Updated on February 11th, 2023 by Quinn Mohammed

Expeditors International of Washington Inc. (EXPD) may not be the best-known stock to most investors given that it services a logistics and transportation niche in global commerce. However, the company has a terrific track record creating value for shareholders, both via appreciation in the share price, and by increasing its dividend payment.

The year 2019 marked the 25th consecutive year Expeditors increased its payout, making it a member of the prestigious Dividend Aristocrats, a group of S&P 500 stocks with at least 25 consecutive years of dividend increases.

There are now 68 Dividend Aristocrats. You can download an Excel spreadsheet of all 68, including important metrics such as dividend yields and P/E ratios, by clicking the link below:

Expeditors has proven over time to be a business with strong growth prospects, although that growth hasn’t been linear by any means. The cyclical nature of the shipping business creates inherent volatility, but over time, Expeditors has delivered growth.

Expeditors stock looks undervalued today. As a result, this may be a good time to buy this particular Dividend Aristocrat.

Business Overview

Expeditors is a global logistics company that offers services including consolidation and forwarding of air and ocean freight, customs brokerage, vendor consolidation, cargo insurance, time-sensitive delivery options, order management, warehousing and distribution, and other customized logistics solutions. In short, Expeditors offers companies global commerce logistics solutions in all shapes and sizes.

Expeditors was founded in 1979 in Seattle and since that time, it has grown from a single office into more than 350 locations across six continents, spanning more than 100 countries and employing more than 18,000 people.

EXPD is a large-cap stock with a market cap above $17.5 billion.

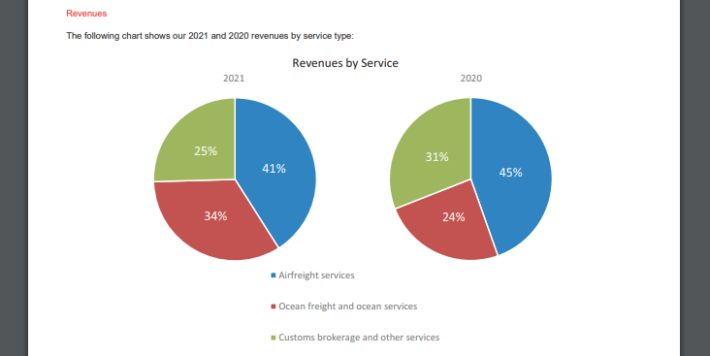

The company is fairly well diversified with its revenue streams, as we can see below:

Source: 2021 Annual Report

The company performed well in the first nine months of 2022, despite the global supply chain constraints. In the third quarter of 2022, revenues saw an increase of 1%, from $4.3 billion to $4.4 billion. Net earnings grew 15% year-over-year to $414 million, and earnings-per-share rose by 22% compared to the third quarter of 2021 to $2.54, which also beat estimates by $0.55.

For the first nine months of 2022, sales were up 22% versus the same nine months of 2021. Net earnings were also up 18% compared to the nine months of 2021. The company achieved a 22% increase in earnings-per-share.

We estimate that Expeditors will generate earnings-per-share of $8.96 for full year 2022, which would represent an 8.3% increase over 2021.

Growth Prospects

Over the past 10 years, the company has seen earnings grow at a compound annual growth rate (CAGR) of 20.3%. For the past five years, it has risen slightly higher, reaching 27.2% CAGR. We see Expeditors producing annual earnings-per-share growth in the area of 2% as we expect the economy to slow down.

Expeditors remains well-positioned to continue to see revenue growth over time through its diverse network of revenue streams, but note that recessions, global trade fears, and other shocks pose a risk to growth.

From 2014-2018, the company grew airfreight tonnage, ocean containers, and gross revenue every year. However, in the third quarter of 2022, airfreight tonnage volume and ocean container volume decreased 13% and 10%, respectively. Tonnage is the preferred volume method Expeditors uses to assess performance, and while growth rates have been volatile, the general direction has been higher in recent years.

Despite short term headwinds, we believe the long-term trend is higher for volumes. This will help drive revenues higher over time, as it has for many years.

Revenue, operating income, and earnings-per-share have moved significantly higher over time, but there have been periods for all categories that showed negative year-over-year growth. Given the inherently volatile nature of the shipping business, we don’t see this as changing, but still expect to see low single-digit earnings-per-share growth annually over full economic cycles.

We think revenue will produce the bulk of these gains, while margins may expand slightly, along with a small tailwind from share repurchases. In total, we forecast 2% annual earnings-per-share growth annually.

Competitive Advantages & Recession Performance

Expeditors’ competitive advantage is its size and scale in a niche of global transportation of goods. Expeditors offers customers the scale of a global shipping company with a diverse network of ports and airports, but with the local and customized options of a smaller firm. This sets Expeditors apart from others in the logistics industry, but note that this is an industry where advantages are difficult to come by.

Expeditors’ earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share: $1.21

- 2008 earnings-per-share: $1.37

- 2009 earnings-per-share: $1.12

- 2010 earnings-per-share: $1.59

Expeditors saw its earnings decline during the Great Recession, but only slightly. In fact, Expeditors held up much better than one would perhaps think given its leverage to the global economy. The next recession will likely crimp earnings growth temporarily but will be far from disastrous for Expeditors. Expeditors exemplified a strong track record during the Great Recession, one of the worst economic periods in recent history.

The company continued to perform well in 2020 and 2021, during another particularly challenging period for the economy. Expeditors achieved record results last year and maintained its impressive streak of annual dividend increases.

Valuation & Expected Returns

Expeditor’s historical growth and future growth potential are impressive, and the stock appears fairly undervalued today. We expect to see $8.96 in earnings-per-share for 2022. With the share price at $112, Expeditors is trading for about 12.5 times earnings.

We see 18 times earnings as fair value for the stock. Therefore, an increasing P/E multiple from 12.5 to 18.0 could increase annual returns by 7.5% per year over the next five years.

Combining the forecast for 2% earnings-per-share growth, and the current 1.2% dividend yield, we see total annual returns of 10.6% over the next five years.

We think Expeditors will also continue to grow its dividend at strong rates over time, as the company has a track record that is difficult to match. Expeditors’ current yield is below the S&P 500 average and therefore is unattractive for income investors, but it remains a strong dividend growth stock.

Final Thoughts

Expeditors has been a strong player in the logistics industry for many years. The company has a diverse network of global ports and airports it services, as well as offering customized, valuable services to its global network of customers. Growth will likely continue to be volatile and vulnerable to interruptions, particularly during recessions, but we see Expeditors as attractive for the long-term.

The valuation today is cheap, but the yield is quite low at just 1.2%. However, dividend growth should continue for many years to come given the payout ratio is around 16%.

Expeditors is appealing for dividend growth investors, but not those seeking a high dividend stock, or earnings safety and consistency. Overall, the stock is attractive today given its valuation against historical norms.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].