A fast observe about some damaging chatter that retains displaying up in varied locations.

Over the previous few weeks, we have now seen knowledge suggesting a softening – however not a contracting – economic system.

Think about:

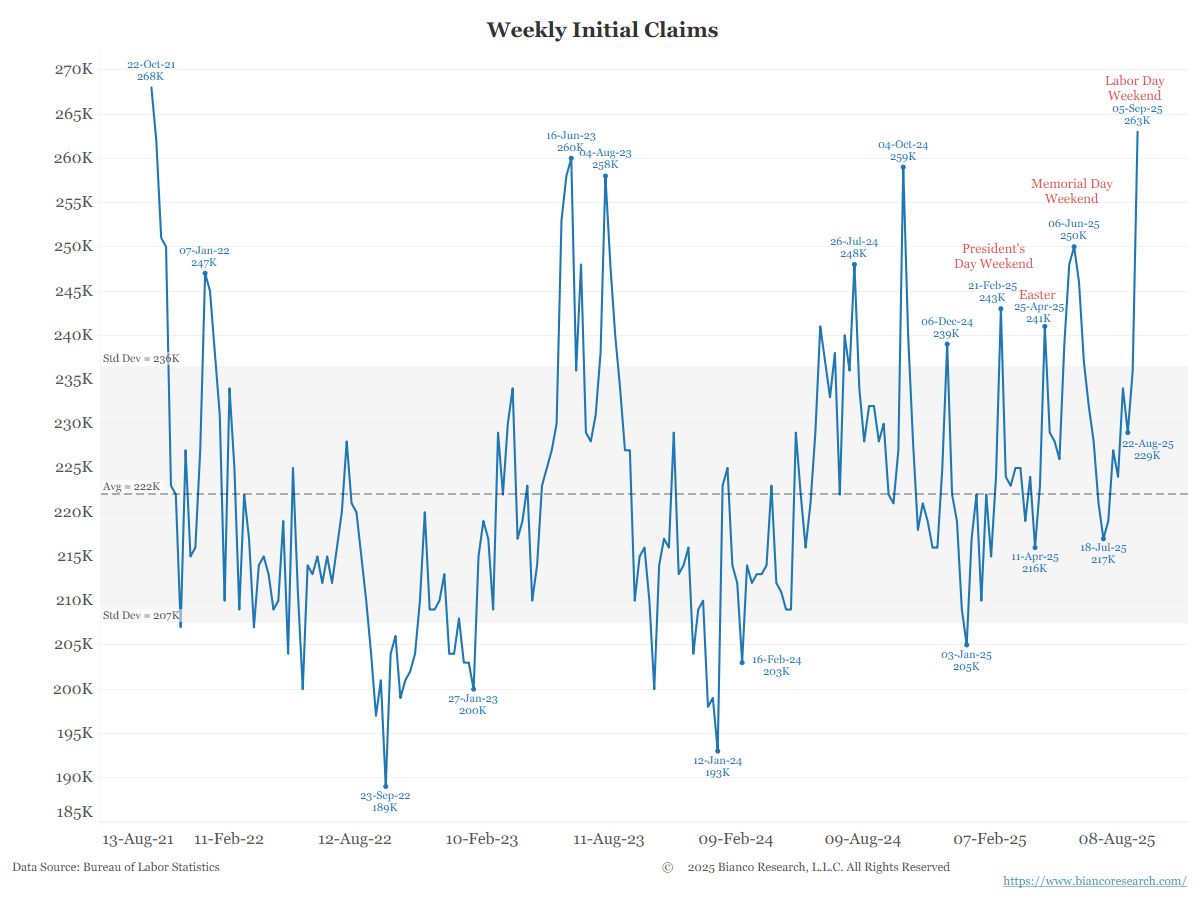

–Jobless Claims Rose Sharply Final Week to a 4-year excessive

WSJ: Within the week via Sept. 6, jobless claims filings rose to 263,000, up from 236,000 per week earlier.–Unemployment moved as much as 4.3%

Up from 3.4% in April 2023–NonFarm Payrolls gained solely 22,000 in August 2025

That is the bottom improve because the pandemic.

It’s simple to know why FOMC Chair Powell has highlighted the rising softness of the Labor Market as the first driver of the 25-bps price lower final week.

However for my part, it isn’t an instantaneous harbinger of a recession; reasonably, the weakening labor market raises the chances of a contraction someday in 2026.

That could be a probabilistic evaluation, not an financial forecast. However this results in folks making the form of claims we noticed throughout different main dislocations:

“The Market has grow to be indifferent from actuality…”

I’m not so positive that is appropriate.

Think about: The S&P500 derives virtually half (41%) of its revenues from abroad. Over the previous 15 years, the U.S. economic system has considerably outperformed Europe and far of Asia. Credit score the huge Keynesian stimulus of the primary two CARES Acts beneath President Trump (I) and CARES Act III beneath President Biden, together with the 10-year Infrastructure and Semiconductor Acts (Biden) and the Tax Cuts (Trump II).

The 2020s have seen a shift from primarily financial stimulus to a extra fiscal-based stimulus. The outperformance of the US inventory market over the previous 5 years could be attributed to this vital stimulus.

This stimulus additionally deserves some (however not all) of the blame for the worldwide surge in inflation from 2021-2023.

Again to shares: Features in EAFE markets underperformed the SPX because the 2009 GFC lows; if the US falters, does this mechanically imply the US markets have a crash? Possibly, possibly not. It actually relies upon upon a) whether or not the U.S. economic system is decelerating or contracting.

To date, we see softening hiring however little improve in layoffs. The US has a structural scarcity of staff, notably in trades, STEM fields, development, agriculture, healthcare, and hospitality providers. One state of affairs is the U.S. GDP slows to beneath 2%, however doesn’t enter a recession.

If a US financial slowdown happens as Europe and Asia emerge from their moribund stasis, we might see revenues and income within the SPX proceed to develop, albeit at a extra subdued tempo. The wild card stays Tariffs (See our MiB with Neal Katyal), which the OECD says will current an financial hit to International GDP in 2026.

All of those assorted outcomes are potential; I’m not positive any of them are possible. All are definitely life like prospects…

Beforehand:

Crosscurrents (August 25, 2025)

Possibly Mr. Market Is Rational After All… (August 7, 2020)

What if Dunning Kruger Explains Every thing? (February 27, 2023)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

See additionally:

MiB Particular Version: Neal Katyal on Difficult Trump’s International Tariffs (September 3, 2025)