Luis Alvarez

Dimensional has a robust status for its factor-based method to investing, offering methods and funds which have an opportunity at outperforming core passive benchmarks. I emphasize the phrase “probability” right here as a result of as we all know, something that isn’t passive tends to have a onerous time being price investor consideration. Having mentioned that, I do like their fairness choices.

Should you’re a fan of Dimensional and searching for one thing completely different than the standard core passive fairness averages, then chances are you’ll need to take into account the Dimensional U.S. Fairness ETF (NYSEARCA:DFUS). The fund has an extended historical past relationship all the best way again to 2001, and has grown to over $9.6 billion in belongings. It benchmarks towards the Russell 3000 Index, which suggests it is going to have small and mid-cap firms within the combine.

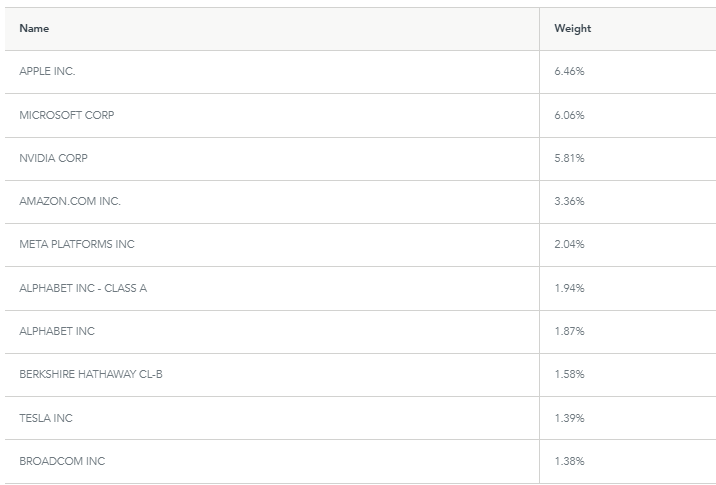

A Look At The Holdings

DFUS contains almost 2,500 completely different firms, giving buyers entry to a broad cross-section of the US fairness market. No place makes up greater than 6.46% of the fund, and the highest 10 positions are all of the mega-cap acquainted names you definitely acknowledge.

dimensional.com

This alone makes this clearly extra of a core fairness portfolio, given it primarily seems just like the S&P 500 or Russell 3000 (albeit with barely extra balanced total weights within the prime 10). There’s nothing flawed with that, however it’s good to bear in mind when excited about the place a fund like this matches into an total portfolio.

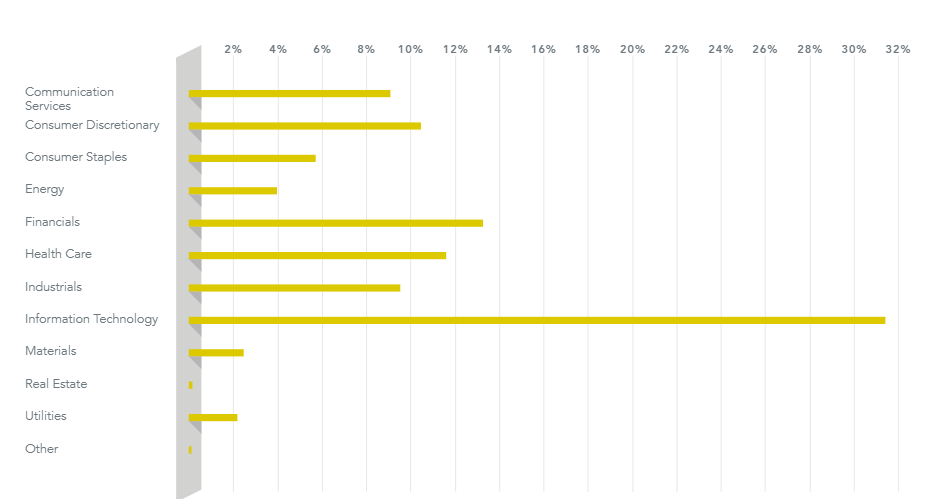

Sector Weightings

As a result of that is extra of a core US fund consultant of the Russell 3000, it ought to come as no shock that Tech is the largest allocation, adopted by Financials. The sector weightings don’t veer too dramatically from what you see within the Russell 3000 benchmark itself, so no main monitoring points from that perspective.

dimensional.com

That is one factor I’m not a fan of, although it doesn’t have something to do with Dimensional. I’m frightened about Tech overexposure this late within the cycle, and suspect that it turns into extra of a laggard over time. Once more – not a knock on DFUS, however one thing that, I feel, will matter going ahead from a return expectations perspective.

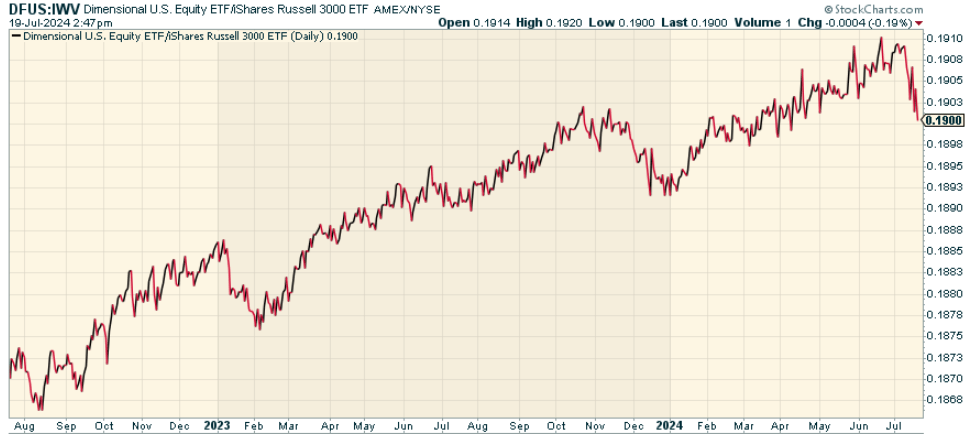

Peer Comparability

To place it mildly, there are lots of opponents on this house. Because the fund’s benchmark is the Russell 3000, it’s price evaluating the portfolio to the iShares Russell 3000 ETF (IWV). After we have a look at the worth ratio of DFUS to IWV, we discover that DFUS has outperformed IWV over the past two years (although not in an enormous method). Dimensional’s method does appear so as to add some alpha on the margin towards its benchmark.

StockCharts.com

Word that I feel the important thing to this going ahead will probably be how Dimensional treats its smaller-cap firms. I believe there’s a interval of outperformance forward, which suggests it is going to matter for DFUS to doubtlessly chubby that a part of {the marketplace} if I’m proper to proceed its edge.

Execs and Cons

On the optimistic aspect? As talked about simply above, the fund does appear to outperform over time. As a core allocation, the method provides worth, and is reasonable at a 0.09% expense ratio. You understand what you’re getting right here, and it’s not going to dramatically differ from what you’d usually get from different broad-based fairness funds on the market.

The draw back? I feel it’s extra a cycle query than a product one. If shares enter a correction or bear market, the outperformance potential gained’t matter as a result of this fund would get hit identical to each different one. The Tech sector allocation, as I discussed, is problematic to me. Sure, it’s par for the course relating to a complete market proxy, however that’s additionally what makes the fund not as interesting to me right here.

Conclusion

There’s nothing flawed with the Dimensional U.S. Fairness ETF. It’s outperformed the Russell 3000, has an extended historical past, and has one of the crucial revered corporations behind the fund. I simply don’t know if it’s price rotating out of 1 core fairness fund you have already got publicity to into this one. I’d take into account this fund after a bigger dislocation in equities. Good total regardless.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you uninterested in being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis device designed to offer you a aggressive edge.

The Lead-Lag Report is your day by day supply for figuring out threat triggers, uncovering excessive yield concepts, and gaining priceless macro observations. Keep forward of the sport with essential insights into leaders, laggards, and all the pieces in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a restricted time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.