Updated on February 11th, 2023 by Nikolaos Sismanis

Investors looking for high-quality dividend growth stocks should take a closer look at the Dividend Aristocrats. The Dividend Aristocrats are a group of 68 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 68 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios and dividend yields, by clicking on the link below:

We review all 68 Dividend Aristocrats each year. The next stock in the series is aerospace and defense company General Dynamics (GD). The company is one of the newer members of the Dividend Aristocrats, having joined the list in 2017.

General Dynamics is a leader in the aerospace and defense industry, with a long history of dividend increases and steady growth.

Business Overview

General Dynamics was incorporated in 1952 through the combination of the Electric Boat Company, Canadair, and several others.

The company has evolved over the years to enter new businesses of the future. The biggest transformation came in the 1990’s, when General Dynamics started buying technology-oriented companies. General Dynamics currently generates annual sales nearing $39 billion.

The company’s revenue stream has been diversified in recent years, and it now no longer relies as much upon the Aerospace segment as it used to.

A breakdown of its segments and their contribution to revenue is below:

- Aerospace (22% of revenue)

- Combat Systems (19% of revenue)

- Technologies (31% of revenue)

- Marine Systems (28% of revenue)

Source: Investor Presentation

The company’s Aerospace segment is focused on business jets and services, while the remainder of the company is engaged with defense-related operations. The company makes the well–known M1 Abrams tank, Stryker vehicle, Virginia–class submarine, Columbia–class submarine, and Gulfstream business jets. These strong businesses have combined to produce consistent growth for many years.

Growth Prospects

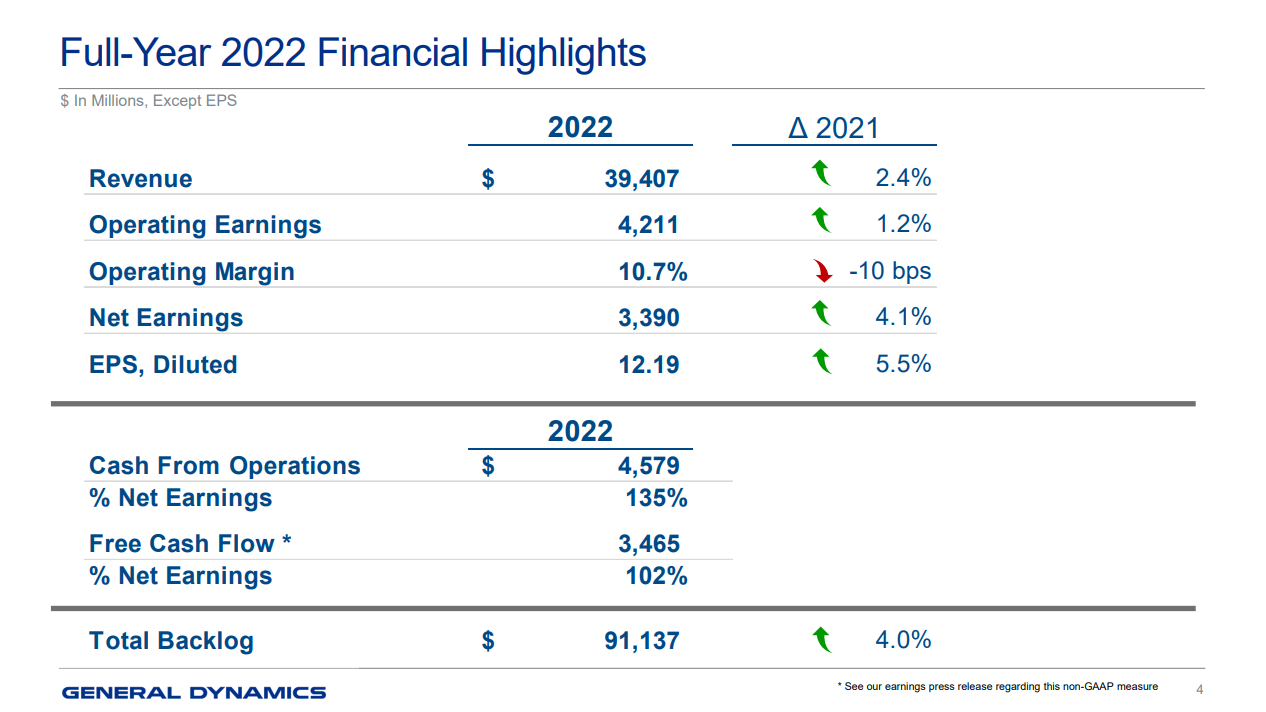

General Dynamics had a satisfactory year in 2022. With the coronavirus pandemic gradually perishing and the previous supply chain issues improving, the company was able to deliver rather robust numbers. For the fourth quarter, company-wide revenues rose 5.4% to $10.9 billion, and diluted earnings-per-share grew by 5.6% to $3.58 on a year-over-year basis.

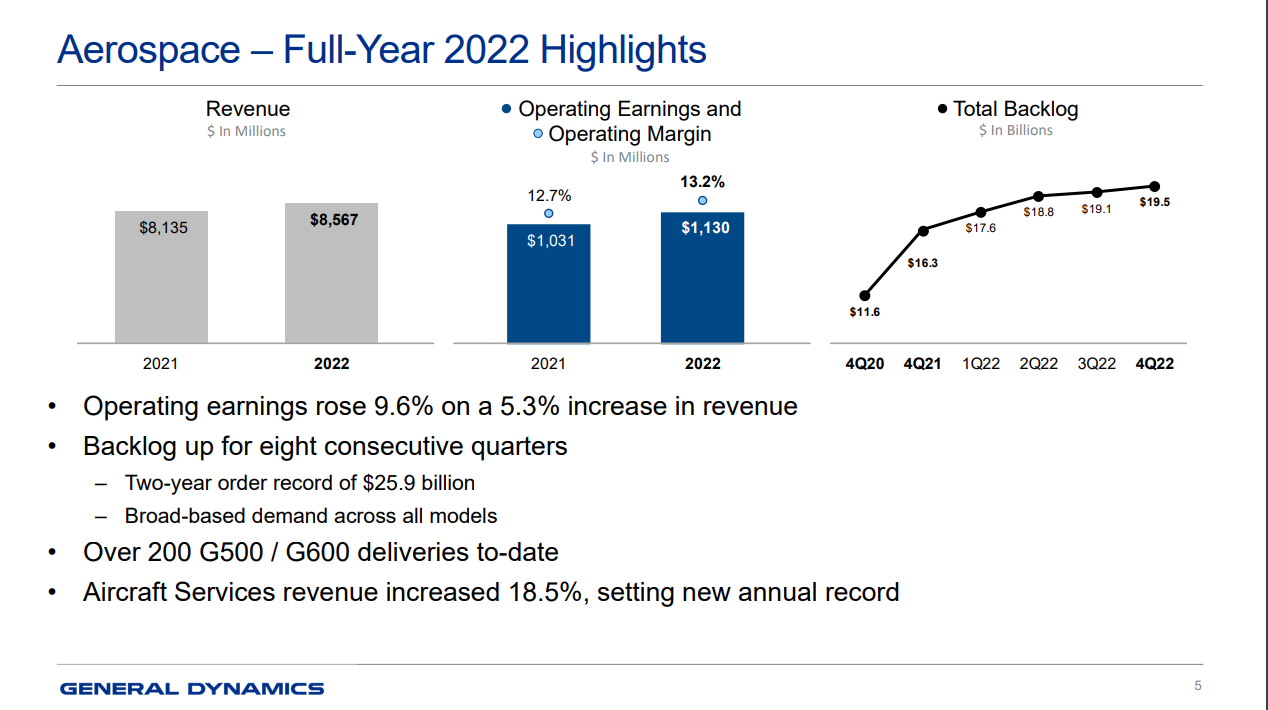

Aerospace revenue fell 4.3% to $2,45 billion from $2. 56 billion in the prior-year period on lower deliveries, but the total backlog grew again to $19,5 billion for the segment, the highest in more than a decade, while Gulfstream demand drove a book-to-bill ratio of 1.21X.

Source: Investor Presentation

Revenue for Marine Systems rose 3.4% to $2.97 billion. Combat Systems revenue also rose 15.5% to $2.8 billion. Finally, Technologies revenue also saw an increase of 9.3% to $3.3 billion.

For the year, company-wide revenue increased by 2.4%, while diluted earnings per share increased by 5.5% to $12.19 from $11.55 in fiscal 2021. The companywide backlog improved 4% to a record $91.1 billion.

General Dynamics’ top and bottom lines have grown for many years due to increasing U.S. defense spending and international sales. General Dynamics has established naval and ground platforms that support maintenance and modernization contracts as well as future prime contract wins. After 2023, we forecast, on average, 6% annual earnings per share growth out to 2028.

Competitive Advantages & Recession Performance

General Dynamics has several competitive advantages. First, it’s a leader in the defense industry, which has very high barriers to entry. Defense companies rely on contracts from the U.S. and foreign governments. A small competitor would have difficulty entering the defense industry and trying to take share.

In addition, General Dynamics has industry-leading brands, such as Gulfstream and Stryker. It has built these brands with significant research and development spending that totals in the hundreds of millions of dollars annually. Indeed, this is part of the significant barriers to entry for potential competitors.

General Dynamics is built to last. The company performed very well during the last recession:

- 2007 earnings-per-share of $5.10

- 2008 earnings-per-share of $6.13 (20% increase)

- 2009 earnings-per-share of $6.20 (1.1% increase)

- 2010 earnings-per-share of $6.82 (10% increase)

As you can see, the company grew earnings in each year of the recession, including two years of double-digit growth. It would not be easy to find many companies that grew earnings-per-share by 20% in 2008, but General Dynamics did it.

One major reason for the company’s excellent recession performance is that it sees steady demand for its products and services each year. The world has many dangerous places. Global conflicts are not likely to cease any time soon, regardless of the economic climate. This will drive ever-increasing levels of defense spending, the US included.

The ongoing war in Ukraine and the U.S.’s decision to supply the country with M1 Abrams tanks should also be proven a growth driver for the company as Western Allies will need to replenish their stocks.

And, General Dynamics’ revenue is secured by long-term contracts with its customers, and switching costs are very high, sometimes impossibly so. This also keeps earnings intact during recessions.

Valuation & Expected Returns

General Dynamics stock has a price-to-earnings ratio of 18.5, which is above our fair value estimate of 15 times earnings.

If the valuation multiple declines from 18.5 to our fair value estimate of 15, it would reduce annual returns by approximately 4.1% per year over the next five years.

Fortunately, shareholder returns will be boosted by projected earnings-per-share growth of 6% per year, as well as the current dividend yield of 2.2%. The dividend payout is highly secure, with a projected 2023 dividend payout ratio of just 40%, which leaves plenty of room for annual dividend increases. As a matter of fact, on March 2nd, 2022, the company announced a dividend increase of 5.9%, which marked its 31 consecutive dividend increase.

Given all of these factors, we see total annual returns of about 4.0% in the coming years. This is not a great rate of return, but considering notable tailwinds could follow during the ongoing, favorable environment for defense companies, we rate the stock as a hold.

Final Thoughts

General Dynamics is a high-quality business with a long history of growth. Geopolitical risk remains a constant, which gives the company a long runway of growth going forward.

General Dynamics is also a shareholder-friendly company and should continue returning significant cash to shareholders through buybacks and dividends. The elevated valuation could limit the stock’s annual returns over the next five years, but General Dynamics should be a reliable long-term holding, likely to be highly appreciated by dividend-growth investors.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].