Juanmonino

I do not learn about you, however once I take into consideration footwear corporations, I usually take into consideration the main gamers within the house. Having stated that, among the most attention-grabbing alternatives could be discovered by wanting on the smaller companies. One such instance is Designer Manufacturers (NYSE:DBI). In recent times, monetary efficiency for the corporate has been considerably risky. A few of this has been because of the COVID-19 pandemic, however the remaining seems to not be associated to it. In all although, the general trajectory for the corporate has been constructive. Add on high of that the truth that shares of the enterprise look reasonably priced presently, and I can’t consider a motive to not charge it a comfortable ‘purchase’ presently.

A shoe-centric enterprise

In accordance with the administration workforce at Designer Manufacturers, the corporate, initially based as DSW Inc., is likely one of the largest designers, producers, and retailers of footwear and equipment in North America. The manufacturers the corporate sells are huge, starting from common contracted model identify and designer merchandise to unique choices. Beneath the unique class, the corporate has manufacturers resembling Vince Camuto, Fortunate, JLO Jennifer Lopez, and Jessica Simpson. The corporate will get these merchandise from an estimated 440 unrelated third-party merchandise distributors. As well as, it is price noting that what all the corporate does have its personal merchandise that it sells, an estimated 91.3% of its gross sales come from merchandise from different suppliers.

Presently, the corporate has three totally different segments that it operates. And to greatest perceive it, we must always dig in a bit to every one. The primary of those segments is known as U.S. Retail. This explicit section operates the DSW Designer Shoe Warehouse banner, which is obtainable within the US market. It does this by means of its direct-to-consumer US shops and its on-line web site. Through the firm’s 2021 fiscal 12 months, this section made up 84.2% of the agency’s income however solely 33.7% of its income. Subsequent in line, we have now the Canada Retail section. That is also referred to as The Shoe Firm and, as you possibly can most likely guess, it generates its gross sales from operations in Canada. Final 12 months, this assertion accounted for 7.1% of the corporate’s income however for 32.7% of its income. And eventually, we have now the Model Portfolio section. This unit is chargeable for the design, improvement, and sourcing of in-season trend footwear and equipment below the Camuto model identify. Your entire goal of this unit is to interact within the sale of wholesale merchandise to its retail segments and to different retail clients. It includes the corporate’s First Price mannequin, which includes the corporate incomes Fee based mostly earnings in trade for serving retail clients as their design and shopping for agent. And eventually, the section additionally includes, to some extent, the promoting of its branded merchandise on one in every of its e-commerce websites. Final 12 months, this section accounted for simply 8.7% of the corporate’s income however made up an astonishing 23.3% of its income.

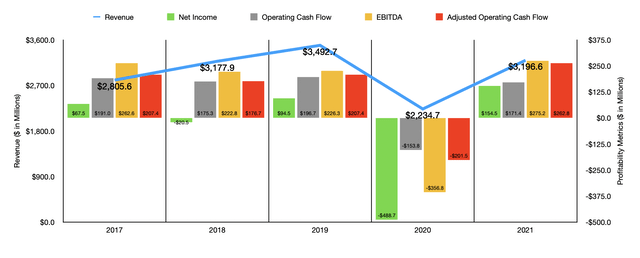

Writer – SEC EDGAR Information

Over the previous few years, the administration workforce at Designer Manufacturers has finished a extremely good job rising the corporate. Income elevated from $2.81 billion in 2017 to $3.49 billion in 2019. In 2020, due to the COVID-19 pandemic, income plummeted to $2.23 billion. However that decline was short-lived. I say this as a result of, final 12 months, gross sales got here in at $3.20 billion. That improve relative to the 2020 fiscal 12 months got here even because the variety of shops the corporate has in operation dropped from 663 to 648. It was pushed, as an alternative, by a 51.6% improve in comparable retailer gross sales. Main the way in which was the U.S. Retail section, with comparable retailer gross sales rising by 55%.

On the subject of profitability, the image has been moderately messy. Between 2017 and 2019, income bounced round between adverse $20.5 million and constructive $94.5 million. The corporate generated a major lack of $488.7 million in 2020 earlier than rebounding and producing a revenue of $154.5 million final 12 months. Different profitability metrics have additionally been considerably risky. Working money move, as an example, has bounced round up to now 5 years between $171.4 million and $186.7 million. The one 12 months the place this was the exception was in 2020 when money outflow was $153.8 million. If we modify for adjustments in working capital, we see the same development. However in that case, 2021 was the very best 12 months with money influx of $262.8 million. In the meantime, EBITDA has additionally been moderately risky, ranging between $222.8 million and $275.2 million over the previous 5 years, with the one down right here being the adverse $356.8 million incurred in 2020.

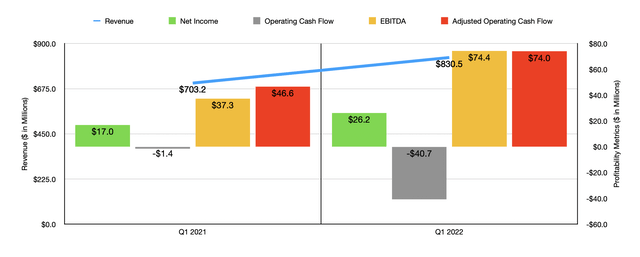

Writer – SEC EDGAR Information

One actually good factor for traders is that the 2022 fiscal 12 months is now wanting up. Income within the first quarter got here in at $830.5 million. That represents a rise of 18.1% over the $703.2 million generated the identical time one 12 months earlier. The corporate actually benefited right here from a 15.3% rise in comparable retailer gross sales, with the Canada Retail section posting a achieve of 41.4% 12 months over 12 months. This isn’t to say every part was nice. In reality, the variety of shops the corporate has continued to say no, dropping from 661 to 650.

On the underside line, the image was typically constructive within the first quarter. Web earnings of $26.2 million beat out the $17 million generated the identical quarter final 12 months. Working money move did worsen, turning from adverse $1.4 million to adverse $40.7 million. But when we modify for adjustments in working capital, it could have risen from $46.6 million to $74 million. We additionally noticed a pleasant improve when it got here to EBITDA. That metric finally grew from $37.3 million to $74.4 million.

For the 2022 fiscal 12 months as a complete, administration solely stated that comparable retailer gross sales ought to improve within the mid-single-digit charge. Nonetheless, the corporate does have some huge plans. Their present aim is to develop gross sales to $4 billion by 2026. Earlier this 12 months, administration revealed a plan to debate these specifics. A part of that plan is to double gross sales of the manufacturers that it owns, largely by means of its direct-to-consumer channels. This is sensible when you think about that manufacturers the corporate owns ought to, in concept, generate larger margins. The corporate additionally needs to cater extra towards the almost 30 million clients that it has, lots of whom are a part of its loyalty program. In fact, none of that is slated to cease the corporate from rewarding traders in different methods. Throughout that announcement, the corporate additionally reinstated its dividend to shareholders, popping out to $0.05 per share every quarter. And, it has additionally repurchased 1.7 million shares below its $500 million share repurchase program. At the moment, $312.2 million is on the market below the plan.

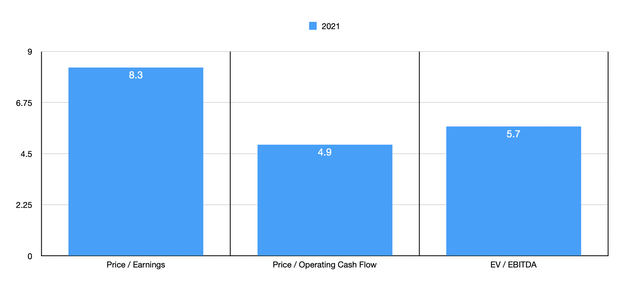

Writer – SEC EDGAR Information

From a profitability perspective, the corporate additionally expects earnings per share to rise to between $2.75 and $2.85. This compares to the $1.90 to $2 per share the corporate is anticipated to generate in income this 12 months. That interprets to roughly $150 million. That is awfully near what the corporate generated final 12 months. No steering was given when it got here to different profitability metrics, however given the proximity of projected earnings this 12 months relative to final 12 months, I’ve determined to imagine that 2022’s outcomes will carefully mirror 2021 outcomes. Doing this, we will see that the corporate is buying and selling at a price-to-earnings a number of of 8.3. The value to adjusted working money move a number of must be 4.9. And the EV to EBITDA a number of must be 5.7. To place this in perspective, I in contrast the corporate to 5 comparable companies. On a price-to-earnings foundation, these corporations ranged between 5.7 and eight.4. Three of the 5 corporations had been cheaper than Designer Manufacturers. Utilizing the worth to working money move method, the vary was between 5.2 and 25.8. On this case, our prospect was the most affordable of the group. And utilizing the EV to EBITDA method, the vary is between 4.2 and 25.8. On this case, two of the 5 companies are cheaper than our prospect.

| Firm | Worth / Earnings | Worth / Working Money Stream | EV / EBITDA |

| Designer Manufacturers | 8.3 | 4.9 | 5.7 |

| MYT Netherlands Guardian B.V. (MYTE) | N/A | 25.8 | 25.8 |

| Guess’ (GES) | 8.4 | 8.6 | 6.0 |

| Caleres (CAL) | 6.3 | 9.3 | 6.4 |

| Abercrombie & Fitch (ANF) | 5.7 | 5.2 | 4.2 |

| The Buckle (BKE) | 6.4 | 6.7 | 4.6 |

Takeaway

At this time limit, Designer Manufacturers appears to be doing pretty nicely for itself. Sure, the corporate has a considerably bumpy working historical past, significantly from a profitability and money move perspective. Having stated that, the general development has been constructive and administration has a good outlook relating to the long run. Whereas shares of the corporate aren’t as low cost as some others on the market, they do look fairly reasonably priced presently. As long as present energy continues, I might think about the corporate producing fairly a pleasant quantity of upside for shareholders. And as such, I’ve determined to charge the enterprise a comfortable ‘purchase’ for now, reflecting my perception that it’s going to probably outperform the marketplace for the foreseeable future.