Updated on January 27th, 2023 by Nikolaos Sismanis

In the realm of dividend investing, the Dividend Aristocrats are the crème de la crème.

The Dividend Aristocrats are a group of stocks in the S&P 500 Index with 25+ consecutive years of dividend increases.

Achieving Dividend Aristocrat status is a rare feat, with only 68 companies currently holding this distinction.

The Dividend Aristocrats list is highly selective. With that in mind, we’ve put together a downloadable list of all 68 Dividend Aristocrats, containing crucial metrics like dividend yields and price-to-earnings ratios.

You can download a free copy of the Dividend Aristocrats list by clicking on the link below:

While there are countless options for dividend stocks, the Dividend Aristocrats are in a league of their own. These companies have a track record of being financially stable and generating consistent cash flow, with the ability to grow their profits over time. This makes them resilient during economic downturns and able to consistently raise their dividends each year.

C.H. Robinson Worldwide, Inc. (CHRW) is a recent addition to the Index. The company recently announced its 25th consecutive annual dividend increase and currently offers a yield of 2.5%.

Despite the transportation industry being rather cyclical, C.H. Robinson Worldwide’s mission-critical logistics solutions have allowed it to generate resilient results over the years and thus afford consistent dividend increases. Therefore, C.H. Robinson could be a fitting stock for income-oriented investors.

Business Overview

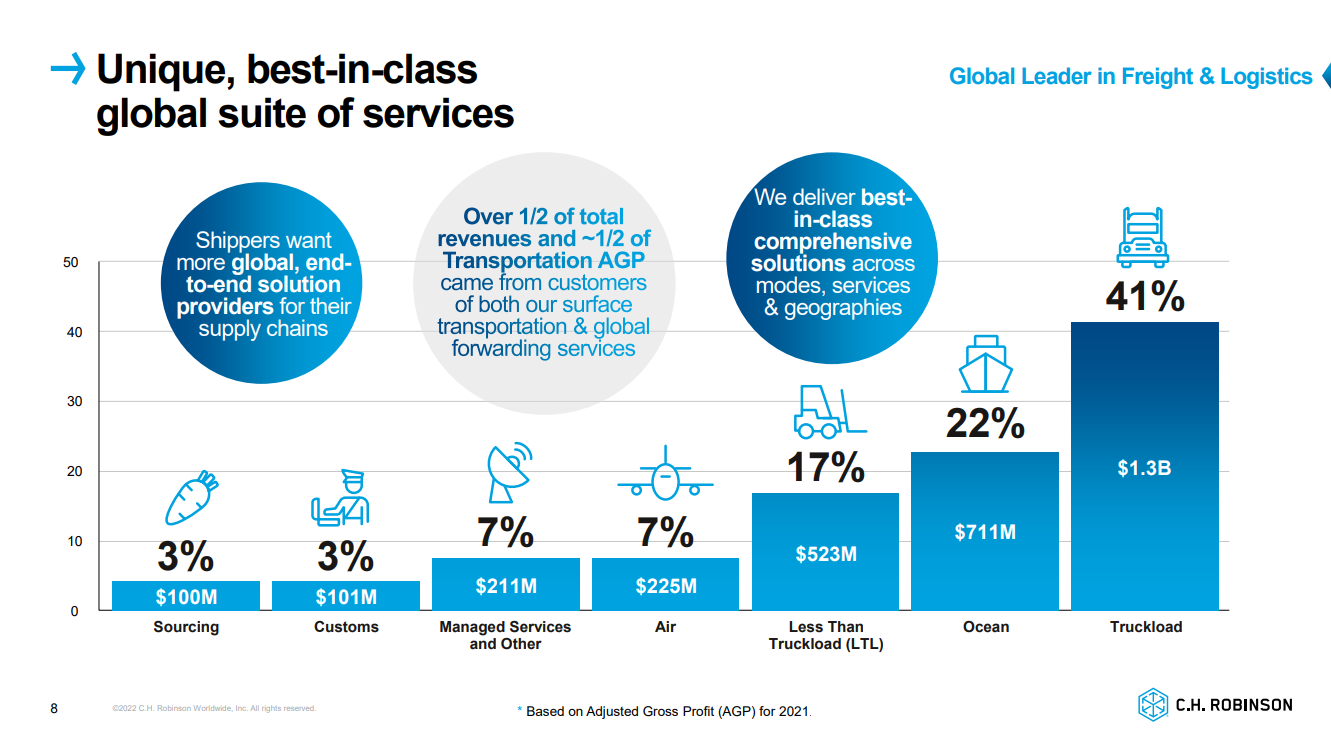

C.H. Robinson Worldwide is a transportation and logistics giant that has been around since the early 1900s. Founded by Charles Henry Robinson, the company has grown to become a Fortune 500 provider of multimodal transportation services and third-party logistics. From freight transportation and transportation management to brokerage and warehousing, CHRW offers a wide range of services to help its clients move their goods. Whether it’s by truckload, air freight, intermodal, or ocean transportation, the company has the expertise to get the job done.

Headquartered in Eden Prairie, MN, the company currently has a market capitalization of approximately $11.5 billion, employs over 18,000 people, and generated revenue of around $22 billion last year.

Source: Investor Presentation

C.H. Robinson has enjoyed strong tailwinds in the recent past as the demand for reliable transportation services continues to grow year after year. The pandemic, in particular, was proven a great growth driver for the company, as rising demand for shipments against supply chain bottlenecks provided significant room for growth.

In fact, in fiscal 2021, C.H. Robinson’s revenues jumped by 42.5% to $21.1 billion. This surge in revenues was not a fluke, as the company is on track to report even higher numbers for fiscal 2022. In fact, estimated revenues of around $25.3 billion for the year suggest an additional 9.6% increase from the previous year’s record-breaking figures.

Growth Prospects

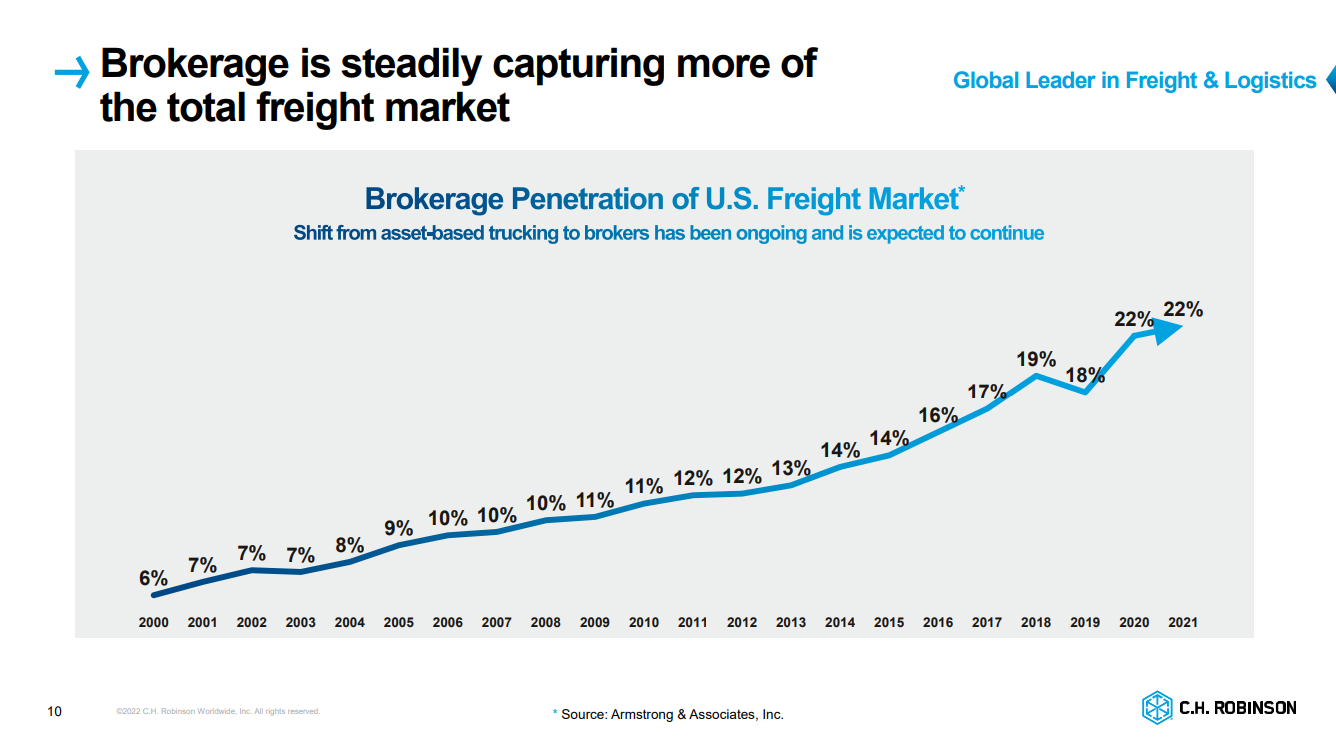

C.H. Robinson adds great value to its customers through its efficient Freight & Logistics brokerage services, which are gradually capturing a larger chunk of the underlying U.S. freight market. In fact, as the industry has been shifting from asset-based trucking to brokers such as C.H. Robinson, brokerage penetration over the past two decades has nearly quadrupled.

Another growth driver for the company includes its digital transformation, which should help scale its operations further. This includes C.H. Robinson providing meaningful products, features, and insights to both sides of the two-sided freight marketplace, which translates to unique information advantages for its customers.

Finally, C.H. Robinson should continue to leverage its scale to capitalize on the growing freight market, expanding its unique global footprint.

Source: Investor Presentation

On November 2nd, 2022, C.H. Robinson Worldwide reported results for the third quarter and first nine months of Fiscal Year (FY) 2022. For the quarter, revenue decreased by 4.0% to $6.0 billion from $6.26 billion in 3Q21.

The decrease in revenue was driven primarily by the lower ocean and air pricing, which was partially offset by higher pricing in less-than-truckload (“LTL”) and truckload. For the quarter, the Truckload segment saw an increase of 19.6%. Ocean transportation saw a decrease of 25.5% year over year, air also saw a decrease of 21.0% year over year, and LTL saw a rise of 22.4% year over year.

For the nine months of the fiscal year, total revenue is up 29.0% compared to the first nine months of 2021, which is driven primarily by higher pricing across most of the company services. Operating expenses increased 14.7% to $1.7 billion year-over-year. Income from operations totaled $1.1 billion, up 38.8% from last year, due to the increase in adjusted gross profits.

Adjusted operating margin saw an increase of 440 basis points or a 39.0% increase compared to the first nine months of FY2021. Overall, Net income totaled $844.3 million, up 37.5% from a year ago. Diluted EPS of $6.50 increased by 42.5%.

For fiscal 2022, we expect earnings-per-share of about $7.95, implying a year-over-year increase of about 26%.

Competitive Advantages & Recession Performance

The integrated Freight & Logistics can be cyclical, resulting in fluctuating results for companies in the space as the demand for transportation can vary based on underlying economic conditions. That said, being the preferred partner in the industry, C.H. Robinson has managed to generate resilient results over the decades.

When it comes to competition, C.H. Robinson is in a league of its own. The company has built a network that is second to none thanks to its efficiency and effectiveness. But what really sets it apart is the massive barrier to entry that new or small competitors would face. Building a network that can rival C.H. Robinson’s would take a huge amount of capital, and that’s something that not many companies have. In other words, C.H. Robinson has a wide economic moat that makes it hard for others to compete with them. This is why they are considered one of the best in the industry.

C.H. Robinson’s ability to continue growing its earnings even under adverse economic conditions was greatly illustrated during the Great Financial Crisis:

- 2007 earnings-per-share of $1.90

- 2008 earnings-per-share of $2.12 (11.8% decline)

- 2009 earnings-per-share of $2.15 (2.4% decline)

- 2010 earnings-per-share of $2.35 (9.4% increase)

As a matter of fact, it has an unbroken streak of profitability dating back to 1996 and has never once posted a loss in any quarter since. This is a remarkable achievement and a testament to the robustness of its business model.

Valuation & Expected Returns

We expect that C.H. Robinson will earn $7.95 per share in the fiscal year 2022. The stock has a price-to-earnings ratio of 12.3. This is below our fair value P/E estimate of 15.0. An expansion in the valuation multiple could modestly boost annualized total returns moving forward.

This valuation tailwind is likely to be accompanied by earnings-per-share growth and dividends. C.H. Robinson has a decent yield of 2.5%, and the dividend payout appears to be well-covered by earnings. A breakdown of potential returns is as follows:

- 4.0% earnings-per-share growth

- 2.5% dividend yield

- 4.1% valuation tailwind

In total, we believe C.H. Robinson could produce annualized total returns of about 10% over the next five years.

Final Thoughts

C.H. Robinson has managed to deliver an excellent track record of growth, consistent profitability, and rising dividends.

The stock’s yield of 2.5% is not substantial, but considering that there is ample room for the company to continue rewarding its shareholders with growing capital returns, dividend growth investors are likely to find C.H. Robinson a suitable stock for their portfolios.

Based on our view that the stock could undergo a valuation expansion, along with our conviction that earnings and dividends should keep growing in the foreseeable future, we forecast that C.H. Robinson’s can generate double-digit annualized returns over the medium term. Accordingly, we have assigned C.H. Robinson a buy rating.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].