Jeff Colburn/iStock via Getty Images

After significant speculation, Diamondback Energy, Inc. (NASDAQ:FANG) confirmed its intentions to acquire privately held Endeavor Energy Resources, continuing the fervor of M&A in oil and gas that has been ongoing but really took off in 2023. The deal sparked a flurry of upgrades across Wall Street, including from many analysts that had turned away from the Diamondback Energy story due to its complications and nuance.

I never soured on Diamondback, but I do agree with Wall Street that there are significant positives to this announcement. While there are some downsides to shareholders – most notably a temporary decline in the pace of shareholder returns – those are far outweighed by the contiguous acreage, added drilling locations, cost synergies, and the ability to firmly pivot to the Midland Basin over a blended development strategy. My price target moves firmly higher, and while it might get reset depending on where I mark to market for end of quarter strip prices, Diamondback looks compelling.

Flurry Of M&A

There has been a lot of jockeying for position in the Permian lately, with the key basin earning a disproportionate dollar share of 2023 mergers and acquisitions (“M&A”) activity. Remember that 2023 was the biggest year of dealmaking in oil and gas in quite some time, outstripping all of that (at the time) heavy activity we saw post pandemic from 2020 to 2022. Combined. Nearly $200B of deals were penned in 2023, with half of that figure coming in the Permian Basin. The Exxon Mobil (XOM) deal with Pioneer (PXD) was the largest, but we also saw Occidental (OXY) tie up with CrownRock and APA Corporation (APA) make its bid for Callon (CPE). Assuming these all go through, the leaderboard has been rejigged as far as top Permian producers are concerned, with Exxon pole-vaulting to the top, followed by Occidental. Chevron, who was formerly the largest, falls to potentially number four as its own M&A purchase is focused overseas (Hess Corporation (HES)).

I’ve talked quite a bit about the disappearing amounts of viable, large-scale targets in the Permian. Mewbourne Oil and Endeavor Energy are really the only two large privates that remained, with Mewbourne staunchly stating that it is not for sale many times. Endeavor was the last remaining crown jewel, and at first glance it is surprising Diamondback Energy (FANG) has emerged as the winner. By the beginning of 2026, I expect Diamondback Energy to be the third largest producer in the Permian and just a nose off second, only incrementally trailing Occidental. Unless we see a large public company megadeal (e.g., EOG Resources acquiring Permian Resources or Devon Energy), this might be one of the last large scale deals done in the Permian.

Signs were there though. Endeavor founder Autry Stephens had been looking to leverage recent M&A activity to sell the company. Like many founders, he wanted to get the firm into the hands of an entity with a similar approach to not only drilling markets but also company culture. Many have now pointed out the long-standing partnership between the two, such as a childcare center in the Midland Basin dedicated to caring for the children of the two companies exclusively. The press release at the time cited “teamwork and amazing partnership” between the two, as well as their “employee and family-centered company cultures.”

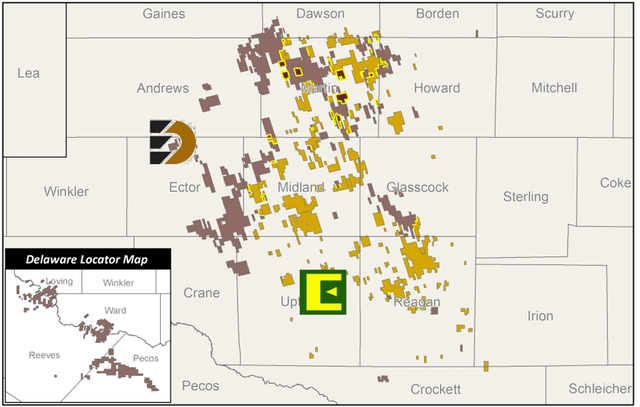

Both firms are headquartered in the Midland Basin, and while Diamondback Energy does have acreage in the Delaware, much of its development has been centered here – bucking the trend of a shift towards the Delaware from other producers. Endeavor is structured the same way, and there is fairly substantial contiguous acreage overlap when layering the two on top of one another.

Diamondback Energy Combined Acreage Map (Corporate Presentation)

Especially considering the size of Endeavor, this promises significant operating and commercial synergies, a fact we’ll get into now as we talk about the financial structure of this deal. The net present value is $3.0B of those savings – reason alone for much of the excitement. That’s only part of it though, and with more than 6,100 combined drilling locations with breakevens at less than $40.00 per barrel, investors are also looking at significant improvement in indicated reserves – one of the weaker parts of the Diamondback story in recent years.

The Nitty Gritty Numbers

Endeavor Energy was not cheap. The price tag here is $26.0B – nearly the enterprise value of Diamondback Energy itself. Funded through a combination of $8.0B in cash and 117.3mm common shares to be issued to Endeavor Energy equity owners, it will not be cheap. While the large stock component eases the burden on both balance sheet and leverage, particularly given Endeavor is debt free, it is going to take some time to pay down. Given the price tag, the list of potential buyers for Endeavor was small, but I think it ended up in the right hands here, while also removing speculation that Diamondback would be a takeover target itself.

Importantly, control still rests with Diamondback. Expected ownership at close puts existing Diamondback stockholders at 60.5% ownership; the Diamondback Energy Board of Directors will be expanded to thirteen, with Endeavor getting four board seats. That representation fades if the Endeavor stockholder group decides to wind down their position; the lockup period is lengthy as well. Plenty of protection here to ensure that Diamondback can keep being, well, Diamondback.

Diamondback is aiming to exert significant influence over Endeavor acreage. A big reason why the market reacted so strongly to the announcement was the $550mm in stated synergies, the bulk of which ($325mm) comes from capital and operating cost improvement on Endeavor holdings.

All told, Diamondback believes it can lower cash operating costs by as much as 10% per barrel of energy (“boe”) extracted. A large portion of this comes from lowering drilling and completion costs by $150 per lateral foot; significant cost savings. While that might seem wild, Diamondback D&C costs are stronger than average but not necessarily out of line with other public E&Ps in the Midland (e.g., EOG Resources). Endeavor was more of the outlier, and it might be easier than one might believe to bring those best practices across.

Something to watch, however, is that Endeavor wells have historically been much productive on a boe basis than Diamondback – particularly late in 2022 and especially into 2023. I think Endeavor was targeting some of its best inventory to put its best foot forward in the sales process, generally that’s normal and a pretty transparent type of window dressing activity, so I expect some slippage as Diamondback takes over, but I still don’t want to see a lot of slippage as they try to cut costs.

There’s also implied savings from overlapping acreage (incremental working interest improvement, running longer laterals) that management estimates will add $150mm in value, as well as savings on the financial and corporate cost side ($75mm) that are pretty typical during any large scale M&A. Additional benefits include potential dropdowns of royalty interests to Viper Energy Partners (VNOM) given Endeavor’s ownership of royalty interests and tiebacks into Diamondback midstream holdings – which were once a part of Rattler Midstream – that would yield cost savings on the gathering and processing side of moving product to market. At a 10.0% discount rate, this works back to $3.0B in net present value: that is more than $10.00 per share in value accretion from synergies alone if both companies were fairly valued separately coming into this transaction.

Changes In Capital Allocation

Despite Endeavor actually being in a net cash position, Diamondback Energy has indicated that it intends to get back down below the $10.0B nominal debt figure quite quickly – within the first year of close. It also intends to get there via non-core asset sales as well, which given the targeted drilling both firms independently made, would mean the disposition of land holdings in the Delaware.

Perhaps unfortunately for Diamondback Energy, Inc. shareholders, this means a temporary reset downward in the shareholder return commitment from 75.0% of free cash flow to “at least 50.0%.” This is just this management team being cautious, and if you do the math, this backs into them wanting to be under 1.0x leverage at $50.00 per barrel WTI pricing. That’s perfectly fine and a strong aspirational target, and management would rather find itself in that leverage scenario if oil and gas markets turn sour. I’m not opposed to this, and we’ve seen similar cases where the market has rewarded this prudence over time (see HF Sinclair (DINO) and its cuts to shareholder returns to fund acquiring the Puget Sound refinery).

Takeaways

In conclusion, Diamondback Energy, Inc.’s acquisition of Endeavor Energy marks a pivotal moment in the company’s growth strategy within the Permian Basin. With the deal reflecting broader trends of consolidation and strategic positioning in the oil and gas sector, Diamondback Energy has showcased its commitment to securing key assets and driving operational synergies. While challenges such as temporary setbacks in shareholder returns and debt reduction efforts lie ahead, the acquisition positions Diamondback Energy as a formidable player in the Permian Basin, poised to capitalize on opportunities and create long-term value for its stakeholders.