by Charles Hugh-Smith

Value slicing is being changed with worth gouging, a substitution that customers acknowledge as inflation..

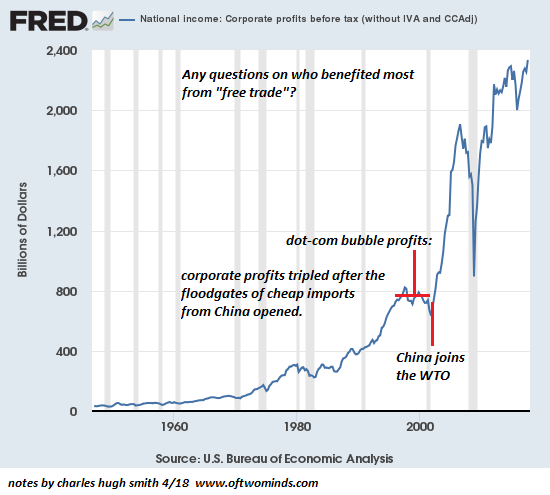

Globalization was deflationary, Deglobalization is inflationary. The complete level of globalization is to 1) decrease prices as a method of maximizing earnings and a couple of) discover markets for surplus home manufacturing. Each serve to export deflation as offshoring manufacturing retains costs secure (and earnings excessive) and dumping surplus manufacturing in high-cost developed-nations suppresses their home producers’ pricing energy.

Deglobalization is inflationary as a result of reshoring manufacturing will increase prices. Securing manufacturing from the threats of geopolitical blackmail, civil/financial dysfunction within the producing nations or damaged provide chains requires shifting important provide chains again to the safety of the home financial system.

This transfer prices cash, and manufacturing prices are increased in developed economies for all the explanations that drove firms to maneuver manufacturing abroad: labor prices, healthcare, environmental compliance, social advantages and taxes are increased.

Now that assets have been depleted in lots of producer nations, the prices of manufacturing important supplies is rising. China, a significant exporter of uncommon earth minerals important to the renewable power sector, is now exploiting neighbor Myanmar’s assets: Myanmar’s poisoned mountains.

As developing-world nations prospered from manufacturing exports, their workforces have demanded increased pay and improved monetary safety. Poisoning the water, soil and air is extremely worthwhile however the public pays the value, and finally the general public calls for some environmental limits on the poisonous dumping of globalization.

The nice and cozy and fuzzy narrative of how great globalization was for everybody was at all times bogus. As I defined again in 2009, importing deflation to the developed world and maximizing earnings by turning the growing world right into a poisonous waste dump was neoliberal capitalism’s “repair” for stagnation: Globalization and China: Neoliberal Capitalism’s Final “Repair” (June 29, 2009).

Globalization enabled cellular capital to swoop in, purchase up native property, create new markets for credit score and imported goodies after which promote on the high earlier than all of the exterior prices of globalization got here due and the credit score bubble burst.

Now that the worldwide credit score bubble is bursting, the cellular capital exploitation get together is over. Now the sport is to exit Periphery nations and transfer the winnings of globalization to the Core for safekeeping.

Globalization lowered prices on the expense of high quality, one other “win” for Neoliberal Capitalism as deliberate obsolescence is now the implicit backdrop of globalization: poor high quality items quickly fail, requiring the hapless client herd to purchase a substitute. Since developed-world customers have already got every little thing (lease a bigger storage unit for all of your stuff), the one strategy to goose demand is to crapify every little thing so changing low-quality items with new low-quality items retains manufacturing strains and earnings buzzing.

This works nice till provide chains break down and customers run out of discretionary earnings. Globalization solely works if each half works completely, as redundancy and buffers (stock, a number of suppliers, and so forth.) have been stripped to maximise cost-cutting and earnings.

Now globalized perfection is breaking down and prices rise. Value slicing is being changed with worth gouging, a substitution that customers acknowledge as inflation.

Deglobalization isn’t a fast or painless course of. The trip down shall be bumpy and price will increase have many sources. Earnings will change into more durable to return by and scarcities will knock down world rows of dominoes in sudden methods. Exterior prices that piled up for the previous 30 years have come due and should be paid.

Inflation isn’t transitory or throughout the management of central banks. The forces at work are far past the attain of central bankers. Value of credit score issues, however so does the actual world.

Latest podcasts/movies:

Save Cash On Meals, Get Free Gold & Silver, Beat Value Inflation (1:08 hrs)

It’s Time To Finish The Fed & Return To A Decentralized Forex (X22 Report, 38 min)

Charles Hugh Smith On Inequalities And The Distortions Brought on By Central Financial institution Insurance policies (FRA Roundtable, 30 min)

Tectonic Shift of Mercantilism Revalued (Gordon Lengthy, Macro-Analytics, 42 min)