Razvan

Disney (NYSE:DIS) is an entertainment conglomerate, the largest in the world. The company has a market capitalization of more than $150 billion. However, it’s still dropped 30% since its 52-week highs. The company is suffering with the overall Hollywood strike along with increased competition from wealthy media companies.

As we’ll see throughout this article, the company has long-term stay power that makes it a valuable investment.

Disney Targets

The company’s targets are to regain its core reputation and refocus on growth. It’s focused on its strong brand.

Disney Investor Presentation

For studios, the company is focused on new creative titles and outputs. This is the most important to us. The company, in our view, has been too focused on sequels of sequels and more. We’d like to see the company more focused on the original content that made Disney. Anecdotally we’ve heard much less excitement about the company’s original titles versus other competitors.

The company is investing massively in the park, doubling planned investment over the upcoming years to $60 billion. The company’s park business is one of the strengths in its portfolio, as travel increased, and increased efficiency can help earnings increase dramatically. After all this, with streaming, the company is focused on sustained profitably.

The company is refocusing on its portfolio, and that’s what we like to see.

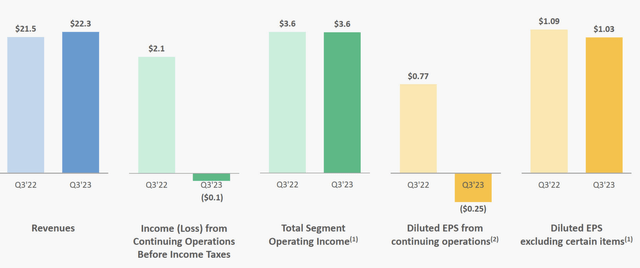

Disney Quarterly Results

The company had an incredibly tough quarter.

Disney Investor Presentation

The company’s revenue increased from $21.5 billion to $22.3 billion, an increase of 3-4%. However, its income dropped off of a cliff and its diluted EPS went negative. Adjusting for certain rules, the company’s annualized EPS was $4 / share, down 5% YoY. The company is trading at a P/E in the mid-20s, not super expensive, but also not where a shrinking company should be.

The quarterly results shows the company’s struggles.

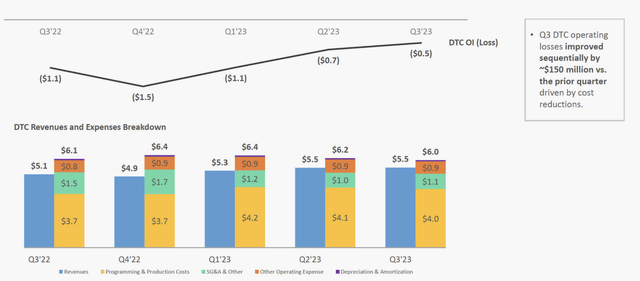

Disney Streaming

The company’s streaming losses have improved but unfortunately so too has the growth.

Disney Investor Presentation

The company’s total U.S. Disney+ subscribers is 46 million, down QoQ from 46.3 million. However, the company’s international subscribers have grown from 58.6 to 59.7 million. Total subscriber count still increased by 800k, but the loss in more profitable U.S. subscribers is disappointing. Domestic revenue was ~25% higher.

The company’s expenses continue to be primarily production cuts and we don’t see those decreasing substantially. That means the company’s ability to earn a profit will be tough especially when revenue remained constant QoQ. That shows the streaming business won’t be a major growth driver for the company, but also not a major cost.

Disney Theatrical Release

The company does have an exciting theatrical release assuming it can solve the outstanding strike.

Disney Investor Presentation

Especially into 2024, Inside out 2, Snow White, and Kingdom of the Planet of the Apes are all big titles. The Marvels going into the holiday season this Thanksgiving is an exciting time as well. Overall theatricals still struggle from where Disney was and what its slate was in the late 2010s before COVID-19 happened.

That could help give the company a boost, especially with park investments, giving it new content to utilize.

Disney Recent Volatility

One sign of Disney’s recent volatility is the volatility around the company’s decisions as it tries to reorient itself.

An example of this is the rumors around a potential spin-off of ABC. The company has a $10 billion offer on the table, and it says it has yet to make a decision. Our view is this would be an intelligent move by the company. It’ll enable it to back away from a dying cable business and grab the cash to focus on where the long-term market is headed.

By avoiding the sale, the company risks conflicting internal interests that stop it from successfully moving past cable.

Another example is the recent strike, which is focused heavily on a new technology, the use of AI in the industry. Discussed in a famous Black Mirror episode, AI and the ability to imitate someone accurately without their consent is a hot button issue. The strike has combined with an increased push for worker rights since COVID-19.

However, with an initial deal in place, the strike appears to be over. The ability to sign a deal here shows that it’s not a substantial long-term issue, and it’s potentially a positive indication of the company’s ability to adapt.

Our View

Disney is a company in a transition. The view of the company as an entertainment powerhouse has dissipated. Some of that, the company brought on itself, focusing more on sequels for its powerhouse Marvel business than anything else. The rest, however, was due to a tough market as deep pocketed competitors entered.

The company was a well-defined power house when it came to content and cable made it money. People used cable for sports primarily and the company’s $10 / cable subscriber, whether or not they utilized it, was strong. In fact, it was so strong that we expect the company to unfortunately never hit that position again.

Disney+ even if it can hit $10/month in regularly billing won’t get everyone to do it. However, some parts of the business are strong. Parks continues to outperform and the company is rapidly ramping up investment here. Overall, Disney has strong potential to outperform, but its reorienting of its business needs to operate successfully.

Thesis Risks

The largest risk to our thesis is the company’s ability to build up its DTC business while it rapidly loses its core business. ESPN is incredibly popular and Disney is one of the largest and most profitable companies from cable. The company makes roughly $10 per cable subscriber whether they use it or not. That’s tough for Disney and it won’t be able to replace that.

The question is, where does it land up, at the end of it.

Conclusion

Disney was a legendary entertainment company, and those times haven’t disappeared. The company has struggled because of much wealthier competitors, competitors that don’t need to make massive amounts of money from their core businesses. That’s pushed down average prices, Disney will never make as much as it did from cable.

The company does have some core differentiated businesses that aren’t having as much competition. For example, its Park business is expected to see investment double. The company should still have strong earnings from its core portfolio. That will enable long-term shareholder returns from its reduced share price as the company focused on what once worked.