guvendemir

The Direxion Daily Aerospace & Defense Bull 3X Shares ETF (NYSEARCA:DFEN), as discussed in my latest article, “DFEN: A Buy For 2023, But Be Careful In The Next Few Months,” has delivered, as I expected, excellent returns, yielding a +25% until the end of 2023 and a +13.11% until now. However, I expect a very different trend in the coming months.

Firstly, the composition of the ETF is far from optimal in the current scenario: an example is the decline of Boeing which has significantly impacted its performance. Secondly, being leveraged x3, the ETF is highly sensitive to slight negative changes in the price of the underlying stocks; and because I think that the momentum in the defensive sector will continue in the coming months, but with much less strength than in 2023, I believe the ETF has to be downgraded from a buy to a hold.

The risk of overexposure and value erosion

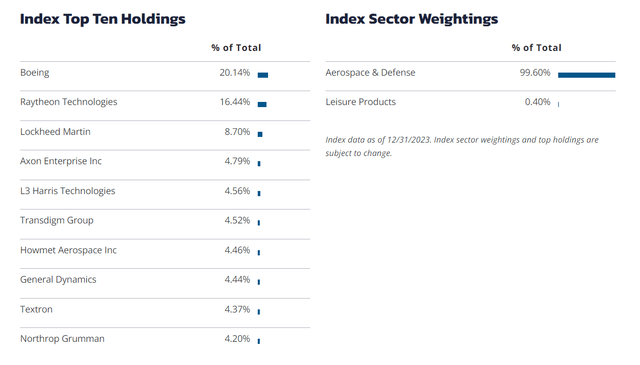

Starting from the data as of December 31, 2023, the fund’s composition is particularly concentrated on just a few stocks.

DFEN Composition (Direxion)

Specifically, from the list, it can be observed that 76.6% of the entire ETF is concentrated in the top 10 holdings. While this concentration is positive during bullish periods for defense stocks, it becomes extremely negative in volatile, sideways, and bearish markets. This is because the x3 leverage amplifies drawdowns more than appreciations, making the investment suitable mainly for short to medium-term speculation. In short, the ETF is susceptible to significant value erosion, especially if used in adverse periods without proper risk evaluation.

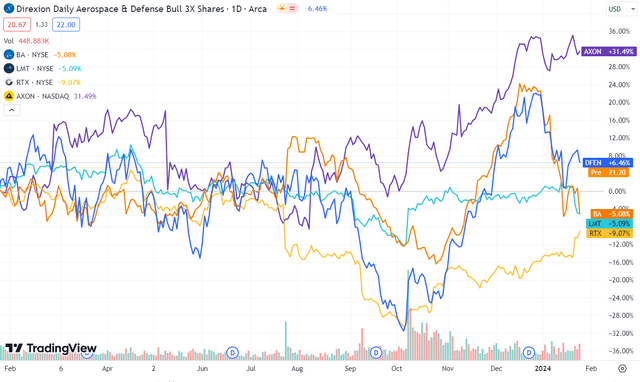

This is evident in the case of Boeing (line in orange): following the Alaska Airlines 737 incident, the company experienced a more than 10% drop in just a few days, bringing down the price of the DFEN ETF, which had Boeing as its largest holding (20.14%), despite other major companies rising over the same period.

Stock comparison (TradingView)

Concentration and leverage are, therefore, strengths of DFEN. However, in non-optimal periods, they can transform into significant risks and adversely impact the investor.

The defense sector may be nearing its peak

In the last two years, the defense sector has experienced staggering growth, with many stocks reporting double-digit growth. Indeed, this optimism is largely tied to the geopolitical situation, where heightened tensions and regional conflicts created huge profit opportunities, because the increase in defense spending targets has become a crucial factor.

Examining the primary buyers of the companies within DFEN, we predominantly find the NATO countries, with the United States at the forefront. As I emphasized in my previous article, over the past year, many of these countries substantially augmented their defense budgets. In Europe, for instance, several countries increased spending to 3% of GDP. The USA, in December, approved a budget of $886 billion for 2024, a rise compared to recent years but in line with the 2023 trend. Moreover, all these countries have provided production and budgeting guidelines for the upcoming years.

Hence, predicting the revenues of defense companies in advance is relatively straightforward, thanks to these government guidelines and long-term contracts. Consequently, this information is promptly factored into stock prices.

However, from a structural point of view and considering the growing debate in public opinion, it is improbable that these budgets will experience substantial further growth in the short to medium term unless new conflict zones emerge.

Therefore, I believe that defense companies are more likely to decline than appreciate further, despite the ongoing favorable momentum. Given the elevated risk of bearish movements, DFEN is not a favorable investment at the moment.

Bottom Line

In conclusion, while the companies within DFEN may continue to grow, I believe there is limited room for the ETF to justify a bullish speculative trade in the short to medium term.

One objection regards using the ETF as “collateral” or “insurance” in the event of an escalation of global geopolitical tensions. However, even in this scenario, I believe other less volatile investment instruments would be more appropriate. In fact, even if the market remains flat, as explained earlier, the value of DFEN would still decline over time, nullifying the positive effects.

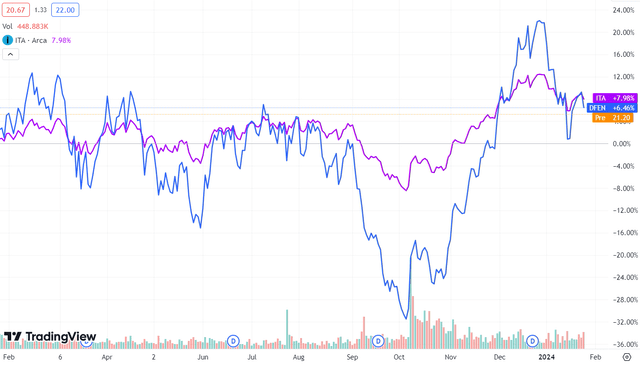

ITA – DFEN Performance (TradingView)

From the graph, it is evident that the iShares U.S. Aerospace & Defense ETF (BATS:ITA), comprising major US defense companies, has returned in one year almost the same performance as DFEN (7.98% – 6.46%) but with significantly reduced volatility and less concentrated exposure, thus mitigating the risk.

For these reasons, the ETF has lost the appeal it had in 2023, and given the increased risks, I give DFEN a Hold rating.