lakshmiprasad S/iStock through Getty Photographs

Dividend development investing is the best technique throughout bear markets for including stability to the portfolio and producing market-beating returns. Nonetheless, selecting the correct dividend development inventory or ETF is essential to producing strong returns. The iShares Core Dividend Development ETF (NYSEARCA:DGRO) is a extremely regarded identify within the dividend development ETF class, nevertheless it does not seem like a great decide throughout market turmoil as a result of the fund focuses on sectors which are getting arduous hit by the broader financial atmosphere. Low dividend yield, excessive volatility, and prospects for slower dividend development make it much less engaging to think about as a hedge towards inflation.

Portfolio Composition Does not Match With Market Developments

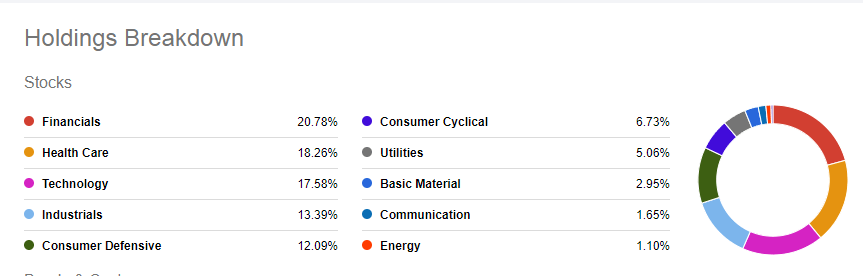

Historic knowledge proves that dividend development investing has outperformed worth and different investing methods throughout bear markets. Moreover, utilizing dividend development ETFs for that objective considerably reduces the volatility and lowers the dangers related to a single inventory funding. In follow, each dividend development ETF is completely different, they usually do not all present wholesome returns that can be utilized as inflation hedges. In relation to DGRO, its important publicity to monetary, know-how, industrial, and shopper cyclical sectors appears dangerous, particularly when rates of interest are rising and financial development is slowing

DGRO’s Sector Breakdown (In search of Alpha)

DGRO’s stake in dividend development shares from the monetary sector declined extra quickly than the S&P 500 index. Its fourth-largest inventory holding, JPMorgan (JPM), has fallen 26% yr to this point, in contrast with the S&P 500’s 18% decline. The chance of investing in monetary and banking shares will be very excessive, particularly if the financial system enters a recession. In mild of the awful financial outlook, JPMorgan Chase CEO Jamie Dimon steered that the financial institution would stay conservative on its steadiness sheet. Beforehand, he referred to financial challenges as storm clouds, however now he calls financial headwinds a “hurricane’.” The newest financial knowledge such because the CPI of 8.6%, the numerous reduce in GDP forecasts, and historic lows in shopper sentiment reinforce the conclusion {that a} recession is imminent and the present bearish pattern in inventory markets will persist.

Financial uncertainty and rate of interest unpredictability weighed closely on know-how shares because the starting of this yr, which make up 17.58 % of the DGRO portfolio. Since financial volatility is more likely to improve, and rates of interest are anticipated to develop at a sooner tempo, fundamentals for tech shares seem weak. Due to this fact, the know-how sector is anticipated to generate decrease income and earnings going ahead, which can harm traders’ returns. Apple (AAPL), as an illustration, anticipates low single-digit development within the quarters to return resulting from slowing demand, inflation, and provide chain disruptions.

Industrial shares, which comprise 13.39% of DGRO’s portfolio, are additionally more likely to face financial headwinds as the worldwide GDP forecast fell to 2.9 % for 2022, a lot decrease than the 4.1 % envisioned in January and the 5.7 % forecasted in 2021. Slowing development, infrastructure, and manufacturing actions don’t bode properly for industrial shares. On the optimistic aspect, DGRO’s stake in low cost retailers and well being care shares might thrive in an inflationary atmosphere, but their weightage isn’t as massive as that of positions in high-risk sectors. Due to this fact, the portfolio composition of iShares Core Dividend Development ETF isn’t a recession- or inflation-proof and carries excessive threat.

Likelihood is Excessive for Low or Adverse Returns

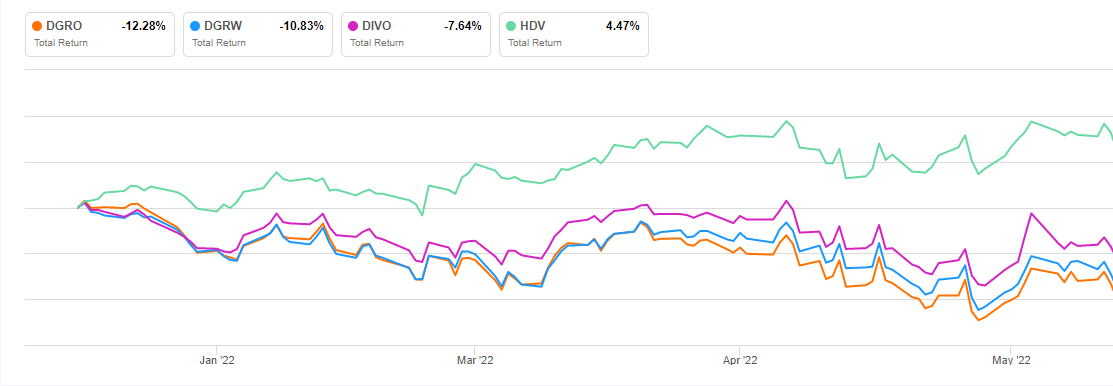

Up to now three, 5, and ten years, DGRO underperformed in comparison with the broader market index. It barely outperforms the S&P 500 index yr to this point, however DGRO’s whole return of -12% does not qualify it as an inflation hedge. The difficult market circumstances for its portfolio holdings have already begun to mirror in its current share value and dividends. Within the first quarter of 2022, the fund paid a dividend of $0.49, in contrast with a dividend of $0.52 in the identical interval final yr. Dividends for the following two quarters may additionally decline as compared with the previous yr since a lot of its portfolio holdings are taking a conservative method and their income are more likely to lower within the second half of 2022.

DGRO Returns Vs. Friends (In search of Alpha)

Moreover, its efficiency seems lackluster when in comparison with different dividend development ETFs together with WisdomTree U.S. Dividend Development ETF (DGRW), Amplify ETF Belief – Amplify CWP Enhanced Dividend Revenue ETF (DIVO), and iShares Core Excessive Dividend ETF (HDV). DIVO, for instance, gives a dividend yield of over 5%, and its shares have carried out higher than DGRO thus far in 2022. HDV, which focuses primarily on well being care and vitality shares, additionally outperformed DGRO when it comes to each dividends and value returns. HDV’s shares are nonetheless buying and selling in a optimistic territory yr to this point whereas its dividends are anticipated to extend significantly from final yr.

In Conclusion

DGRO doesn’t seem like a great addition to a portfolio as a result of it neither gives stability in a unstable market nor does it supply wholesome returns that beat inflation. As well as, the fund carries a substantial amount of threat resulting from rising rates of interest and inflationary pressures. A recession will exacerbate the dangers related to development shares working within the tech, monetary, and industrial sectors. Buyers ought to due to this fact search for dividend development alternatives which are secure and dependable.