Drew Angerer/Getty Images News

Investment Thesis

I believe Dell Technologies (NYSE:DELL) has emerged as a strong investment opportunity after their remarkable FY Q4 2024 performance, which not only exceeded expectations but also spotlighted the new opportunities in AI, which I think are under-appreciated. With earnings per share (“EPS”) of $2.20 beating analyst forecasts by $0.48 and revenues reaching $22.32 billion, slightly above consensus estimates, Dell’s financials reflect a robust execution of its business strategy, especially in the high-growth sectors of AI and server optimization.

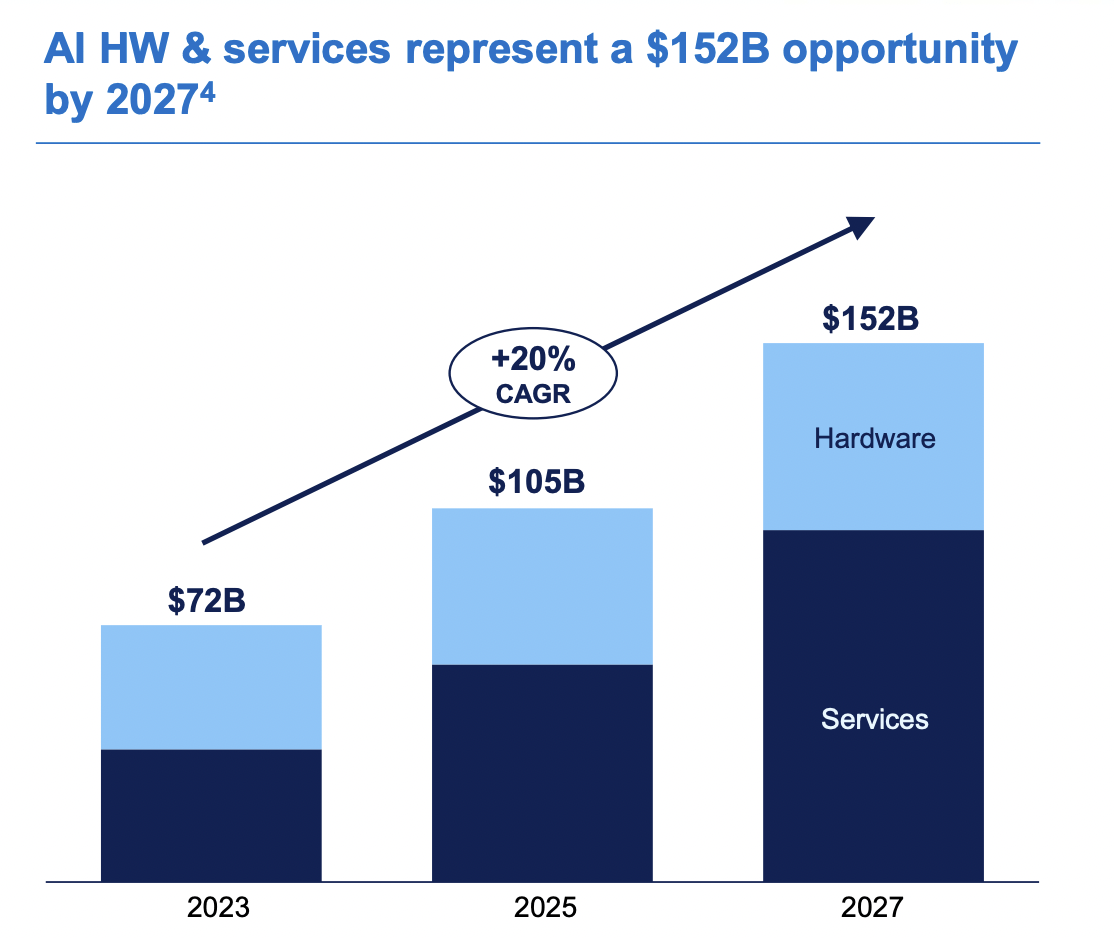

Dell’s strategic emphasis on AI and on-premises solutions, in alignment with evolving enterprise needs for data security and intellectual property protection, showcases its foresight and adaptability in a rapidly changing technological landscape. This approach is crucial as the AI server market is projected to expand significantly, from $30 billion in 2023 to an impressive $150 billion by 2027. With this, Dell has increased their AI total addressable market (“TAM”) projection to $152 billion by 2027, indicating a strong growth trajectory and positioning itself as a leader in this burgeoning field.

Considering the significant initiatives Dell has investments in, especially in AI and edge computing, alongside its, what I believe to be, conservative revenue projections for FY2025, I believe there is a clear path towards robust company growth and market leadership. Despite the slow recovery of the PC market, Dell’s robust strategy and commitment to long-term financial goals underline its potential for sustained growth and value creation.

In my opinion, Dell Technologies stands out as a strong buy for investors. Its impressive Q4 performance, strategic alignment with key technological growth areas, and proactive market positioning affirm its potential for significant returns, making it an attractive investment in a future driven by innovation and technological advancement. I believe the stock is a strong buy.

Q4 Recap: Surpassing Expectations

I believe the FY Q4 2024 earnings report for Dell was notable, showcasing the company’s resilience and strategic acumen in what has been an overall slow PC market. Dell reported EPS of $2.20, which exceeded analyst expectations by $0.48.

Revenue for the quarter stood at $22.32 billion, beating the consensus estimate by $148 million, marking a marginal but important victory for Dell in maintaining its sales trajectory. While even with this revenue Dell faced a year-over-year decline of 10.9% last quarter, I think it shows how Dell is positioning, especially in the high-growth areas like AI and server optimization.

The increased demand for Dell’s AI-optimized server portfolio, such as the PowerEdge XE9680, combined with a nearly doubled backlog to $2.9 billion (and $800 million in filled orders in the quarter), suggests a robust demand pipeline that positions Dell well for future growth (Q4 Earnings Call). For FY 2025, the company forecasts non-GAAP EPS to be $7.50/share. I believe this estimate is likely conservative. I think if the company can see the power of AI servers in their order book take further hold, they may raise this guidance (again, their AI-server portfolio order book nearly doubled).

For the year overall, Dell’s revenue declined 14% from $102.3 billion to $88.4 billion. However, the company’s non-GAAP basic EPS held more firm, declining just 7% to $7.29/share from $7.81/share. This was driven (in part) due to the company expanding gross margins from 22.9% to 24.3%. PC sales slumped overall in 2023 due to global macroeconomic conditions, but the firm managed costs well, allowing them to expand growing margins. I find it encouraging that they were able to expand gross margins in a shrinking market. I think this is a testament to their market leadership, which I will talk more about later.

Dell’s Q4 emphasizes something I have been researching for the last few months as well: AI will likely be a big boost for on-premises solutions, in response to growing enterprise needs for data security and IP protection. I believe this opens up a unique opportunity for Dell to ride the AI wave.

The AI Server Market Is A Big Opportunity

Last year, Jensen Huang, Nvidia (NVDA)’s CEO and founder, predicted that over $1 trillion will be spent upgrading data centers. This is because of what Huang is describing as a computer revolution.

Over the last 60 years, Huang describes computer chips and computers as running retrieval models, meaning that when you put in a request to a computer, it will retrieve a file with data in it from a server or storage.

Now with AI, computers will be doing “retrieval + generation” of data (they will retrieve data and augment it for the users specific requests). The implications of this are big.

What this means is that more companies will need to integrate what Huang is calling “accelerated computing” into their servers. This will require a retooling of data centers that he estimates will be over $1 trillion in projects.

To me, it’s increasingly clear that we are standing on the cusp of a technological revolution, one that promises to redefine the boundaries of computing and data management.

According to insights from Foxconn, the AI server market is on a trajectory to expand from $30 billion in 2023 to a 5x valuation of $150 billion by 2027.

This powerful growth is indicative of a strong shift towards servers that are specifically optimized for AI, equipped with GPUs or specialized processors to meet the demanding requirements of generative AI services (again what Nvidia calls accelerated computing).

The burgeoning demand for AI applications, which require far more advanced server capabilities than traditional servers can offer, is a testament to the sector’s potential and underscores the trillion-dollar opportunity Jensen Huang is referring to.

My focus on Dell Technologies, particularly, draws from the company’s adjusted market opportunity estimation, which illustrates management’s vision of where they sit within the AI server market. Dell has revised its projection of their total addressable market to $152 billion by 2027, with a CAGR of 20% (Q4 Earnings Presentation).

Dell AI Market TAM (Dell Q4 Earnings Presentation)

Why I Believe Dell Is Well Set To Compete In The Server Market

Dell is not the only company to recognize the potential sea change in server retooling, Nvidia’s CEO clearly sees it as well.

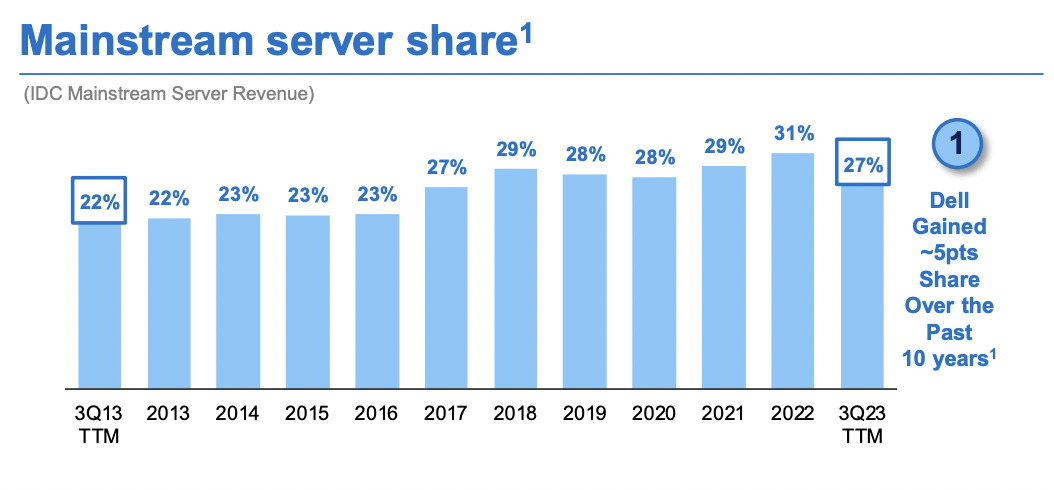

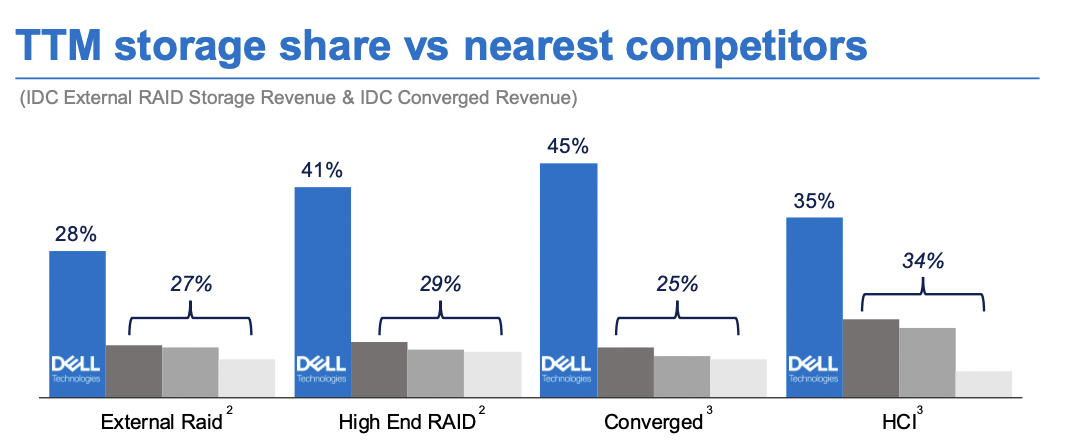

However, I think the key to what I think will be Dell’s success lies in the current landscape. The company (according to their most recent earnings release) maintains leading market share in both the Mainstream server market and in the trailing 12 months storage market share.

Dell Mainstream Server Market Share (Dell Q4 Earnings Presentation)

In fact, their market share in the TTM storage market is bigger than competitors 2-4 combined. In my opinion, given they are already in so many data centers, they are the first choice (and leader) to sell their customers now AI enabled servers.

Dell TTM Storage Market Share (Dell Q4 Earnings Presentation)

Strong Strategy

One of the best parts I like about Dell’s AI server strategy is how management is looking to add support functions and services to each server sale to help increase customer ease of use and adoption.

In the Q4 conference call, one analyst originally wondered what the follow on value would be to Dell:

for every dollar an AI server is being spent, is it like $0.50 or $0.75 or about another dollar of incremental AI storage spending for the down line? -Q4 Call

Management had an even better answer:

we’re looking at an opportunity where every dollar that is for a AI server, GPU server, there’s $2 to a growing $3 of professional services around that, networking around that, storage around that. -Q4 Call

I believe this is powerful and a testament to Dell’s strategy (and was mentioned in their TAM slide). Dell offers a more complete lifecycle management system of their customers’ servers compared to their competitors, meaning they can help with the original products, add on storage, and services to help companies make the most of their Dell products. I like this a lot. I’m a firm believer that firms with an ecosystem to manage their products are more successful. Dell is doing that here with their new AI server products.

Finally, I believe Dell is offering a more robust strategy than one of their close competitors, Hewlett Packard Enterprise (HPE) by offering Pre-validated AI designs that come with pre-tested and optimized configurations. These configurations come with cloud vendors like Amazon or Microsoft that have specific programs for AI services like conversational AI (like ChatGPT), automated machine learning, and intelligent video analysis.

Valuation

While Dell’s strong quarter caused the stock to jump over 31% on Friday, I still think the company has a promising fiscal year ahead of it (and with it an attractive valuation).

For example, multiple Wall Street banks upgraded Dell on Friday on the back of a better than expected AI server demand outlook, with Evercore noting that they think the company could see up to $5 billion in demand this fiscal year, much higher than the $2.9 billion in backlog that management is noting.

Overall, if the company lives up to their pipeline of accelerating AI demand, I think they deserve to trade at a sector median forward P/E as well. Growing AI demand will allow the company to grow revenue at or above the roughly 8% goal, outpacing the broader PC market growth of 3-4%. Keep in mind this new TAM they are focusing on is growing at 20% year over year on its own.

The current forward (Non-GAAP) P/E for Dell is 16.58, even after the massive run-up in stock price we saw on Friday. However, if the company were to converge on the sector median forward P/E of 25.24, this would represent an additional 50.6% upside in share price from here.

I feel the sector median forward P/E is an appropriate benchmark here because most of the companies that are considered as part of the Seeking Alpha sector median are also benefiting from the same AI trends. Many of these firms now sport a higher P/E, such as Super Micro Computer (SMCI) with a forward P/E of 41.76 that reflect this.

While Dell’s forward Non-GAAP P/E (16.58) does vary notably from the company’s forward GAAP P/E ratio of 27.39 (due to lower GAAP EPS), a notable piece that causes this discrepancy is stock-based compensation. Since this is a non-cash expense, I believe the company still has ample cash resources to fund further AI-server investments, with almost $7.4 billion in cash on hand.

Why I Don’t Think This Is Priced In

From a quantitative standpoint, I think the forward PEG metric tells a powerful story. The company’s forward PEG is 1.53, which is below the sector forward PEG of 2.08. Given that Dell is already projected to grow at twice the overall PC sector’s growth rate, I think it’s fair that the company could rerate with a higher forward P/E ratio and PEG ratio to accompany this.

Risks

I believe the biggest risk Dell is facing is a slowing PC market due to enterprises and consumers not upgrading their PCs at the same rate as they did in previous fiscal years. Many companies pull ahead demand for PCs during COVID, causing a jump in sales that has since abated. Management recognizes this, with COO Jeff Clarke noting the macroeconomic environment on the earnings call.

How Dell Is Addressing This & How I Am Monitoring The Company in FY 2025

I believe the recovery of the core PC market, while slow, is set against a backdrop of strategic initiatives by Dell that leverage its strengths in AI and edge computing to drive growth across its offerings, including corporate PCs over the next few years.

Management’s optimism for FY2025, with revenue projections ranging from $91 billion to $95 billion, underscores a return to growth for Dell.

Management’s confidence is supported by several key trends, including the momentum around AI, improvements in traditional servers, and an aging PC install base poised for a refresh cycle. The aging PC base is key because of the timing. Many of these PCs were purchased as part of the COVID work from home trend. The new AI in PC trends that partners like Microsoft are pushing, means that PCs will need to be upgraded (replaced) to accommodate the retrieval + augmentation trend that Nvidia’s CEO is talking about. For example, Microsoft is integrating a new AI key into the keyboard (not in current computer models). Dell believes this trend has yet to play out.

The industry’s advancements in AI-enabled architectures and software applications are expected to catalyze this refresh cycle, particularly as Windows 10 approaches its end of life, signaling potential uplift for Dell’s CSG business.

Despite the soft PC market, Dell has maintained pricing discipline and managed costs effectively, ensuring solid operating margins despite the competitive environment. For example: they reduced non-GAAP operating expenses by $1 billion in FY 2024.

The expectation is for the PC market recovery to accelerate in the second half of this fiscal year as enterprise and large customers’ spending caution begins to ease, aligning with Dell’s strategy of when they launch new AI-powered PCs.

For myself, I’ll be watching market and enterprise acceptance of the new PC models that Dell is looking to roll out later this year as a gauge for how the computer giant plans to boost its PC sales and bring them back to growth.

Bottom Line

Heading into FY 2025, Dell showcases strategic innovation, particularly evident in its Q4 2024 outperformance with an EPS of $2.20, surpassing expectations, and revenue of $22.32 billion beating by $148 million. I believe this performance underlines Dell’s capability to navigate market challenges around still sluggish PC demand while capitalizing on emerging trends, especially in AI and server optimization. With the AI server market projected to grow from $30 billion in 2023 to $150 billion by 2027, and with Dell’s revised TAM increasing to $152 billion by 2027, the company has ample opportunities for growth.

With this, I believe Dell represents a compelling investment opportunity, underscoring what I think is a strong buy for investors seeking exposure to a company at the forefront of a potentially $1 trillion trend in data center retooling.