Updated on Febuary 17th, 2023 by Felix Martinez

The Dividend Aristocrats consist of companies that have raised their dividends for at least 25 years in a row. Many of the companies have turned into huge multinational corporations over the decades, but not all of them. You can see the full list of all 68 Dividend Aristocrats here.

We created a full list of all Dividend Aristocrats, along with important financial metrics like price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Aristocrats list by clicking on the link below:

Dover Corporation (DOV) has raised its dividend for a staggering 67 consecutive years, giving it one of the longest dividend growth streaks in the entire stock market.

The company has achieved such an exceptional dividend growth record thanks to its strong business model, decent resilience to recessions, and conservative payout ratio, which provides a wide margin of safety during recessions.

Due to its conservative dividend policy, the stock is offering a 1.3% dividend yield, which is roughly in line with the average yield of the S&P 500 Index.

On the other hand, there is a lot of room for continued dividend raises each year. Dover is a time-tested dividend growth company, and in this article, we’ll examine its prospects in further detail.

Business Overview

Dover is a diversified global industrial manufacturer which provides equipment and components, consumable supplies, aftermarket parts, software and digital solutions to its customers.

It has annual revenues of about $8.5 billion, with just over half of its revenues generated in the U.S., and operates in five segments: Engineered Systems, Fueling Solutions, Pumps & Process Solutions, Imaging & Identification and Refrigeration & Food Equipment.

Pumps & Process Solutions is the best-performing segment. It proved the most resilient segment amid the pandemic, primarily due to the critical nature of its products, which are essential to Dover’s customers.

The COVID-19 crisis caused some tough times for Dover. As its customers are industrial manufacturers, they were significantly hurt by the global recession caused by the pandemic. However, Dover and its customers rebounded out of the crisis in a big way, and Dover is back to strong growth, including what should be record revenue this year.

Source: Investor Presentation

We can see the company has guided for organic growth of 8% to 10% this year in terms of revenue, which should translate to even more than that from an EPS perspective. The company’s history of boosting revenue is only part of the puzzle, as Dover’s focus on ever-increasing profitability has helped drive EPS growth over the years, including 2022.

The company’s fourth-quarter earnings were released on January 31st, 2023, and showed strong growth year-over-year. Revenue was up more than 8% to $2.1 billion, and adjusted earnings-per-share were $2.16, up from $1.78, which is an increase of 21%. Engineered Products led the way with a 13% revenue growth rate in Q4, while Clean Energy & Fueling also posted an increase in revenue.

For the year, revenue increased 8% year-over-year while also seeing 9% in organic growth. Thus, adjusted earnings were up 11% to $8.45 per share for 2022 compared to $7.63 per share in 2021.

Growth Prospects

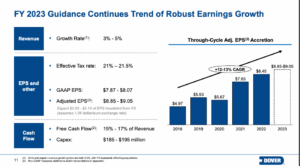

Dover has pursued growth by expanding its customer base and through bolt-on acquisitions. Dover has routinely executed a series of bolt-on acquisitions and occasional divestments to reshape its portfolio and maximize its long-term growth. The company expects to grow revenue 3% to 5% for 2023.

Source: Investor Presentation

The management team is constantly focused on delivering the most value to shareholders through portfolio transformation, which has generally been successful. Today, the company is a highly diversified industrial company with an attractive growth profile.

In addition, Dover is also likely to enhance its earnings per share via opportunistic share repurchases. We see 8% long-term earnings-per-share growth in the years to come, driven primarily by revenue increases, with a helping hand from margin expansion and share repurchases reducing the float.

Competitive Advantages & Recession Performance

Dover is a manufacturer of industrial equipment, and some investors may think that the company has no moat in its business due to little room for differentiation. However, the company offers highly engineered products, which are critical to its customers. It is also uneconomical for its customers to switch to another supplier because the risk of lower performance is material.

Therefore, Dover essentially operates in niche markets, which offer a significant competitive advantage to the company. This competitive advantage helps explain Dover’s consistent long-term growth trajectory.

On the other hand, Dover is vulnerable to recessions due to its reliance on industrial customers. In the Great Recession, its earnings per share were as follows:

- 2007 earnings-per-share of $3.22

- 2008 earnings-per-share of $3.67 (14% increase)

- 2009 earnings-per-share of $2.00 (45% decline)

- 2010 earnings-per-share of $3.48 (74% increase)

Dover got through the Great Recession with just one year of decline in its earnings per share, and the company almost fully recovered from the recession in 2010. That performance was certainly impressive.

Downturns in the oil industry also impact Dover during periods of weak oil prices. The collapse of the price of oil from $100 in mid-2014 to $26 in early 2016 is a notable example of such a downturn. Its earnings per share decreased 28% from $4.54 in 2014 to $3.25 in 2016.

However, in 2018, Dover spun off its energy division, Apergy, which now trades as ChampionX Corporation (CHX).

Given its sensitivity to the economic cycles, it is impressive that Dover has grown its dividend for 67 consecutive years.

The exceptional dividend record can be attributed to the aforementioned decent resilience of the company to recessions. Another reason is the conservative dividend policy of management, which targets a payout ratio of around 30%. This policy provides a wide margin of safety during rough economic periods. Today, the payout ratio is just 23% of earnings, so we don’t see any scenario where the payout would be at risk.

Moreover, management has become remarkably conservative in its dividend raises over the last five years. Dover has raised its dividend at a ~3% average annual rate during this period.

Overall, Dover will certainly continue to raise its dividend for many more years thanks to its low payout ratio, its decent resilience to recessions, and its healthy balance sheet. Its 1.3% dividend yield is congruent with that of the overall market, as is its modest dividend growth rate. From a pure-income investor perspective, the stock is likely not that attractive.

Valuation & Expected Returns

Dover stock is trading almost exactly where it did before the pandemic, but its earnings profile is much better. That means the stock trades for just 18.2 times this year’s earnings, which is higher than our estimate of fair value at 17 times earnings. That implies a ~1% annual headwind to total returns from valuation compression.

Including 8% expected annual earnings-per-share growth, the 1.3% dividend yield, and a 1% annualized compression of the price-to-earnings ratio, we expect Dover to offer a robust 8% average annual return over the next five years. This puts Dover into the territory of a hold rating, particularly given its exemplary dividend history.

Final Thoughts

Dover has an impressive dividend growth record, with 67 consecutive years of dividend raises. This is an impressive achievement, particularly given the dependence of the company on industrial customers, who tend to struggle during recessions.

However, due to its conservative dividend policy, the stock is offering a modest yield of 1.3%, while its dividend growth has significantly slowed in recent years. As a result, the stock is not highly appealing to investors who are focused primarily on income.

On the bright side, Dover has consistently grown its earnings per share over the years, primary thanks to a series of bolt-on acquisitions. The stock has generated strong total returns to shareholders due to the company’s revenue and earnings growth.

The company has ample room to keep growing via this strategy for many more years.

The stock is slightly overpriced, meaning it earns a hold rating with its 8%+ projected total returns.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].