Updated on February 4th, 2023 by Nikolaos Sismanis

The Dividend Aristocrats are a group of stocks in the S&P 500 Index with 25+ years of consecutive dividend increases. These companies have high-quality business models that have stood the test of time and shown a remarkable ability to raise dividends every year regardless of the economy.

We have compiled a list of all 68 Dividend Aristocrats, along with relevant financial metrics like dividend yield and P/E ratios. You can download the full Dividend Aristocrats list by clicking on the link below:

The list of Dividend Aristocrats is diversified across multiple sectors, including consumer goods, financials, industrials, and healthcare. One group that is surprisingly under-represented is the utility sector.

There are only three utility stocks on the list of Dividend Aristocrats: Consolidated Edison (ED), NextEra Energy (NEE), and Atmos Energy (ATO).

The fact that there are only three utilities on the list may come as a surprise, especially since utilities are widely regarded as being steady dividend stocks. This article will discuss Atmos Energy’s path to becoming a Dividend Aristocrat.

Business Overview

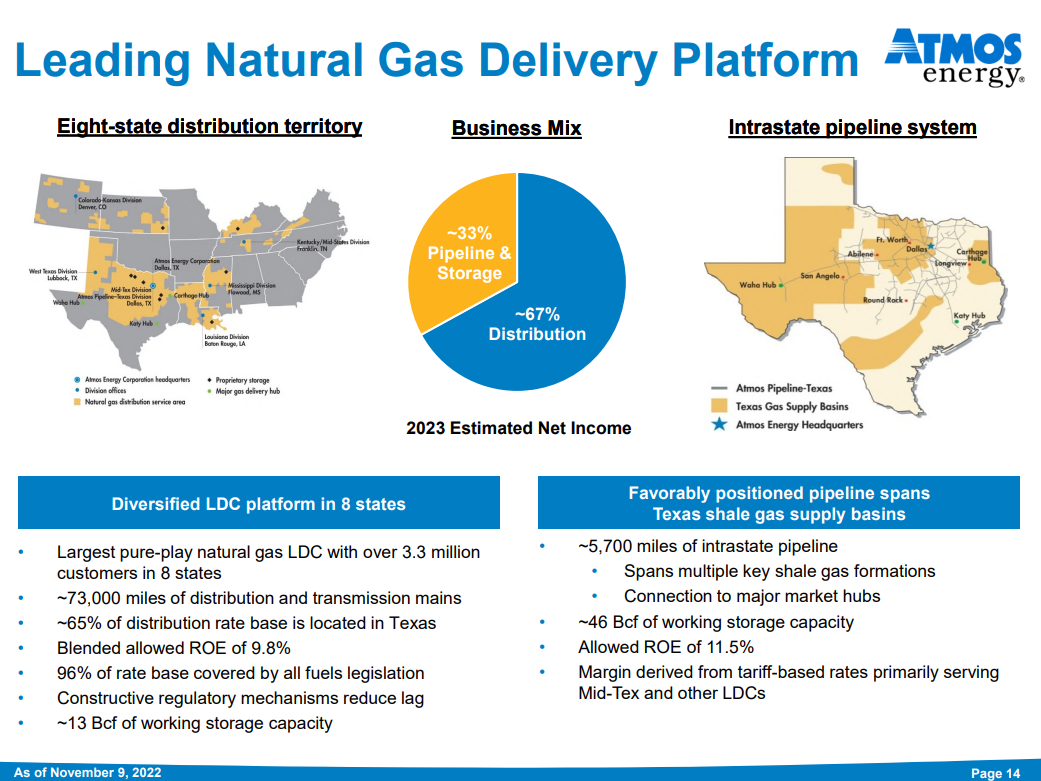

Atmos Energy can trace its beginnings all the way back to 1906, when it was formed in Texas. Since that time, it has grown both organically and through mergers. Today, Atmos Energy distributes and stores natural gas in eight states, serving over 3 million customers. In addition, Atmos owns about 5,700 miles of natural gas transmission lines. The utility should generate about $4.6 billion in revenue this year.

Atmos Energy is a large-cap stock with a market capitalization above $16.5 billion.

The company serves over 3 million natural gas customers spread across eight different states.

Source: Investor Presentation

Atmos reported fourth-quarter and full-year earnings on November 9th, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to 51 cents, seven cents better than estimates. Revenue soared 27% year-over-year to $723 million, which was $63 million better than expected.

For the full year, consolidated operating income was up $16 million to $921 million. Refunds of excess deferred income taxes reduced operating income by $112 million, which was substantially offset by a decrease in income tax expense. Excluding these items, operating income was up $128 million due to rate outcomes in both of its segments, as well as customer growth in distribution. These were partially offset by mild weather and lower consumption in the distribution segment, as well as increased operations and maintenance expenses.

The company guided for earnings-per-share of $5.90 to $6.10 to start the fiscal year, indicating another year of strong growth. Accordingly, we’ve set our forecast at the midpoint,.

Growth Prospects

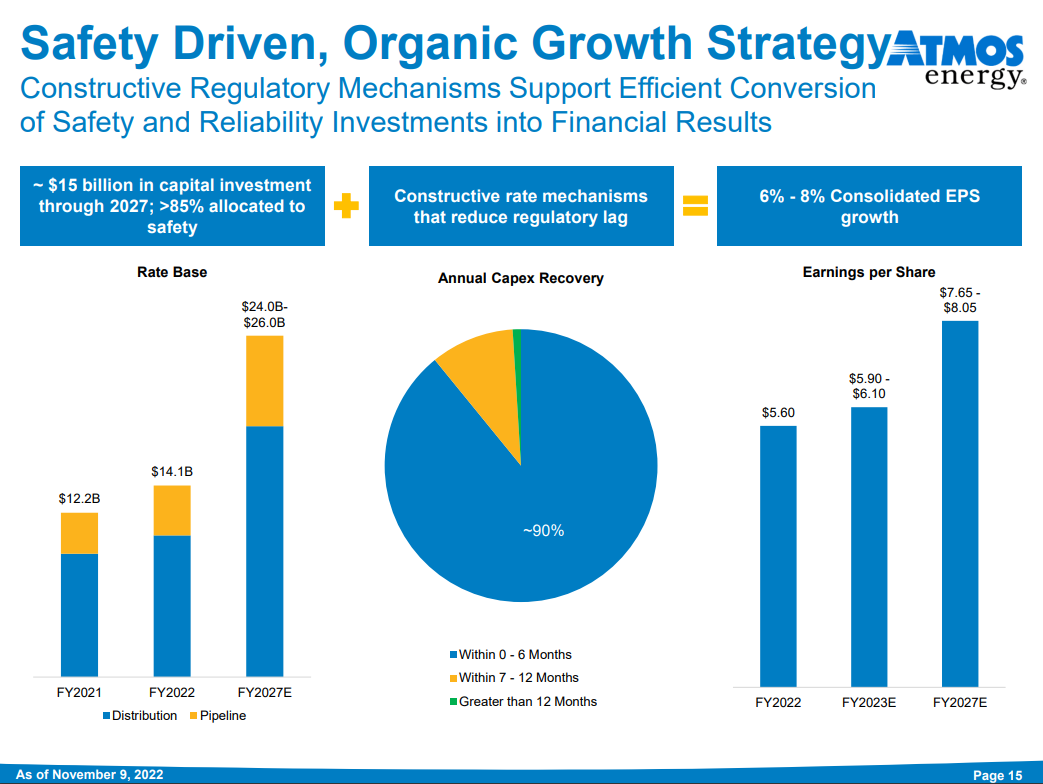

Earnings growth across the utility industry typically mimics GDP growth. However, we expect Atmos Energy to continue outperforming this trend due to its focus on capital investment in its regulated operations, a constructive regulatory environment in Texas, and population growth.

As a result, the company should benefit from strong rate base growth, which in turn will generate annual earnings per share growth in accordance with management’s 6% – 8% guidance.

The growth drivers for Atmos Energy are new customers, rate increases, and aggressive capital expenditures. One benefit of operating in a regulated industry is that utilities are permitted to raise rates on a regular basis, which virtually assures a steady level of growth.

Source: Investor Presentation

The primary risk facing the company is its ability to achieve timely and positive regulatory rate adjustments. If the company achieved lower than expected allowed returns, it could cause significant harm to profits.

However, we believe Atmos can achieve at least 6% annual EPS growth through continued improvements in gross margin, reductions in operating costs as a percentage of revenue, and top-line growth via acquisitions as well as organic customer growth.

The company continues to file favorable rate cases with its various localities that provide for small revenue increases over time as well, as we saw again in fiscal 2022 full–year results. The core distribution business performed very well in the fourth quarter, which we think is a positive indicator for 2023 results.

Competitive Advantages & Recession Performance

Atmos Energy’s main competitive advantage is the high regulatory hurdles of the utility industry. Gas service is necessary and vital to society. As a result, the industry is highly regulated, making it virtually impossible for a new competitor to enter the market. This provides a great deal of certainty to Atmos Energy and its annual earnings.

Another competitive advantage is the company’s stable business model and sound balance sheet, giving it an attractive cost of capital. This enables it to fund accretive acquisitions and growth capital expenditures, driving outsized earnings per share growth.

In addition, the utility business model is highly recession-resistant. While many companies experienced large earnings declines in 2008 and 2009, Atmos Energy’s earnings per share kept growing. Earnings-per-share during the Great Recession are shown below:

- 2007 earnings-per-share of $1.91

- 2008 earnings-per-share of $1.99 (4% growth)

- 2009 earnings-per-share of $2.07 (4% growth)

- 2010 earnings-per-share of $2.20 (6% growth)

The company still generated healthy growth even during the worst of the economic downturn. Results remained resilient and continued to grow during the pandemic as well, demonstrating the mission-critical nature of Atmos’ assets.

- 2019 earnings-per-share of $4.35

- 2020 earnings-per-share of $4.69 (7.8% growth)

- 2021 earnings-per-share of $5.12 (9.1% growth)

This resilience has allowed Atmos Energy to continue increasing its dividend each year during these unfavorable market environments.

Valuation & Expected Returns

Atmos Energy is expected to earn $6.00 this year. Based on this, the stock trades with a price-to-earnings ratio of 19.5. This is slightly above our fair value estimate of 19x tearnings, which is slightly below the 10-year average price-to-earnings ratio for the stock.

As a result, Atmos Energy shares appear to be slightly overvalued. If the stock valuation retraces to the fair value estimate over the next five years, the corresponding multiple contraction would reduce annual returns by 0.6%. This could be a small headwind for future returns.

Fortunately, the stock could still provide positive returns to shareholders, through earnings growth and dividends. We expect the company to grow earnings by 6% per year over the next five years.

In addition, the stock has a current dividend yield of 2.5%. Atmos Energy last raised its dividend by 8.8% in November 2022. This marked the 39th year of dividend growth for Atmos Energy.

Source: Investor Presentation

Putting it all together, Atmos Energy’s total expected returns could look like the following:

- 6% earnings growth

- -0.6% multiple reversion

- 2.5% dividend yield

Added up, Atmos Energy is expected to generate 7.0% annualized total returns over the next five years, making the stock attractive for investors interested in dividend growth and total returns.

The dividend yield is not substantial but remains attractive, while the dividend appears quite safe. The company has a projected 2023 payout ratio of ~49%, which indicates a sustainable dividend. As a result, we view Atmos Energy as a blue-chip stock.

Final Thoughts

Atmos Energy stock is attractive for investors looking for an above-average yield and regular dividend growth. Because of this, Atmos Energy can serve a valuable purpose in an income investor’s portfolio as the stock offers a very secure and growing dividend income stream, and its dividend yield is well above the average dividend yield of the S&P 500 Index.

Note: Atmos Energy also ranks well using The Chowder Rule.

Atmos Energy is also a Dividend Aristocrat and should raise its dividend each year. Therefore, risk-averse investors looking primarily for income right now–such as retirees–could see greater value in buying utility stocks like Atmos Energy.

Additionally, the following Sure Dividend databases contain the most reliable dividend growers in our investment universe:

If you’re looking for stocks with unique dividend characteristics, consider the following Sure Dividend databases:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].