to annual returns over this time period.

Shareholder returns will also be derived from expected earnings growth and dividends. The company’s strong brand and multiple catalysts for future growth should add up to higher EPS growth as well.

We expect MKC to grow its EPS by 7% per year, while the stock has a 2.5% current dividend yield. Total annual returns could be 10.0% per year over the next five years, making the stock a buy.

Final Thoughts

McCormick dominates the spices and seasonings category. Its strong brands provide the company with high-profit margins and growth opportunities, both in the U.S. and the international markets.

McCormick has a market-beating dividend yield of 2.5% and has a very strong dividend growth history. The company should be able to lift the dividend each year, likely at a mid-to-high single-digit annual rate.

With an expected rate of return of 10% annually going forward, we rate the stock a buy.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].