AzmanJaka

Recommendation

Desktop Metal (NYSE:DM) stock is currently trading at near its all-time low but I think it has the potential for significant upside over the next two years based on consensus estimates. This growth is supported by industry trends and DM’s leading product offerings, as well as the company’s cost-cutting initiatives and potential for increased visibility and profits.

Business

DM is at the forefront of a new generation of additive manufacturing technologies. They offer a full suite of additive manufacturing options to the engineering, design, and production communities. From product creation to manufacturing on a massive scale and support for existing products, DM solutions are applicable across many sectors.

Legacy manufacturing process is not good enough

Traditional and subtractive manufacturing processes include casting and molding. Most have a high barrier to entry because of the high cost of initial tooling investment, such as molds and dies. Designing and producing these tools can have minimum volume requirements and lengthy lead times in order to achieve cost efficiencies. Additionally, the limitations imposed by the available tools reduce the number of possible design iterations without increasing the development cycle or the price tag. In fact, businesses’ ability to introduce new products is slowed when they have to create a new mold to accommodate new components or design changes. This method also reduces a company’s agility, making it harder to adapt to shifting consumer tastes and stay competitive.

Computer numerical controlled [CNC] machining is a good option if you need to produce a lower quantity of parts and want to get them more quickly. One advantage of CNC machining is that it doesn’t require a mold or die. However, CNC machining can be expensive and generate a lot of material waste because it involves removing material from a block to create the final part. Another thing to consider is that CNC machining often requires specialized technicians and can be time-consuming to set up and program the machines.

Due to the constraints of these time-honored production methods, designs are frequently required to compromise performance in favor of ease of manufacturing and increased complexity in both production and supply chains.

DM offers a solution to the need of additive manufacturing

Using digital models and a computer-controlled 3D printer, additive manufacturing creates three-dimensional objects by depositing successive layers of material.

Production methods had to be adjusted as a result of the pandemic’s effects on the supply chain, which affected nearly every industry. Throughout the product’s lifespan, additive manufacturing is a more efficient and effective process than conventional methods because it avoids many of the problems that plagued them. Customers can save on freight costs, reduce inventory, and avoid tariff surcharges. More and more companies are looking to additive manufacturing as a way to adapt to the challenges posed by rising global competition and shifting consumer tastes.

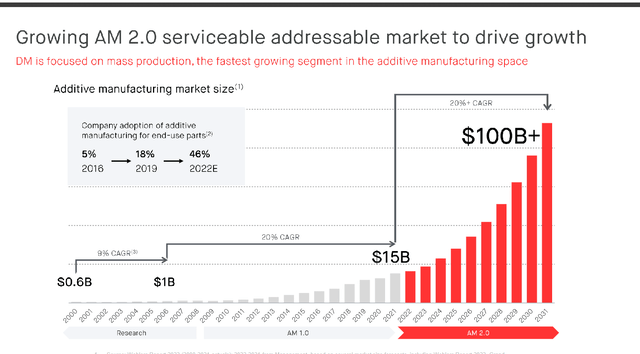

December 22 investor presentation

DM offers a one-of-a-kind technological service to fill this void. Over the years, DM has invested heavily in coming out with its technologies to hasten additive manufacturing’s widespread adoption, and the solutions are built on these enabling technologies. In my opinion, DM’s future product introductions and the enhancement of its existing offerings will hinge on these foundational technologies.

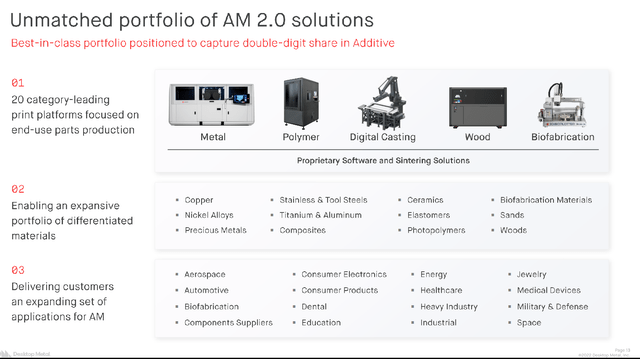

DM produces the fastest Single Pass Jetting [SPJ] technology, and it has 90% share in binder jetting (Aug 22 Jefferies Industrials Conference). This solution is reportedly up to 100 times faster than laser powder bed fusion. Customers can benefit from the lower manufacturing costs and greater design freedom of additive manufacturing by using DM’s Production System to produce a large number of parts at once. Moreover, DM provides a selection of additive solutions that emphasize mass production for final parts and feature high speeds, accuracy, and a wide range of materials.

December 22 investor presentation

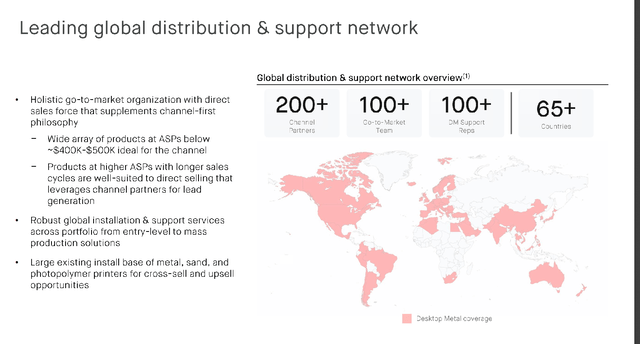

Global reach

DM has established an international network of resellers for its solutions. Furthermore, this network is conveniently located near the vast majority of factories around the world. End users in many different industries can take advantage of DM resellers’ marketing and local support services. Resellers play a crucial role for DM because they introduce the company to a pre-existing customer base that can be educated about the benefits of additive manufacturing and potentially converted into paying customers.

December 22 investor presentation

Margin has room to improve if cost structure is fixed

Similar competitors with more experience, such as Stratasys (SSYS) and 3D Systems (DDD), have gross margins nearly twice as high as DM. Through the elimination of unnecessary expenses, the outsourcing of production, and the incorporation of revenue from services, software, and consumables, I believe DM can achieve similar level of margins. For the time being, I’ll be concentrating on margins, and management sounds ready to cut cost aggressively, judging by the breakeven EBITDA target they’ve set for fiscal year 2023.

Valuation & model

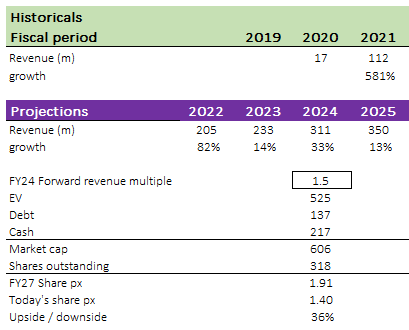

To begin with, the stock has been brutally beaten down since its high of $34.94 following the merger. Obviously, the stock was ridiculously priced at $34, but the situation has changed. We don’t need much for the stock to work at $1.40.

Using consensus estimates, I believe DM is worth 36% more in FY24 than the current share price. My model is based on the assumption that DM can meet market expectations. That’s all we need to achieve the expected upside. This growth is supported by the aforementioned industry trends as well as DM’s ability to maintain market share through its leading product offerings.

DM is currently trading at an all-time low. I expect the market to give management more credit as DM shows progress in its cost-cutting initiatives, resulting in increased visibility to positive profits. We may see an inflection in multiples by then, which should drive stock prices higher. However, even at its current valuation, DM still offers significant upside over the next two years based on my consensus estimates.

Author’s own calculations

Risks

Adoption risk

Most factories might not switch to 3D printing technology if it takes too long to produce items and costs too much more. Many companies, especially smaller ones, put off adopting new technology so they can concentrate on getting by.

M&A integration

DM has made several acquisitions to increase its manufacturing capacity, and an additional ten are scheduled for 2021. The growth of DM could be stunted if unanticipated problems arose as a result of the company’s inability to integrate solutions.

Summary

Traditional manufacturing methods such as casting and molding can have high barriers to entry and design limitations, while CNC machining can be expensive and generate waste, and require specialized technicians and time-intensive setup. Additive manufacturing, on the other hand, is more efficient and effective, and can save on costs, reduce inventory, and avoid tariffs.

DM is a leading company in the additive manufacturing industry, offering a range of 3D printing solutions for various sectors. I believe it is well-positioned in the growing additive manufacturing industry and has the potential for growth based on its leading technologies and solutions.