Stay informed with free updates

Simply sign up to the Global Economy myFT Digest — delivered directly to your inbox.

December’s US consumer price inflation data, released on Thursday, is expected to be highly influential as traders lose confidence that the Federal Reserve will begin cutting interest rates from March.

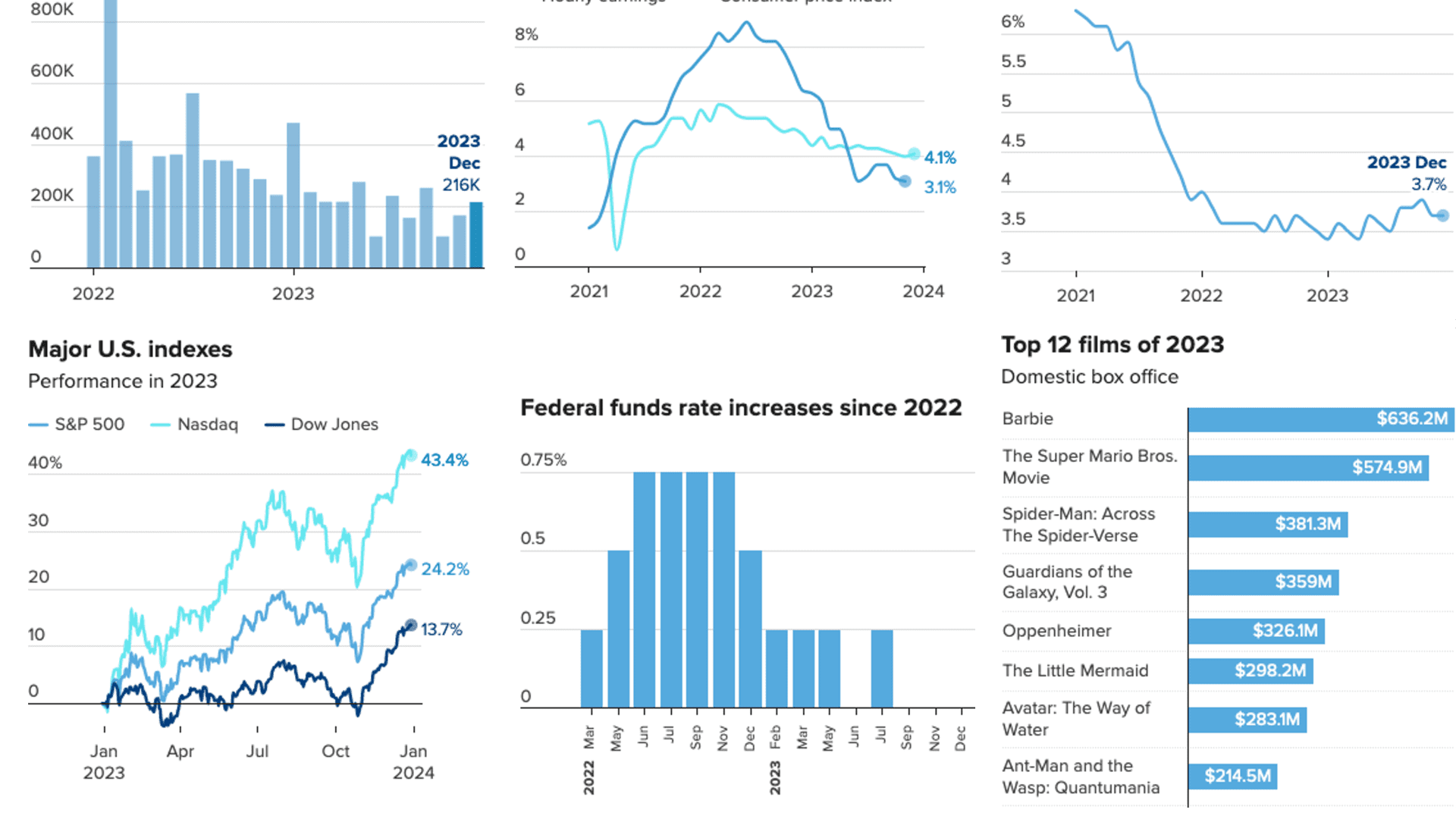

Headline US consumer price inflation, from the Bureau of Labor Statistics, is expected to show that headline inflation rose 3.2 per cent in December, year over year, according to economists surveyed by Bloomberg.

That would mark a small increase from the headline inflation figure of 3.1 per cent in November, likely driven by an increase in energy costs.

However core inflation, which strips out the volatile food and energy components, is expected to have slowed to 3.8 per cent in December, from 4 per cent the prior month, according to the Bloomberg survey.

While good news on core inflation has been harder to come by, the figures together may be seen by market participants as evidence that progress in the fight on inflation is likely to be slower this year as the US gets closer to the Fed’s 2 per cent target.

Chair Jay Powell at the Fed’s meeting in December signalled that the central bank had finished raising interest rates this cycle. Since that pivot, markets have pulled forward bets on monetary easing, pricing in about an 80 per cent chance of a quarter-point cut in March.

Those bets, which have already softened in the first week of the year, may lose steam if there is evidence that only incremental progress on inflation has been made. Kate Duguid

Will China exit deflation?

With China’s economy still struggling to hit its stride more than a year after the end of Covid-19 restrictions, investors will be on alert this week for signs that price growth could return to the world’s second-largest economy.

China’s statistics bureau on Friday publishes December figures for the official consumer and producer price indices. November’s CPI reading was pushed into deflationary territory by tumbling pork prices, undercutting official efforts to bolster confidence in the Chinese economy.

Economists at Citigroup have forecast a year-on-year fall of 0.5 per cent for consumer prices, unchanged from a month prior, as “food prices stabilised in December, with pork prices flat and vegetable prices rising.” Meanwhile, they have forecast a drop of 2.4 per cent for producer prices thanks to base effects, stable energy prices and rises in the domestic cost of steel and cement.

Any upside surprise on inflation is likely to spur greater interest in Chinese equities, the performance of which strongly correlates with rising prices, according to strategists at Goldman Sachs, who described moderate inflation as “critical” to their expectations for a rally this year.

If deflation persists, the market impact could be partially offset by a strong December reading for Chinese exports, also due on Friday. Economists polled by Bloomberg have forecast outbound shipments to rise 1.6 per cent year on year, up from 0.5 per cent in November, while imports are expected to be level compared with a year ago. Hudson Lockett

Will the UK dodge a technical recession?

Investors’ attention will focus on UK GDP data for November as they assess how early and to what extent the Bank of England is likely to cut interest rates this year.

The unexpected 0.3 per cent fall in UK output in October prompted traders to ramp up their bets that the central bank would cut rates in the months ahead. Economists polled by Reuters forecast that the economy marginally rebounded in November. They expect the figures published on Friday to show UK output grew 0.2 per cent between October and November, driven by growth in the services sector.

The November data will also help determine whether output contracted in the final three months of 2023 after posting a 0.1 per cent fall in the previous quarter.

“The possibility that the UK economy entered a technical recession in the second half of 2023 remains very much alive. Yet it is by no means certain,” said Sandra Horsfield, an economist at Investec. “Were there to be upward revisions to October figures, or indeed a solid rebound in the November data, this may yet be avoided.”

In December, the Bank of England said it expected no economic growth in the final three months of last year, a downward revision from a 0.1 per cent expansion forecast in November.

Horsfield expects growth of 0.2 per cent in November, driven by a 0.4 per cent expansion in the services sector. This is based on retail sales, which rebounded strongly by 1.3 per cent in November. Output in utilities should also have been boosted by the cooler weather, she said.

Horsfield expects “lacklustre activity” to continue at the start of 2024, but added that “receding inflation, and the boost to real spending power it brings, ought to bring about a recovery before long — also helped by tax cuts and, eventually, lower interest rates”. Valentina Romei