Roman Tiraspolsky

HOKA has become a growth engine for Deckers Outdoor (NYSE:DECK), but the stock looks overvalued compared to its peers.

Company Profile

DECK designs and distributes footwear under a variety of brands. The company sells its products both through the wholesale channel, as well as direct to consumer through its e-commerce platform as well as through company owned retail stores.

The UGG brand is DECK’s largest and accounted for about 53% of its sales in FY23. The brand is known for its comfortable sheepskin boots. Some of the company’s products also use two types of propriety materials. UGGpure is made of repurposed wool woven into a durable backing, while UGGplush is repurposed wool and lyocell woven into a durable backing.

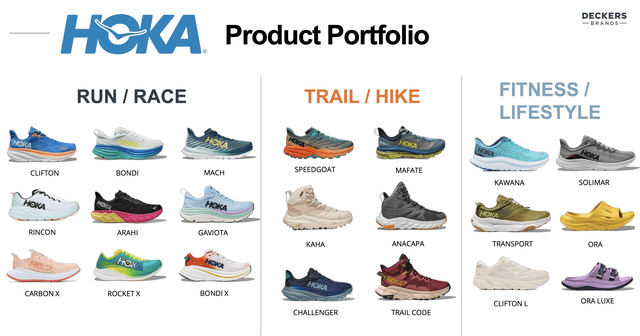

DECK’s second-largest brand and fastest growing is HOKA. The brand represented over 39% of its sales in FY23. HOKA is known for its well-cushioned and minimal weight running shoes. DECK acquired the brand back in 2013. The company also owns the Teva, Sanuk, and Koolaburra brands of footwear as well.

Opportunities and Risks

While long known for its UGG brand, HOKA has taken over as the growth driver for DECK. The brand grew its revenue a whopping 58% in FY23 (ended March) to $1.4 billion, and the brand has seen its sales increase by 50% or more for four straight years.

While the size of HOKA will make such robust growth more difficult to attain in the future due to the law of large numbers, DECK still has levers to pull to continue to grow the brand strongly. Chief among them is growing its DTC business and number of retail stores. At the end of March, DECK had 164 retail stores in 57 countries, but only 18 of those stores were HOKA brand stores. Thus, it has a pretty big runway to increase both its number of concept and outlet stores for the brand.

Improving brand awareness, category expansion, and increasing distribution and shelf space are other areas that can help the momentum of HOKA going. Last year, the company launched its first ever global marketing campaign to solid success, so there is more opportunity to push marketing and improve brand awareness. The company said its initial campaign increased the brand’s awareness by 40% in 3 important countries.

On the category expansion side, the company has done a good job of moving beyond its running roots to also offer trail and hiking shoes. The company has also recently expanded into the youth shoe market through its DTC channel and a few select wholesale partners. Last year, people who purchased multi-category HOKA shoes rose 79% in the U.S and 127% in EMEA, showing how category expansion is helping drive sales.

Company Presentation

Getting into different types of shoes can also help the company gain shelf space and distribution in the wholesale channel, as can increased brand awareness. The company also noted that it will pay closer attention to segmentation with its increasing distribution, only offering some exclusive high-performance products at specialty running stores and its DTC channel.

Discussing HOKA on its FQ4 earnings call, CEO David Powers said:

“Importantly, HOKA continues to bring new consumers into the brand, while also retaining existing consumers, evidenced by a 78% increase in acquisition and an 81% increase in retention as compared to last year. Momentum with younger consumers in the U.S. helped drive these increases as HOKA more than doubled the number of purchasers aged 18 to 34 years old. As HOKA continues to expand, we are encouraged by the broader product adoption from consumers beyond the brand’s heritage running styles. We’ve seen this trend among DTC consumers and continue to gain category shelf space with wholesalers. Among DTC purchasers in the U.S. and EMEA, multi-category purchases increased 79% and 127% versus last year, respectively. Across all channels, HOKA more than doubled revenue on trail and hike products aided by the Speedgoat and Challenger updates as well as market share gains with the Kaha and Anacapa franchises, and fitness and recovery products benefiting from greater [ore] recovery, sandal adoption and the introduction of both the Solimar and Transport styles. With the success HOKA is experiencing across a variety of innovative products, we’re very excited to now offer a selection of our most popular items to the next generation of HOKA athletes with the brand’s recently launched first ever Youth collection through our DTC channel and with very select wholesale partners. We view the opportunity with kids as an avenue to further expose the brand to parents and younger athletes over the long term.”

The company guided for 20% growth in the HOKA brand this fiscal year, which while a big growth deceleration from year’s past, is still strong growth.

DECK’s largest brand, UGG, had a more difficult year in FY23, with sales falling nearly -3% to $1.93 billion, albeit up slight excluding currency impacts. Going forward, the company will mostly be focused on international expansion to drive sales, while removing inefficient SKUs and leaning into its core silhouettes and DTC to help with margins.

When it comes to risks, the macroeconomy remains front and center. DECK’s two main brands are higher end, so have a little less vulnerability, but they also aren’t at the top end of the luxury spectrum.

Fashion risks and fashion trends are another risk. This is particularly true with UGGs. While the brand has shown its lasting power and its comfort reduces its fashion risk, there have been periods where the brand has been less trendy. As for HOKA, its position as a high-end running shoe isolates it from fashion trends among its core running fans. However, as it has expanded its user base and gotten more into other categories, it adds an element of trend risk to the brand.

Valuation

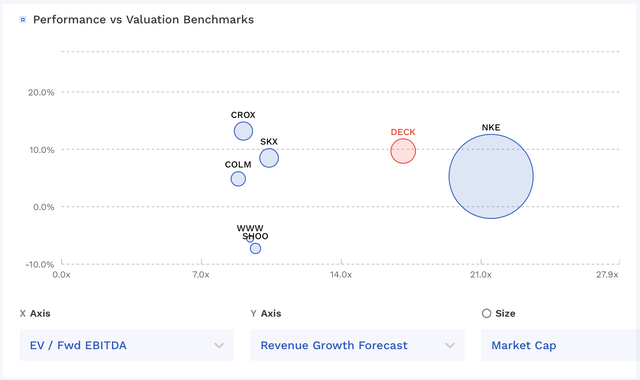

DECK trades around 17.2x the FY24 (ending March) consensus adjusted EBITDA of $783.8 million and 15x the FY25 consensus of $900.5 million.

From an EV/EBITDAR perspective, it trades at 15.5x FY24 estimates.

It trades at a forward PE of 24.6x the FY22 consensus of $21.97. Based on FY25 analyst estimates of $25.70, it trades at 21x.

DECK is projected to growth its revenue nearly 10% in FY24 and about 11% in FY25.

Comparatively, fellow popular footwear brands Crocs (CROX) and Skechers (SKX) trades at a much lower multiple despite similar projected growth.

DECK Valuation Vs Peers (FinBox)

Conclusion

DECK has done a really good job of maintaining the popularity of its UGG brand, while helping turn HOKA into a growth machine. That said, it trades at a large premium valuation to its peers, and the outsized growth of HOKA will start to slow just given its sheer size now. I think overall the stock looks overvalued, and as such I will put a “Hold” rating on the name with a slight bearish bias.

In the footwear space, I much prefer CROX, which I upgraded to “Strong Buy” in early June. I think the very wide valuation gap between two stock looks unjustified in my view, and I could see them meet in the middle.