Updated on January 24th, 2022 by Nikolaos Sismanis

Only companies in the S&P 500 Index, with at least 25 years of dividend growth, can claim the title of being a Dividend Aristocrat. This club is so exclusive that there are only 65 such companies in the S&P 500 Index. As a result, Dividend Aristocrats are relatively rare among the broader S&P 500.

With this in mind, we created a list of all 65 Dividend Aristocrats, along with important financial metrics like price-to-earnings ratios and dividend yields.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by clicking on the link below:

Chubb Ltd. (CB) is a relatively new addition to the list, having joined within the past few years. It announced its 29th consecutive annual dividend increase in 2022. Chubb yields 1.5% right now, which is not a high dividend yield. In fact, it is below the S&P 500 Index’s current dividend yield of 1.65%.

While Chubb is not a high-yield dividend stock, it does provide consistent dividend increases each year, backed by a strong business model.

Business Overview

Chubb is based in Zurich, Switzerland, and provides insurance services, including property & casualty insurance, accident & health insurance, life insurance, and reinsurance. The company operates in over 50 countries and territories. It is the world’s largest publicly traded P&C insurance company and the largest commercial insurer in the U.S.

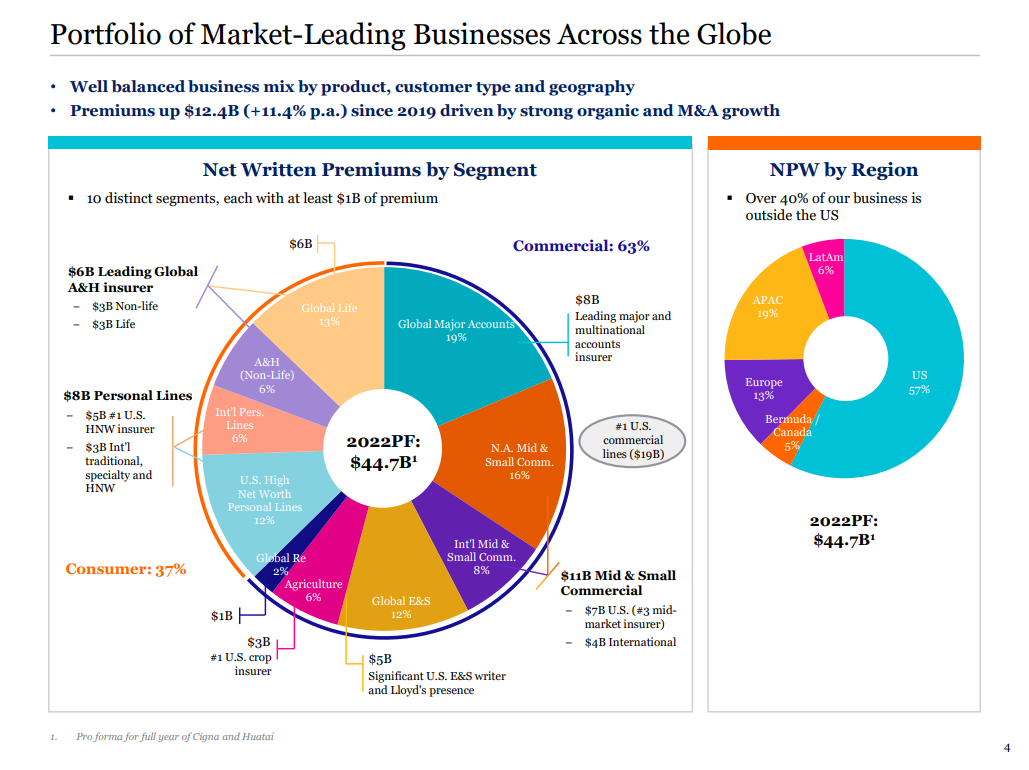

Chubb has a large and diversified product portfolio.

Source: Investor Presentation

Chubb’s diversified product line has served the company well lately, as it has been able to remain highly profitable and even produce some growth. Revenue totaled $11.5 billion during the third quarter of fiscal 2022, up 15% year-over-year. Net written premiums rose by 11.2% year-over-year in constant currency in Chubb’s core P&C segment, totaling $10.7 billion.

Net investment income of $979 million increased from $866 million in the year-ago quarter. Book value was down by 7% during the third quarter to $114.80, mainly due to the mark-to-market impact from rising interest rates in Chubb’s fixed income portfolio.

For 2022, Chubb is expected to report a core operating income of about $15.40 per share. Assuming the company can increase its investment income further as a result of its float generating higher returns amid rising interest rates, Chubb has a positive growth outlook for 2023 as well.

Growth Prospects

Chubb has created significant value for shareholders in terms of growing its book value per share, a key metric for insurance companies. Since 2009 the company’s book value has grown at a compound average growth rate of ~7% per year.

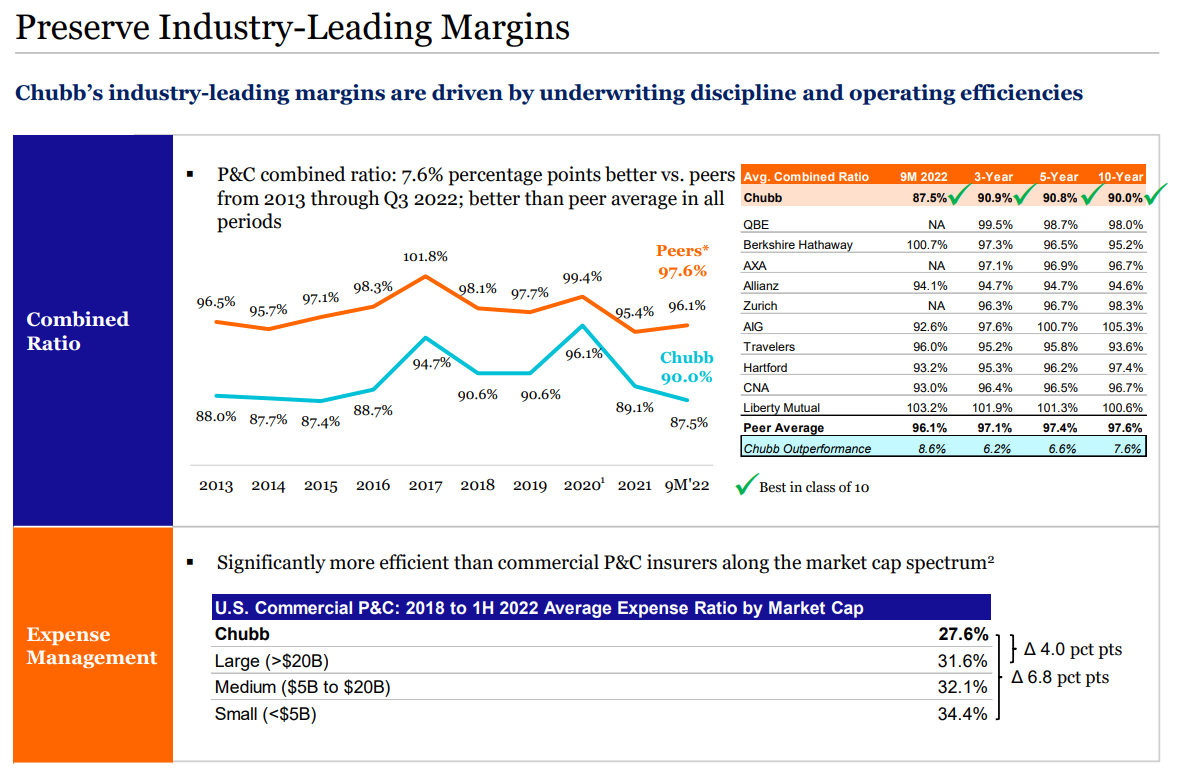

Chubb compares favorably in terms of profitability versus many of its peers. Its combined ratio for the 2022 third quarter was 87.5%. Chubb has outperformed its peers on this metric over the past 1, 3, 5, and 10 years by 6%, 7%, and 8%, respectively.

Source: Investor Presentation

Note: The combined ratio is calculated as the sum of incurred losses and expenses divided by earned premiums. A combined ratio under 100% shows the insurance company is operating profitably before investment income. A combined ratio in excess of 100% shows unprofitable underwriting.

As an insurance company, Chubb has a large pool of accumulated premium income that has not been paid out in claims to customers. This is known as float. Insurers invest premiums as soon as they are collected to earn interest or other income.

Chubb had a fixed-income investment portfolio of $96.8 billion at the end of Q3 2022, invested primarily in investment-grade fixed-income securities. Higher interest rates can be a positive catalyst for Chubb’s investment income. In fact, management calculates that at the current state of Chubb’s investment portfolio, every 100-basis point increase in portfolio investment yield generates approximately $1.1 billion more in pre-tax net investment income per year.

The company also buys back shares which will help grow earnings. For example, CB returned $3.7 billion to shareholders with its repurchased program over the past twelve months. Overall, we estimate Chubb could grow book value by 5% annually over the next five years.

Competitive Advantages & Recession Performance

Chubb’s competitive advantages are its leading industry position as well as its financial strength. First, Chubb is the world’s largest publicly traded property and casualty insurance company and the largest commercial insurer in the United States. It has a dominant position across its product categories, which helps it to retain customers.

It is also in a strong financial position. Chubb is rated A by Standard & Poor’s and Aa3 by Moody’s, the major U.S. credit rating agencies. Its healthy balance sheet and high credit rating provide the company with financial strength that helps retain clients and invest for growth.

The insurance industry can be cyclical. As the economic strengths, people tend to have more discretionary capital that can be used to add to their insurance policies. If the economy weakens, customers may pull back on their spending. This occurred during the Great Recession for Chubb.

- 2007 earnings-per-share of $8.07

- 2008 earnings-per-share of $7.72 (-4.3% decrease)

- 2009 earnings-per-share of $8.17 (5.8% increase)

- 2010 earnings-per-share of $7.79 (-4.7% decrease)

- 2011 earnings-per-share of $6.96 (-10.7% decrease)

Although Chubb didn’t see quite as severe profit declines as many other financial firms, earnings-per-share did experience some variability. However, Chubb remained highly profitable during the Great Recession, which allowed it to continue raising its dividend even through the steep economic downturn. Chubb also remained highly profitable in 2021, even during the coronavirus pandemic.

While earnings-per-share may fluctuate from year to year, the company’s book value has increased more consistently.

Valuation & Expected Returns

Using Chubb’s most recent share price of ~$224, along with expected earnings-per-share of $15.40 and $116 per share in book value for 2022, the security is currently trading at a price-to-earnings ratio of 14.5 and a price-to-book ratio of 1.9.

We believe that valuing Chubb solely through the lens of earnings-per-share does not paint the full picture of the company’s worth. In addition to earnings-per-share, investors should also consider book value per share when thinking about the valuation of insurance companies.

Our fair value estimate is a P/B ratio of 1.15 for Chubb stock. If shares were to revert to this average value by 2027, investors would see total returns reduced by about 10% per year.

Taking the company’s expected growth rate of 5%, dividend yield of 1.5%, and potential book value multiple reversion (-10%) collectively leads to total expected returns of -3.4% per year over the next five years.

Thus, valuation headwinds could outweigh any returns to be generated from the company’s growth and dividend.

Final Thoughts

While Chubb is a well-managed and diversified insurance stock with a long history of growing book value, we believe there is a chance the company may generate negative returns in the coming years.

This is due to the high P/B valuation of the stock when compared to its 10-year average. The stability in a cyclical industry is noteworthy, as is the exceptional dividend growth record, but the current valuation makes us lean toward a bearish view. We have therefore assigned a sell rating to the stock.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].