Published on November 21st, 2023 by Bob Ciura

The Dividend Aristocrats consist of 68 companies in the S&P 500 Index that have raised their dividends for at least 25 years in a row. Many of the companies have turned into huge multinational corporations over the decades.

You can see the full list of all 68 Dividend Aristocrats here.

We created a full list of all Dividend Aristocrats, along with important financial metrics like price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Aristocrats list by clicking on the link below:

Kenvue Inc. (KVUE) is the most recent addition to the Dividend Aristocrats list, having recently been spun off from former parent company Johnson & Johnson (JNJ).

This article will analyze Kenvue’s business model, future growth catalysts, and expected returns.

Business Overview

Kenvue operates in the healthcare sector as a consumer products manufacturer. In May 2023, Kenvue was spun off from Johnson & Johnson. Now, Kenvue operates three segments: Self Care, Skin Health and Beauty, and Essential Health.

Self Care’s product portfolio includes cough, cold, allergy, smoking cessation, and pain care products among others. Skin Health and Beauty holds products such as face, body, hair, and sun care. Essential Health contains products for women’s health, wound care, oral care, and baby care.

Well-known brands in Kenvue’s product line up include Tylenol, Listerine, Band-Aid, Neutrogena, Nicorette, and Zyrtec. These businesses contributed approximately 17% of Johnson & Johnson’s annual revenue.

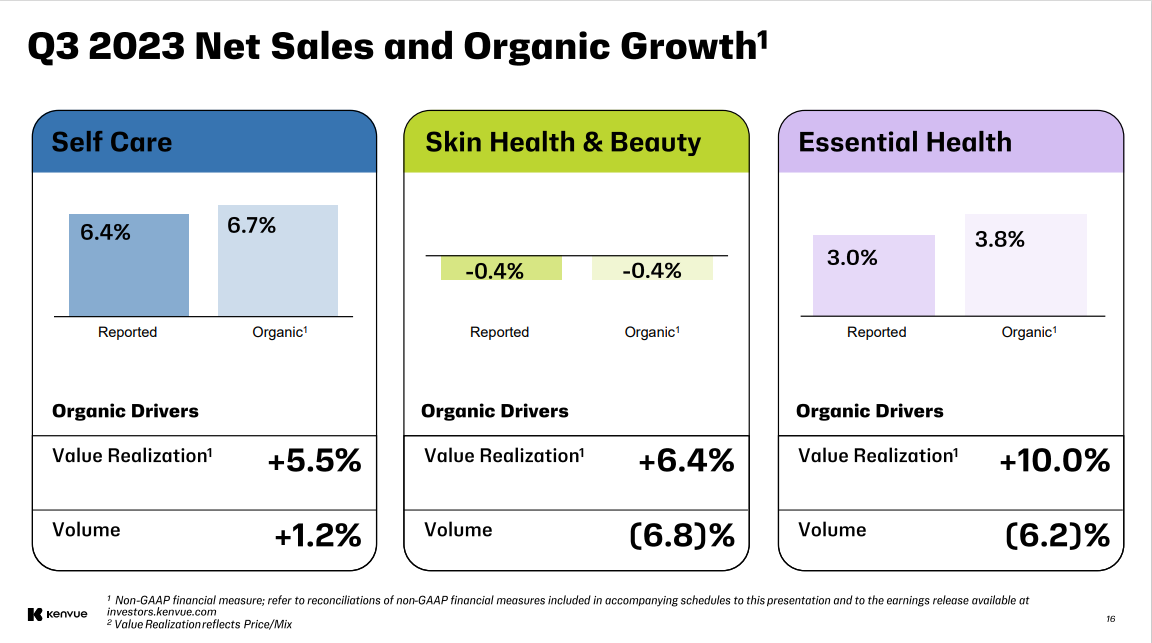

On October 26th, 2023, Kenvue reported third quarter earnings results for the period ending October 1st, 2023. Revenue grew 3.4% to $3.92 billion, which was $10 million above estimates.

Source: Investor Presentation

Adjusted earnings-per-share of $0.31 was in-line with expectations. Organic sales grew 3.6% as pricing and mix were partially offset by a 3.5% decline in volume. Cold and cough were again strong while skin, health, and beauty also showed gains. Gross profit margin improved 140 basis points to 57.5%.

Kenvue also provided an updated outlook for 2023. The company now expects revenue growth to be in a range of 4.0% to 4.5% and organic growth of 5.5% to 6.0%, down from 4.5% to 5.5% and 5.5% to 6.5%, respectively. Kenvue projects adjusted earnings-per-share to be in a range of $1.26 to $1.28 for the year.

Growth Prospects

Johnson & Johnson produced annual earnings growth of 7% for the 2013 to 2022 period as the company’s diversification allowed it to be one of the more stable companies in the market place. Kenvue consists of just the consumer products businesses, which were often produced the lowest levels of growth. Therefore, we expect that Kenvue will grow earnings-per-share by 3% annually through 2028.

Johnson & Johnson’s dividend growth streak of 61 consecutive years is one of the longest in the market place. The company is both a Dividend King and a Dividend Aristocrat. We believe that penchant for dividend growth is in Kenvue’s business DNA.

Competitive Advantages & Recession Performance

Kenvue’s former parent company Johnson & Johnson has proven to be one of the most successful companies at navigating recessions. Though Kenvue no longer benefits from its parent company’s diversification, we believe that it would prove equally effective at handling economic downturns.

Since Kenvue was a subsidiary of Johnson & Johnson during the Great Recession of 2008-2009, there is no data on its earnings-per-share performance during that time. However, investors can reasonably infer that Kenvue would display a similar degree of resilience during recessions as its former parent company.

The company’s products, such as Band-Aid and Tylenol, are needed regardless of the state of the economy as they deal directly with consumers’ health and well-being. As trusted products, they would like continue to perform well even under adverse conditions.

Overall, Kenvue should continue to raise its dividend for many more years thanks to its low payout ratio, its decent resilience to recessions, and its healthy balance sheet.

Valuation & Expected Returns

We expect Kenvue to generate adjusted earnings-per-share of $1.27 for 2023. Therefore, shares of Kenvue currently trade for a price-to-earnings ratio of 15.6. For context, Johnson & Johnson shares have an average price-to-earnings ratio of close to 19 since 2013.

Countering the fact that Kenvue holds some of the industry leading brands with that its products were the lower margin businesses within the parent company, we have a target price-to-earnings ratio of 14 for the stock. This implies a headwind from multiple contraction.

Therefore, valuation could reduce annual returns by 2.1% if the stock were to reach our target multiple by 2028. Positive returns will be generated by EPS growth (estimated at 3% per year) and dividends.

On July 20th, 2023, Kenvue announced its first-ever quarterly dividend of $0.20 per share to be distributed on September 7th, 2023. The annualized payout of $0.80 per share represents a current yield of 4.0%.

Putting it all together, total returns are expected to reach 4.9% per year through 2028. This is a solid expected rate of return that makes the stock a hold, but not a buy at this time.

Final Thoughts

Kenvue is a new addition to the Dividend Aristocrats list. After decades as part of Johnson & Johnson, Kenvue became an independent entity early in the second quarter. The company has produced decent results so far as an independent company.

While we find the legacy business to be recession-resistant and the high dividend yield to be attractive for income investors, the total return profile is not high enough for a buy recommendation. We rate KVUE stock to be a hold.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

- The Dividend Champions: Dividend stocks with 25+ years of dividend increases, including those that may not qualify as Dividend Aristocrats.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].