Up to date on March twelfth, 2025 by Nathan Parsh

Annually, we evaluate the entire Dividend Aristocrats. Attaining membership to this group is tough: firms have to be of a sure dimension, belong to the S&P 500 Index, and (most significantly) have no less than 25 consecutive years of dividend progress.

There are simply 69 Dividend Aristocrats, proving the exclusivity of the listing.

You may obtain an Excel spreadsheet of all 69 Dividend Aristocrats, together with essential monetary metrics similar to P/E ratios and dividend yields, by clicking the hyperlink under:

Disclaimer: Certain Dividend is just not affiliated with S&P World in any method. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal evaluate, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s based mostly. Not one of the info on this article or spreadsheet is official knowledge from S&P World. Seek the advice of S&P World for official info.

Albemarle Company (ALB) joined this unique listing in 2020. The corporate is without doubt one of the most unstable names among the many Dividend Aristocrats, however this makes its dividend progress streak much more spectacular.

This text will evaluate Albemarle’s funding prospects.

Enterprise Overview

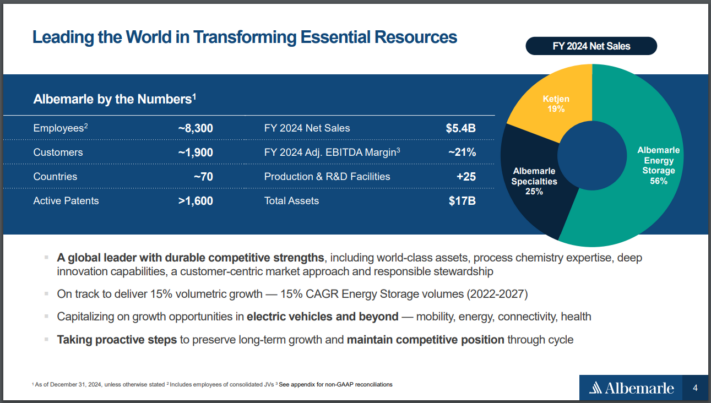

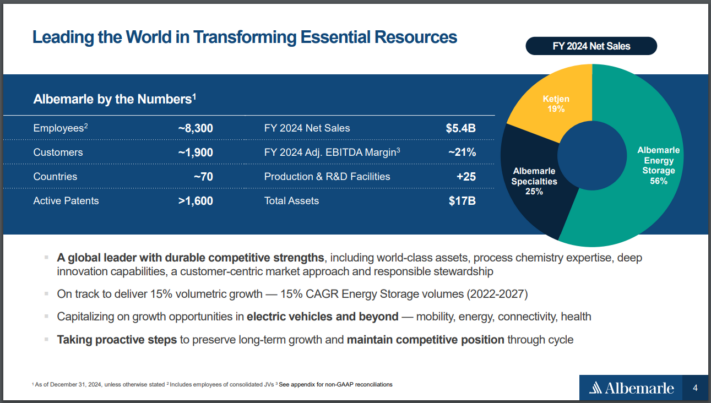

Albemarle is the most important producer of lithium and second-largest producer of bromine on the planet. The 2 merchandise account for the overwhelming majority of annual gross sales. Albemarle produces lithium from its salt brine deposits within the U.S. and Chile.

The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile property provide a really low-cost supply of lithium. The corporate operates in almost 100 international locations.

Starting January 1st, 2023, the corporate reorganized into the next segments: Power Storage, Specialties, and Ketjen.

Albemarle produces annual gross sales above $5 billion.

Supply: Investor Presentation

On February twelfth, 2025, Albemarle introduced fourth-quarter and full-year 2024 outcomes. For the quarter, income declined 48% to $1.23 billion, which was $110 million lower than anticipated. Adjusted earnings-per-share of -$1.09 in contrast very unfavorably to $1.85 within the prior 12 months, which was $0.42 under estimates.

For the 12 months, income declined 44% to $5.4 billion, whereas adjusted earnings-per-share have been—$2.34 in comparison with $22.25 in 2023. It must be famous that the corporate had almost $10 billion in gross sales in 2023, serving to as an example that huge swings within the enterprise can happen quickly.

Decrease lithium costs as soon as once more negatively impacted outcomes. For the quarter, income for Power Storage decreased 63.2% to $616.8 million. Quantity declined 10%, whereas costs have been down 53%.

Specialties revenues have been decrease by 2.0% to $332.9 million, as a 3% enchancment in quantity was offset by a worth lower. Ketjen gross sales of $245 million have been down 17.4% from the prior 12 months, as a slight worth enhance was greater than offset by weakening quantity.

Albemarle offered an outlook for 2025 as effectively, with the corporate anticipating income in a variety of $4.9 billion to $5.2 billion. The corporate is anticipated to supply earnings-per-share of -$0.80 in 2025. We imagine that Albemarle has earnings energy of $3.50.

Progress Prospects

Outcomes are anticipated to be effectively above prior numbers, and Albemarle stands to learn from the elevated gross sales of electrical automobiles, as the corporate’s lithium is used to supply the batteries.

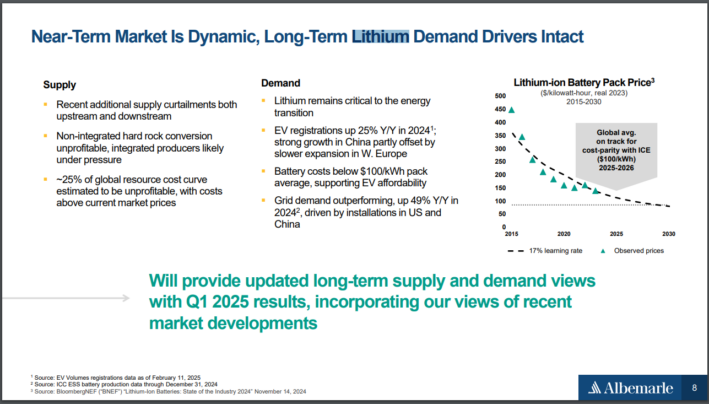

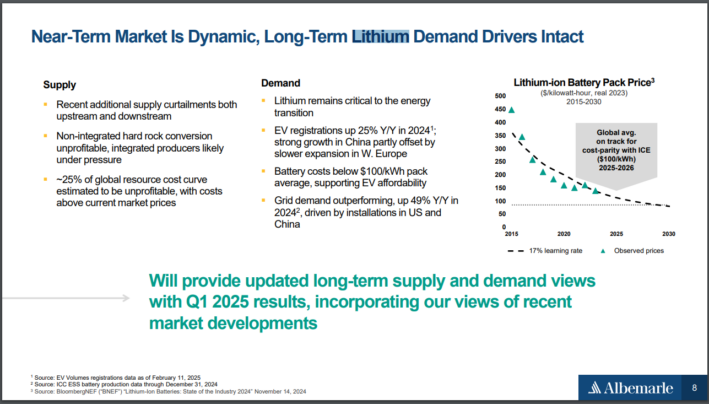

Lithium is anticipated to be a progress phase over the following 5 years because of growing demand for a variety of functions, together with electrical automobiles and client electronics.

Supply: Investor Presentation

Demand for vitality storage tends to fluctuate, however the future appears to be like promising for electrical automobiles as extra customers take into account making that buy. By 2035, electrical automobiles are projected to account for 26% of all automobiles on the highway within the U.S. Battery dimension can be anticipated to develop.

With this progress will come a major enhance in demand for lithium.

As a consequence of its management positions in lithium and bromine, we imagine the corporate can develop earnings per share at a price of seven.5% yearly for the following 5 years.

Aggressive Benefits & Recession Efficiency

Regardless of being amongst international leaders in a number of companies, Albemarle isn’t content material to relaxation on its earlier success. The corporate has been energetic in buying companies that strengthen its market share.

Albemarle is just not a recession-proof firm. Listed under are the corporate’s earnings-per-share throughout and after the final recession:

- 2007 earnings-per-share of $2.41

- 2008 earnings-per-share of $2.40 (0.4% lower)

- 2009 earnings-per-share of $1.94 (19% enhance)

- 2010 earnings-per-share of $3.51 (45% enhance)

The specialty chemical enterprise is closely reliant on buyer demand. Decrease demand ends in decrease pricing, which negatively impacts Albemarle’s efficiency. The corporate is more likely to face an analogous sort of slowdown throughout the subsequent recession.

That mentioned, the corporate has sturdy aggressive benefits. A key aggressive benefit is that it ranks as the most important producer of lithium on the planet. The metallic is utilized in batteries for electrical automobiles, prescribed drugs, airplanes, mining, and different functions.

Albemarle can be a high producer of Bromine, which is used within the electronics, development, and automotive industries. The corporate possesses a dimension and scale that others can not match.

Buyers concerned with investing in Albemarle ought to perceive that possession of the inventory comes with dangers because of the nature of its business.

Valuation & Anticipated Returns

Utilizing our anticipated earnings energy determine of $3.50 for the 12 months, ALB shares have a price-to-earnings ratio of 20.9. Over the past decade, Albemarle has traded with a mean price-to-earnings ratio of 21.3.

Our a number of goal is 18x earnings, which we really feel takes into consideration the demand for the corporate’s supplies and the excessive volatility of lithium costs. If the inventory have been to commerce with this goal by 2030, then valuation could be a 2.9% headwind to annual returns over this time interval.

As well as, the dividend yield of two.2% will add to shareholder returns. The dividend payout is well-covered, because the projected payout ratio for the 12 months is simply 46% of our earnings energy estimate.

Given the character of its enterprise, the corporate has been profitable at prudently managing its dividend. Albemarle has raised its dividend for 29 consecutive years.

Due to this fact, we mission that Albemarle will present a complete annual return of 6.6% over the following 5 years, stemming from 7.5% earnings progress and a beginning yield of two.2% which might be offset by a low single-digit headwind from a number of contraction.

Last Ideas

Reaching Dividend Aristocrat standing isn’t any small feat. Albemarle is the dominant participant within the lithium business. The corporate advantages from low-cost mines and its management place in a number of classes.

Albemarle is much from recession-proof and has skilled some vital earnings declines over the past decade, however this makes the corporate’s dividend progress observe report much more spectacular.

Whereas the corporate’s enterprise might be unpredictable, we price Albemarle’s shares as a maintain.

Moreover, the next Certain Dividend databases include probably the most dependable dividend growers in our funding universe:

In the event you’re searching for shares with distinctive dividend traits, take into account the next Certain Dividend databases:

The key home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].