uschools

This article was coproduced with Leo Nelissen.

Of all real estate industries, the office industry is my least favorite. It’s highly competitive, the industry has seen decades of oversupply, and nobody really likes working in an office.

The pandemic made that very clear.

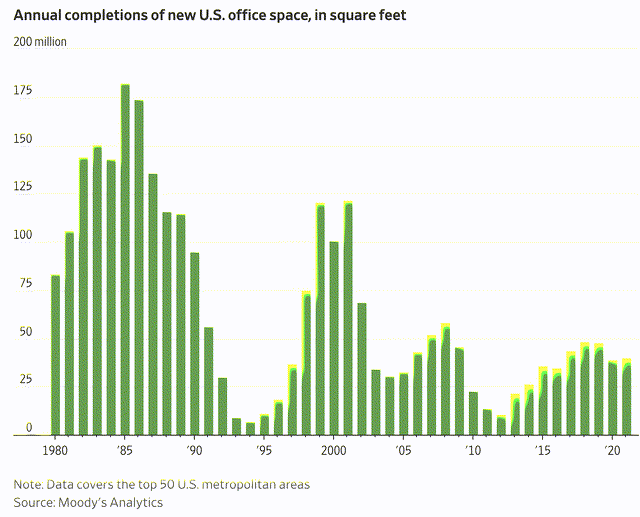

One of the biggest threats to successful real estate investments is new supply. In 1981, changes in the tax code allowed investors to depreciate commercial real estate more quickly. In the office industry, it fueled so-called “cubicle farms.”

The chart below shows the massive surge in office supply in the 1980s.

Wall Street Journal

After the Great Financial Crisis, the office boom was fueled further by major projects like New York’s Hudson Yards and the New World Trade Center.

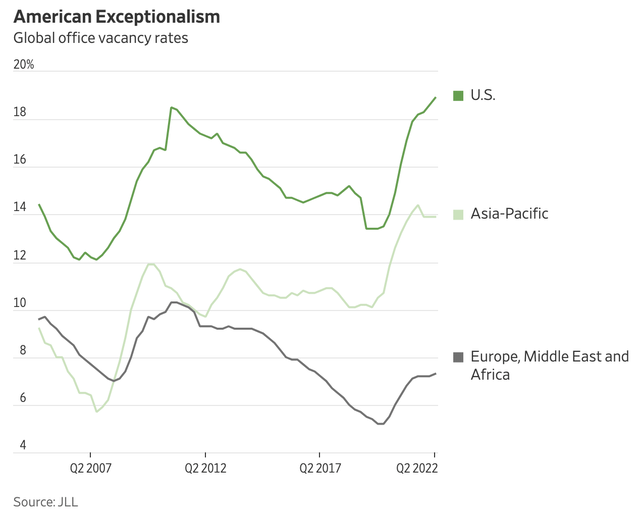

When the pandemic started, the U.S. already had an office vacancy rate of almost 14%, which is more than Asian and EMEA nations were dealing with. As a result of the pandemic, the vacancy rate rose to more than 18% in the second quarter of 2022.

Wall Street Journal

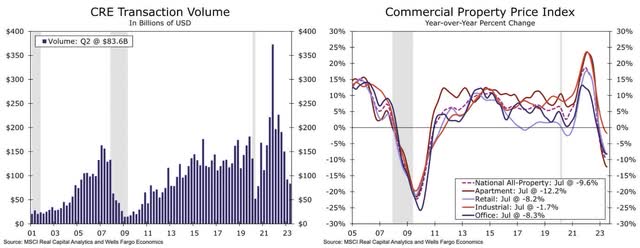

Now, the office industry – like its peers in other commercial industries – is dealing with another issue: rising rates.

Debt-reliant financing in real estate makes it sensitive to interest rate fluctuations, resulting in property valuations declining, notably in the apartment and central business district office segments.

Wells Fargo reported that transaction volumes have drastically decreased, impacting property pricing and fundamentals. The office sector is especially impacted, with notable downsizing and increased vacancy rates.

Wells Fargo

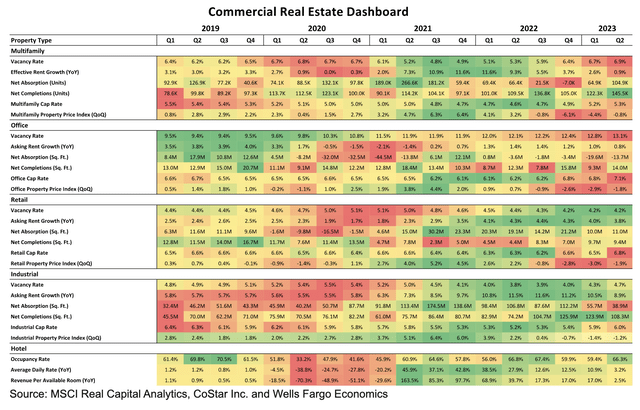

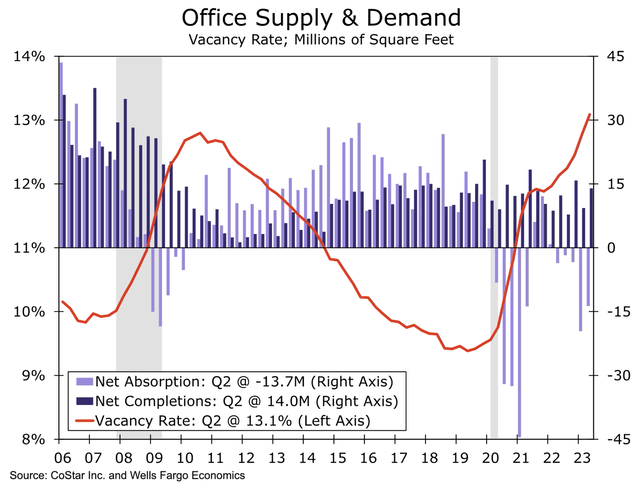

The office market is grappling with the rise of hybrid work models, resulting in persistent negative net absorption and an increase in office vacancy rates. The table below shows that vacancy rates in the industry have hit a new multi-year high in 2Q23.

Wells Fargo

The supply-demand imbalance is reflected in decreased rent growth nationally.

Despite this, new office supply continues to enter the market, further impacting vacancy rates and rent growth.

It also doesn’t help that generous concession packages are being offered to tenants, affecting asking rent data and overall market dynamics.

Wells Fargo

In light of these developments, there is one company I like in particular. Not only does this company have a specific focus on top-tier tenants and modern, state-of-the-art offices, but it also is proving that successfully operating office real estate in this environment is possible.

The company also gives us a lot of intel into the markets it serves!

That company is the Kilroy Realty Corporation (NYSE:KRC).

Resilient High-Tech Office Real Estate

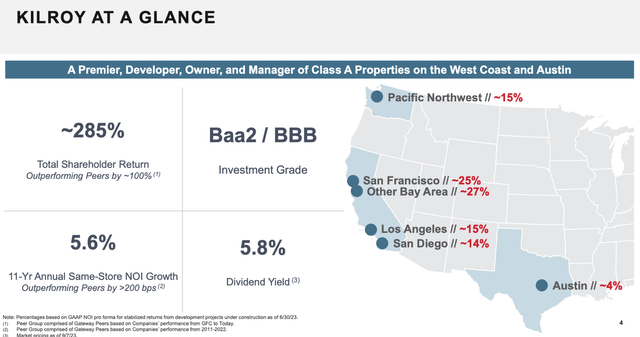

Kilroy Realty has two major issues that have caused people to dump the stock. Not only does it operate in the office real estate industry, but it also has a focus on California, a market a lot of investors want to avoid.

Almost all of its revenues come from the San Francisco Bay Area and Southern California.

Kilroy Realty Corporation

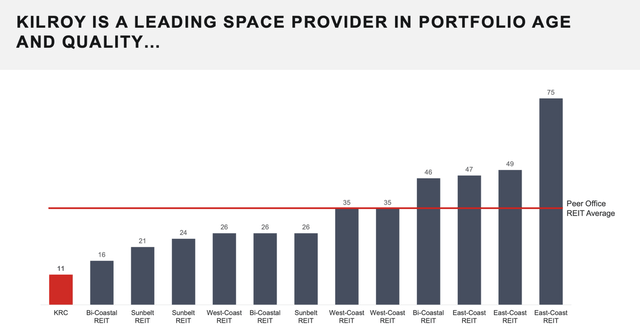

Having said that, the company isn’t just an ordinary office real estate investment trust, or REIT. No. Kilroy is focused on top-tier offices for major tenants. For example, the company has the youngest office portfolio among major REITs, with an average age of just 11 years.

Kilroy Realty Corporation

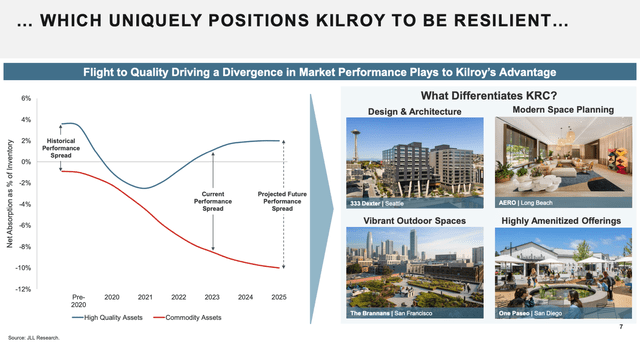

Using third-party research, the company noticed outperformance of high-quality office assets over commodity office buildings. This trend is expected to continue, with a new absorption rate in the low-single-digit range on a prolonged basis.

Kilroy Realty Corporation

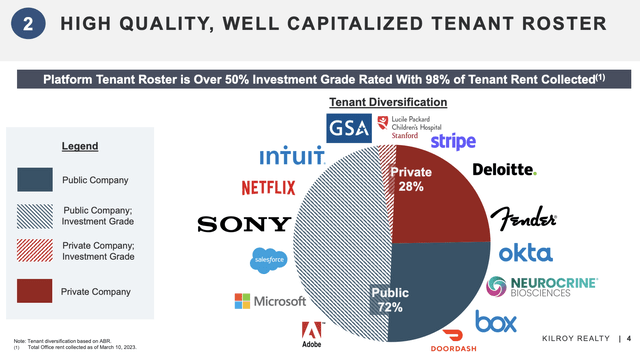

As of December 31, 2022, the company had 119 office properties with more than 16 million rentable square feet. Roughly three-quarters of its tenants are public companies operating in the technology sector. A quarter of its tenants are private companies like Deloitte.

Kilroy Realty Corporation

Half of its tenants are investment grade. This is very unique in this industry.

In its second-quarter earnings call, the company noted the resurgence of in-person work, citing major employers like Meta Platforms (META), Google (GOOGL), and AT&T (T) requiring employees to return to the office.

This return to office is contributing to increased foot traffic in urban areas, revitalizing cities, and positively impacting Kilroy’s portfolio’s physical occupancy and parking income.

The leasing market remains active, with significant lease signings and positive leasing spreads in key portfolios like Los Angeles and Hollywood.

Furthermore, during the call, the company highlighted the continued success and promising prospects in the Life Science business, driven by demographic trends and increased funding in the industry. These tailwinds also apply to Alexandria Real Estate (ARE), a company we have a Strong Buy rating on.

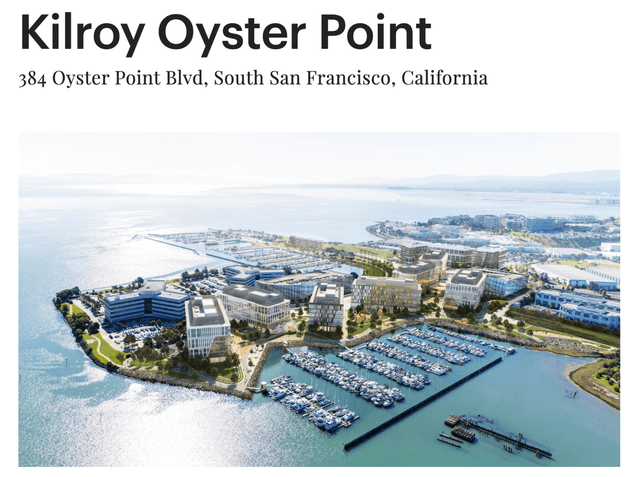

Kilroy specifically mentioned leasing activities with life science tenants and ongoing development at its Oyster Point in South San Francisco.

Kilroy Realty Corporation

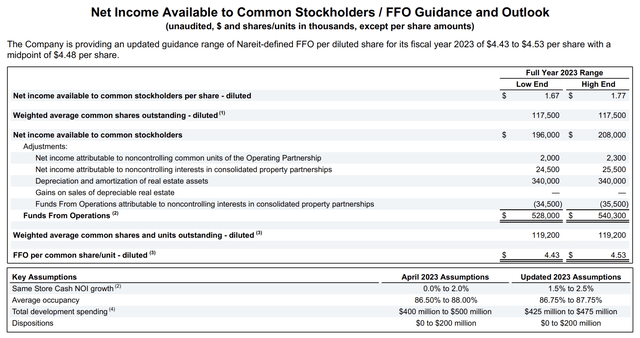

On a full-year basis, the company expects an occupancy rate of at least 86.75%.

According to the company:

“Physical occupancy at Kilroy’s portfolio is up 800 basis points from the beginning of the year and over 500 basis points from just last quarter. Our parking income is also a beneficiary, with NOI up approximately 20% compared to the first half of last year.”

Furthermore, during the recent Bank of America Global Real Estate Conference, the company commented on its top-tier assets.

The company emphasized the need for efficient and sustainable buildings that feature ample amenities designed for speed to market. The goal is to position Kilroy’s spaces as the top choices for prospective tenants to ensure they remain relevant and appealing in a dynamically changing market.

By focusing on efficient, modern, and adaptable office spaces, Kilroy Realty Corporation strives to meet the evolving needs and expectations of the workforce and business landscape.

If it keeps succeeding, it is in a good spot to escape general weakness in the office industry.

The company also enjoys a fortress balance sheet with a 5.7x leverage ratio, 95% unencumbered assets (not used as collateral), and no maturities until December 2024.

95% of the company’s debt has fixed or capped rates.

Kilroy Realty Corporation

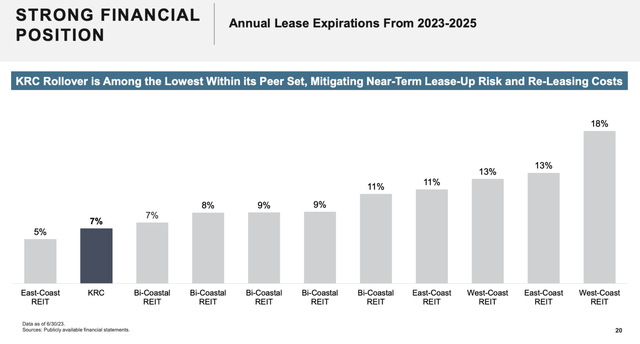

Also, through 2025, only 7% of its leases are due.

The company’s balance sheet is a big part of its offensive versus defensive business approach, which relies on maintaining a healthy balance sheet while expanding in promising areas.

Related to the aforementioned high-quality tenant comments, the company’s $1.8 billion development pipeline consists of more than 50% of life science assets.

Not only does KRC benefit from a healthy balance sheet, strong tenants, low mid-term lease expirations, and a young portfolio, but it was even able to raise its full-year guidance.

On a full-year basis, it raised the funds from operations (“FFO”) guidance midpoint to $4.48, which is up from $4.40.

“The biggest drivers behind the increase are higher interest income, better parking revenue, and earlier revenue recognition for our 9514 Towne Centre Drive development. These are partially offset by additional interest expense from the One Paseo financing.”

Kilroy Realty Corporation

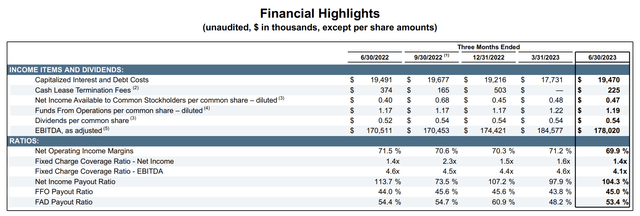

Having said that, Kilroy comes with a 6.0% dividend yield.

This is a juicy yield. However, it gets even better!

The company has a payout ratio of less than 54% of its distributable funds. This is one of the healthiest payout ratios I have discussed on Seeking Alpha in a very long time (among REITs).

It means that there’s plenty of room for dividend growth and a huge margin of safety in case things go south for the company.

Kilroy Realty Corporation

Over the past five years, the company has hiked its dividend by 4.5% per year, on average.

On September 8, 2022, the company hiked by 3.8%.

In the first quarter earnings call, the company was asked about the sustainability of its dividend. The company said that it has a very healthy payout ratio and REIT-related requirements to pay a dividend. The company was very comfortable with its dividend. That did not change in the second quarter.

Given ongoing developments, I doubt that changes anytime soon.

Valuation

KRC shares are trading at 7.8x 2023E FFO. This is well below the REIT median of 12.2x.

Prior to the pandemic, the stock used to trade consistently above 10x FFO. Needless to say, back then, office demand was stronger and rates were much lower. It’s hard to argue against a steep (relative) discount in this sector.

However, KRC is different. The company has a top-tier portfolio, a high occupancy rate, a stable tenant base, and a well-protected juicy dividend.

The current consensus price target is $41, which is 17% above the current price.

We maintain a Speculative Buy rating. While KRC is one of my favorite office REITs, I believe that adding the Speculative tag to the rating is the right way to go. After rallying 35% from its lows, the risk/reward is less favorable.

While I believe that KRC will be fine, general industry woes are getting worse.

If I were in the market looking for high-income plays, I would wait for a 15-20% drawdown before starting to buy gradually. I have little doubt that KRC will maintain strong long-term dividend growth.

Ten to 15 years from now, we’re likely looking at a much healthier industry and a much higher stock price. The tricky part is finding the right entry.

Given economic challenges, I play it safe. Some disagree with my strategy, but I prefer to lose out on opportunities instead of chasing rallies – at least in this environment.

I believe that a steeper correction from current levels could offer potential. Especially for hidden gems like KRC.

Takeaway

In a fiercely competitive and oversupplied office real estate industry, Kilroy Realty stands out.

Focusing on high-quality, modern offices for major tech and public tenants, KRC boasts a unique, young portfolio and a strong balance sheet.

While the pandemic exposed the industry’s vulnerabilities, marked by rising vacancy rates and rent declines, KRC’s strategic approach, emphasizing efficiency and sustainability, propels them beyond industry challenges.

Their juicy dividend yield and healthy payout ratio underline stability and growth potential.

While the market may see fluctuations, my strategy leans toward caution, waiting for potential opportunities, especially in hidden gems like KRC.

In the ever-evolving office real estate landscape, KRC is a beacon of hope for savvy investors. If the market offers another correction, this stock could be one of the best income (growth) plays in its industry.