Asanka Ratnayake/Getty Photos Information

With the inventory market having declined considerably in latest months, it appears as if a common worry has permeated most shares. Even firms which are producing robust efficiency and that may doubtless fare effectively, in the long term, are experiencing materials draw back. In fact, these corporations would possibly finally see some ache if we do, certainly, head right into a recession. However for companies which are persevering with to develop and higher buying and selling at essentially low ranges counter, this might symbolize a particularly uncommon and profitable shopping for alternative. One candidate that traders who’re targeted on the lengthy haul ought to contemplate is footwear, attire, and equipment producer Deckers Outside Company (NYSE:DECK). Because the market has declined, the corporate’s inventory has additionally been hit. This comes regardless of rosy steerage from administration and a share worth that appears fairly interesting presently. On account of this, I’ve determined to retain my ‘purchase’ ranking on the enterprise.

Sturdy Efficiency Continues To Be The Case

The final time I wrote an article about Deckers Outside was in February of this 12 months. At the moment, I noticed the corporate in a slightly favorable gentle. I used to be notably drawn in by the engaging development the corporate had generated in prior years, each on its high line and its backside line. Relative to related gamers available in the market, I made up my mind that the corporate was kind of pretty valued. However on an absolute foundation, shares seemed engaging sufficient to warrant engaging upside. On account of all of this, I finally rated the enterprise a ‘purchase’, indicating my perception that shares would expertise upside better than the overall market over an prolonged timeframe. Since then, issues haven’t gone precisely as I might have hoped. Whereas the S&P 500 is down 15.4%, shares of Deckers Outside have dropped 16.9%.

Given this efficiency, one could be forgiven for considering that the basic image for the corporate has worsened. However that has not been the case. As an alternative, monetary efficiency is stronger now than it has ever been. To be clear, once I final wrote in regards to the agency, we solely had information overlaying by means of the third quarter of its 2022 fiscal 12 months. As we speak, we now have information overlaying that closing quarter. And we even have steerage from administration for the corporate’s 2023 fiscal 12 months.

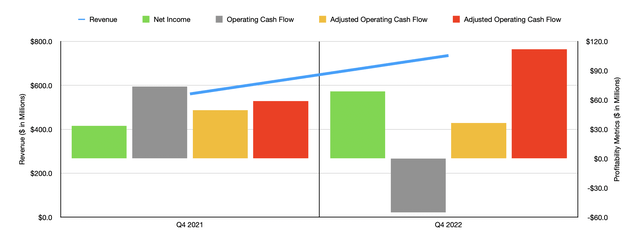

Creator – SEC EDGAR Knowledge

Based mostly on the information supplied, Deckers Outside completed the 2022 fiscal 12 months off with a bang. Income within the closing quarter got here in at $736 million. That is 31.1% greater than the $561.2 million generated the identical quarter one 12 months earlier. This year-over-year development was pushed largely by two key manufacturers the corporate has. The actually heavy lifting got here from the corporate’s HOKA model, which reported a 59.7% year-over-year gross sales improve, taking income from $177.5 million to $283.5 million. Gross sales for the UGG model merchandise rose a extra modest however nonetheless spectacular 24.7%, with income climbing from $300.5 million within the closing quarter of 2021 to $374.6 million within the closing quarter of 2022. The Koolaburra model additionally reported a gross sales improve, however solely to the tune of two.4%. In the meantime, the Teva and Sanuk manufacturers each noticed gross sales weekend, falling by 8.8% and 1.7%, respectively, 12 months over 12 months.

Backside-line efficiency for the corporate was largely constructive as effectively. Web earnings within the closing quarter rose from $33.5 million to $68.8 million. In the meantime, EBITDA jumped from $59 million to $111.9 million. The one weak point in profitability got here from the working money circulate facet. This metric fell from $73.9 million within the closing quarter of 2021 to destructive $55 million the identical time of 2022. Even when we modify for modifications in working capital, the image nonetheless worsened 12 months over 12 months, declining from $49.7 million to $36.6 million. Regardless of this, administration nonetheless determined to purchase again further inventory for the 12 months underneath its inventory repurchase program. The corporate acquired 308,000 shares for about $90 million. This introduced the entire buy of inventory for the 2022 fiscal 12 months to 1.04 million shares at a worth of $356.7 million. That leaves $454 million at present remaining underneath the corporate’s share repurchase authorization.

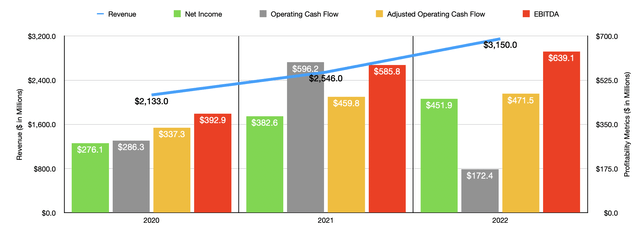

Creator – SEC EDGAR Knowledge

Because of the robust efficiency within the closing quarter, the corporate had its greatest 12 months ever. Income of $3.15 billion translated to a year-over-year improve of 23.7% in comparison with the $2.55 billion generated within the 2021 fiscal 12 months. Web earnings for the corporate rose by 18.1% from $382.6 million to $451.9 million. Working money circulate did decline, plummeting from $596.2 million to $172.4 million. But when we modify for modifications in working capital, it could have inched up barely from $459.8 million to $471.5 million. In the meantime, EBITDA for the agency rose from $585.8 million to $639.1 million.

Though traders and the market, generally, could also be involved in regards to the 2023 fiscal 12 months for the enterprise, administration is clearly not. At current, they at present anticipate income of between $3.45 billion and $3.50 billion. On the midpoint, that will translate to a year-over-year improve of 10.3%. Earnings per share must be between $17.40 and $18.25, ignoring the potential influence of share buybacks. On the midpoint, this is able to translate to internet earnings of $495.3 million if this involves fruition, it could indicate a rise of 9.6% in comparison with the $451.9 million reported for 2022. No steerage was given when it got here to different profitability metrics. But when we assume that they are going to improve on the similar price that earnings ought to, then traders can anticipate adjusted working money circulate of $516.8 million and EBITDA of $700.5 million.

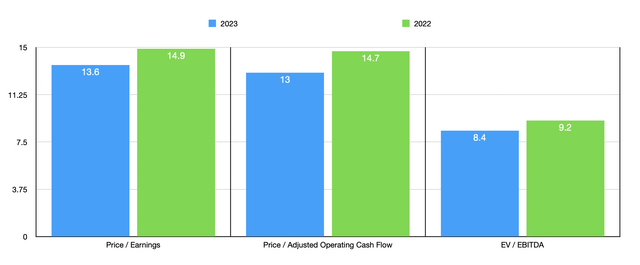

Creator – SEC EDGAR Knowledge

Utilizing this information, we are able to simply worth the enterprise. On a price-to-earnings foundation, utilizing 2022 fiscal outcomes, the corporate is buying and selling at a a number of of 14.9. That is down from the 20 that I calculated as an estimate for 2022 fiscal leads to my prior article. For 2023, this a number of seems set to drop to 13.6. The worth to adjusted working money circulate a number of for 2022 is 14.7. That is really up from the 12.8 in my authentic estimation for the corporate. In the meantime, the a number of for the 2023 fiscal 12 months is 13. And at last, we arrive on the EV to EBITDA a number of. This could are available at 8.4 for the 2023 fiscal 12 months. That is down from the 9.2 if we use information from 2022 and is down farther from my prior 2022 estimate of 12.1.

To place the valuation of the corporate into perspective, I made a decision to check it to 5 related corporations. On a price-to-earnings foundation, these firms ranged from a low of 4.3 to a excessive of 39.9. And utilizing the EV to EBITDA method, the vary was from 7.6 to 22.1. Utilizing the 2022 figures, we see that three of the 5 firms are cheaper than Deckers Outside. Utilizing the worth to working money circulate method, we get a variety of 6.4 to 60.9. On this case, one of many 5 corporations is cheaper than our prospect.

| Firm | Worth / Earnings | Worth / Working Money Circulate | EV / EBITDA |

| Deckers Outside | 14.9 | 14.7 | 9.2 |

| Skechers U.S.A. (SKX) | 7.3 | 60.9 | 7.6 |

| Crocs (CROX) | 4.3 | 6.4 | 8.3 |

| Steven Madden (SHOO) | 10.8 | 19.5 | 7.8 |

| Wolverwine World Large (WWW) | 39.9 | 22.0 | 22.0 |

| Nike (NKE) | 28.2 | 28.5 | 22.1 |

Takeaway

At this cut-off date, I perceive why the market is worried. Having stated that, administration has confirmed repeatedly that the corporate is a top quality operator that’s able to producing constant development. Development this 12 months is forecasted to be fairly robust, and earnings are prone to observe swimsuit. Shares of the enterprise additionally look engaging from a pricing perspective on an absolute foundation, although they’re most likely kind of pretty priced in comparison with related corporations. On account of all of this, particularly counting on administration’s personal steerage, I can not assist however to nonetheless price the enterprise a ‘purchase’ presently.