Brandon Bell/Getty Photographs Information

Dell Applied sciences Inc. (NYSE:DELL) traders lastly had their second of reckoning over the summer season, because the main enterprise PC and server maker noticed its inventory collapse right into a bear market. It fell greater than 50% from its Might 2024 highs by its lows in early August 2024, revisiting ranges final seen in February 2024. Consequently, traders who chased the inventory earlier within the 12 months seemingly discovered invaluable classes about not overexposing themselves to DELL’s AI hype.

In my cautious Dell article in April 2024, I urged traders to watch out about giving an excessive amount of credence to Dell’s AI development story. I underscored my conviction that purchasing enthusiasm on its AI momentum might peak, as its valuation appeared frothy. Given the inventory’s relative underperformance over the previous 4 months, I assess a lot of the zeal positioned on its early AI thesis has seemingly been washed out. Coupled with extra sturdy shopping for momentum over the previous two weeks, dip-buyers appeared to have returned with extra aggression as they await Dell’s upcoming earnings scorecard.

Dell’s FQ2 earnings launch might be delivered on August 29. Following Supermicro’s current earnings scorecard in early August, it has seemingly set the stage for a extra sturdy AI server income steerage from Dell. As a reminder, Dell’s AI server buildout remains to be early, although its backlog reached $3.8B in FQ1. Regardless of that, Dell’s extra diversified roadmap encompassing general-purpose servers and a downstream PC enterprise suggests it may very well be much less prone to margin strain that ensnared Supermicro (SMCI) lately.

As a reminder, SMCI’s earnings commentary indicated how expensive the AI server ramp may very well be because the main AI server rack maker shifts its market management to direct liquid-cooled options. Nonetheless, given the mandatory manufacturing ramp, it is also anticipated to crimp its near-term profitability. Nvidia’s (NVDA) current Blackwell structure delay is anticipated to hamper Dell as nicely, though to a a lot lesser extent. Whereas Dell’s development thesis is undoubtedly predicated on its elevated AI publicity, it has a solidly worthwhile infrastructure options group enterprise in opposition to which to diversify. Therefore, I assess that the market has already mirrored a slowdown in Dell’s AI ramp as we await extra readability on any potential delay in backlog conversion.

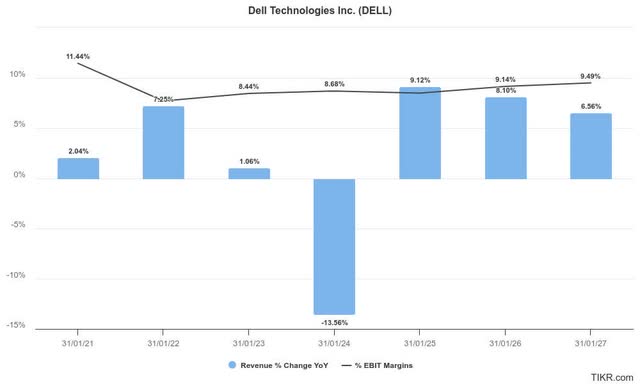

Dell estimates (TIKR)

Regardless of that, Dell’s income development outlook and adjusted working profitability estimates are anticipated to stay comparatively secure by FY2027. Dell indicated in FQ1 that it expects to report a 20% income development in its ISG enterprise, surpassing its full-year income development projection of 8% (midpoint) on the company degree.

Moreover, the AI PC refresh cycle can also be anticipated to supply a near-term raise to Dell’s enterprise, serving to to mitigate unanticipated AI headwinds linked to potential margin dilution or conversion delays. Given SMCI’s much less constructive commentary on its margins, I imagine the market has seemingly assessed greater execution dangers on DELL’s AI development thesis forward of its upcoming earnings launch.

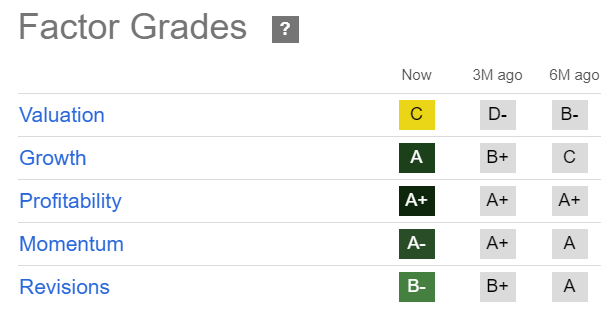

DELL Quant Grades (Looking for Alpha)

DELL’s valuation has improved markedly over the previous three months (from a “D-” to a “C” grade), given the sharp decline highlighted earlier. The inventory remains to be rated for development (“A” development grade), underscoring the market’s confidence in its AI upcycle alternative.

Dell’s skill to achieve extra share in opposition to SMCI should not be understated. Given its present penetration on the enterprise and smaller-scale information middle ranges, Dell’s AI manufacturing facility might speed up its go-to-market technique forward of SMCI. Therefore, traders will seemingly assess administration’s commentary fastidiously to establish its early AI monetization development prospects.

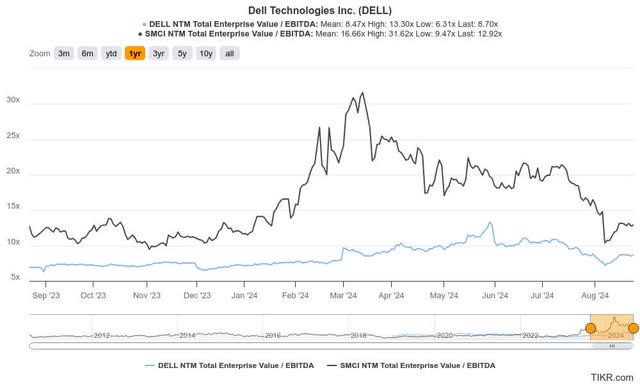

DELL Vs. SMCI ahead valuation multiples (TIKR)

Furthermore, DELL’s “A-” momentum corroborates its sturdy shopping for sentiments, because the market seemingly rotated out of SMCI into the inexpensive DELL inventory. Their valuation bifurcation has narrowed considerably over the previous 5 months, corroborating the outward rotation.

In consequence, Dell can proceed to place strain on Supermicro with extra strong execution amid the Blackwell delay whereas demonstrating its extra well-diversified server enterprise mannequin.

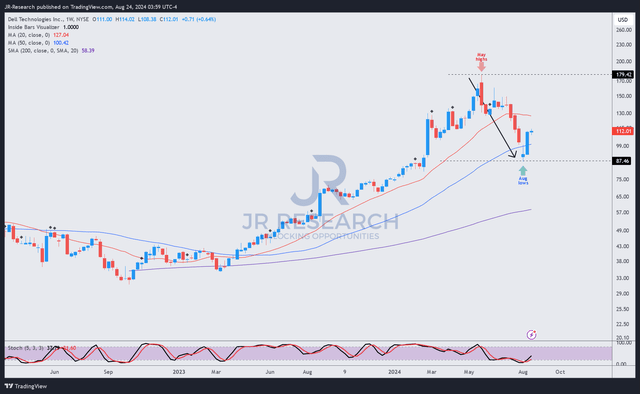

DELL value chart (weekly, medium-term, adjusted for dividends) (TradingView)

DELL’s value chart signifies strong dip-buying momentum above the $85 degree, which helped stem an extra decline from the inventory’s Might 2024 highs. In consequence, it additionally marked the inventory’s most important decline in current occasions, which seemingly dissipated appreciable optimism.

My remark is bolstered by the marked enchancment in DELL’s valuation grade, as mentioned earlier. Patrons have additionally returned at a crucial degree, serving to the inventory backside out above its essential 50-week shifting common (blue line). In consequence, its strong shopping for sentiments ought to assist underpin its uptrend continuation bias, offering AI traders one other alternative to contemplate including extra publicity.

Dangers To Dell’s Thesis

Dell is anticipated to profit from a stronger backlog buildout because it will increase its publicity and competitiveness in opposition to Supermicro and Hewlett Packard Enterprise (HPE). Its shut collaboration with Nvidia in its AI manufacturing facility is anticipated to use Dell’s competitiveness within the enterprise market. Nonetheless, the adoption curve stays unsure, probably complicating its monetization prospects. Therefore, traders should fastidiously assess the conversion metric from its backlog over the following 4 quarters.

As well as, SMCI’s extra aggressive AI server buildout might additionally intensify its competitiveness in opposition to Dell within the hyperscaler market, crucial to Supermicro’s core AI technique. In consequence, Supermicro’s extra aggressive GTM push might put extra strain on Dell to observe go well with, at the same time as they try and compete on worth fairly than value immediately. Given the nascent developments in DLC options aligned with Blackwell’s launch, the need to push for an accelerated rollout may strain Dell’s server margins, hurting investor sentiments.

Ranking: Improve to Purchase.

Vital be aware: Buyers are reminded to do their due diligence and never depend on the knowledge offered as monetary recommendation. Contemplate this text as supplementing your required analysis. Please all the time apply impartial considering. Notice that the score just isn’t meant to time a selected entry/exit on the level of writing except in any other case specified.

I Need To Hear From You

Have constructive commentary to enhance our thesis? Noticed a crucial hole in our view? Noticed one thing essential that we didn’t? Agree or disagree? Remark under with the intention of serving to everybody locally to study higher!