Updated on February 28th, 2024

At Sure Dividend, we are huge proponents of investing in high-quality dividend growth stocks. We believe companies with long histories of raising their dividends are most likely to reward their shareholders with superior long-term returns.

This is why we focus so intently on the Dividend Aristocrats.

Our review of each of the 68 Dividend Aristocrats, a group of companies in the S&P 500 Index with 25+ consecutive years of dividend increases, continues with medical supply company Becton Dickinson (BDX).

You can download an Excel spreadsheet with the full list of all 68 Dividend Aristocrats (plus important metrics like dividend yields and price-to-earnings ratios) by using the link below:

Disclaimer: Sure Dividend is not affiliated with S&P Global in any way. S&P Global owns and maintains The Dividend Aristocrats Index. The information in this article and downloadable spreadsheet is based on Sure Dividend’s own review, summary, and analysis of the S&P 500 Dividend Aristocrats ETF (NOBL) and other sources, and is meant to help individual investors better understand this ETF and the index upon which it is based. None of the information in this article or spreadsheet is official data from S&P Global. Consult S&P Global for official information.

Becton Dickinson has grown into a global giant. In 2017, Becton Dickinson completed its $24 billion acquisition of C.R. Bard. This was Becton Dickinson’s largest acquisition ever and brings together two huge companies in the medical supply industry.

The fundamentals of the industry remain very healthy. Aging global populations, growth of healthcare spending, and expansion in the emerging markets are attractive growth catalysts. In this article, we examine Becton Dickinson’s investment prospects.

Business Overview

Both Becton Dickinson and C.R. Bard have long operating histories. C.R. Bard was founded in 1907 by Charles Russell Bard, an American importer of French silks, after he began importing Gomenol to New York City. At the time, Gomenol was commonly used in Europe, and Mr. Bard used it to treat his discomfort from tuberculosis.

By 1923, C.R. Bard was incorporated. Later, it developed the first balloon catheter, and slowly expanded its product portfolio.

Meanwhile, Becton Dickinson has been in business for more than 120 years. Today, the company employs more than 75,000 employees in over 50 countries. The company generates approximately $20 billion in annual revenue. Approximately 43% of annual sales come from outside the U.S.

With the addition of C.R. Bard, Becton Dickinson now has three segments: Medical, Life Sciences, and Intervention, which houses products manufactured by Bard. The company sells products in several categories within these businesses. Some of its core product categories include diagnostics, infection prevention, surgical equipment, and diabetes management.

On February 1st, 2024, BD released earnings results for the first quarter of fiscal year 2024, which ended on December 31st, 2023.

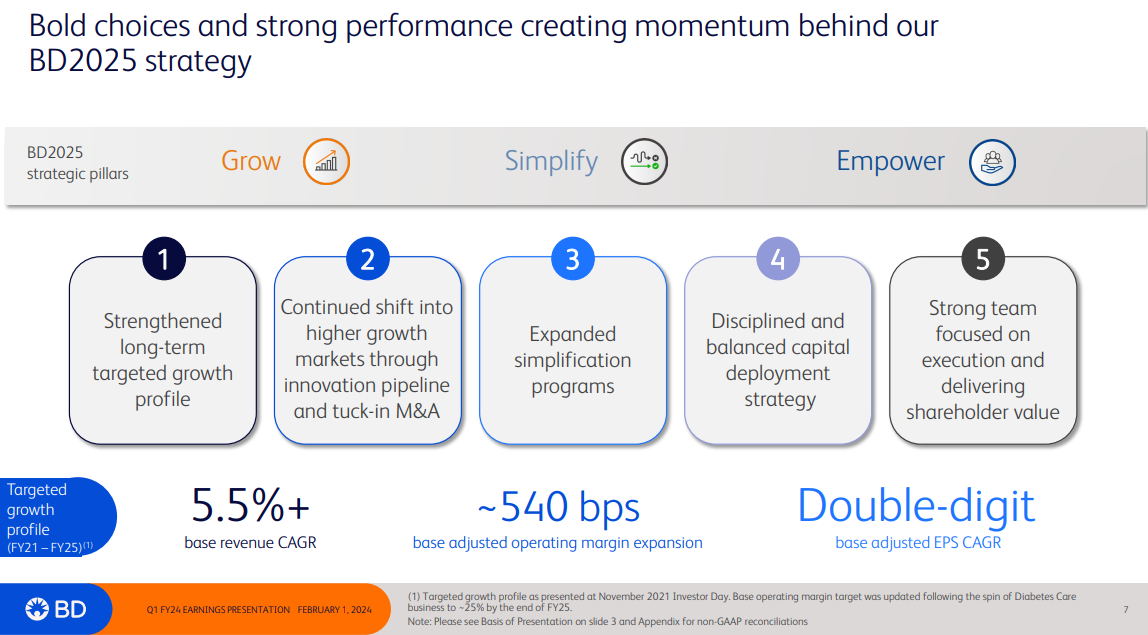

Source: Investor Presentation

For the quarter, revenue grew 2.6% to $4.7 billion, but missed estimates by $30 million. On a currency neutral basis, revenue grew 1.6%. Adjusted earnings-per-share of $2.68 compared unfavorably to $2.98 in the prior year, but was $0.28 above expectations.

Organic growth was 2.4% for the period. For the quarter, U.S. grew 0.7% while international was up 2.9% (up 5.5% on a reported basis). COVID-19 diagnostic revenue was not material during the period. The Medical segment grew 2.4% to $2.23 billion as all businesses were up year-overyear. Life Science revenue declined 2.5% to $1.29 billion as a weaker demand for respiratory products impacted demand.

BD provided an updated outlook for fiscal year 2024 as well. The company expects organic growth in a range of 5.5% to 6.25%, compared to 5.25% to 6.25% previously. Adjusted earnings-per-share is projected to be in a range of $12.82 to $13.06, compared to $12.70 to $13.00 previously.

Growth Prospects

Becton Dickinson has been able to enter several new growth categories with C.R. Bard in tow, in the U.S. and around the world. First, there are healthcare associated infections, which Becton Dickinson estimates costs patients nearly $10 billion every year.

According to Becton Dickinson, one out of every 15 patients acquires an infection during care. The combined company will be able to treat these unaddressed conditions, specifically in surgical site infections, blood stream infections, and urinary tract infections caused by catheters.

Source: Investor Presentation

Next, C.R. Bard has helped expand Becton Dickinson’s oncology and surgery products, in biopsies, meshes, biosurgery, and infection prevention devices. Lastly, the acquisition boosts Becton Dickinson’s international presence, particularly in medical technology. The company already generates nearly half of its annual sales from outside the U.S.

Over the long-term, the acquisition provides Becton Dickinson the opportunity to expand its reach in new therapeutic areas. The company is targeting investment in diabetes, peripheral vascular disease, and chronic kidney disease. Along with organic growth, the acquisition should provide synergies that will be a boost to Becton Dickinson’s earnings.

BDX has increased earnings-per-share by approximately 8% per year over the past 10 years, and has grown earnings in 9 out of the last 10 years. We feel the company can grow earnings-per-share at a rate of 8% per year through fiscal 2029.

Competitive Advantages & Recession Performance

Becton Dickinson has significant competitive advantages, including scale and a vast patent portfolio. These competitive advantages are due to high levels of investment spending.

Becton Dickinson spends over $1 billion per year on research and development. This spending has certainly paid off, with strong revenue and earnings growth over the past several years. The company has obtained leadership positions in their respective categories because of product innovation, a direct result of R&D investments.

These competitive advantages provide the company with consistent growth, even during economic downturns. Becton Dickinson steadily grew earnings during the Great Recession. Becton Dickinson’s earnings-per-share during the recession are as follows:

- 2007 earnings-per-share of $3.84

- 2008 earnings-per-share of $4.46 (16% increase)

- 2009 earnings-per-share of $4.95 (11% increase)

- 2010 earnings-per-share of $4.94 (0.2% decline)

Becton Dickinson generated double-digit earnings growth in 2008 and 2009, during the worst years of the recession. It took a small step back in 2010, but continued to grow in the years since, along with the economic recovery.

The ability to consistently grow earnings each year of the Great Recession, which was arguably the worst economic downturn in decades, is extremely impressive.

The reason for its strong financial performance, is that health care patients need medical supplies. Patients cannot choose to forego necessary healthcare supplies. This keeps demand steady from year to year, regardless of the condition of the economy.

Becton Dickinson has a unique ability to withstand recessions, which explains its 52-year history of consecutive dividend increases. Becton Dickinson’s dividend is also very safe based on its fundamentals.

Valuation & Expected Returns

Using estimated earnings-per-share of $12.94 for the fiscal year 2024, the stock has a price-to-earnings ratio of 18.5. Our fair value estimate for BDX stock is a P/E ratio of 19, meaning shares appear just slightly undervalued. Multiple expansion to the fair value P/E could increase annual returns by 0.5% per year over the next five years.

But valuation isn’t the only factor in estimating total returns. BDX stock will generate returns from earnings growth and dividends as well.

In total, we project annual returns of 10% through fiscal year 2029, stemming from 8% earnings growth, the current dividend yield of 1.5%, and the 0.5% annual boost from P/E expansion. The expected return of 10% annually makes the stock a buy in our view.

As far as dividends, Becton Dickinson remains a quality dividend growth stock. It has a very secure payout, with room for growth. Based on fiscal 2024 earnings guidance, Becton Dickinson will likely have a dividend payout of approximately 30%.

This is a very low payout ratio. It leaves plenty of room for sustained dividend growth moving forward, particularly since earnings will continue to grow.

Final Thoughts

Becton Dickinson’s business continues to perform very well. Given the positive growth outlook for the healthcare industry, we feel that Becton Dickinson has room for strong earnings growth.

In addition, Becton Dickinson has a high likelihood of annual dividend increases for many years. With expected total returns of 10% per year and a safe and growing dividend, Becton Dickinson is an attractive stock for dividend growth investors.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].