Updated on February 1st, 2023 by Quinn Mohammed

Automatic Data Processing (ADP) might not be a household name, but it should be for dividend growth investors. ADP has raised its dividend each year for nearly 50 years in a row.

Its most recent increase came in November 2022. Last year’s 20% dividend increase was incredible, indicating that the company is growing quickly.

ADP is a member of the Dividend Aristocrats, a group of 68 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases. ADP has one of the longest streaks of dividend increases among the Dividend Aristocrats.

We have created a full list of all 68 Dividend Aristocrats, along with important metrics like P/E ratios and dividend yields, which you can download by clicking on the link below:

ADP’s long history of dividend growth is the result of a strong business model and huge competitive advantages.

This article will review ADP’s fundamentals and discuss whether the stock is trading at an attractive enough valuation to buy now.

Business Overview

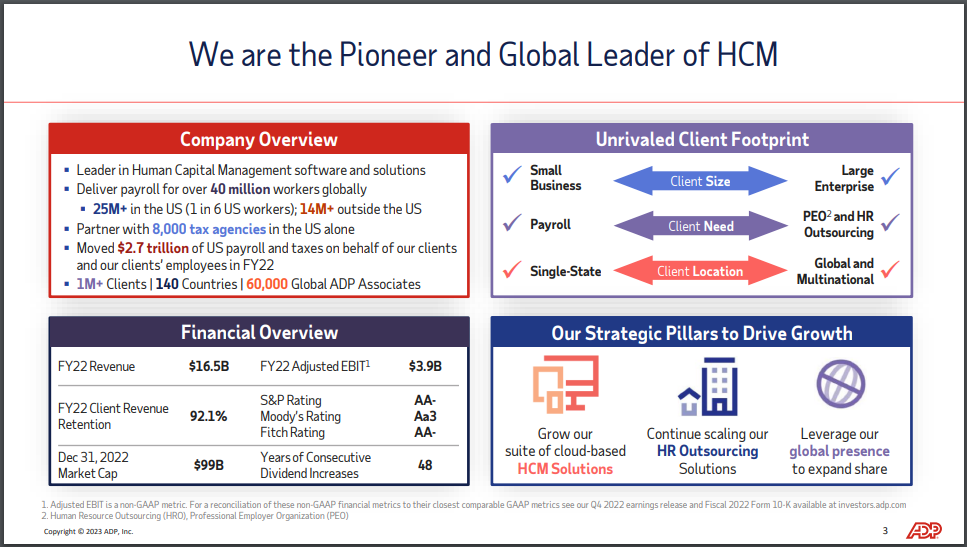

ADP is a business outsourcing services company. It was founded in 1949 and began with a single client. In the 74 years since ADP has grown into the leading payroll and human resource outsourcing company. It has over 1 million clients in more than 140 countries worldwide.

ADP provides services to companies of all sizes, including payroll, benefits administration, and human resources management. ADP enjoys high demand for these services, as companies would prefer to outsource these functions in order to better focus on their core business activities.

Source: Investor Presentation

ADP has a leading position across its strategic pillars, as well as a highly diversified client list.

The company has undergone significant restructuring in recent years. In 2014, ADP spun off its human capital management business, which now trades as CDK Global (CDK).

ADP reported fiscal second-quarter results on January 25th, 2023. Revenue rose just over 9% year-over-year to $4.39 billion, which met expectations. Adjusted earnings-per-share came to $1.96, which was two cents ahead of estimates.

Employer Services revenue increased 10% on an organic constant currency basis, while PEO Services revenue rose 11%,

Growth Prospects

Along with quarterly results, ADP maintained its guidance of 8% to 9% revenue growth and ~16% adjusted diluted earnings-per-share growth for the full year.

It also expects adjusted EBIT margin expansion of 125 to 150 basis points, leading to expected adjusted EPS growth of 15% to 17% for fiscal 2023.

ADP credits its large and growing HCM market as a major growth catalyst in the next several years.

Source: Investor Presentation

Two key long-term growth catalysts for ADP are continued payroll increases and expanding regulations.

While there have been a number of layoffs in the beginning of 2023, we anticipate that businesses will be hiring more people in the long run. The number of employees on ADP clients’ payrolls continues to grow, and we believe this will continue for the foreseeable future.

Next, the increasingly complex regulatory environment creates significant compliance costs for businesses; this also helps provide ADP with steady growth.

We believe ADP is likely to succeed in executing on its long-term growth objectives, thanks in large part to its competitive advantages.

Competitive Advantages & Recession Performance

Many competitive advantages fuel ADP’s growth. ADP has a deep connection with its customers and enjoys a strong reputation for customer service, which helps keep customer retention very high.

ADP enjoys a tremendous scale that its competitors cannot match. As a global company, ADP is uniquely positioned to help companies with employees on multiple continents.

In addition, ADP benefits from a recession-resistant business model. ADP’s earnings-per-share during the Great Recession are shown below:

- 2007 earnings-per-share of $1.83

- 2008 earnings-per-share of $2.20 (20% increase)

- 2009 earnings-per-share of $2.39 (8.6% increase)

- 2010 earnings-per-share of $2.39 (flat)

ADP increased earnings-per-share in 2008 and 2009, which is a rare accomplishment. The reason for ADP’s continued growth during the Great Recession is that businesses still need payroll and human resource services, even in an economic downturn.

The company continued to perform relatively well in the 2020 economic downturn caused by the coronavirus pandemic. ADP remained highly profitable during the pandemic, which allowed it to maintain its streak of annual dividend increases.

The necessary nature of ADP’s services helps insulate the company from the effects of a recession. Given ADP’s size and scale, we believe it will perform well during the next recession, increasing the stock’s attractiveness.

Rarely do investors find a combination of strong growth prospects, recession resilience, and a world-class dividend increase streak.

Valuation & Expected Returns

We forecast adjusted earnings-per-share of approximately $8.10 for fiscal 2023. Based on the current share price of ~$222, the stock has a price-to-earnings ratio of 27.5.

We see fair value for ADP at 29 times earnings, meaning the stock appears to be undervalued. This implies a small tailwind to total returns in the coming years from valuation expansion.

As a result, investors can rely on an expanding price-to-earnings ratio, earnings growth, and dividends to fuel total returns.

We expect ADP to grow earnings-per-share by 8% annually over the next five years. In addition, the stock has a current dividend yield of 2.2%.

The combination of earnings growth, dividends, and valuation expansion results in a total expected return of 11.1% per year through fiscal 2028.

ADP will almost certainly continue to increase its dividend for many years to come, given that its fundamentals are so strong. ADP maintains a target payout ratio of 55%-60% of annual earnings, so the payout is very safe with room to grow.

The current annual dividend payout is $5.00 per share after the November 2022 increase. Based on the forecast for earnings-per-share management provided, the payout ratio for this year should be ~62%.

With robust forecast earnings-per-share growth, ADP should have ample room to continue raising the payout for many years.

Final Thoughts

ADP is a strong business. The company maintains a large list of customers and holds a top position in the industry. This gives it a wide economic “moat”, a term popularized by investing legend Warren Buffett.

Indeed, ADP’s wide moat keeps competitors at bay, leading to high profitability levels.

There should be plenty of growth going forward, both in terms of earnings and dividends. Regulations continue to become more complex.

And, as the economy expands, companies are adding employees and increasingly use ADP’s services. If a recession occurs, ADP should continue to increase its dividend, as customers will still need its services.

With an expected rate of return above 11%, we rate ADP stock a buy.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].