Up to date on January twenty seventh, 2025 by Bob Ciura

Every year, we individually overview every of the Dividend Aristocrats, a bunch of 69 shares within the S&P 500 Index that has raised their dividends for at the very least 25 consecutive years.

To make it on the checklist of Dividend Aristocrats, an organization should possess a worthwhile enterprise mannequin with a worthwhile model, world aggressive benefits, and the flexibility to face up to recessions.

For this reason Dividend Aristocrats can proceed elevating dividends in tough years.

With this in thoughts, now we have created a listing of all 69 Dividend Aristocrats.

You possibly can obtain your free copy of the Dividend Aristocrats checklist, together with necessary monetary metrics akin to price-to-earnings ratios and dividend yields, by clicking on the hyperlink beneath:

Disclaimer: Positive Dividend is just not affiliated with S&P World in any means. S&P World owns and maintains The Dividend Aristocrats Index. The knowledge on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

Erie Indemnity Firm (ERIE) is among the many new additions to the Dividend Aristocrats checklist for 2025.

This text will look at Erie’s enterprise mannequin, development prospects, and whether or not we’re at present ranking the inventory as a purchase, promote, or maintain.

Enterprise Overview

Erie Indemnity is an Erie, Pennsylvania-based insurance coverage firm. It has established itself in life insurance coverage, auto, residence, and industrial insurance coverage. The corporate’s historical past dates to the Nineteen Twenties.

Erie Indemnity reported its third quarter earnings outcomes on October 31. Revenues totaled $999 million throughout the quarter, which was 16% greater than the identical quarter the earlier yr.

Income development was pushed by larger administration payment revenues (for coverage issuance and renewal companies) to a big diploma, which rose by 19% yr over yr. Administrative companies payment income grew 6%.

Funding revenue was up considerably on a year-over-year foundation throughout the quarter, which will be defined by tailwinds from larger rates of interest.

Erie Indemnity generated GAAP earnings-per-share of $3.06 throughout the third quarter, which was up by 20% year-over-year.

The present estimate for this yr’s earnings-per-share is $11.50, which might be the very best yr in Erie Indemnity’s historical past.

Development Prospects

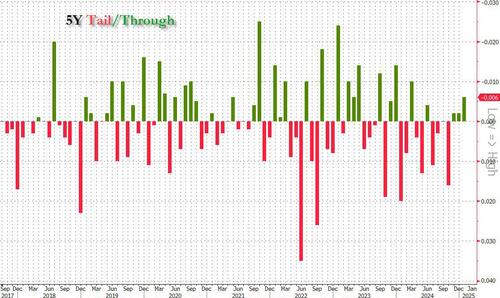

Erie elevated its earnings-per-share by 11% yearly between 2014 and 2023. Like different insurance coverage corporations, Erie Indemnity has a large float – money that it has acquired by premiums and that it wants to speculate.

The corporate’s monetary outcomes are depending on market charges, akin to treasuries.

With rates of interest rising within the latest previous, Erie Indemnity skilled a giant revenue improve in 2023, and one other massive improve is anticipated for the present yr.

Lately, Erie Indemnity has achieved interesting income development, and we imagine that revenues ought to develop within the foreseeable future. We imagine that Erie Indemnity ought to be capable to develop its income at a mid-single-digit tempo all through the approaching years.

Rising revenues are one development driver, whereas additional will increase in funding revenue might have a constructive affect on the corporate’s revenue development as properly.

We count on Erie to develop its earnings-per-share by 5%-6% per yr over the subsequent 5 years.

Aggressive Benefits & Recession Efficiency

Erie Indemnity is just not an enormous insurance coverage firm, in relation to its friends. Due to this fact, it doesn’t have any main scale benefits over its opponents.

Nevertheless it was, in comparison with many different insurance coverage corporations and monetary firms, comparatively steady throughout the Nice Recession, which is a constructive from a threat perspective.

Its earnings took a success, however the firm managed to stay worthwhile and was in a position to increase its dividend.

Erie’s earnings-per-share throughout the Nice Recession are beneath:

- 2007 earnings-per-share of $3.43

- 2008 earnings-per-share of $1.19 (65% decline)

- 2009 earnings-per-share of $1.89 (59% development)

- 2010 earnings-per-share of $2.85 (51% development)

Whereas Erie definitely felt the ache from the Nice Recession, its earnings rebounded pretty rapidly and the corporate remained worthwhile all through.

Not like many different monetary corporations, Erie Indemnity didn’t reduce its dividend throughout the Nice Recession. As an alternative, the corporate continued to boost its payout even throughout these troubled years, holding its dividend development observe report intact.

Due to this fact, it’s clear that Erie is uncovered to recessions because of working within the monetary sector. Nevertheless it additionally has a historical past of recovering from downturns properly.

Valuation & Anticipated Returns

Primarily based on anticipated 2024 earnings-per-share of $11.50, ERIE shares are at present buying and selling for a P/E ratio of 35. That is above the inventory’s 10-year common P/E of 32.

Primarily based on Erie Indemnity’s previous report and the forecasted earnings-per-share development fee, we imagine that the corporate’s shares must be valued at round 22 instances internet earnings.

Because of this, ERIE inventory appears to be like considerably overvalued right now. If the valuation reverts to 22 over the subsequent 5 years, shareholder returns can be decreased by -8.9% per yr over that interval.

Shareholder returns can be positively boosted by earnings-per-share development and dividends. We count on Erie to generate earnings-per-share development of 5.5% per yr.

Subsequent, shares are at present yielding 1.4%. Placing all of it collectively, complete returns are anticipated at -2.0% per yr. With unfavorable anticipated returns, we fee Erie inventory a promote.

Ultimate Ideas

Erie Indemnity has grown its earnings-per-share constantly over its historical past. The corporate is more likely to set a report for its earnings-per-share in 2025. The long-term development outlook is strong.

Nonetheless, the excessive valuation is a big headwind for Erie Indemnity’s forecasted complete returns. Erie Indemnity appears to be like like a comparatively steady insurance coverage firm essentially, however the excessive valuation causes shares to earn a promote suggestion at present costs.

Moreover, the next Positive Dividend databases comprise essentially the most dependable dividend growers in our funding universe:

For those who’re on the lookout for shares with distinctive dividend traits, take into account the next Positive Dividend databases:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].