Updated on January 23rd, 2023 by Samuel Smith

When it comes to dividend growth stocks, not many stocks can surpass the Dividend Aristocrats. The Dividend Aristocrats are a group of 65 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases. These companies have managed to increase their dividends every year without exception, even during recessions.

The Dividend Aristocrats have a proven ability to raise their dividends even during economic downturns. We have created a full list of all 65 Dividend Aristocrats, along with important metrics such as price-to-earnings ratios and dividend yields.

You can download an Excel spreadsheet with the full list of Dividend Aristocrats by clicking on the link below:

In this article we are going to look more deeply at one of the best-performing Dividend Aristocrats over the past year: Cardinal Health (CAH). With 35 consecutive years of dividend increases, the company has clearly proven to be a reliable dividend growth stock, which speaks to the resilience of Cardinal Health’s business model. Over the past year alone, its stock price is up by nearly 50%.

The company is highly profitable and currently offers a 2.6% dividend yield with more annual dividend increases expected for the foreseeable future.

Business Overview

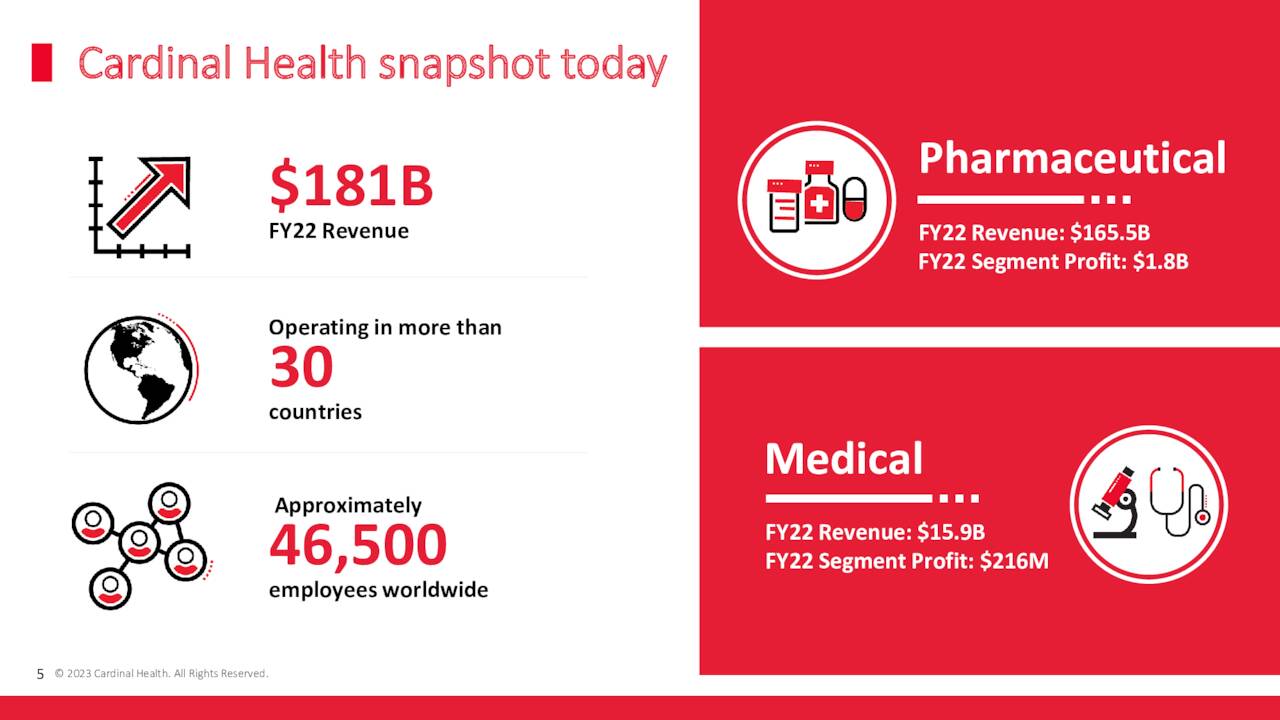

Cardinal Health, founded in 1971, is one of the “Big 3” drug distribution companies along with McKesson (MKC) and AmerisourceBergen (ABC). Cardinal Health serves over 24,000 United States pharmacies and more than 80% of the country’s hospitals.

The company has two operating segments: Pharmaceutical and Medical. The Pharmaceutical segment is by far the company’s largest, as it represents nearly 90% of total revenue. The pharmaceutical segment distributes branded and generic drugs and consumer products. It distributes these products to hospitals and other healthcare providers.

Source: Investor Presentation

Meanwhile, the medical segment distributes medical, surgical, and laboratory products to hospitals, surgery centers, clinical laboratories, and other service centers.

Growth Prospects

Since 2010 Cardinal Health has grown both earnings and dividends by a mid-single-digit rate. However, this growth has stalled meaningfully in the last few years.

On November 4th, 2022, Cardinal Health released Q1 fiscal year 2023 results for the period ending September 30th, 2022. (Cardinal Health’s fiscal year ends June 30th.) For the quarter, the company’s revenue grew 13% to $49.6 billion, which was $1.44 billion higher than expected. On an adjusted basis, the company posted earnings of $328 million, or $1.20 per share, compared to $372 million, or $1.29 per share, in the year ago period. Adjusted earnings-per-share was $0.23 above estimates.

For the quarter, Pharmaceutical sales of $45.8 billion was a 15% increase year-over-year, while segment profit of $431 million was up 6%. Branded pharmaceutical sales were up for the quarter due to higher demand from new customers. Revenue for the Medical segment decreased 9% to $3.8 billion while segment profit was negative $8 million. A divesture was the main headwind to top-line decline as pricing and volume were higher for the period. Inflationary pressures and supply chain constraints were a drag on profits as well. The Pharmaceutical segment makes up the lion’s share of revenues, but the Medical segment remains important due to its higher margins and growth potential.

Cardinal Health reaffirmed its outlook for fiscal year 2023 as well, with the company expecting adjusted earnings per share of $5.05 to $5.40. At the midpoint, this would be a 3.6% improvement from the prior year. Furthermore, there are multiple catalysts for the company to return to earnings growth going forward. A few of its specific growth catalysts include acquisitions, moderating price deflation, growth in specialty products, and cost cuts. Taking these items collectively, we are forecasting 3% annual EPS growth over the next five years.

Source: Investor Presentation

Competitive Advantages & Recession Performance

The biggest competitive advantage for Cardinal Health is its distribution capability, which makes it very difficult for competitors to successfully enter the market.

Cardinal Health distributes its products to roughly 90% of U.S. hospitals. It serves more than 29,000 U.S. pharmacies, as well as over 10,000 specialty physician offices and clinics. It also manufactures and distributes more than 50,000 types of Cardinal Health medical products and procedure kits. The company’s home healthcare business serves over 3.4 million patients, with more than 46,000 products.

In addition, Cardinal Health operates in a stable industry with high demand. The company should remain steadily profitable, as there will always be a need for pharmaceutical products to be distributed.

Here’s a look at Cardinal Health’s earnings-per-share during the Great Recession:

- 2007 earnings-per-share of $3.41

- 2008 earnings-per-share of $3.80 (11.4% increase)

- 2009 earnings-per-share of $2.26 (40.5% decline)

- 2010 earnings-per-share of $2.22 (1.8% decline)

While part of this is recession-related, keep in mind that Cardinal Health’s financial results were materially impacted by its spinoff of CareFusion Corporation, which was completed in 2009. Despite this spinoff, the company’s segment revenues, segment earnings, and dividends continued to grow during this time.

Moreover, earnings returned to growth in 2011 and had a strong run through 2017. Since people will always need their medications and healthcare products, regardless of the economic climate, Cardinal Health could be considered more recession-resistant than the average company.

Valuation & Expected Returns

Based on anticipated adjusted earnings-per-share of $5.23 for fiscal 2023, and a share price near $75, Cardinal Health is currently trading at a P/E ratio of 14.3.

Cardinal Health has traded hands with an average P/E ratio of about 14-15 times earnings dating back to 2010. However, this was during a time when growth was much more robust. We have used a multiple of 10x earnings as a starting place for a fair value in recognition of the lower anticipated growth rate and risks in the industry. Given the current valuation, this implies a 6.9% annualized headwind to shareholder returns over the next five years.

That said, if the company can return to strong earnings per share growth, it could justify a higher valuation. For example, Cardinal Health stock could see its valuation improve due to reduced litigation risk. Still, we prefer to be cautious when it comes to the fair value estimate.

In addition to changes in the valuation multiple, future returns will be generated from earnings growth and dividends. We expect Cardinal Health to grow earnings-per-share by 3% per year, primarily from revenue growth and share repurchases.

Finally, the stock has a current dividend yield of 2.6%. While the pace of dividend growth has slowed, the starting yield is reasonable for a company with such a strong track record. As a Dividend Aristocrat, Cardinal Health is likely to continue raising its dividend each year. Moreover, the dividend appears secure, with a projected dividend payout ratio of approximately 38% for fiscal 2023.

Putting all the pieces together – average growth and dividend yield offset by a meaningful valuation headwind – our expected total return for Cardinal Health is -1.3% per year over the next five years. This qualifies Cardinal Health stock as a Sell right now.

Final Thoughts

The economics of the healthcare distribution industry has deteriorated in recent years. This has impacted all the major players, including Cardinal Health.

Fortunately, Cardinal Health continues to grow revenue. And, the company has put in place a number of initiatives that should return it to positive earnings-per-share growth going forward.

High-quality companies like Cardinal Health have withstood difficult periods before and will do so again. The history of the company, its dividend history, and its current yield of 2.6% makes the stock an interesting choice for income investors. Total expected returns remain very low, however, making the stock a sell at the moment.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].