Up to date on January twenty ninth, 2025 by Bob Ciura

Annually, we individually overview every of the Dividend Aristocrats, a bunch of 69 shares within the S&P 500 Index that has raised their dividends for not less than 25 consecutive years.

To make it on the listing of Dividend Aristocrats, an organization should possess a worthwhile enterprise mannequin with a beneficial model, international aggressive benefits, and the power to resist recessions.

This is the reason Dividend Aristocrats can proceed elevating dividends in troublesome years.

With this in thoughts, we’ve got created an inventory of all 69 Dividend Aristocrats.

You’ll be able to obtain your free copy of the Dividend Aristocrats listing, together with vital monetary metrics reminiscent of price-to-earnings ratios and dividend yields, by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend isn’t affiliated with S&P International in any means. S&P International owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official information from S&P International. Seek the advice of S&P International for official info.

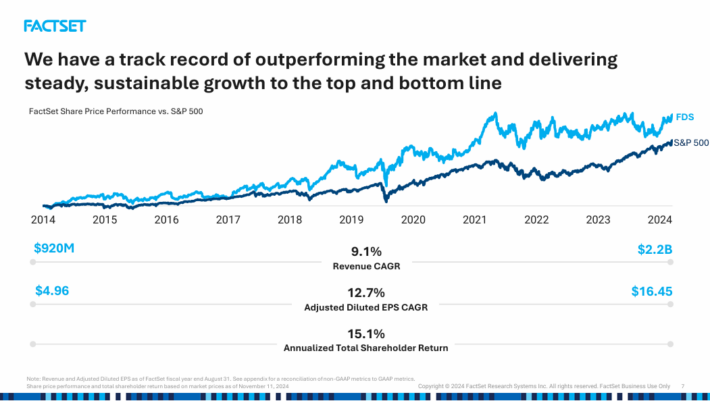

FactSet Analysis Techniques (FDS) is among the many new additions to the Dividend Aristocrats listing for 2025.

This text will look at FactSet’s enterprise mannequin, progress prospects, and whether or not we’re at the moment score the inventory as a purchase, promote, or maintain.

Enterprise Overview

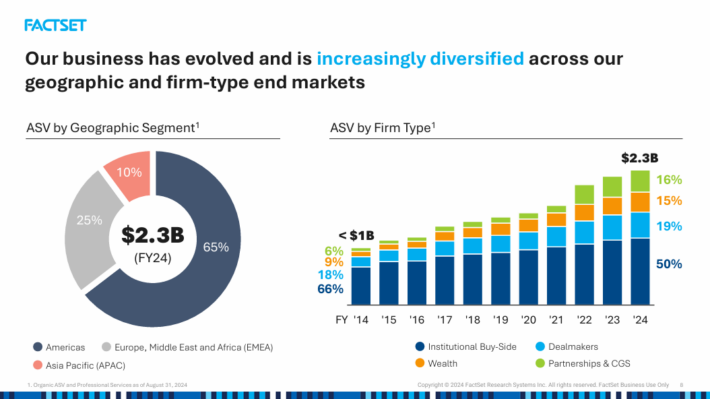

FactSet Analysis Techniques, a monetary information and analytics agency based in 1978, supplies built-in monetary info and analytical instruments to the funding group within the Americas, Europe, the Center East, Africa, and Asia-Pacific.

The corporate supplies perception and knowledge via analysis, analytics, buying and selling workflow options, content material and know-how options, and wealth administration.

Supply: Investor Presentation

On December nineteenth, 2024, FactSet Analysis Techniques introduced Q1 2025 outcomes, reporting non-GAAP EPS of $4.37 for the interval, beating market consensus by $0.09 whereas income rose 4.9% to $568.7 million.

FactSet Analysis Techniques kicked off fiscal 2025 with stable progress in Q1, reporting GAAP revenues of $568.7 million, a 4.9% year-over-year enhance.

The income enhance was pushed by robust efficiency throughout its wealth administration, asset proprietor, and institutional consumer segments.

Natural Annual Subscription Worth (ASV), a key efficiency metric, rose 4.5% to $2,258.8 million, reflecting sustained demand for FactSet’s monetary information and analytics options.

Nevertheless, the corporate confronted margin pressures, with its GAAP working margin slipping 120 foundation factors to 33.6%, attributable to elevated amortization bills {and professional} charges.

Earnings per share provided a combined image. GAAP diluted EPS edged up 1.3% to $3.89, whereas adjusted diluted EPS rose 6.1%, supported by income progress and decrease worker compensation prices.

FactSet reaffirmed its fiscal 2025 steerage, together with projected GAAP revenues of $2.29–$2.31 billion and adjusted diluted EPS within the vary of $16.80–$17.40.

Development Prospects

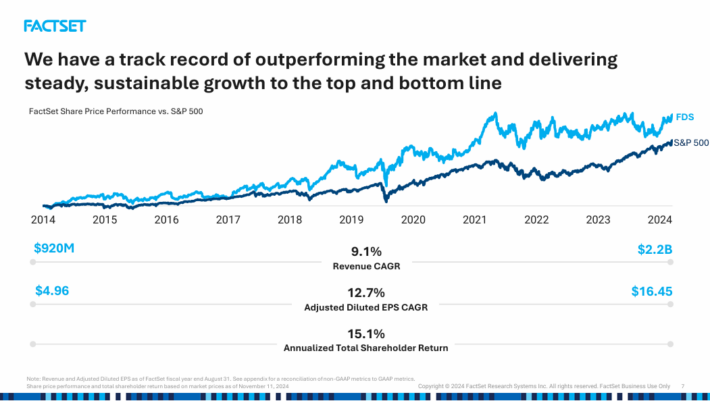

FactSet has grown its earnings-per-share by a median compound progress fee of 10.3% over the past 10 years. The corporate’s investments and improved product choices may result in important margin enlargement within the following years.

Supply: Investor Presentation

We now have elevated our EPS estimate for 2025 to $17.10, matching the midpoint of the administration’s steerage, however we’ve got maintained our 8.5% annual earnings progress forecast for the following 5 years, resulting in an estimated earnings-per-share of $25.71 by 2030.

Elevated earnings arising from increasing margins might be a main dividend progress driver within the following years. We additionally consider that the corporate’s continued investments in its digital platforms will proceed to drive person progress within the coming years.

FactSet has elevated its dividend for 25 consecutive years.

Lastly, share buybacks ought to enhance future EPS progress. Throughout Q1, FactSet repurchased 104,475 shares of its frequent inventory for $48.8 million at a median worth of $467.00 per share, leaving $251.2 million accessible below its present buyback program.

Aggressive Benefits & Recession Efficiency

FactSet faces competitors from Axioma, MSCI, Aladdin, S&P Capital IQ, Refinitiv, and Bloomberg.

The corporate’s proprietary information choices differentiate the corporate within the market, however various options by the opposite suppliers will dilute this aggressive benefit over time.

The excessive switching prices tied to altering suppliers present the corporate with some safety and visibility over its money circulation due to its subscription-based choices.

FactSet’s earnings-per-share in the course of the Nice Recession are beneath:

- 2008 earnings-per-share of $2.50

- 2009 earnings-per-share of $2.97 (19% progress)

- 2010 earnings-per-share of $3.13 (5% progress)

Through the previous 5 years, the corporate’s dividend payout ratio has averaged round 64%. The corporate has a projected 2024 payout ratio of 63%, which signifies a sustainable dividend.

Given the anticipated earnings progress, there’s nonetheless room for the dividend to proceed to develop on the similar tempo and prolong the observe document of consecutive dividend will increase which is a crucial issue for dividend progress buyers.

Valuation & Anticipated Returns

Primarily based on anticipated 2024 earnings-per-share of $17.10, FDS shares are at the moment buying and selling for a P/E ratio of 27.4.

FactSet has traded with a comparatively excessive valuation a number of within the final decade. The inventory’s 10-year common P/E ratio is round 30.7, and the five-year common is 35.0. We’re utilizing a P/E goal of 28.0 as our honest worth goal by 2030.

Due to this fact, the inventory seems barely undervalued proper now. An increasing P/E a number of from 27.4 to twenty-eight would enhance shareholder returns by 0.4% per yr over the following 5 years.

Subsequent, shares are at the moment yielding 0.9%. We additionally estimate 8.5% annual EPS progress.

Placing all of it collectively, complete returns are anticipated at 9.8% per yr. With annual returns estimated to succeed in ~10% per yr, we fee the inventory a purchase.

Ultimate Ideas

FactSet presents a secure, constant, and regular long-term dividend progress document.

We forecast practically 10% annualized complete returns for the medium-term, derived from the forecasted earnings-per-share progress of 8.5%, the 0.9% dividend yield, and a small valuation tailwind. Due to this fact, we preserve our purchase score for the inventory.

Moreover, the next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

If you happen to’re on the lookout for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].