Updated on February 6th, 2023 by Samuel Smith

The Dividend Aristocrats are a group of 68 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases. The Dividend Aristocrats each have strong business models, with competitive advantages that provide them with the ability to raise their dividends each year.

There are currently 68 Dividend Aristocrats. You can download an Excel spreadsheet of all 68 Dividend Aristocrats (with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking the link below:

In order to become a Dividend Aristocrat, a company must possess a profitable business model and durable competitive advantages, along with the ability to raise dividends even during recessions. Consumer staples stocks such as Amcor plc (AMCR) have all the necessary qualities of a Dividend Aristocrat.

Amcor has increased its dividend for over 25 years in a row. It has maintained its dividend growth streak thanks to a very strong brand portfolio.

Business Overview

Amcor plc that trades on the NYSE today was formed in June 2019 with the completion of the merger between two packaging companies, U.S.-based Bemis Co. Inc. and Australia-based Amcor Ltd. Amcor plc’s current headquarters is in Bristol, U.K. Amcor is a large-cap stock with a market capitalization above $17.6 billion.

Amcor develops and manufactures a diverse array of packaging products for many consumer uses all over the world, including food and beverage, medical and medicinal, and home and personal care. It consists of two main business segments: Flexible Packaging and Rigid Packaging.

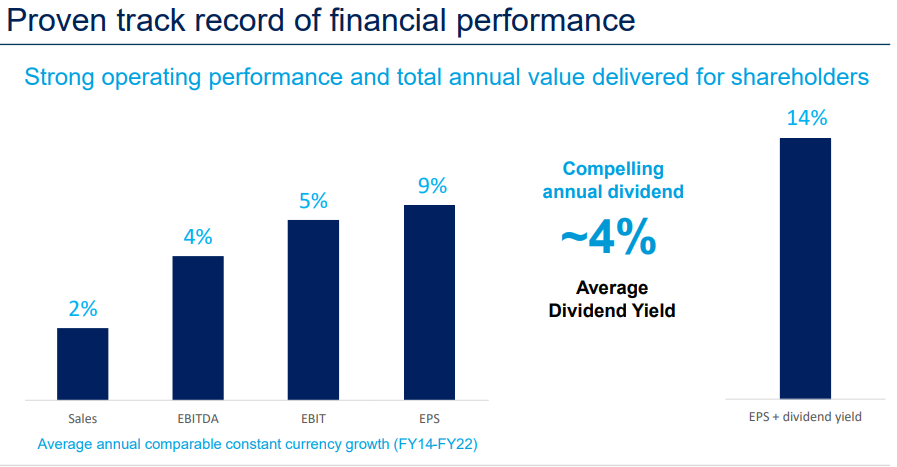

The company has generated a long history of steady growth.

Source: Investor Presentation

Amcor reported its first-quarter results for Fiscal Year (FY) 2023 on November 1st, 2022. The company’s fiscal year ends at the end of June. Sales were up 9% for the quarter compared to the first quarter of FY2022. Sales have grown from $3,712 million in 1Q2022 to $3,420 million this quarter, driven by price increases of about $400 million representing 12% growth. Net sales on a comparable constant currency basis were 3% higher than the same period last year, reflecting price/mix benefits. Volumes were 0.6% lower than last year. Net income was flat year over-year.

The company also declared a quarterly cash dividend of $0.1225 per share, which is an increase of 2.1%. The company has now increased its dividend for three straight years.

Management provided an outlook for Fiscal Year (FY) 2023, and they see EPS growth of 3%-8%. The management team updated its adjusted EPS expectations on a reported basis to $0.77 to $0.81 vs. consensus of $0.81. They also reaffirmed adjusted Free Cash Flow of $1.0 – $1.1 billion. Thus, we will use $0.79 per share as our calculation for the company valuation and expected returns.

Growth Prospects

Amcor is counting on its Bemis acquisition to drive strong growth over the next half decade. The main factors that will drive this growth acceleration are its global footprint opening up new attractive end markets and customers for the company’s products, and greater economies of scale driving efficiencies and higher margins.

Another growth catalyst for Amcor is the emerging markets such as China and Latin America, where economic growth is high and demand for packaging products is rising.

Source: Investor Presentation

The company is also in the midst of an aggressive share buyback program that should boost per share growth numbers. Furthermore, its balance sheet is quite strong with a relatively low leverage ratio, giving it flexibility to finance its dividend, share repurchases, and remain opportunistic on future growth opportunities.

We believe that all of these factors should combine to generate solid 4% annualized earnings per share growth over the next half decade.

Competitive Advantages & Recession Performance

Amcor’s competitive advantages are fueled by its industry leadership position. Although Amcor’s headquarters are in Europe, its largest markets are in the Americas. That means Amcor should be relatively safe from potential future declines to the pound (or to the Australian dollar, for that matter).

In addition, Amcor’s products are used every day around the world. People around the world will continue to need packaging. Amcor’s emphasis on recyclable and reusable products should appeal to more conscious end users, while the merger with Bemis brings it huge prospects in developing markets.

Plus, with the merger into one gigantic manufacturing entity, Amcor has increased ability to negotiate better costs from its suppliers. This should make Amcor an unstoppable force in the packaging industry.

Amcor is also fairly resistant to recessions. As Amcor as it exists today (post merger) was not a publicly-traded company during the Great Recession, its earnings-per-share performance during the downturn is not available.

It is reasonable to assume Amcor’s earnings-per-share would decline somewhat during a recession, as the company’s global business model is reliant on economic growth. But it should continue paying (and raising) its dividend each year for the foreseeable future.

Valuation & Expected Returns

We expect Amcor to generate earnings-per-share of $0.79 for 2023. Based on this, shares of Amcor are currently trading at a price to earnings ratio of 15.

Even using a conservative multiple, we think that a recession-resistant Dividend Aristocrat with mid-single-digit growth prospects such as Amcor should trade for 15 times earnings. Therefore, we view the stock as fairly valued right now.

A fair five-year expected earnings-per-share growth rate of 4.0% and the 4.1% dividend yield will help boost shareholder returns. Overall, we expect annualized total annual returns of approximately 8.1% through 2028.

Final Thoughts

Amcor is uniquely positioned for strong growth in the coming years thanks to its recent acquisition that has opened up several new attractive end markets and provides an opportunity to unlock valuable synergies. Furthermore, the company has the balance sheet to fund growth investments, and share repurchases which should boost EPS moving forward.

As a result, we think that shares offer decent value here. With expectations of ~8.1% annualized total returns over the next half decade, we view Amcor as an attractive Hold right now.

That said, it could be an opportunity for dividend growth investors with a more conservative outlook, as its 4.1% yield is above average for the S&P 500 and its strong growth track record and recession-resistant business model make it an attractive long-term holding.

Finally, with its solid growth outlook, it will likely continue growing its dividend for the foreseeable future.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].