bjdlzx/E+ via Getty Images

Recap

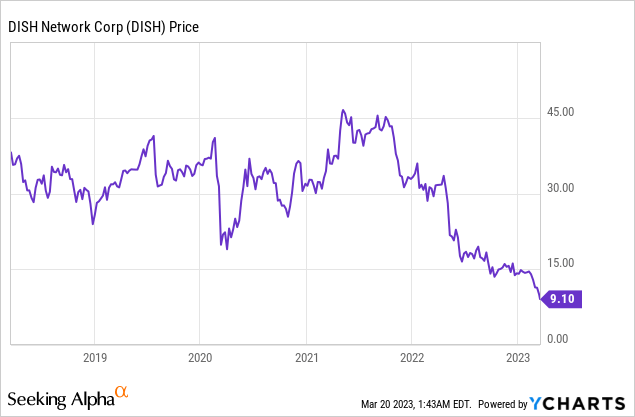

In our published article titled “DISH: Shares Were Beaten Down But There Is A Glimmer of Hope,” we wrote that DISH’s (NASDAQ:DISH) pay TV business continued its secular decline while at the same time spending billions of dollars for its network build. However, the situation might change if DISH can bring in sizable postpaid customers. Since our publication, the stock has nosedived by 40%.

[Stock price as of March 17th]

Severe Headaches Persist

DISH lost 268,000 pay TV subscribers, and the wireless net losses stood at 24,000 in 4Q22. The cash-generating pay TV business remains in a secular decline, but DISH alleviated some of the pains through price increases, which drove ARPU. Still, pay TV’s service revenue declined by about $400 million in 2022. In the meantime, DISH continues its network build to satisfy the FCC’s requirement and prepares for its postpaid roll-out. As things stand, Boost Infinite is available in 12 “big markets” and 30 million POPs in its early access program.

To ramp up its network coverage to 70% of the FCC’s requirement, DISH is building 1,000 sites monthly. According to the 10-Q, DISH needs about “$2 billion of additional capital,” and the company raised $2 billion from its senior secured notes at 11.75%. However, DISH needs to build 20,000 sites more in addition to the 15,000 sites it has built by the end of last year, assuming that 35,000 sites are required to complete its build-out, according to Raymond James and New Street Research estimates.

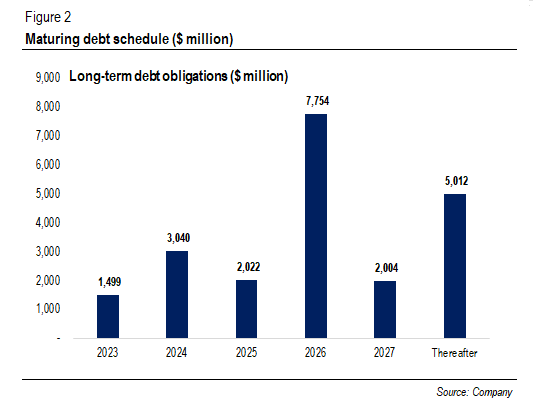

Additionally, DISH was conducting 5G tests in T-Mobile’s 800 MHz band spectrum, which will cost DISH $3.59 billion if the option is exercised. DISH noted the importance of having access to licensed spectrum in more than one band to compete in the enterprise market. Finally, massive debt also causes severe headaches. DISH carried more than $21 billion of debt in 2022, and billions of dollars of its long-term debt is set to mature in the next few years.

DISH’s long-term debt maturities ($ million) (Company)

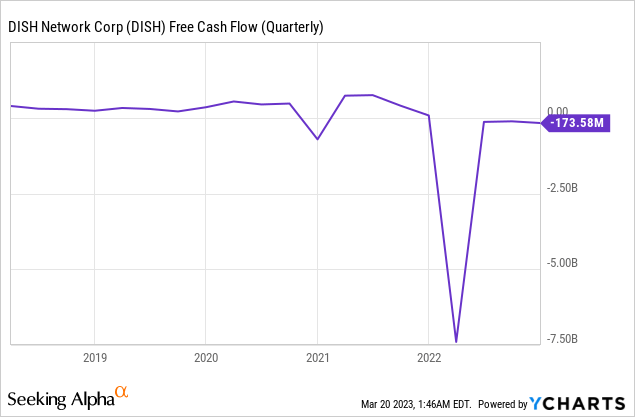

Still, where will the money come from? The company generated $3.1 billion in operating cash flow last year, down from $4 billion in 2021. Revenue deterioration is one of the main culprits. As a result, DISH had a negative FCF of $620 million. One way is to sell its retail wireless business, but according to CONX’s latest fillings, the company is still holding “preliminary discussions” with DISH.

Another way is to take more debt. S&P Global suggests that network deployment and debt obligations will require DISH to raise an additional $4 billion to $5 billion by the end of 2024. The figure should be much higher if DISH purchases the 800 MHz band spectrum. While DISH’s balance sheet situation makes it unlikely for the company to exercise the option, in our view, it remains to be seen as the management said that the possibility has “increased.”

Or perhaps, DISH’s network will start generating money to self-invest in its network scale-up. As cited in the 3Q22 earnings call transcript:

So — but that’s — our Board looks at that. We’ve got a talented board. We’ve got people that have a lot of experience in this. And all I can say is that strategically, we like DBS to fund DBS, we’d like network to fund network and we’d like retail to fund retail. And we think that, that’s doable.

But that is assuming the postpaid and enterprise businesses, DISH’s potential source of growth, will immediately be up and running. First, since the ransomware attack, DISH has “kept its customers in the dark,” and some customers are still experiencing issues, per Tech Crunch. Second, the Principal of Wave7 Research Jeff Moore mentioned that Celluphone, a wireless distribution that helped with the advertisement of Boost Infinite, was “going out of business.”

Lastly, DISH expects to gain one-fourth of the enterprise market and estimates “real revenue” to start coming in next year.

We’re better positioned there. We would expect as a gross utilization with four players with national networks, 25% of the enterprise business wouldn’t be unreasonable for us to get, as opposed to the retail business where we’re starting decades behind people and maybe getting to low single — low double-digits would be a reasonable expectation for us.

However, private 5G wireless might come later than expected. For example, Verizon (NYSE:VZ) CFO Matthew Ellis said that “the adoption curve of mobile edge compute and 5G private network…a little different than we hoped it might be.” Analysts agree that private wireless is an “expensive value proposition” and will take off as “device costs” are lower. However, when asked why DISH had not changed its game plan, Charlie Ergen implied that DISH’s “modern network” is a differentiated proposition that is “better, faster, and cheaper,” allowing the company to grab the opportunity when others could not.

We believe private 5G wireless will be a new source of growth in the industry. In addition, T-Mobile’s (NASDAQ:TMUS) partnership with AWS implies an opportunity. But the thing is that DISH is racing against time: the pay TV business is losing customers left and right, the company is spending massively for its expensive network build-out, and billions of dollars of debts are about to mature in a few years. Competition in the retail wireless industry is tougher as cable companies are more aggressive in bundle pricing.

Valuation

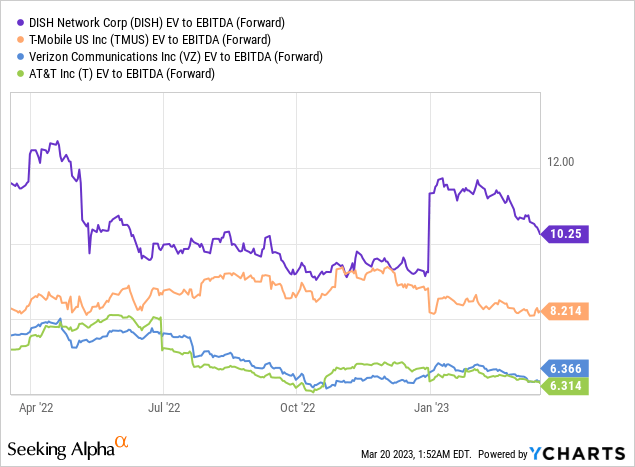

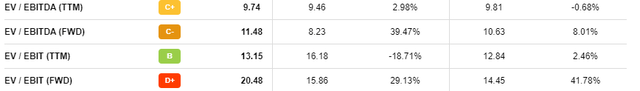

While the stock price appears cheap, DISH trades at 10x of its forward EBITDA, a premium relative to its peers and the 5-year average. DISH’s debt, which stands at $21.3 billion, far overshadows its $4.8 billion market cap. We believe that negative free cash flows, a cybersecurity attack, and a recent double downgrade due to “concerns about the company’s wireless network plans” put pressure on the stock.

DISH’s multiple vs. peers and 5-year average (Seeking Alpha)

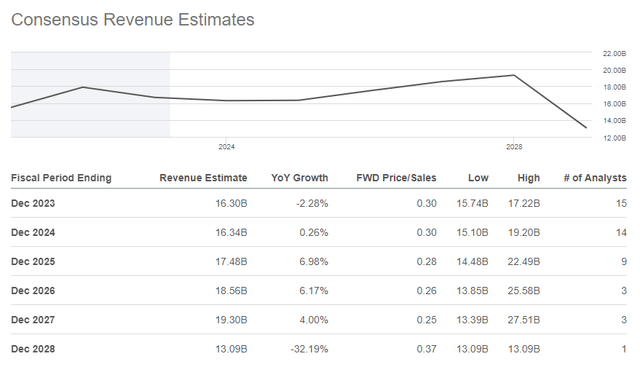

The market is expecting revenue to decline 2% this year, better than a 7% contraction in 2022, and pick up in 2025. But what if the postpaid roll-out plan does not go as expected? The ransomware attack has not yet been fully resolved. This might result in DISH pushing back the launching of Boost Infinite, which is scheduled to launch this quarter.

Indeed, other operators had their issues as well, but DISH is about to launch its new postpaid brand. Will this issue prevent potential customers from switching to DISH? Next, what if private 5G wireless demand proliferates later than anticipated?

Consensus revenue estimates (Seeking Alpha)

Conclusion

While investing in an out-of-favor company might bear fruit, DISH’s current situation is tricky. DISH’s cash-generating business is declining while at the same time the company is required to spend massively for its network build. Further, DISH is facing a cybersecurity attack, possibly forcing the company to push the postpaid roll-out schedule. In addition, will this issue prevent potential customers from switching to DISH? Indeed, its network build is suitable for enterprises, but the long-awaited private 5G wireless could proliferate later than expected.

Valuation-wise, the stock is trading at a premium relative to its peers and the 5-year average. Perhaps the situation could improve. But DISH needs to sell its retail business or raise capital by possibly adding more debt, further stretching its balance sheet. Therefore, the stock does not provide an attractive buying opportunity, in our view. If you have any questions, please do not hesitate to comment below.